Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

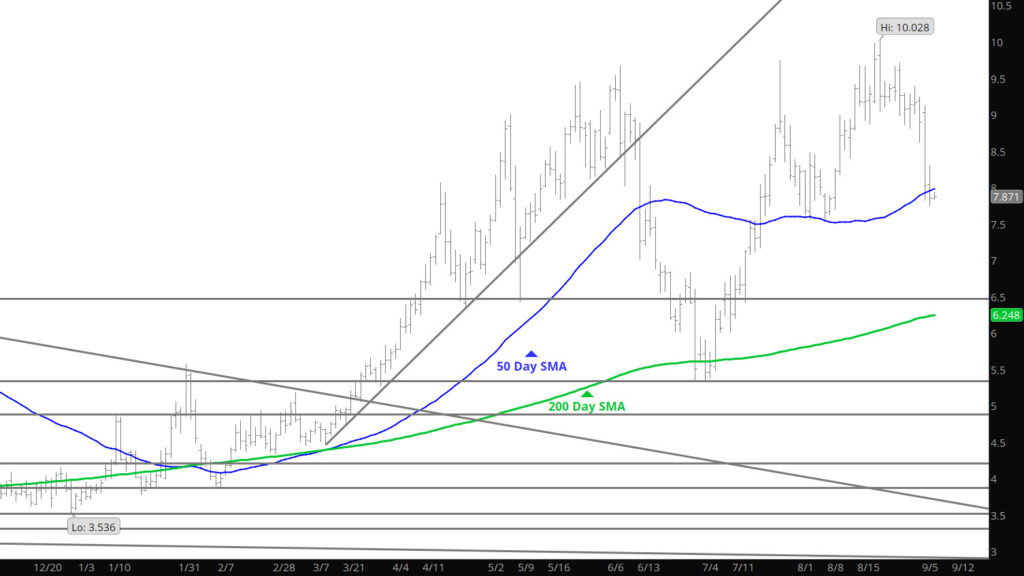

Now That Is An Extension

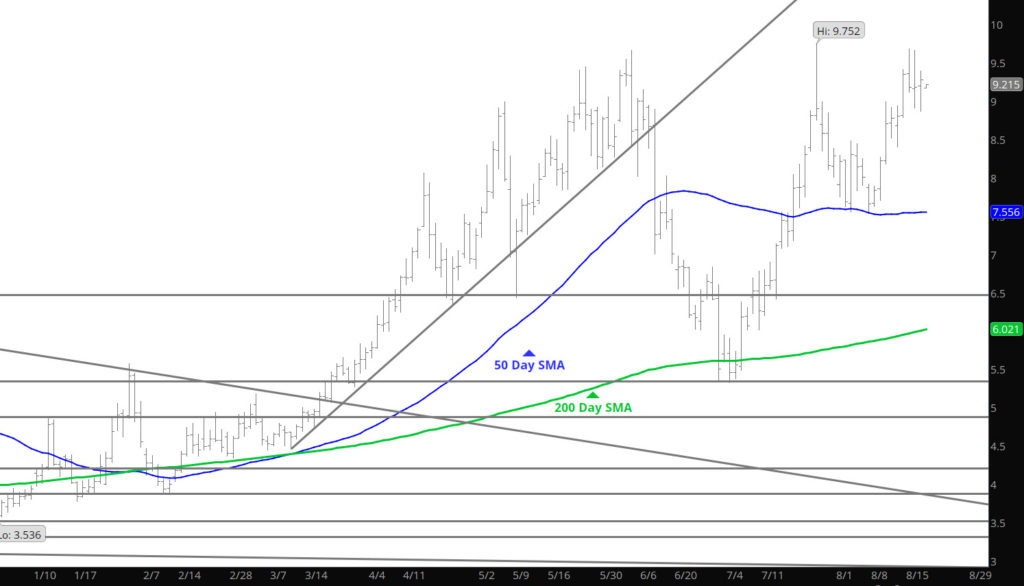

Prices continued the extension of the declines, as prompt dipped below $8.00 briefly, challenging the 50 day SMA and attacked the 20 Week SMA that have been well held support zones lately. The key will be how does the market respond on this test. If support holds then the range up to $9.00 remains, a break down below will suggest the lows of early August around $7.50 are in target.

Major Support: $7.956-$7.91, $7.55, $7.14, $7.078, $6.88, $6.754,$6.38, $6.02, $5.623,

Minor Support $7.35, $7.41, $6.42, $5.548, $5.40-$5.45

Major Resistance: $8.58-$8.61, $9.021, $9.35, $9.40, 9.664–$9.67, $9.98

Seasonal History Wins

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Friday Collapse — A Directional Indication or Short Term Profits

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Brief Pause

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Potential Issue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market “Seems” Strong

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Run Continues? or Light Selling Commences

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Resistance Even On a Bullish Report

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Caution Flag

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.