Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Differential to Dec Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Something Has to Give or Go

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

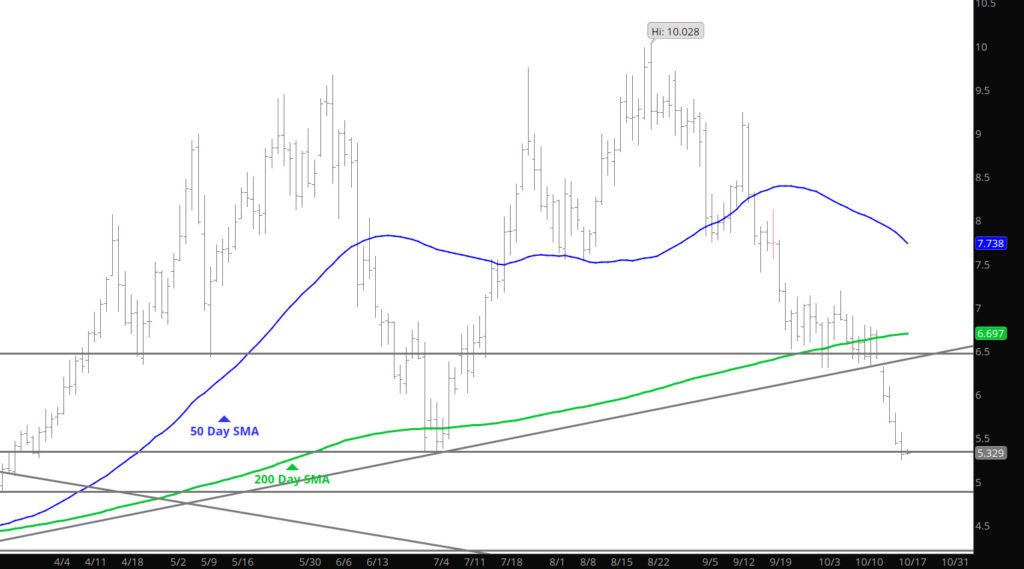

Bias Has Flipped– Expiration Coming

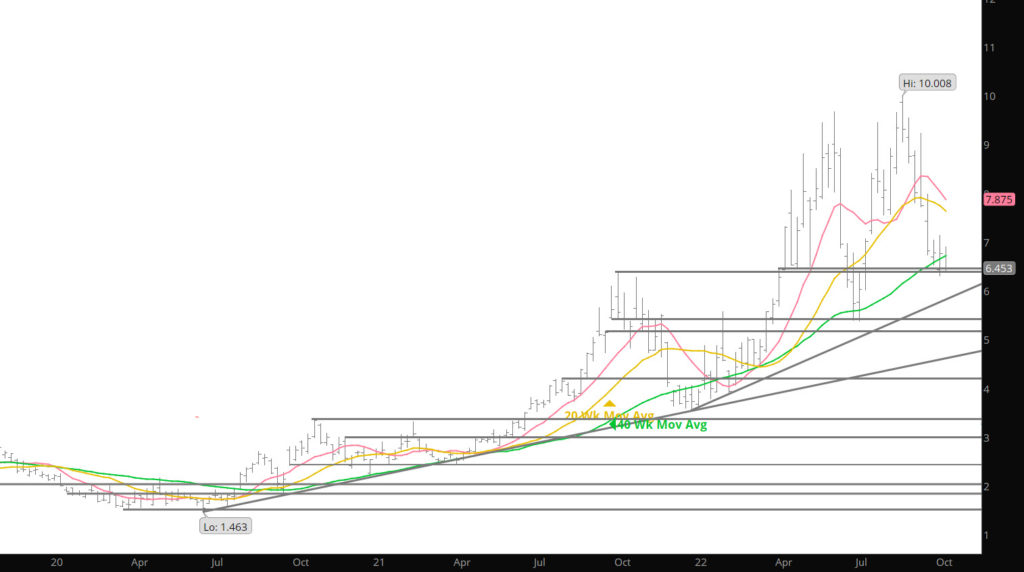

Don’t see how the market could be more bearish — but when at these levels of being oversold (levels on six times in the history of trading — see Weekly section) the market historically taken a breath. What is going to be interesting to this trader is what happens during expiration. We have seen a series of strength month after month but that behavior was modified at the Oct expiration. With all the selling in the last couple of weeks is there a period of strength coming this month — Not sure but that’s why it will be interesting to me.

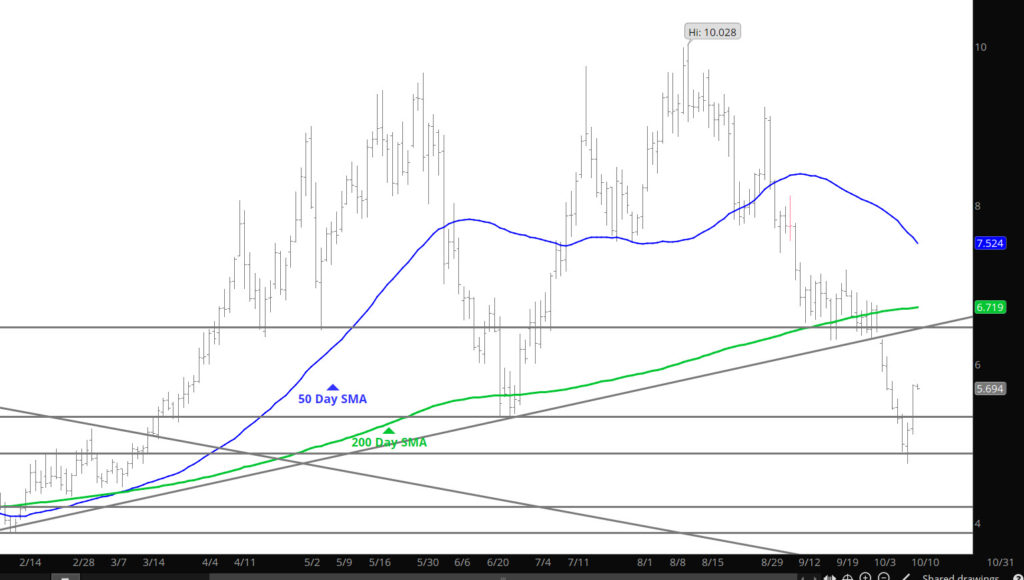

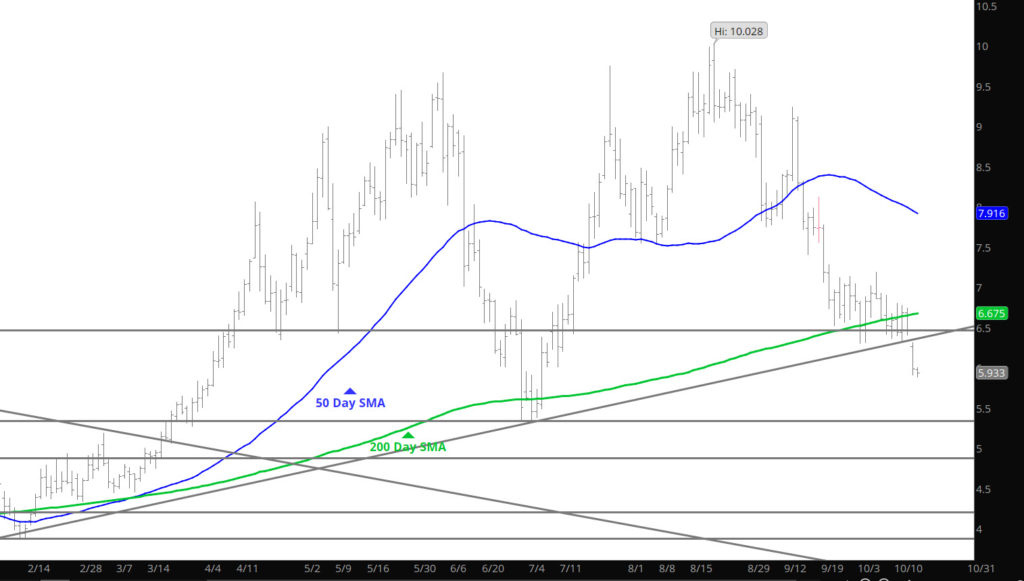

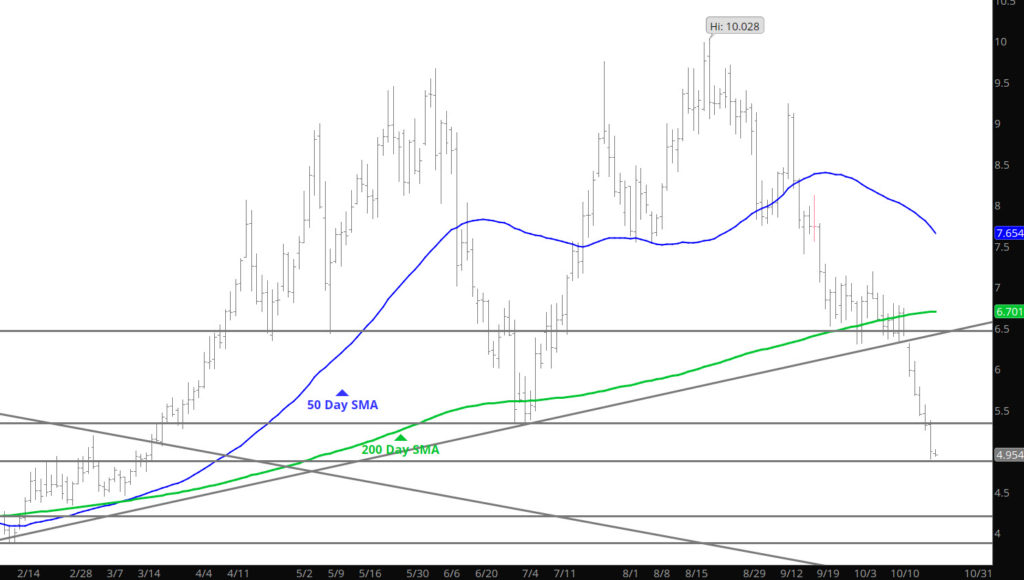

Major Support: $4.903, $4.716, $4.705-$4.68

Minor Support

Major Resistance:$5.32-$5.37, $6.314, $6.456, $6.74, $7.18, $7.532, $7.71-7.75, 8.021,

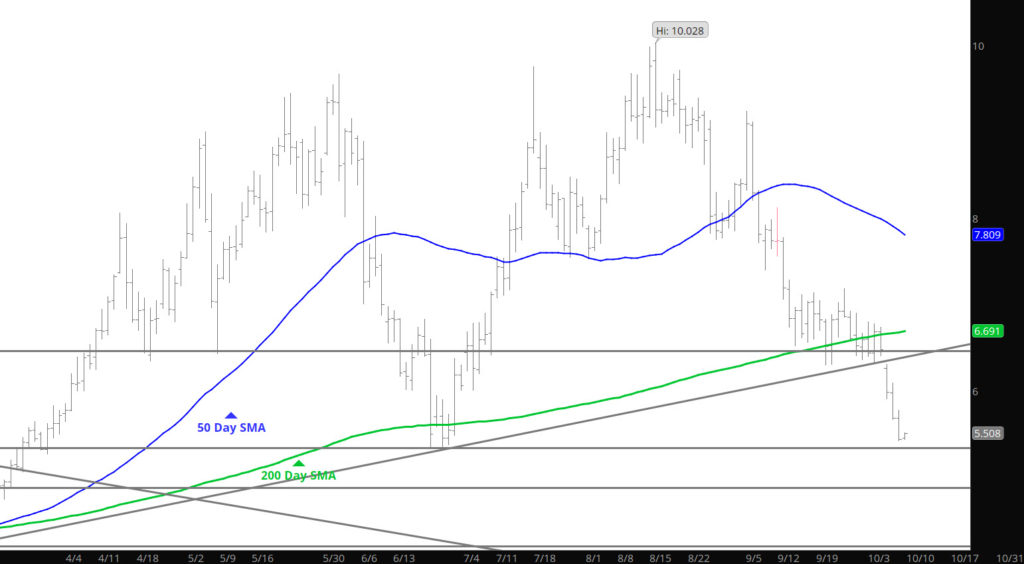

Technical Destruction of 2022 Bull Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

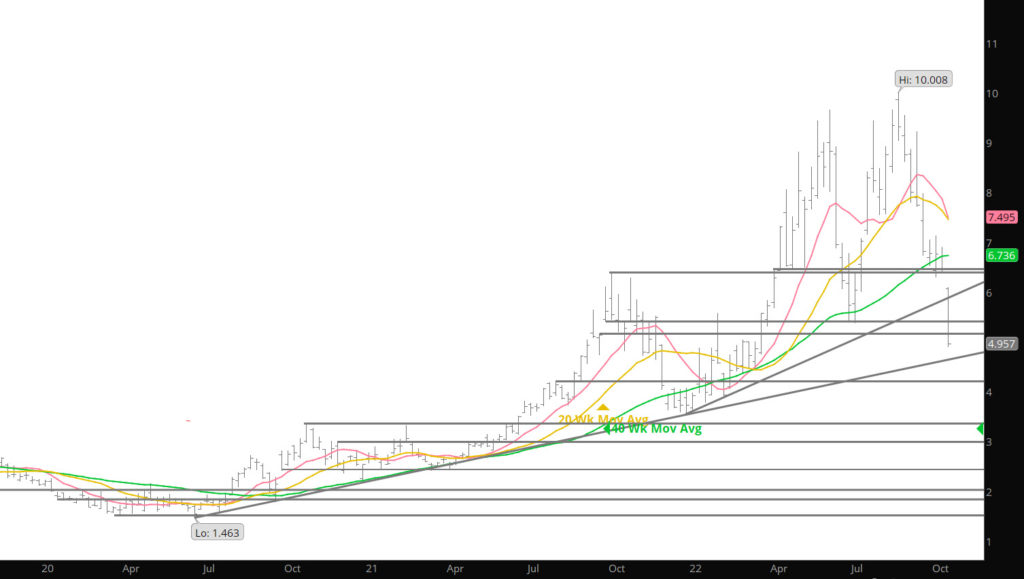

2 Year Bull Market May Be Closing

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Perhaps Range Is Defining

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Continuing To Define the Low End of Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Sunday Weakness Confirmed — Huge

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation — Range Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.