Category: Daily Call

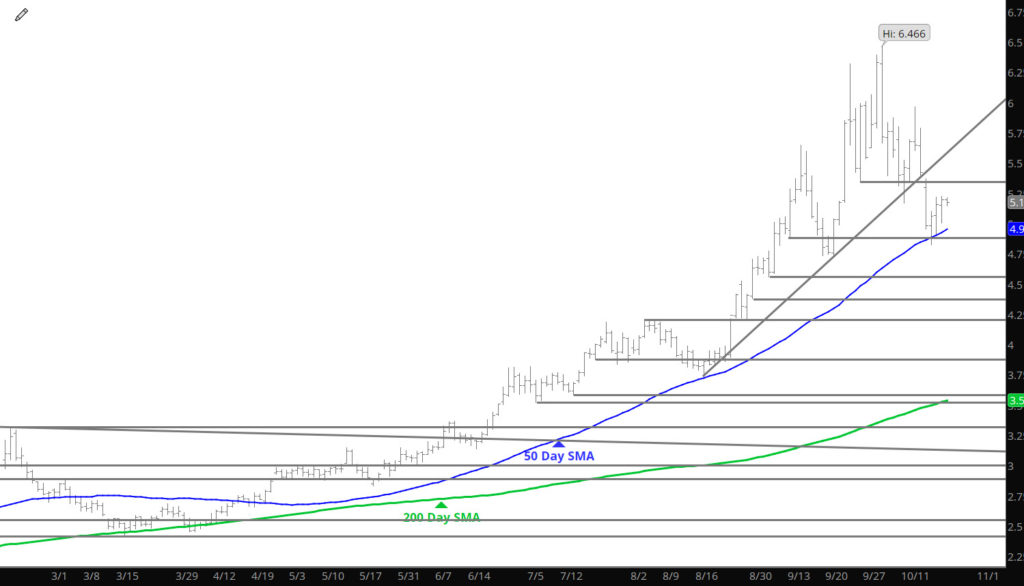

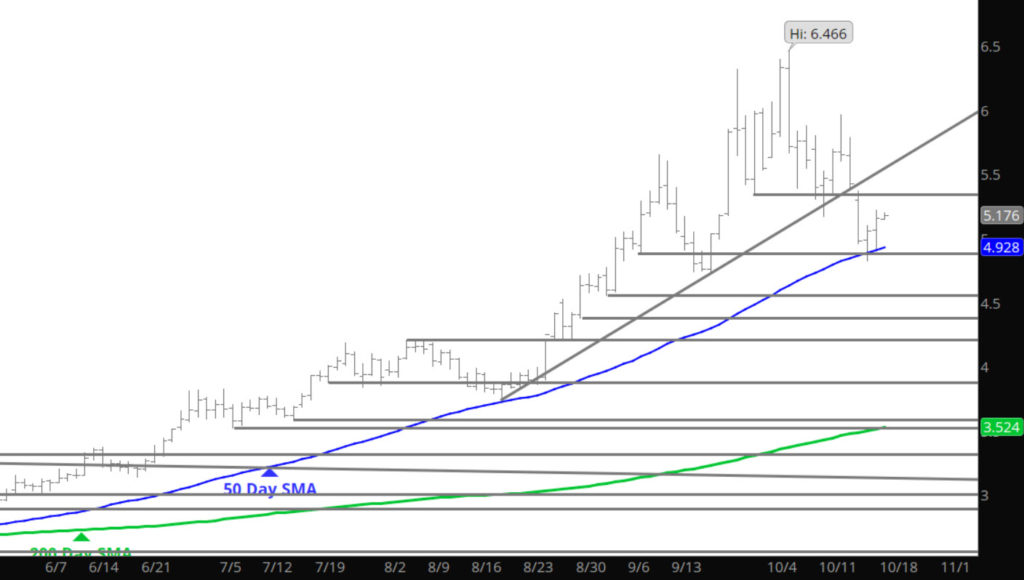

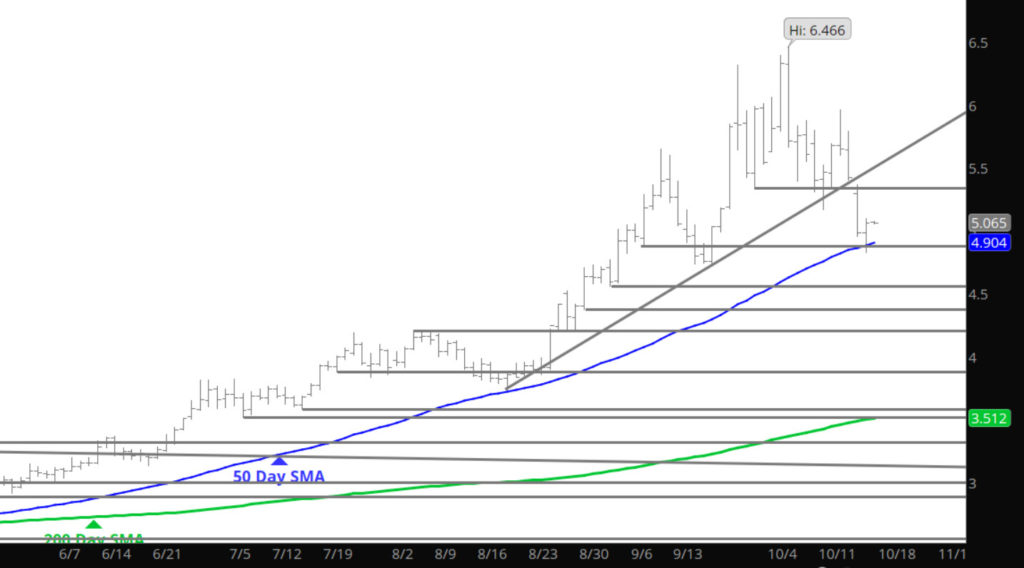

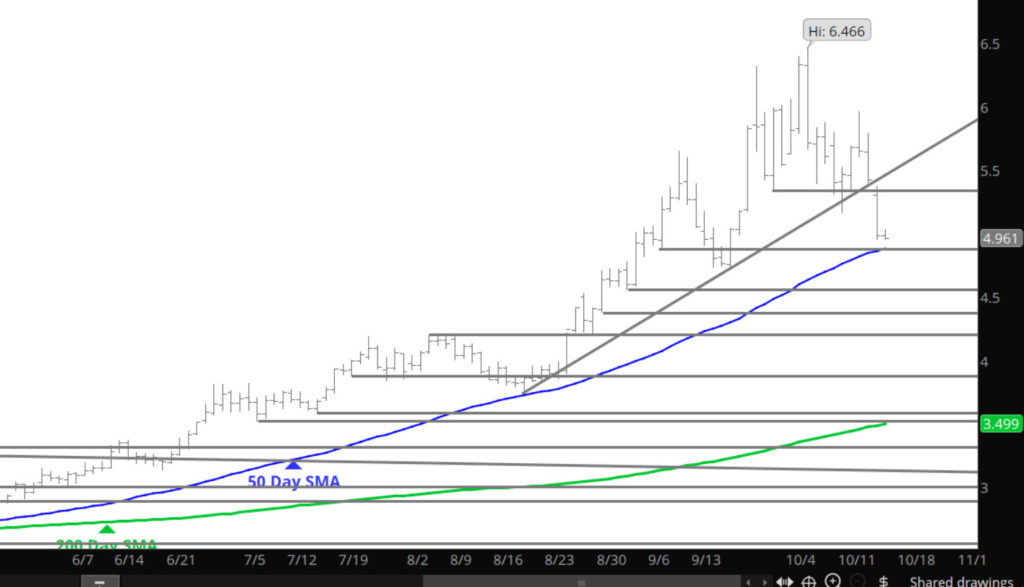

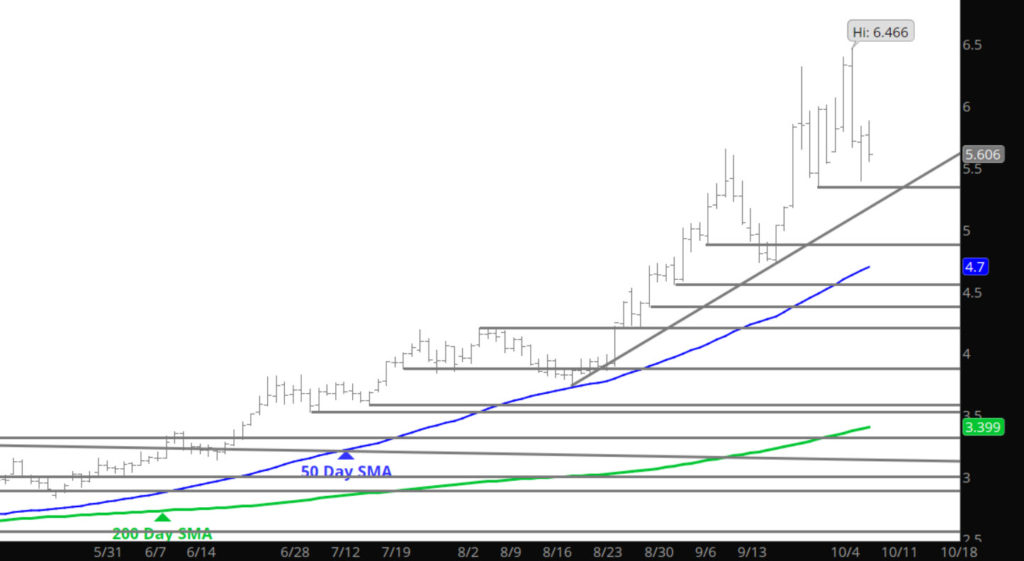

Journey to High End of Range Continues

Support Zone for Range Starts to Establish

Declines Cruise Through Support

Market Commences Order

Top Of the Range Tested — Failed

Rocking Again

Consolidation Bounces at Support

Some Continued Consolidation

Well — got my extension of weakness and now the market has corrected over $1.10 from the highs just four days ago. Needless to mention that the momentum indicators have calmed down and falling from the extreme areas- the market has fallen well below the 2 standard deviations from the 20 week SMA and to my knowledge (limited) it is all due to Russia committing more gas to Europe. I could care less as to why, more interested as to the correction and consolidation and wanting to add back as winter is not here yet so all of previous action is based upon the expectations and not based on actual.

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821,

Minor Support: $5.62-$5.633, $4.728-$4.70, $4.66

Major Resistance: $5.876, $6.24-$6.439