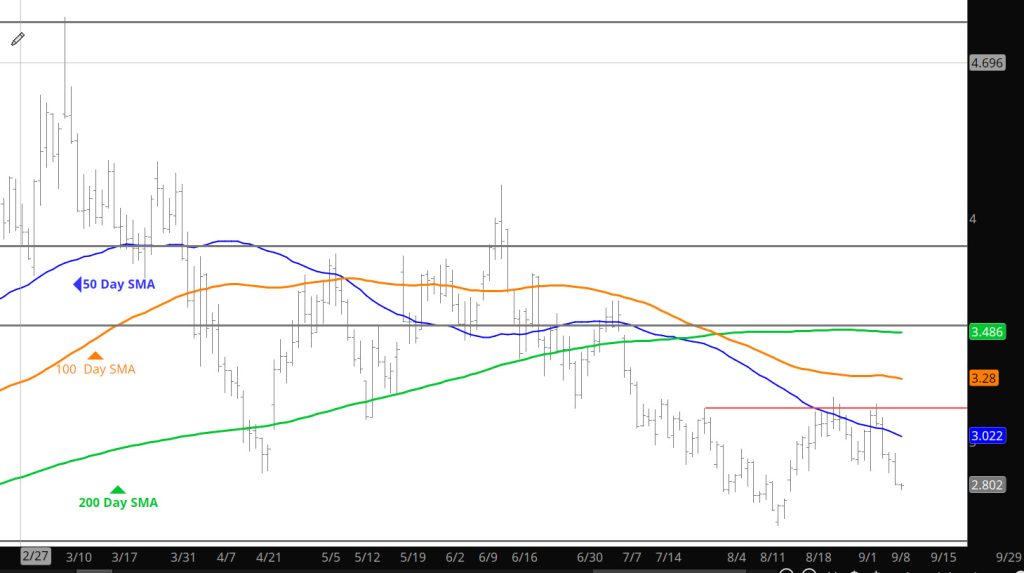

Category: Daily Call

Key Support Zone

Daily Continuous

Prices headed south to the key areas discussed in the Weekly section that held and found some support. Will be very curious about the upcoming storage release and the market’s response on Thursday.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

Where’s the Momentum

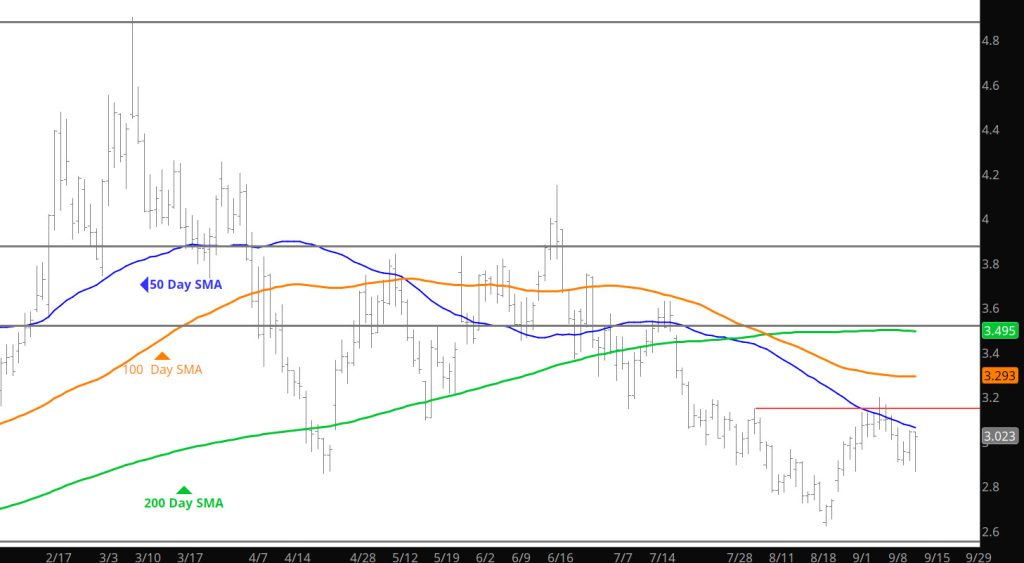

Look For A Test Early In the Week

Back In the Saddle (Range)

Bouncing Between

Daily Continuous

Price action bounced within the range that has developed – watch to see how the market responds to the storage action coming.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

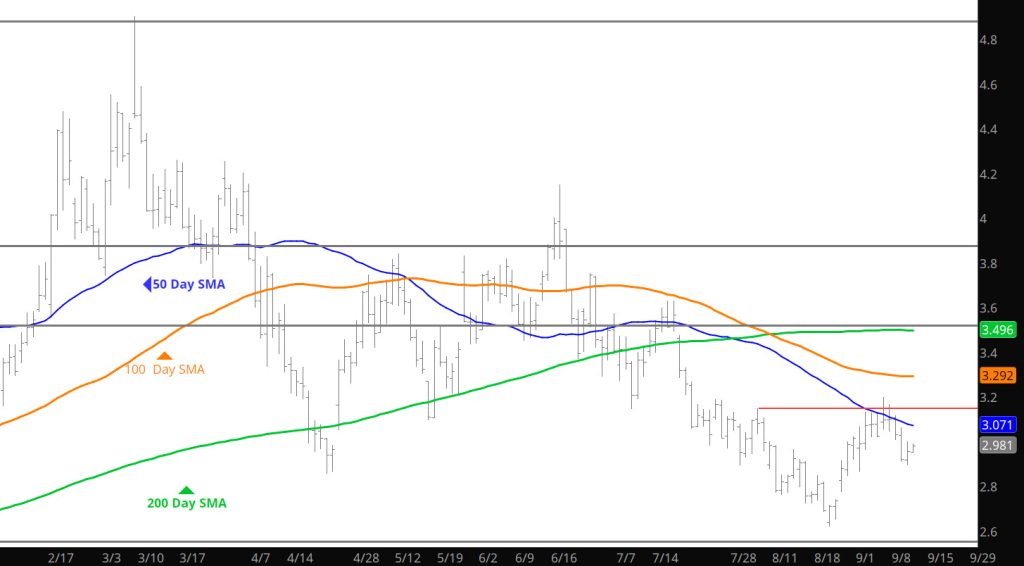

Bizarre Trade Become Strength

Daily Continuation

Mentioned that action in the after market trade yesterday, but it turned out a useless indicator for future prices as the market continued to gain. Now approaching the earlier month highs for the price range– but should be continued as resistance for near term trade.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,

Weird Action

Another Range Bound Monthly Trade

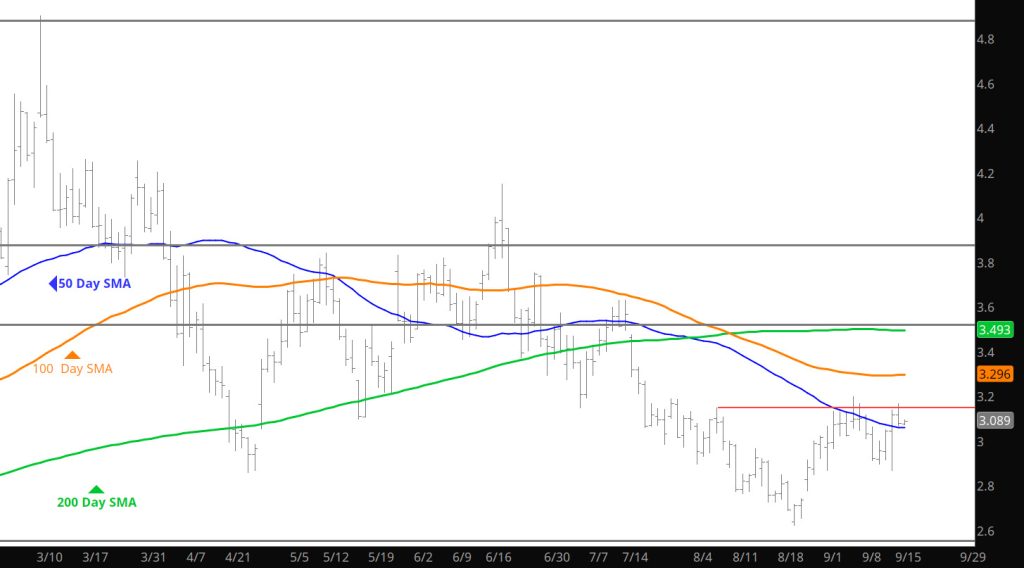

Storage Report Breaks Down Prices

Daily Continuous

The release of the storage data was more of an injection than expected but doesn’t have any sort of dramatic impact on prices through the winter (watch the prompt relationship to Jan’26) in the near term. That is where you will see any concerns about gas this winter to October.

Major Support: $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance: $3.061, $3.16, $3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,