Category: Daily Call

Perhaps a Small Bounce and Consolidation

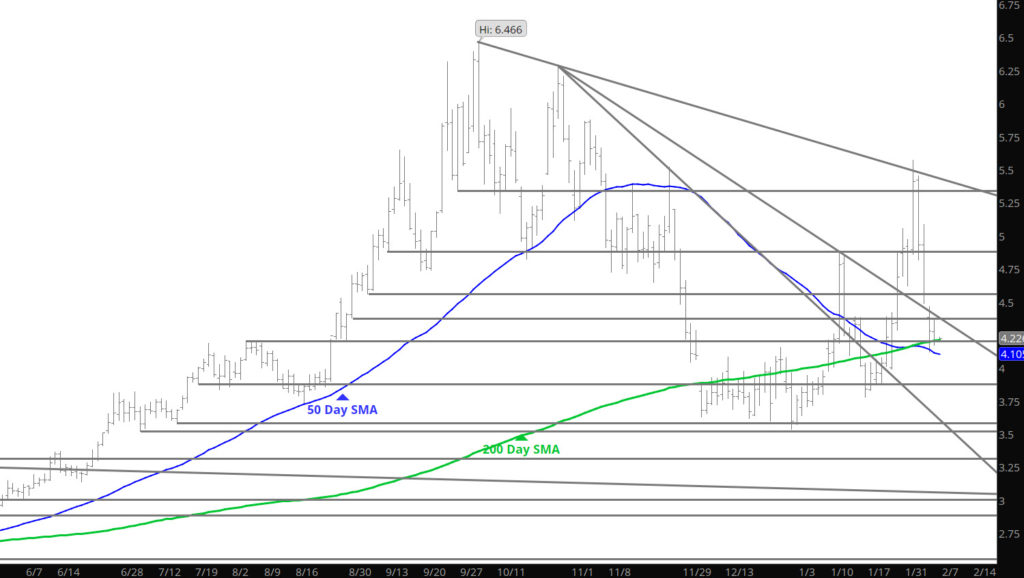

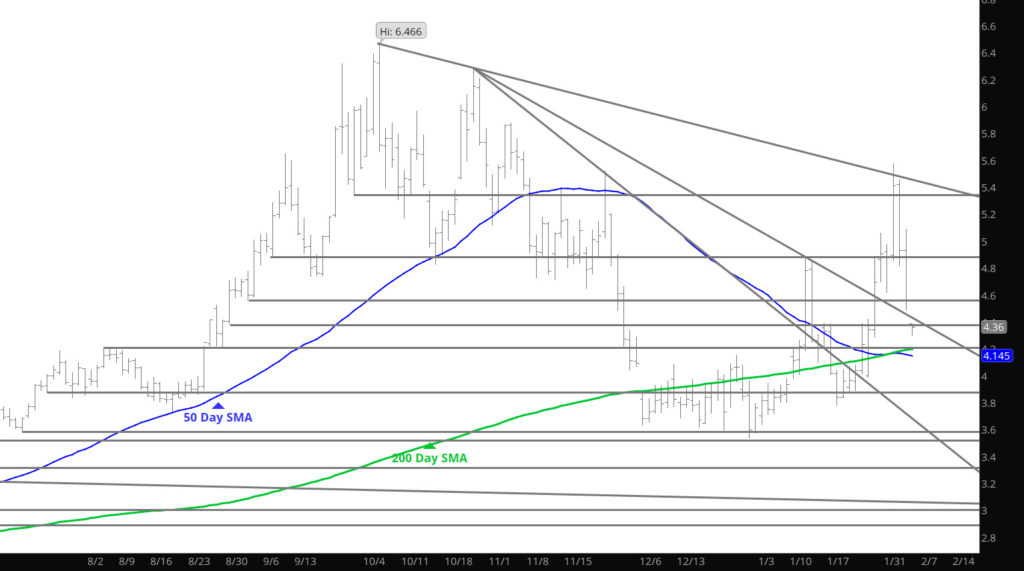

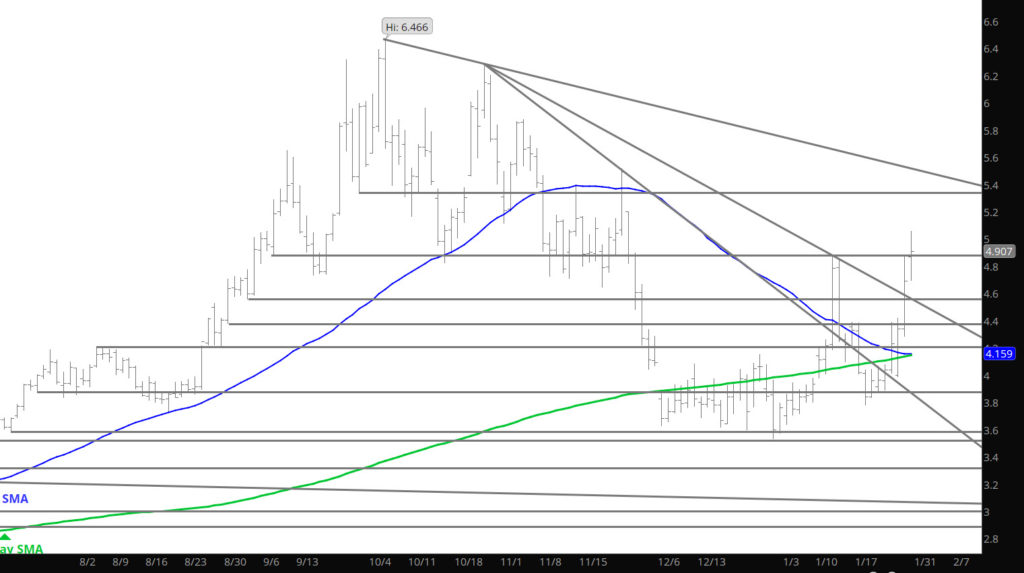

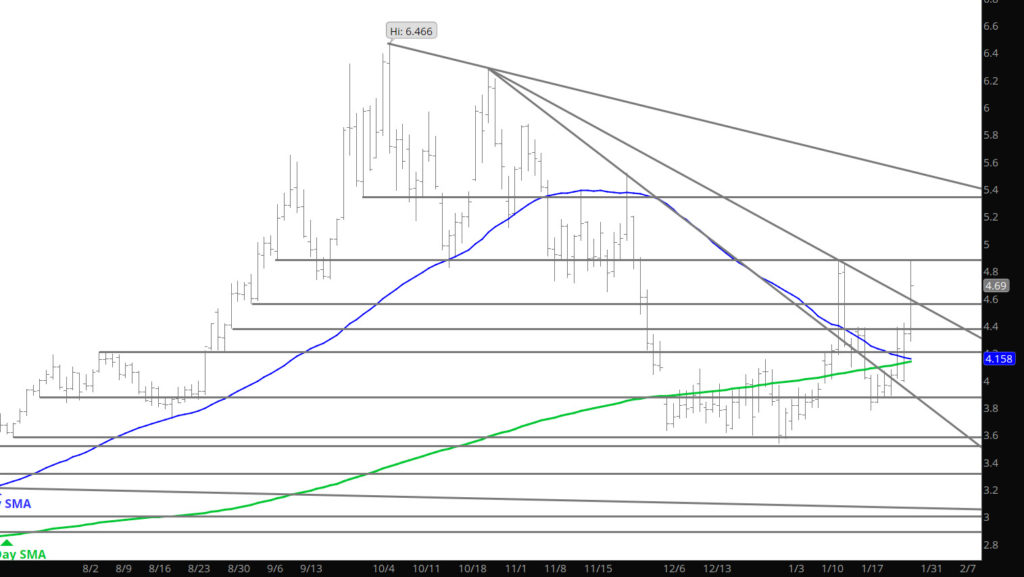

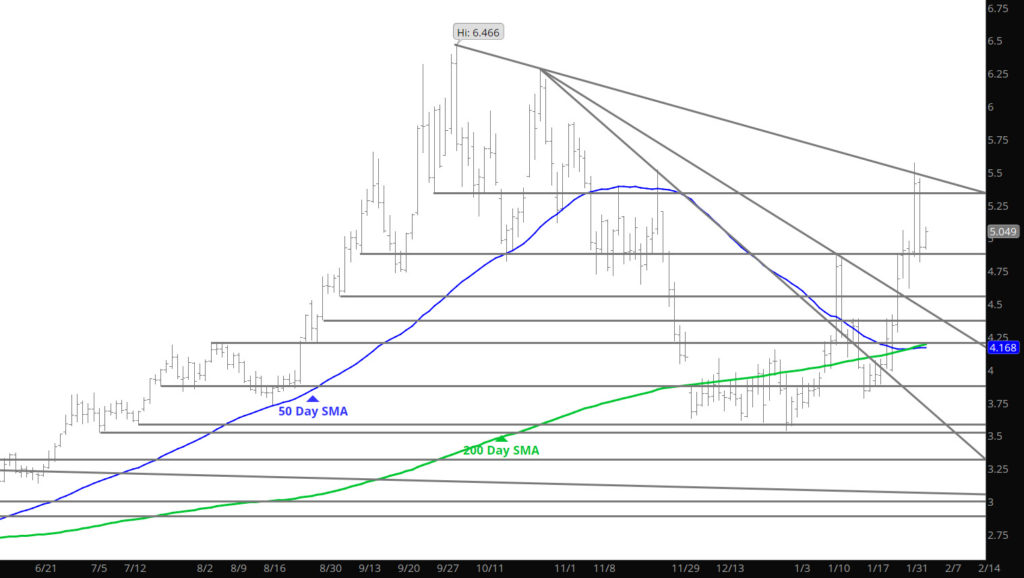

Prices action continue to behave well for additional declines but not sure today will be down that much — look for a small decline or perhaps a little bounce. The gap from yesterday should be thought of as the near term high end of the range.

Major Support: $4.20-$4.186, $4.057-$3.972, $3.734, $3.63, $3.584-$3.522

Minor Support:

Major Resistance: $4.46-$4.48, $4.82, $5.5

Correction Seems to Continue with Gap Opening

Timely Daily

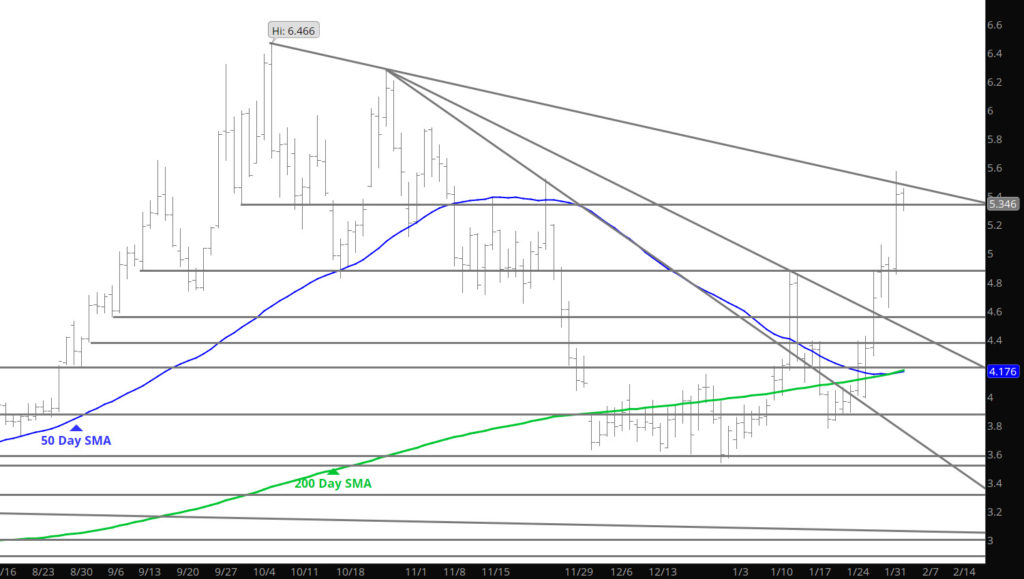

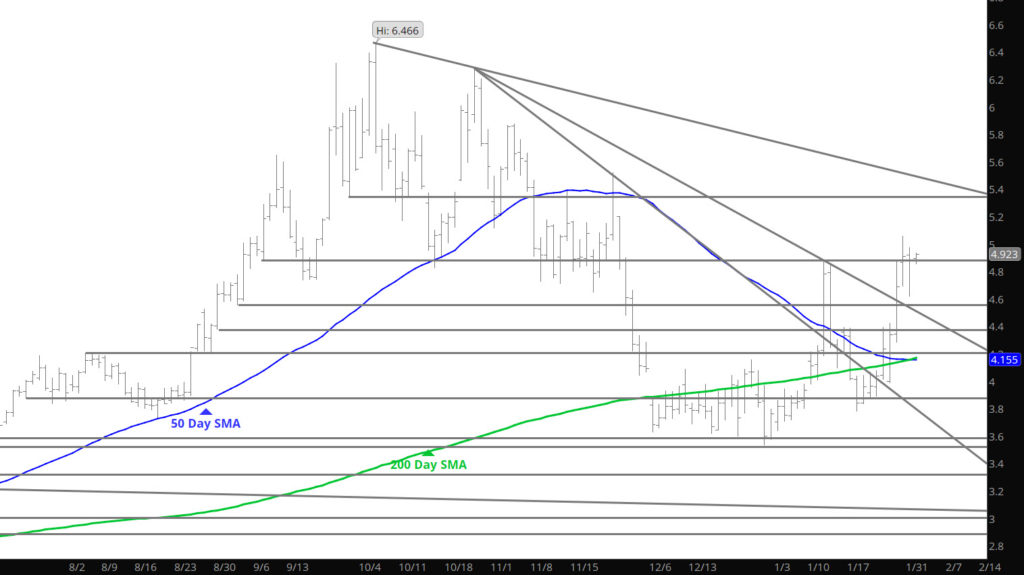

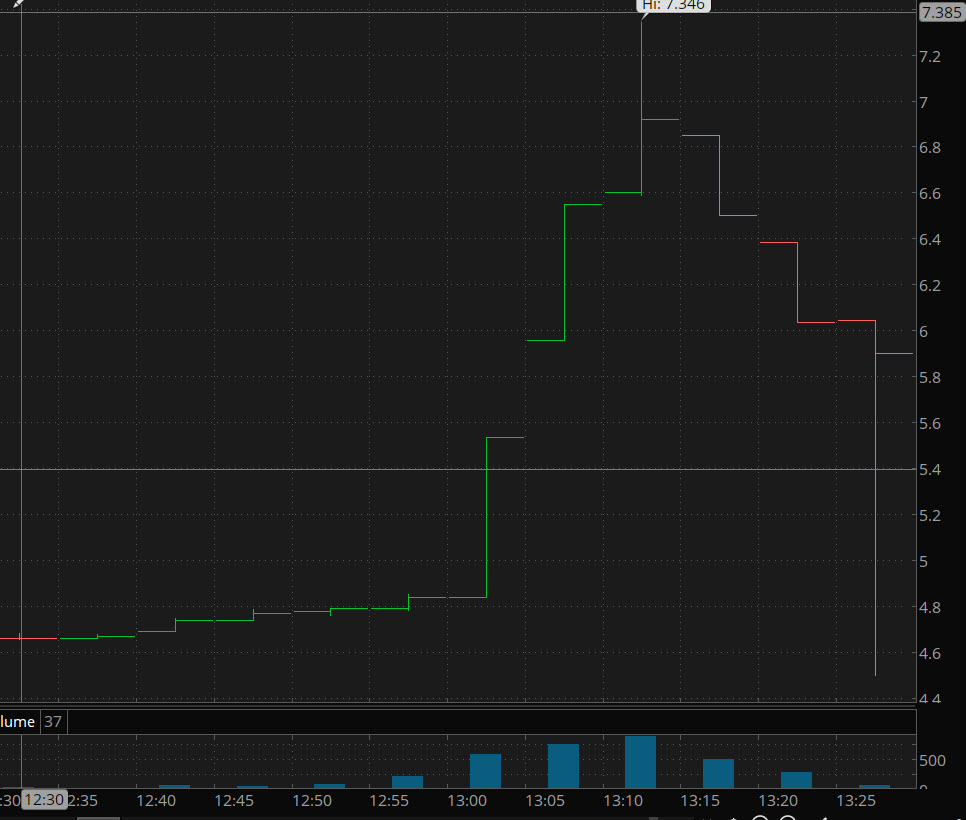

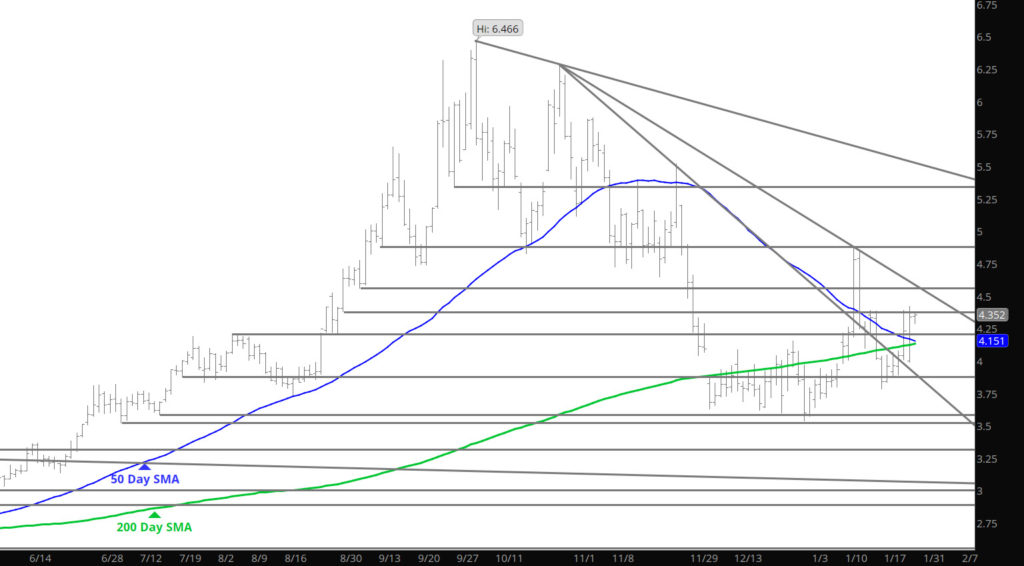

The day I decide to remember history — is the day prices correct over $.60 downward– all I can say is I wish I had that kind of influence on the Craps table. Seriously, prices corrected yesterday but tonight they are trying to rally again– not sure what the strength is leaning with — fundamentals are bullish and have been for the next two week period which begs the question of why the sell off? May be in for additional volatility until the market realizes that the ending winter inventories are likely to be at a 200+ Bcf deficit to the 5year average (March being average demand). There I go again into the fundamental world — so please disregard the last comment.

Major Support: $4.19-$4.186, $3.734, $3.63, $3.584-$3.522

Minor Support:$4.81, $4.73, $4.52, $4.38

Major Resistance: $5.81-$6.13, $6.181