Category: Daily Call

Reversal in Prices — Provides Little Medium Term Impact

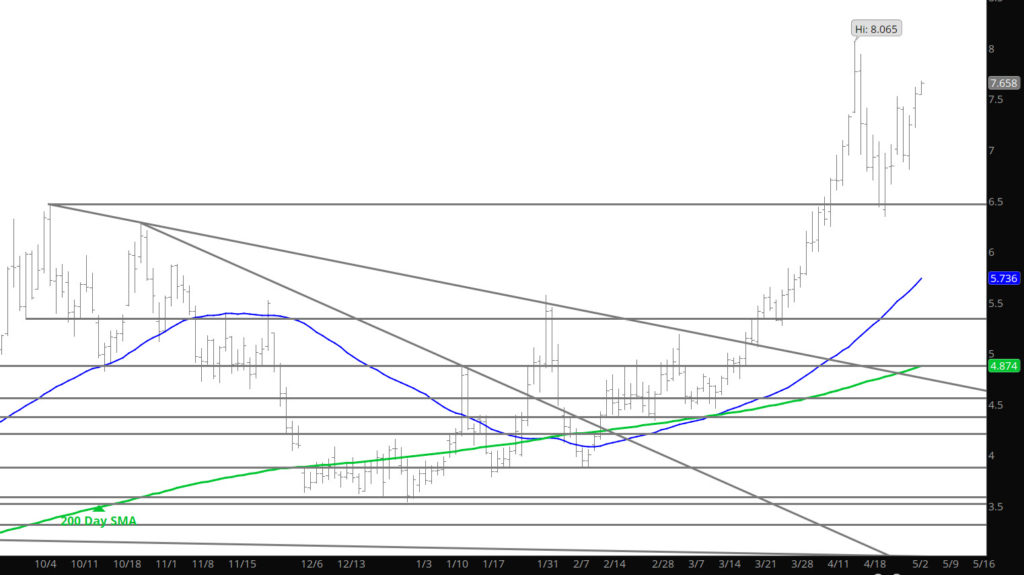

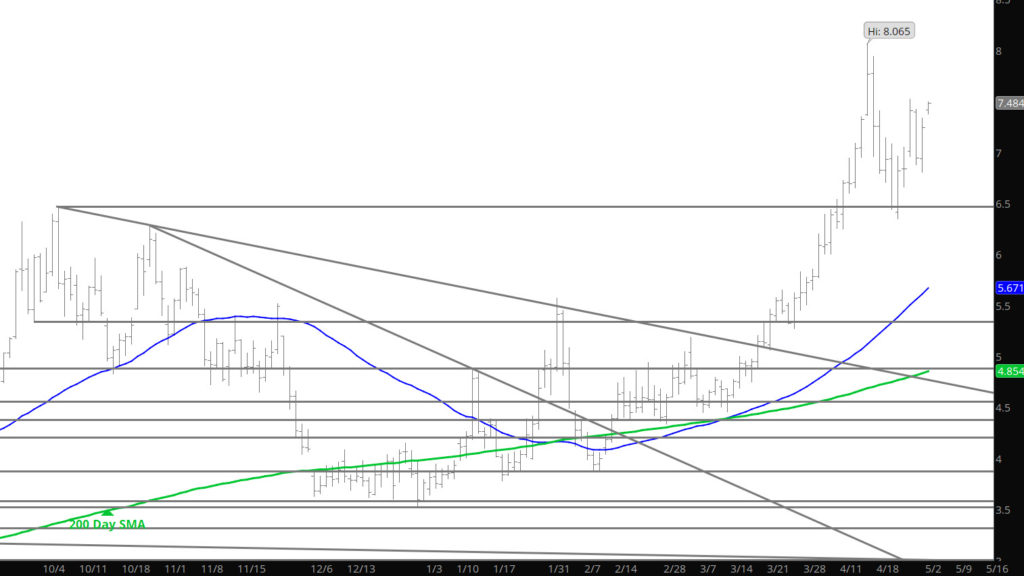

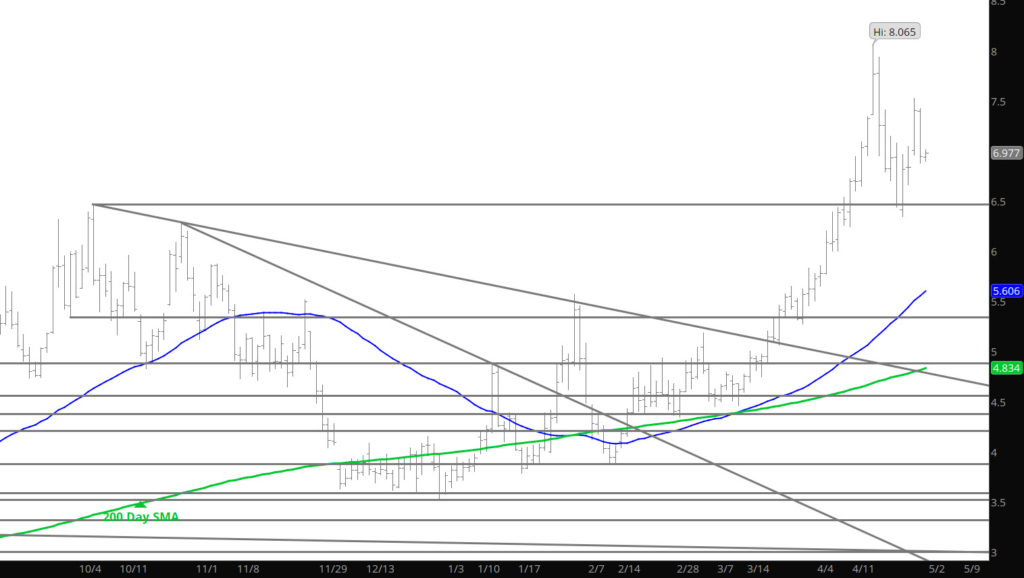

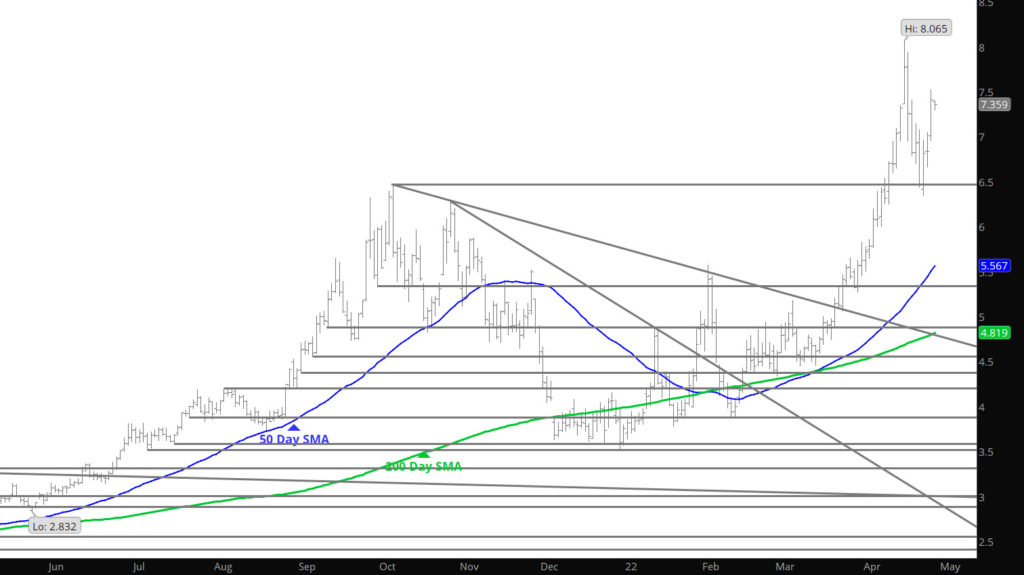

Been Here Before

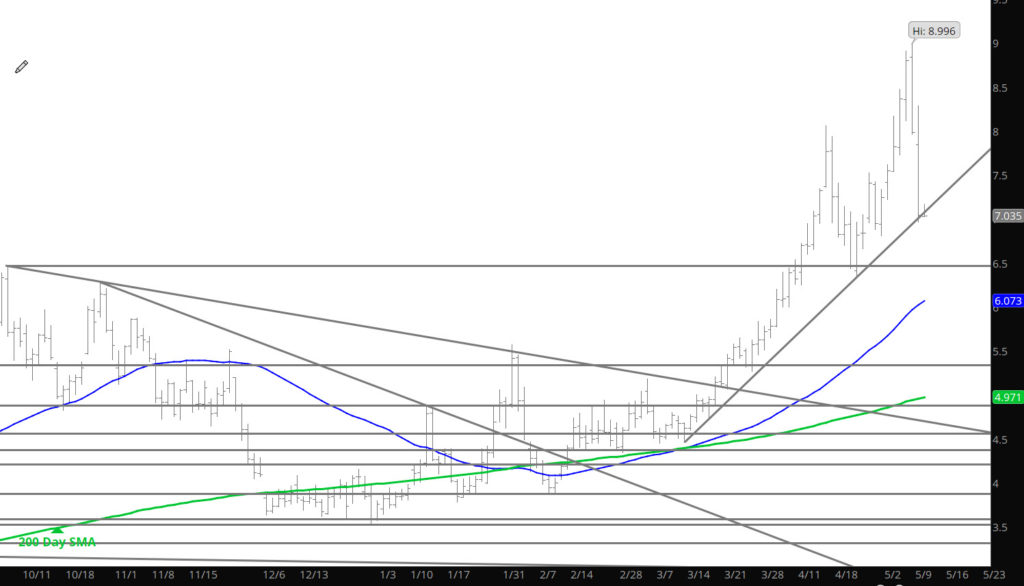

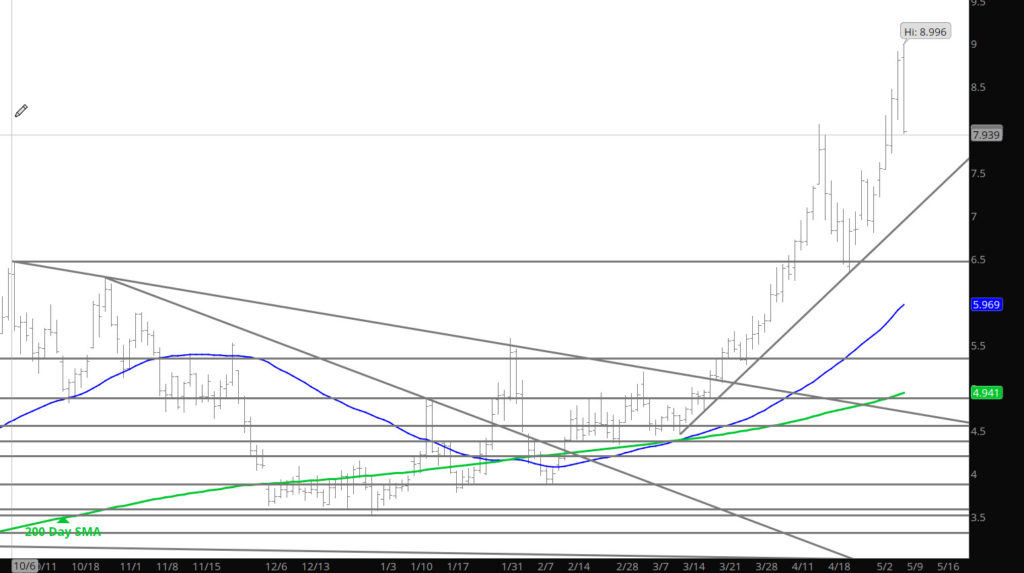

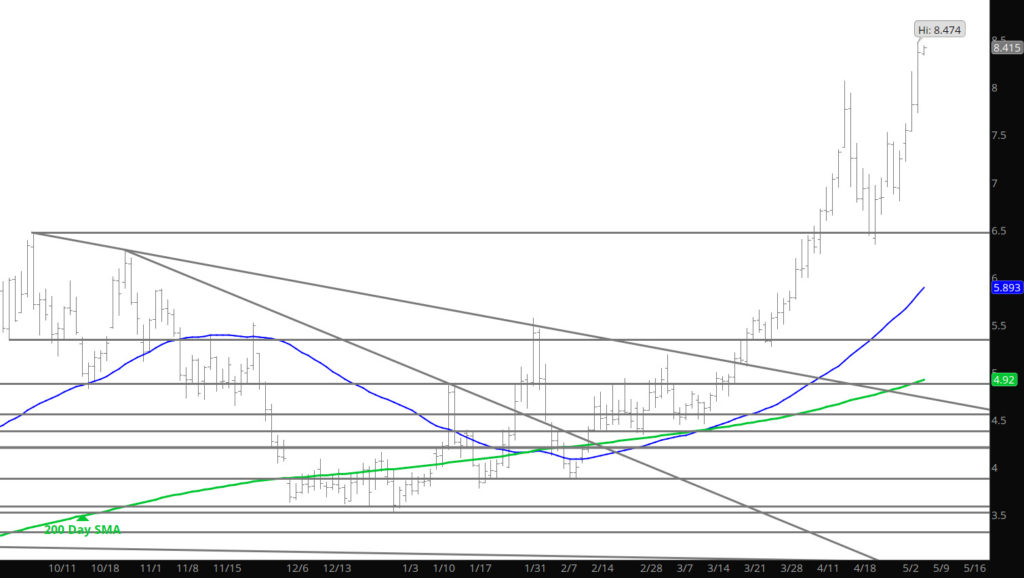

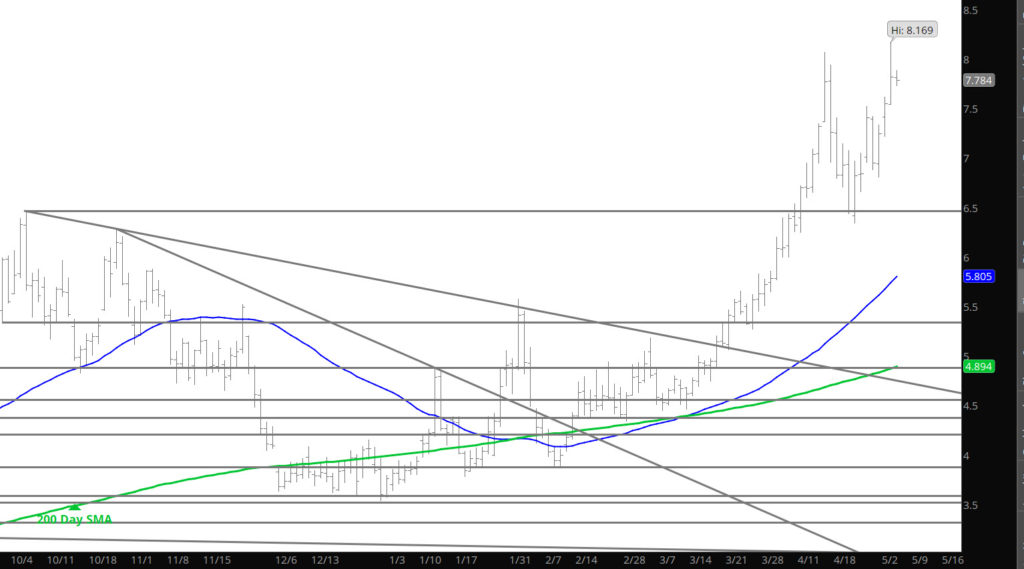

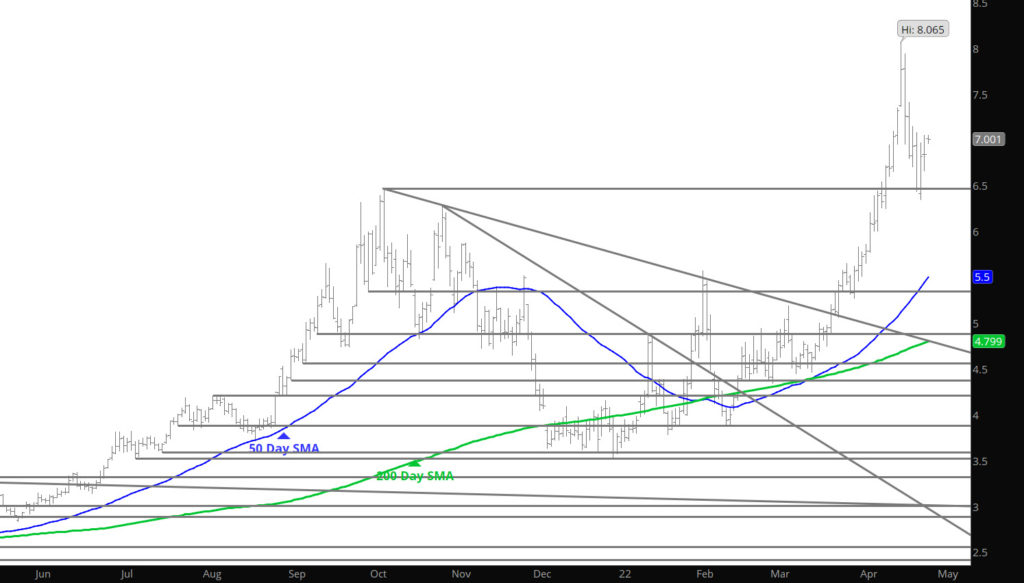

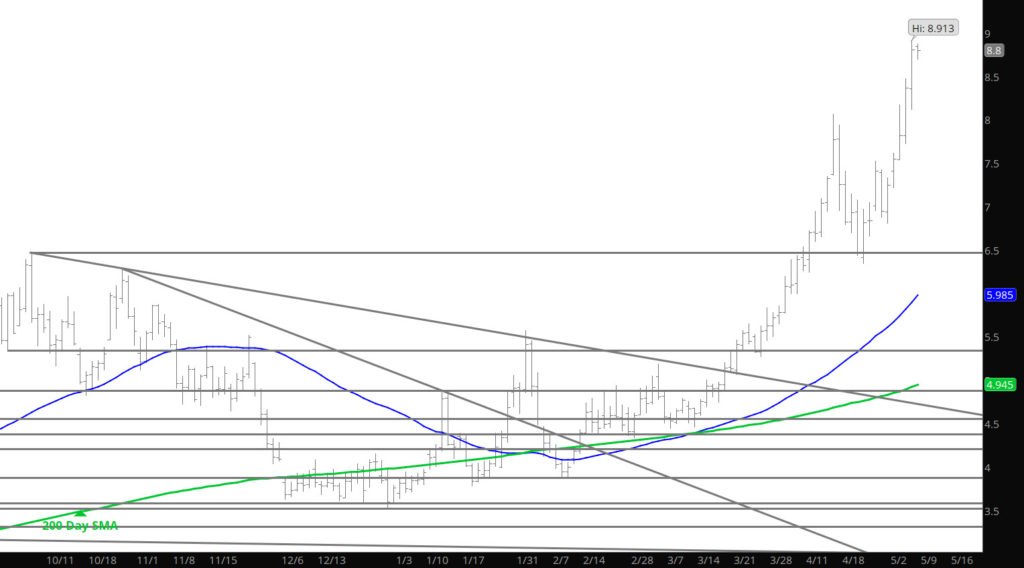

We were in a very similar position a couple of weeks ago, if you remember the chart below:

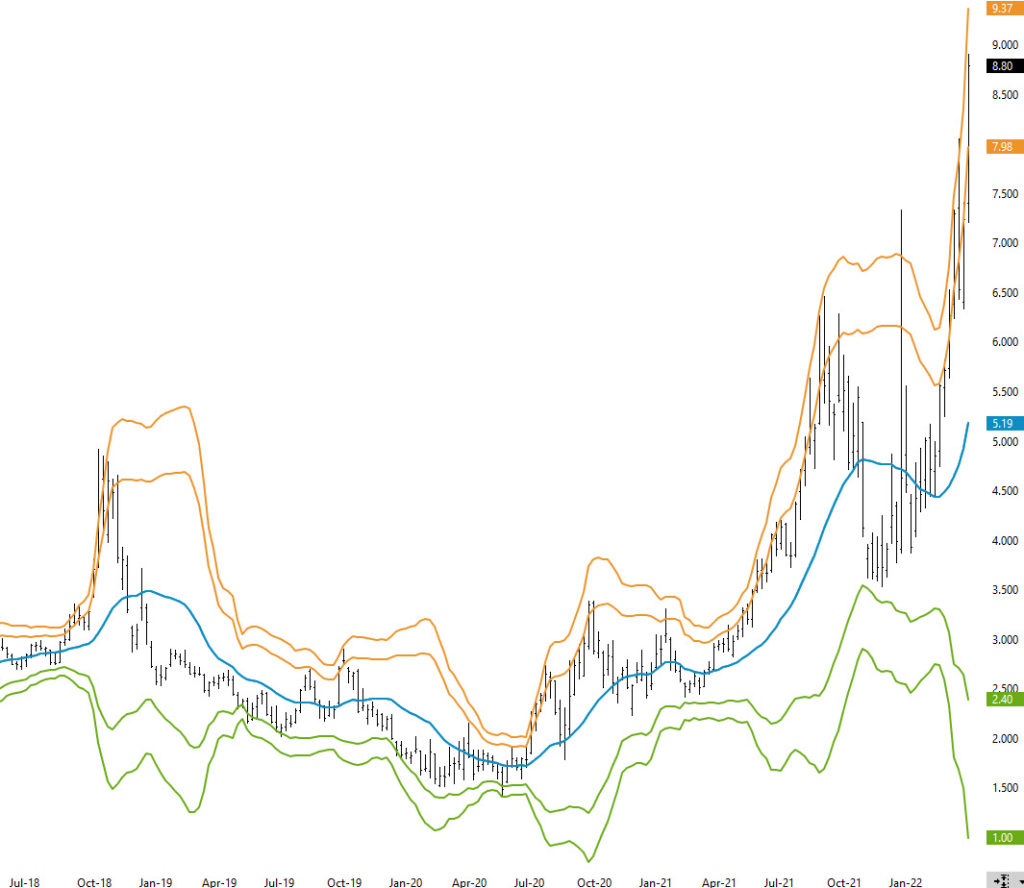

When prices extend nearly three standard deviations above the 20 WK SMA– it is over cooked. Last time (last month) prices corrected nearly 20% before finding support. Not calling this the high, as prices can continue well beyond technical points — but trust me — there will be a correction. If you are playing this with length — rock and roll, I have retired from playing this market (even on a daily play) until some of the silliness recedes. BTW — I thought that was a bearish storage report — that is why I don’t trade on fundamental data points.

Major Support:, $7.00-$6.855, $6.411-$6.392, $6.247-$6.278, $5.27-$5.199, $5.001, $4.40-$4.26, $4.187

Minor Support: $6.00, $5.063, $5.04, $4.88, $4.60-$4.557

Major Resistance: $8.47-$9.60