Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Interesting Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gains Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Continue to Rock in Late Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Forecasts ?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Clueless on Direction

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Early Trade Closes Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Low Range Tested In Front of Storage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Previous Low Tested

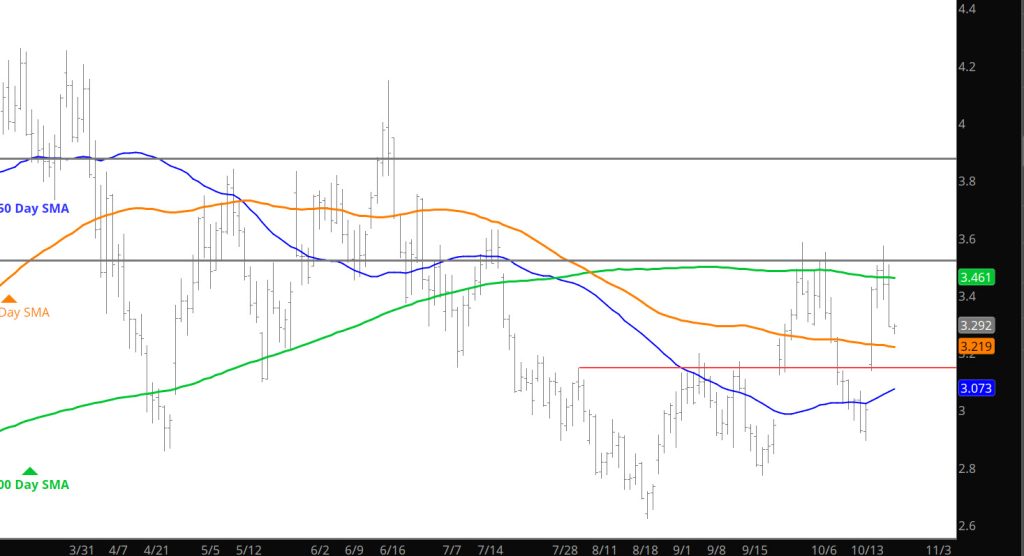

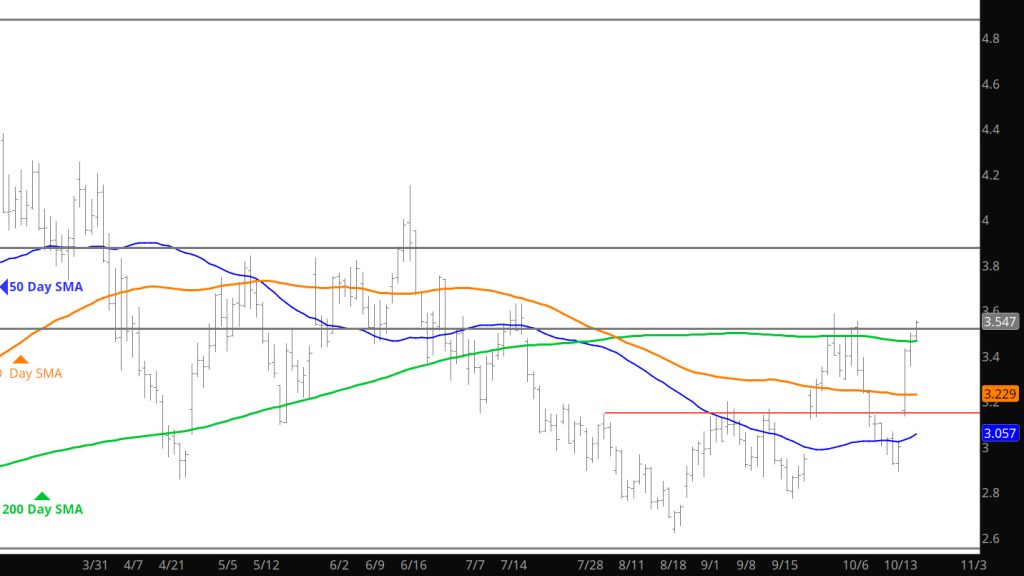

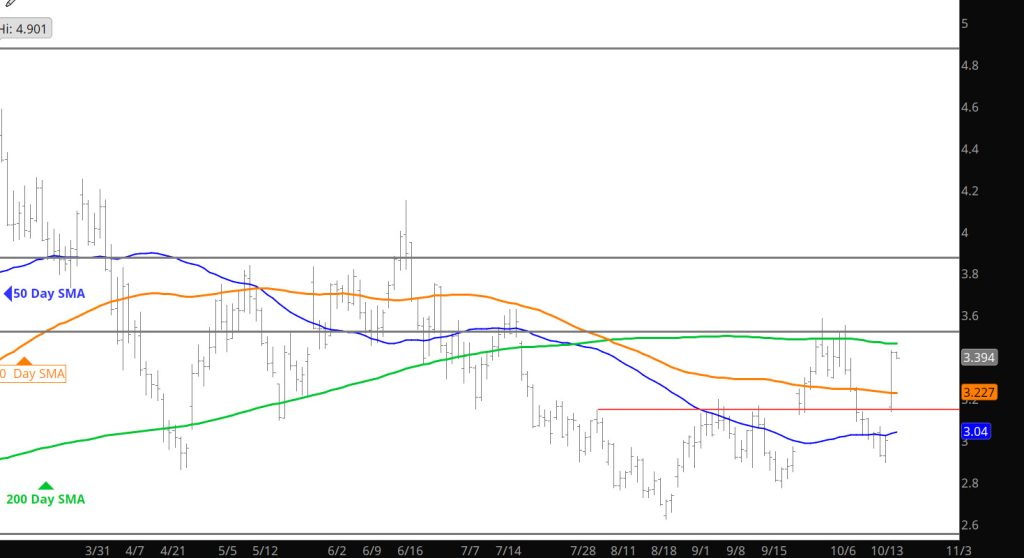

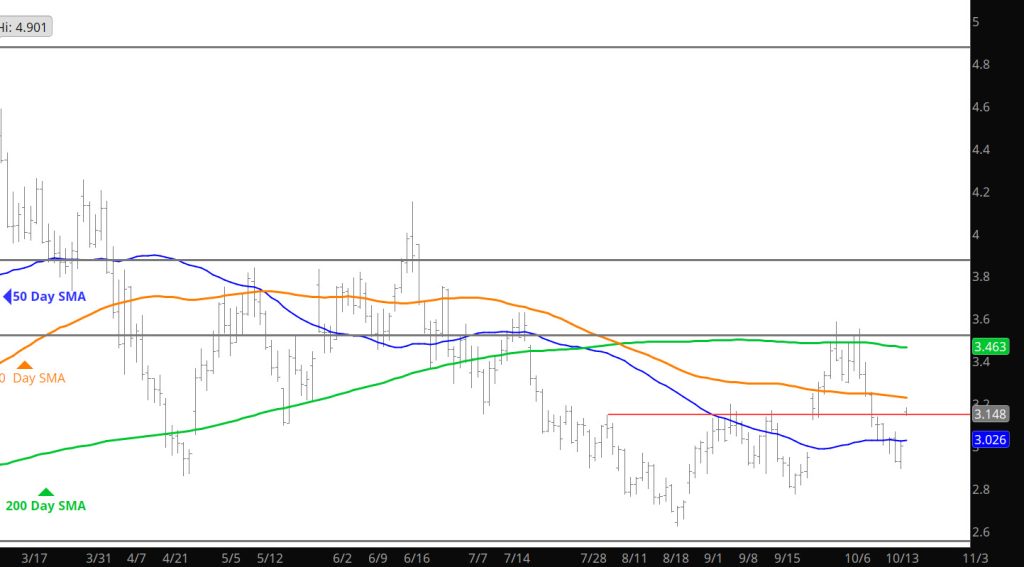

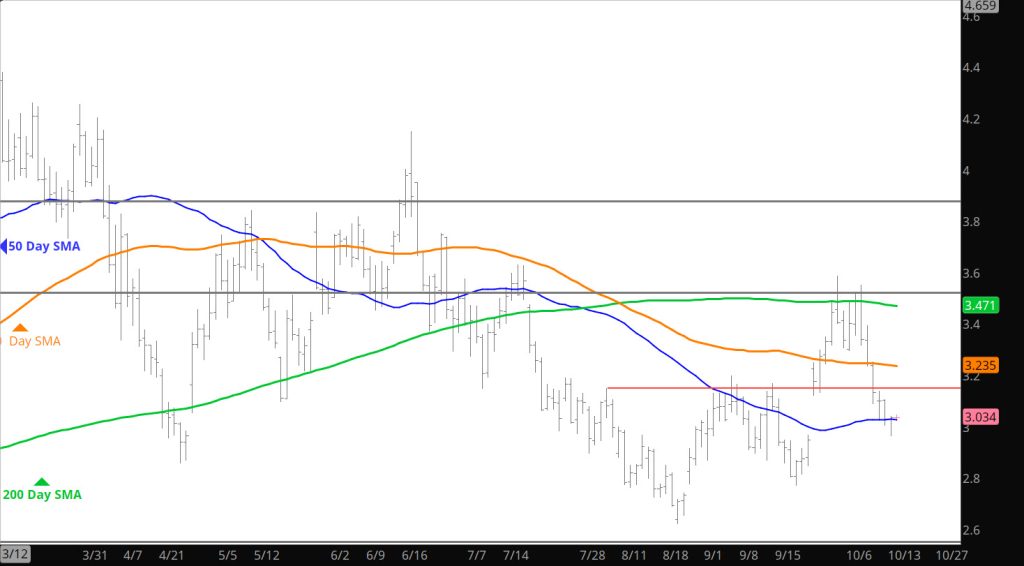

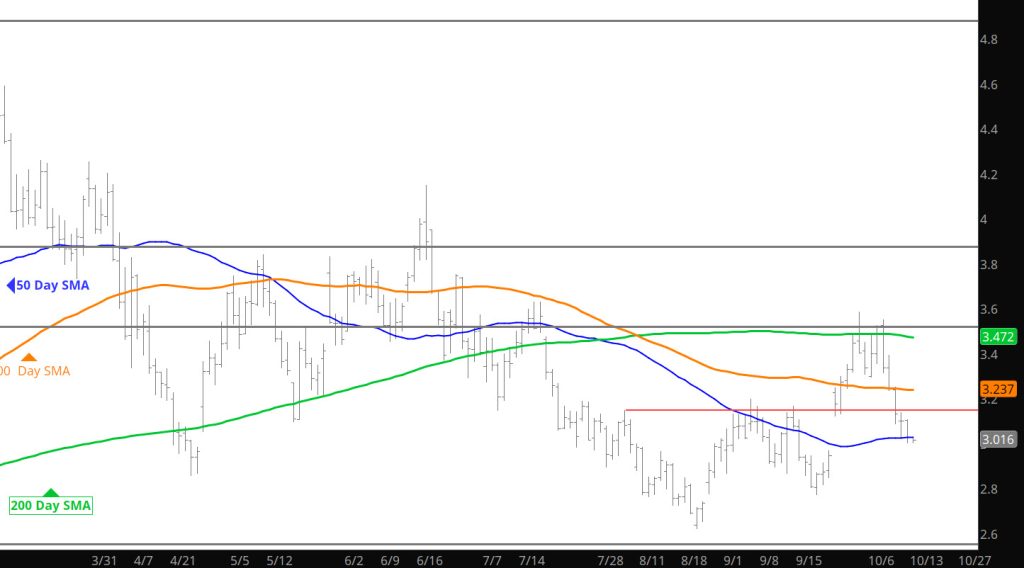

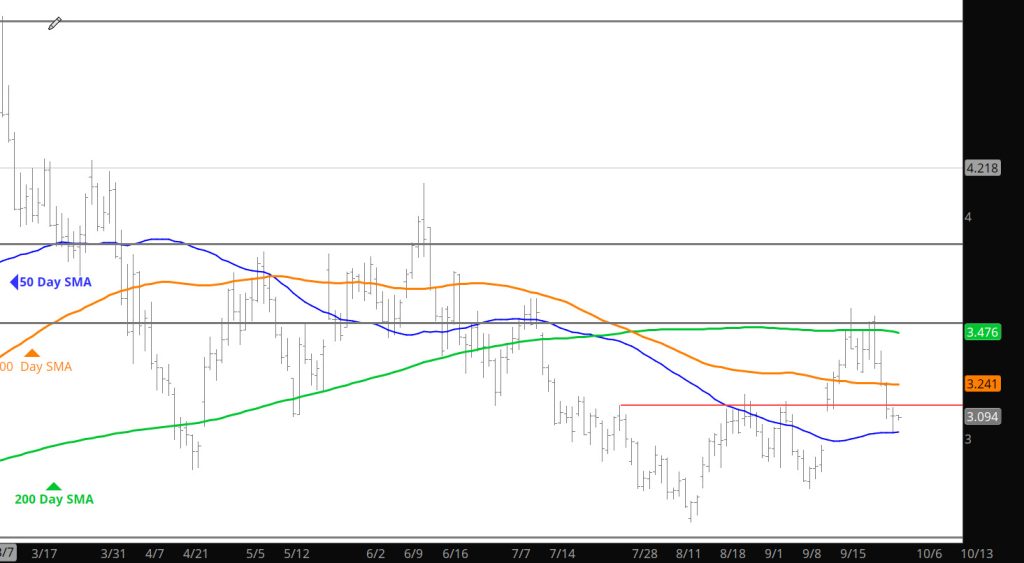

Daily Continuous

Prices extended the declines and tested the low from earlier in the month, but with volume declining the declines stopped at previous lows for the prompt. Does it seek additional support for the press lower — we shall see?

Major Support: $3.167, $3.06, $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support :

Major Resistance:$3.19, $3.39, $3.62, $3.80-$3.85, $4.168, $4.461,

Holiday — Lighter Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.