Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

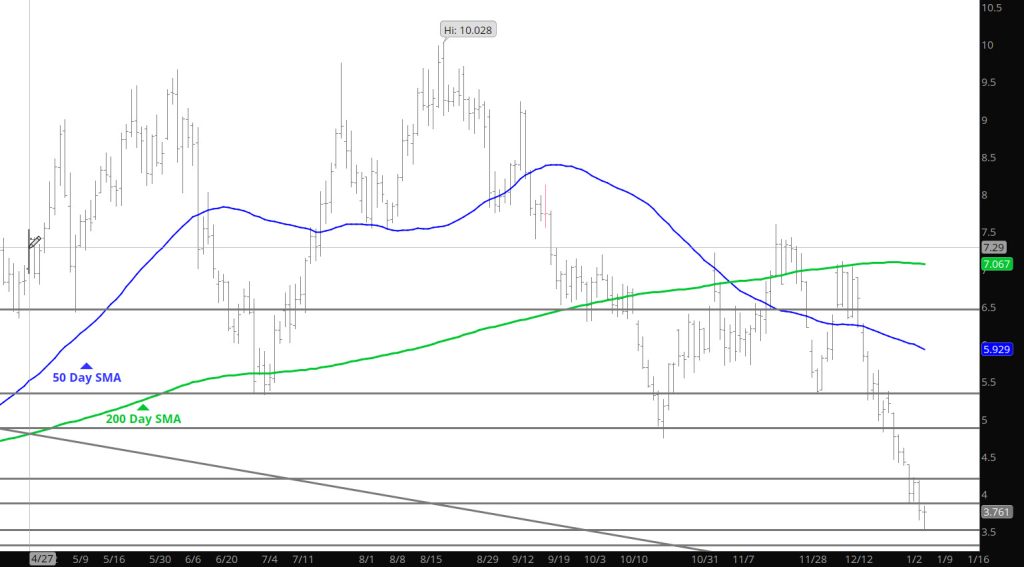

Does It Sound Familiar — Range Range Range

Not going to waste your time nor mine — nothing to add to the Weekly or Daily — Can I spell Range.

Major Support: $3.638-$3.536

Minor Support:

Major Resistance$4.22-$4.39, $4.75-$4.825, $4.948, $5.056

Monday Holiday Brings Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Still In the Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No Changes — Just a Test of Support as Expected

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Back To Where We Started

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

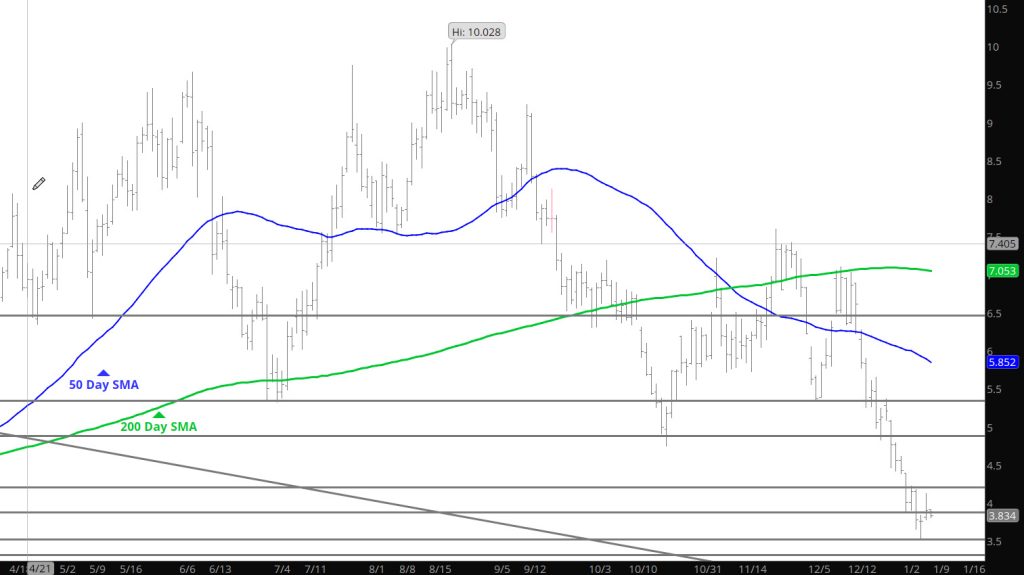

Mitigates Some Of The Extreme Over-Sold Conditions

Yesterday’s action was a start to a corrective rally to relieve the over-sold conditions– now the market is likely to range trade to further allow the market to create a base from which to rally from or extend the declines. Due to prices declining at the end of the day — expect them to add to weakness today.

Major Support: $3.638

Minor Support:

Major Resistance$4.22-$4.39, $4.75-$4.825, $4.948, $5.056

Declines Hitting Extreme Area

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Continue — Approaching Unsustainable

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Rebound Off 2021 Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.