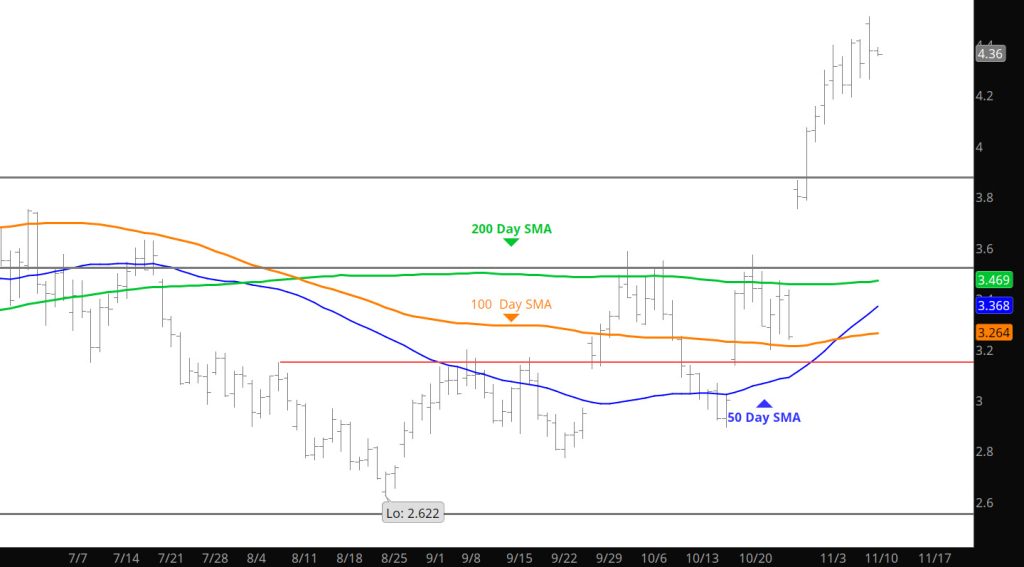

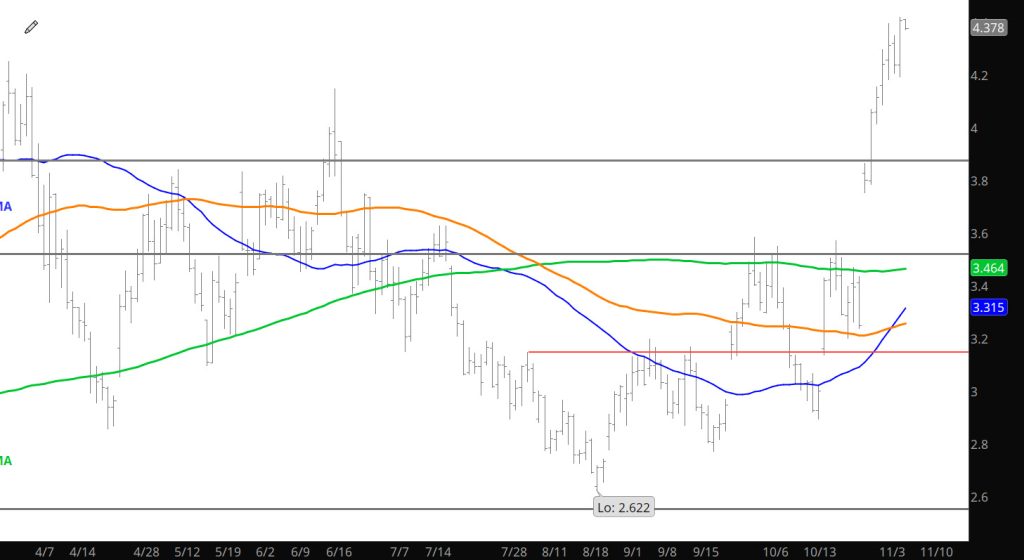

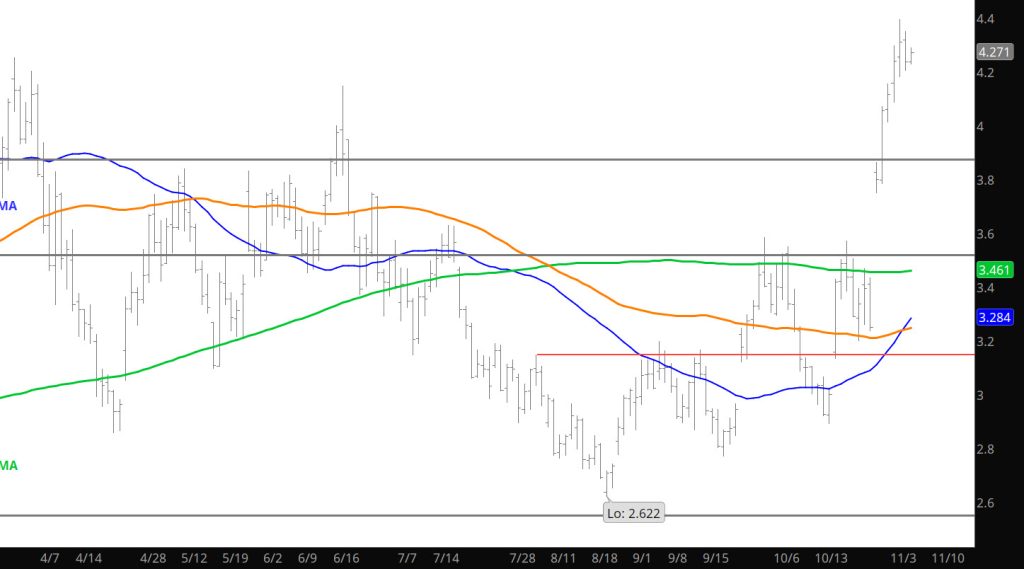

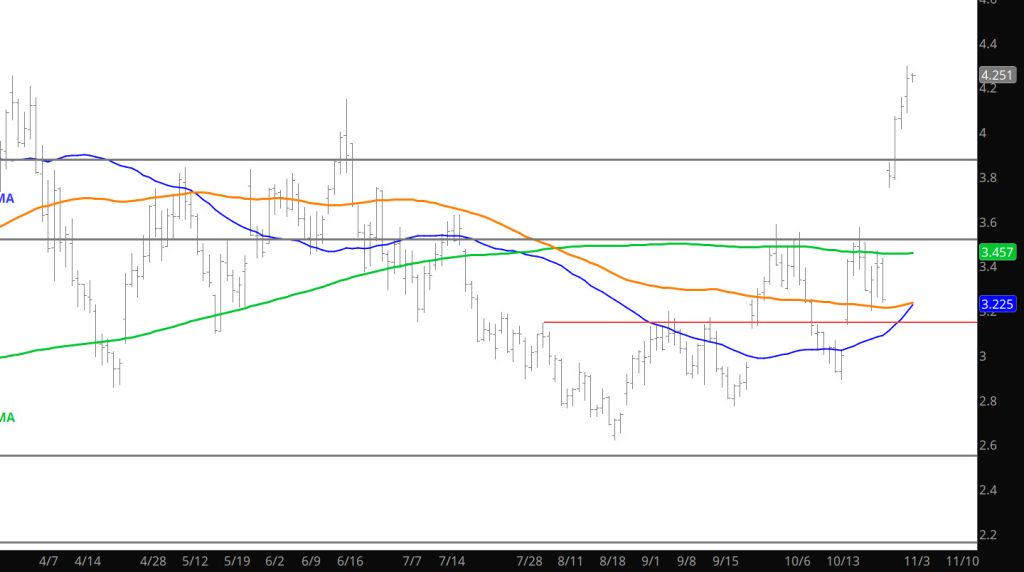

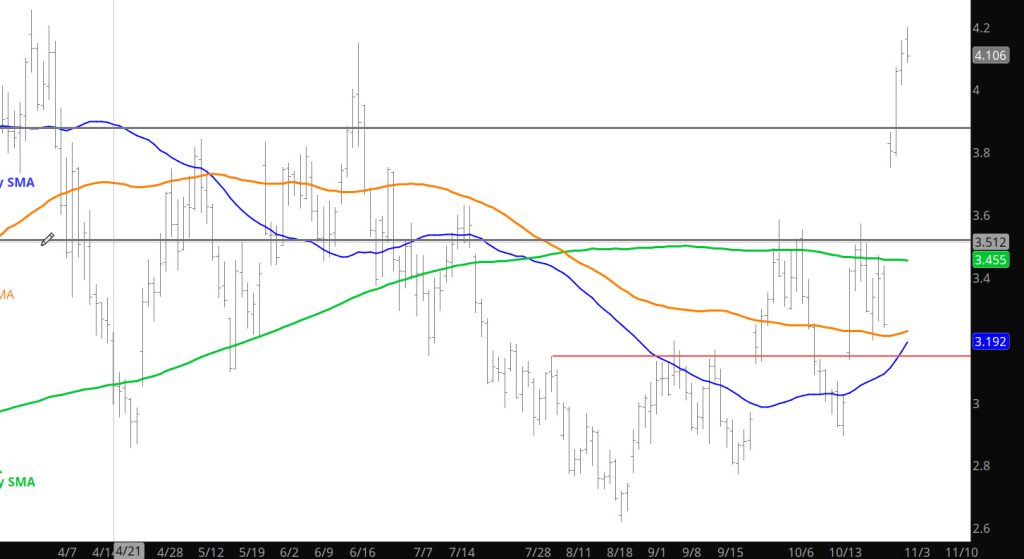

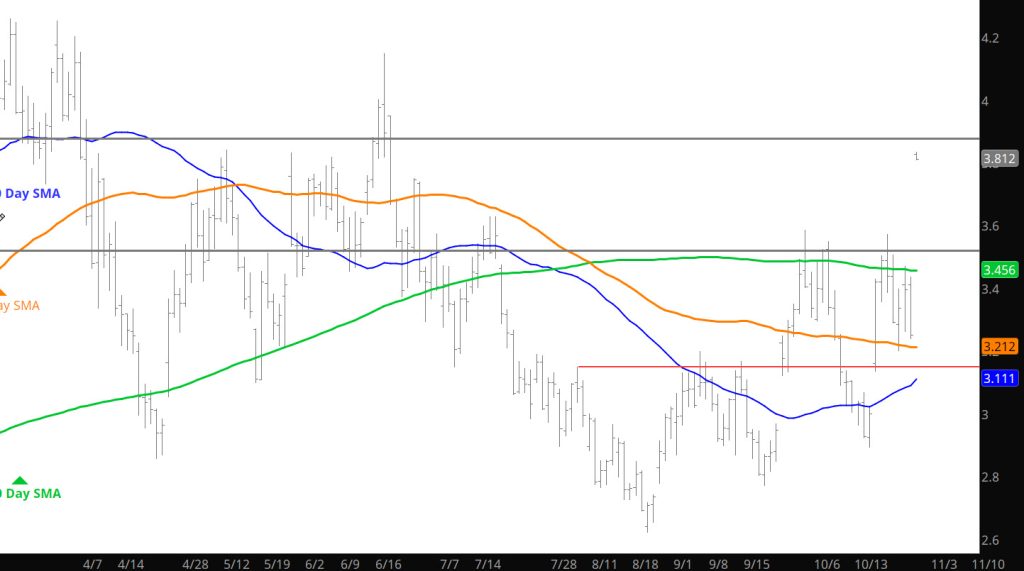

Daily Continuous

Prices seem to want to test the high side of the Nov contract range that has been developing. Positions should hold until existing weather moves on and the storage report is released– watch for a retracement back to the early month lows ($4.20-$4.00).

Major Support: $4.21-$4.139,$4.122,$4.055,

Minor Support : $3.942, $3.75,$3.65

Major Resistance: $4.394, $4.461-$4.475, $4.49-$4.55, $4.901,