Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

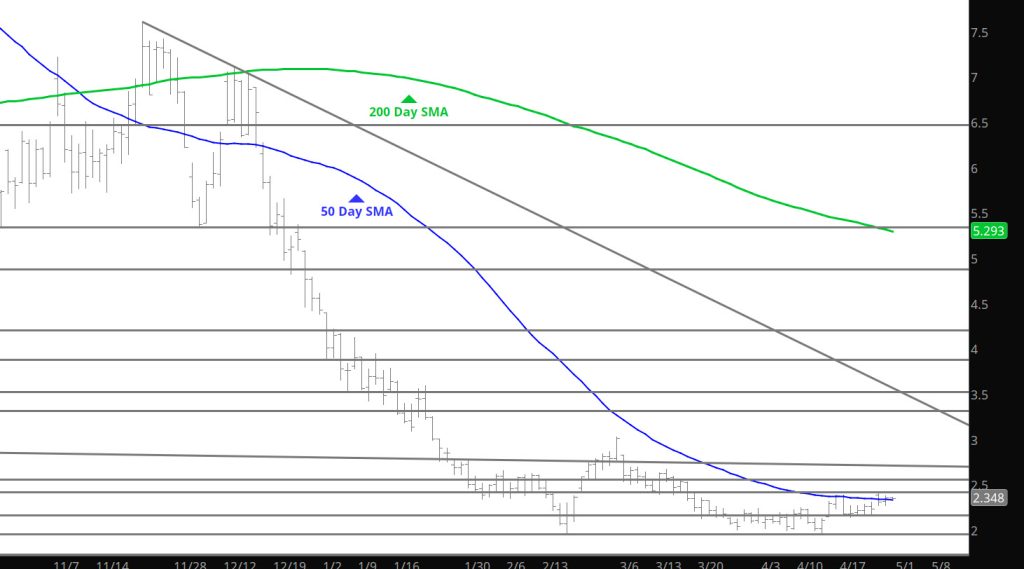

Expected Test of Closing Action

Mentioned earlier in the week that the expectation of prices to test support after June took over as prompt and that is what happened yesterday — but I must admit that closing some of the premium afforded to June was not expected. I thought the price action would carry down further into the closing range of the May contract. Apologies for the lack of a Daily but I did not know I would be without internet while up in Montana yesterday. The bearish storage report should of done more damage to prices than yesterday’s declines. We shall see if there is additional extensions lower today.

Major Support:$2.134-$2.14, $2.12, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:

Major Resistance $2.36, $2.836, $3.00, $3.536, 3.595

First Test Fails

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Different Tune This Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Seen This Before

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Short Covering Rally at the End

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

So Close — But a Rally At The End

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Took An Extra Day But Results Expected

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Surprise Suprise

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

My Bad –Happy Easter

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.