Category: Daily Call

Quiet Start to the Trade

Not much to say about the trade yesterday except that the number forced some shorts to cover– set the high for the day and then wallowed around on light volume. Light volume not surprising going into the holiday week. Looks like folks in the northeast are having troubles leaving for the holiday and judging from the trade — some may be nat gas traders. Speaking of leaving — I will not be providing a Daily on Monday and the next Daily will be on the 5th of July– have a great Independence celebration with your families.

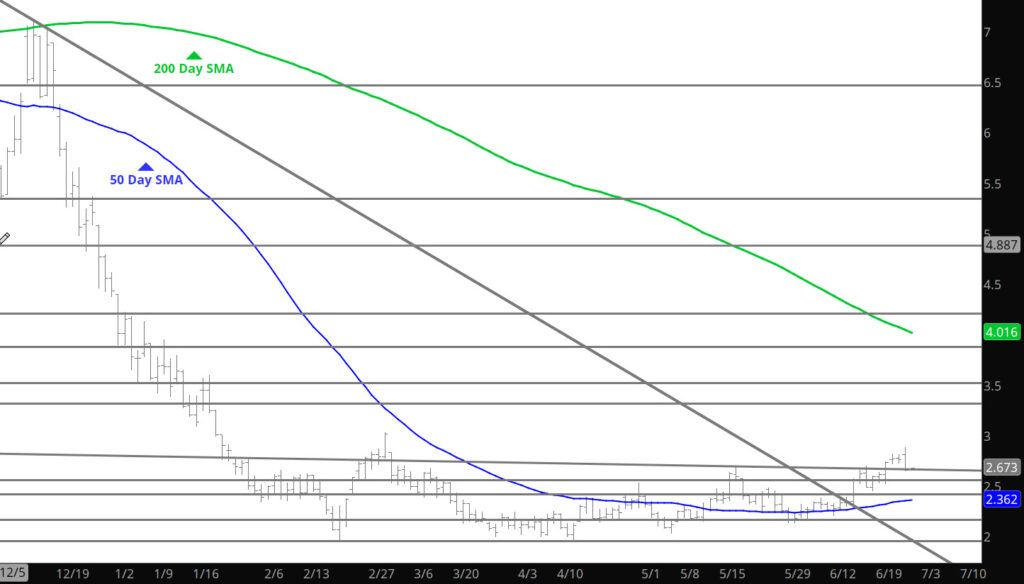

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:$2.47, $2.38-$2.26, $2.17

Major Resistance $2.816-$2.836, $3.00, $3.536, 3.59

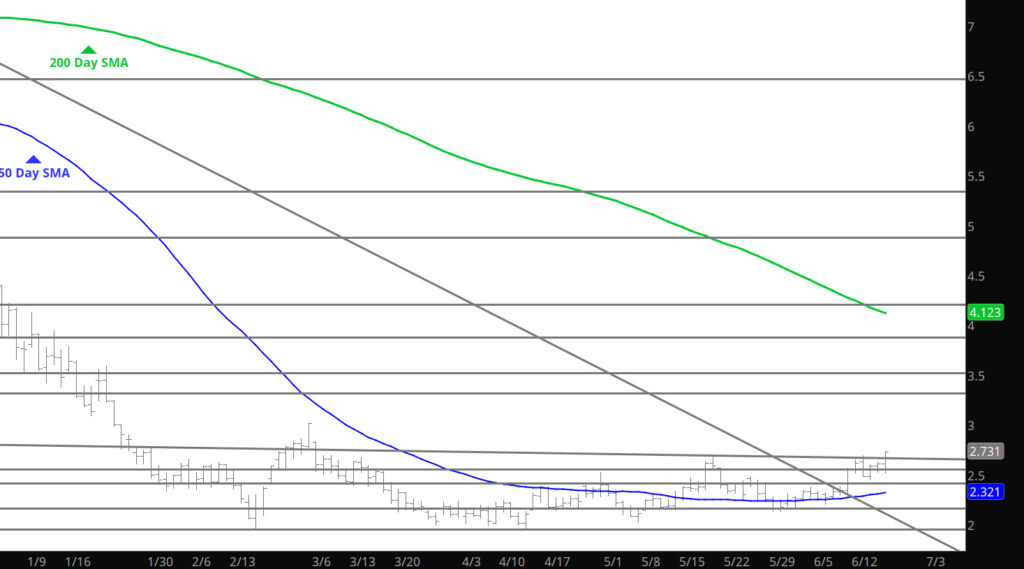

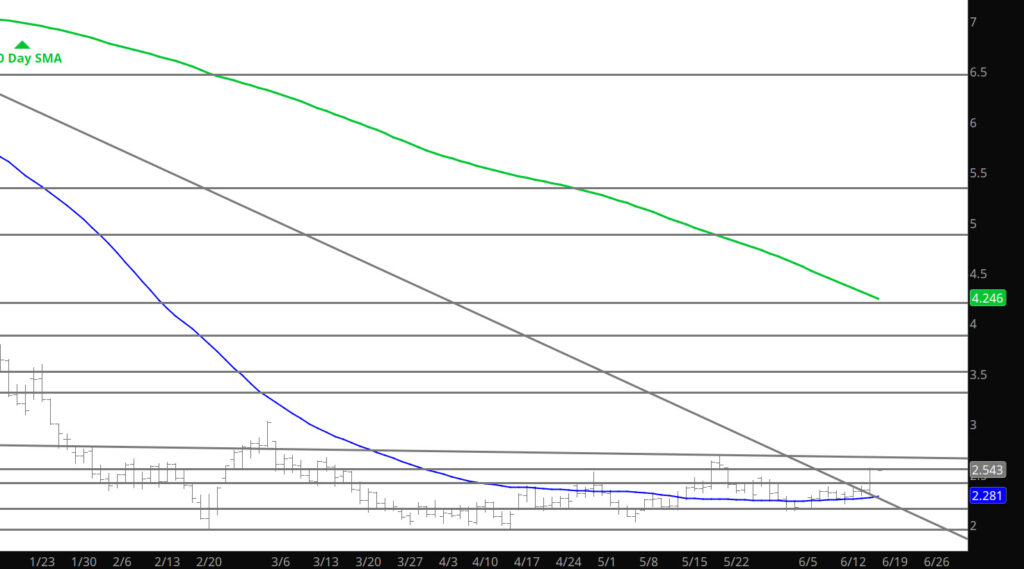

Aug Now Rules July Trade

June Rolls Into July

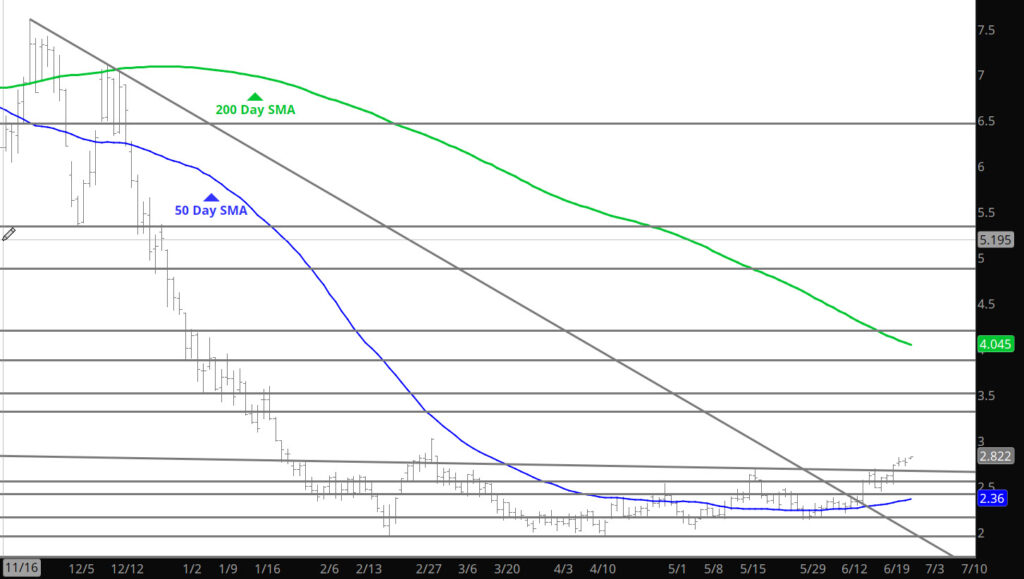

The July contract has had a hard time pushing the envelop higher beyond the $2.80 area and once again, got altitude sickness yesterday. No worries, as the August contract will be taking over after tomorrows expiration and is likely to challenge the $3.00 selling zone.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:$2.47, $2.38-$2.26, $2.17

Major Resistance $2.816-$2.836, $3.00, $3.536, 3.59