Category: Daily Call

Strong Weakly Close Light Volume Expect Slight Retrace

Daily Continuation

Discuss the Holiday trade and associated effects on price in the Weekly section. Would expect a retracement in the gains as the market is over-bought on a weekly basis (technically) and the light volume close is suspect.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901, $5.01

No Charts

I refer to the Weekly section for the Daily as I am unable to download my charts while traveling for the holiday. Summarize, expiration will like test the low side to the range developed during Nov. but the decline in open interest may provide some volatility in the near future.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901,

Strength Before Storage Data

Storage Data Holds Prices

Daily Continuous

Guess the storage data which was what was expected. Now it starts to look to the expiration of the Dec contract as prompt. The majority of the impact will occur early next week before the Holiday when trade will be light — be careful and look for the Jan contract for directional bias.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901,

Range Developed

Daily Continuous

Price decline and started to test the lows from last week. Will the declines break below the lows of last week before another rebound — not convinced either way. Today should set up for the storage release on Thursday and would expect a test of the mid $4.20’s during the week.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901,

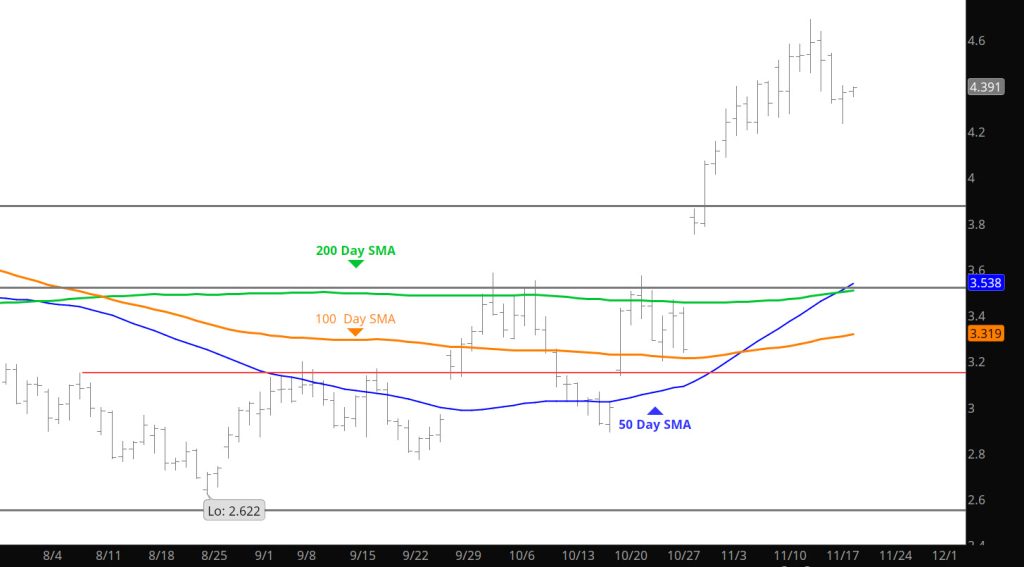

A Brief Correction?

Daily Continuous

Not sure of the declines being extended to major support yesterday reminded us that when price become over extended there will be a correction at some point. Yesterday’s decline brought the prices back below 2 standard deviations over the 20 week SMA which is a necessary correction for any further gains.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901,

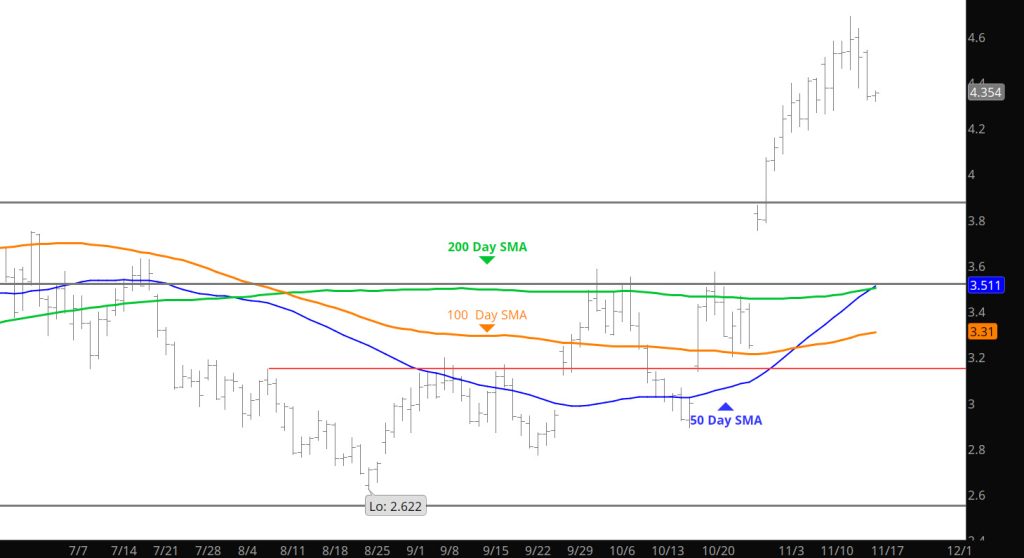

Rally Slows Momentum

Daily Continuous

Price positive action with one setback left prices at the high end of the range. Go into some of the underlying technical indicators in the weekly section. Would be cautious in adding significant length until the directional bias becomes better defined.

Major Support: $4.219-$4.139,$4.083,$4.055,

Minor Support : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.73-$4.75. $4.901,

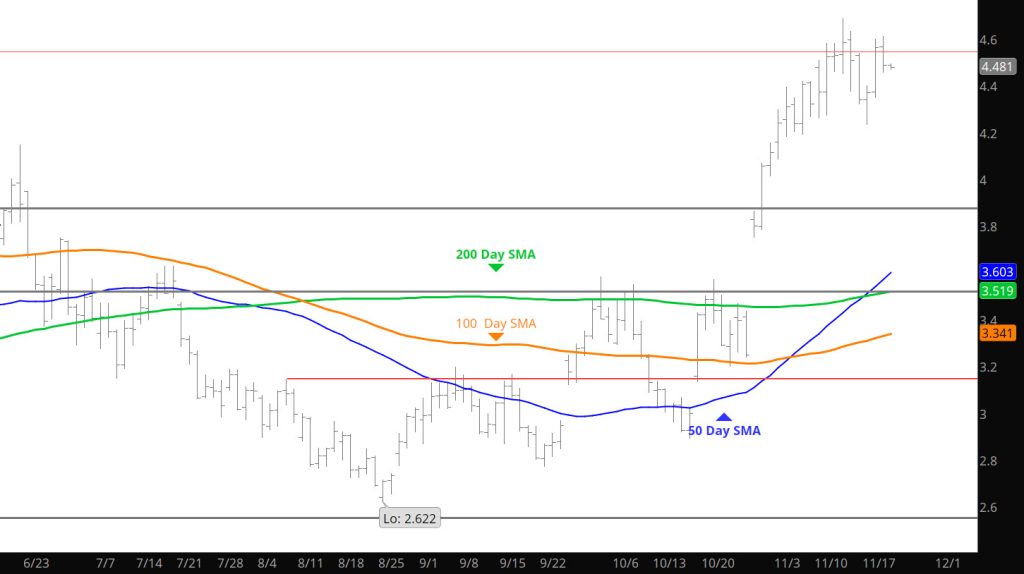

Developing a Range

Weekly Continuous with Bollinger Band and RSI

The strength in the prompt is challenging levels (3 standard deviations) over the 20 week SMA and the over bought levels in the Weekly RSI. These are levels that are usually met with some sort of brief correction.

Major Support: $4.21-$4.139,$4.122,$4.055,

Minor Support : $3.942, $3.75,$3.65

Major Resistance: $4.394, $4.461-$4.475, $$4.901,