Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

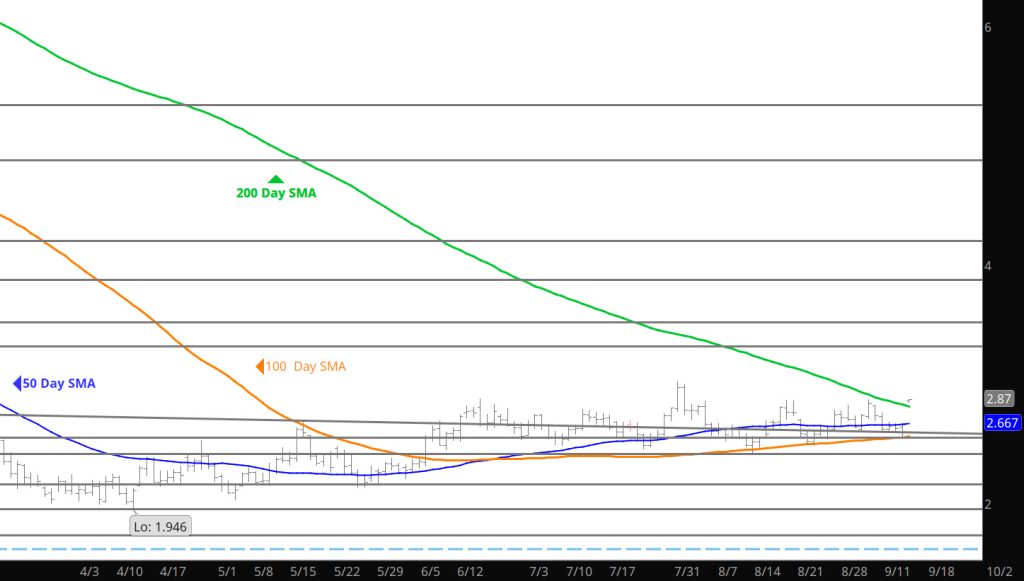

Does the Gap Close?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

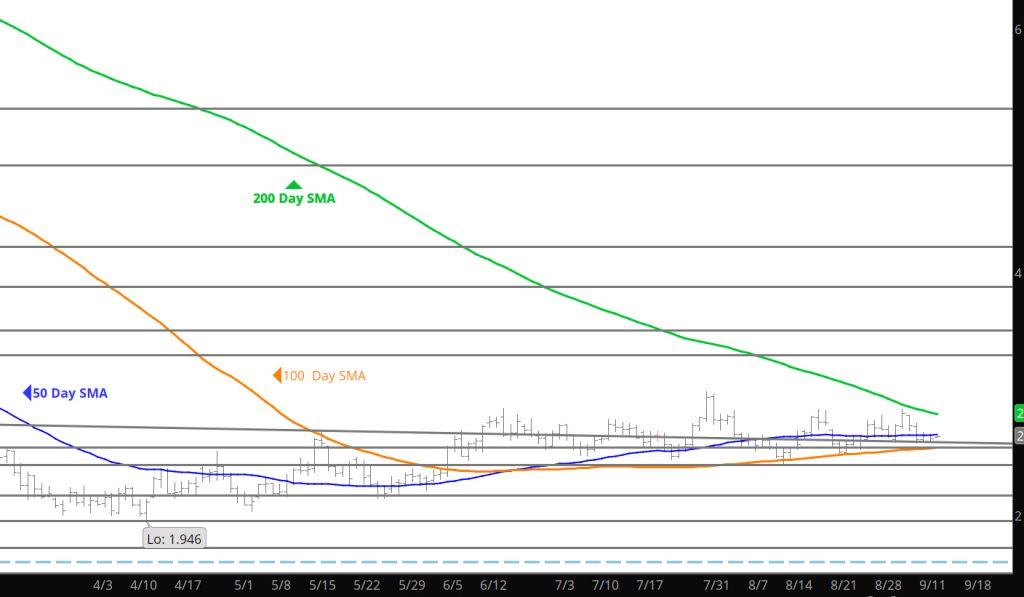

Premium Suppressed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Nothing Changes

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

October Lives For Three Days

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Guesses

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

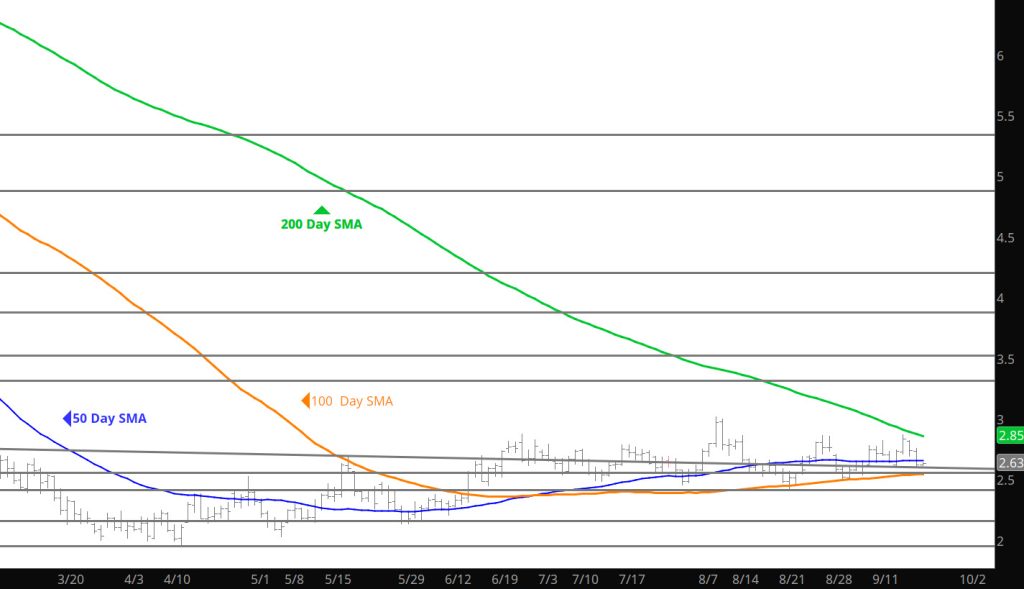

Market Winding Tighter In Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What To Make

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet Trade For Birthday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

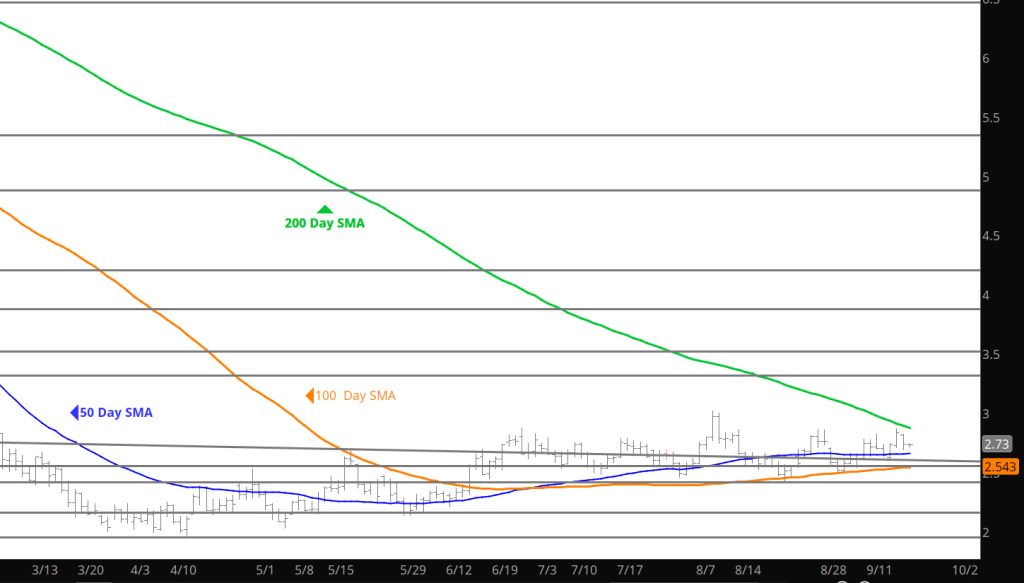

No Serious Action on the Storage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.