Category: Daily Call

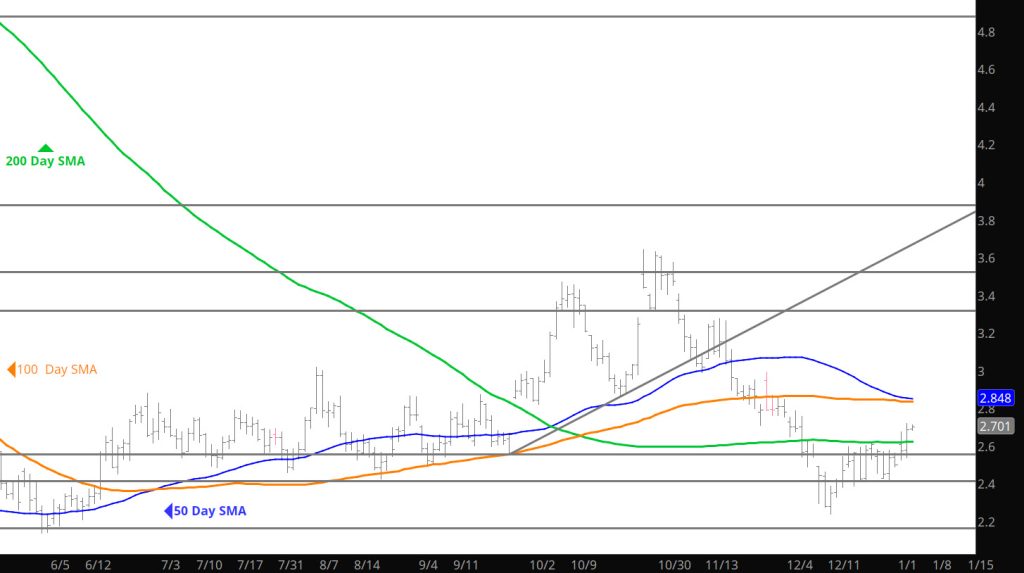

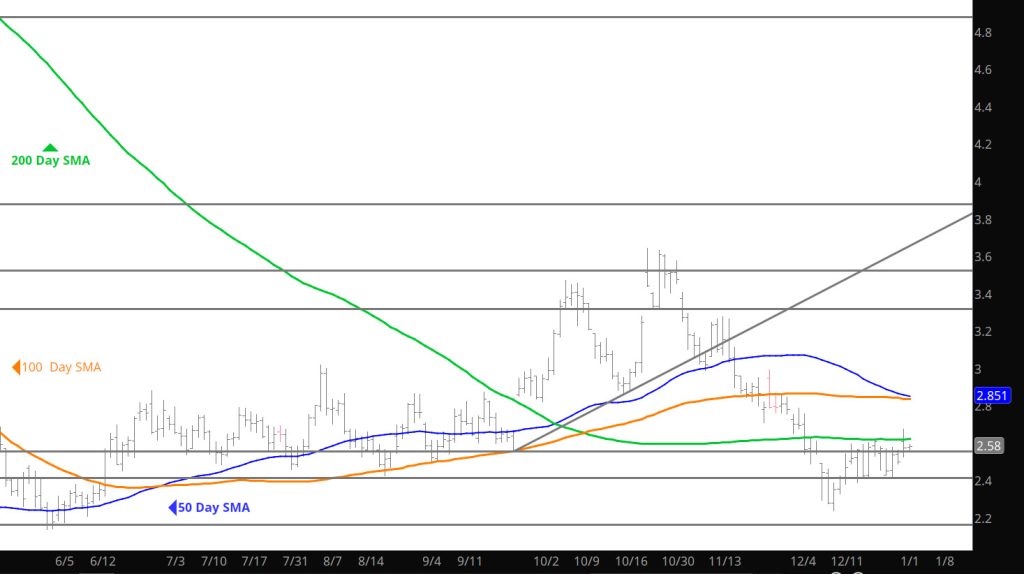

Tad Dramatic

Daily Continuous

That was a bit of drama going down when no one wants to buy– now we have a whole new market in the same old range that held the market in December. Lets see where this all leads us.

Major Support:, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.62, $2.47, $2.38-$2.26, $2.17

Major Resistance $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

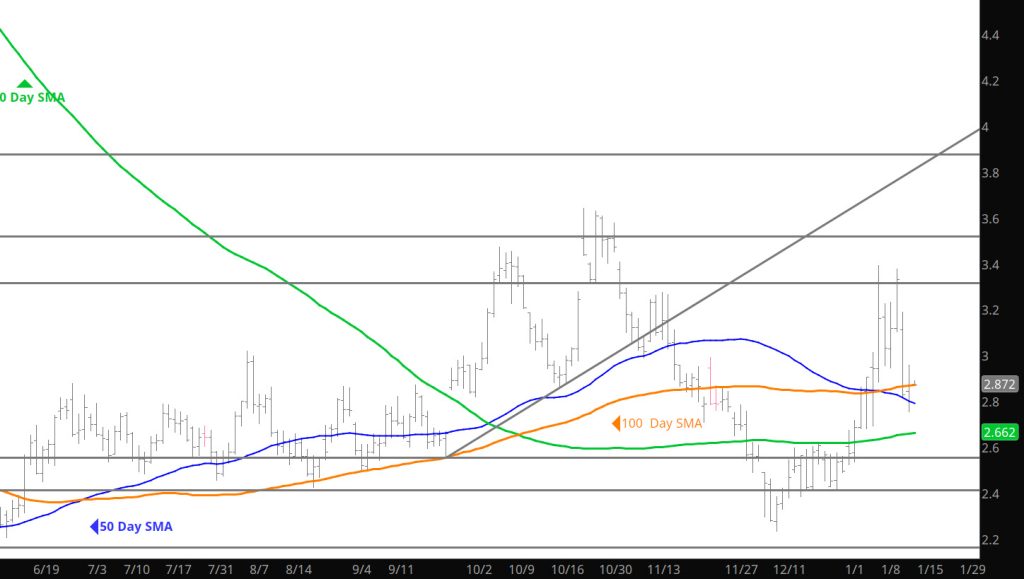

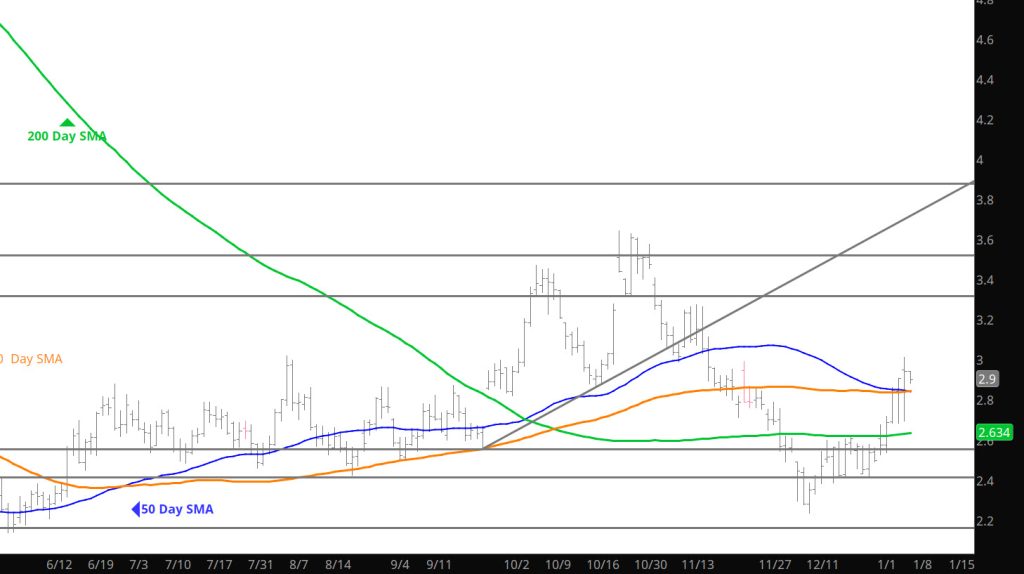

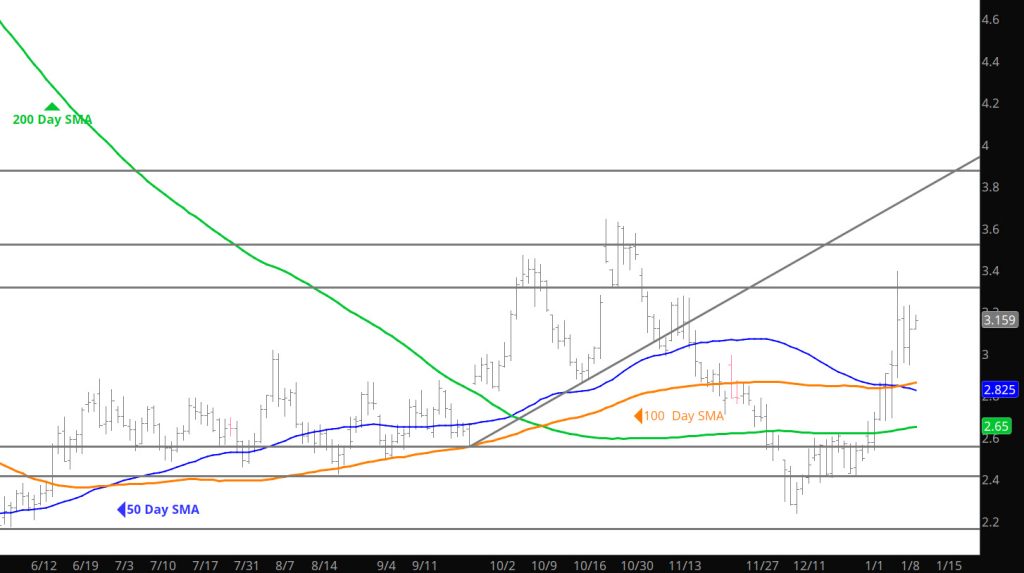

Perhaps the Market Showed Too Much Strength

Is It Going To Consolidate Gains?

Daily Continuous

Interesting day trade as prices firmed after open interest fell on Wednesday. It may be that the trade is starting to develop a more positive bias it will need some additional gains — however small– in the near term.

Major Support:, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.62, $2.47, $2.38-$2.26, $2.17

Major Resistance $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

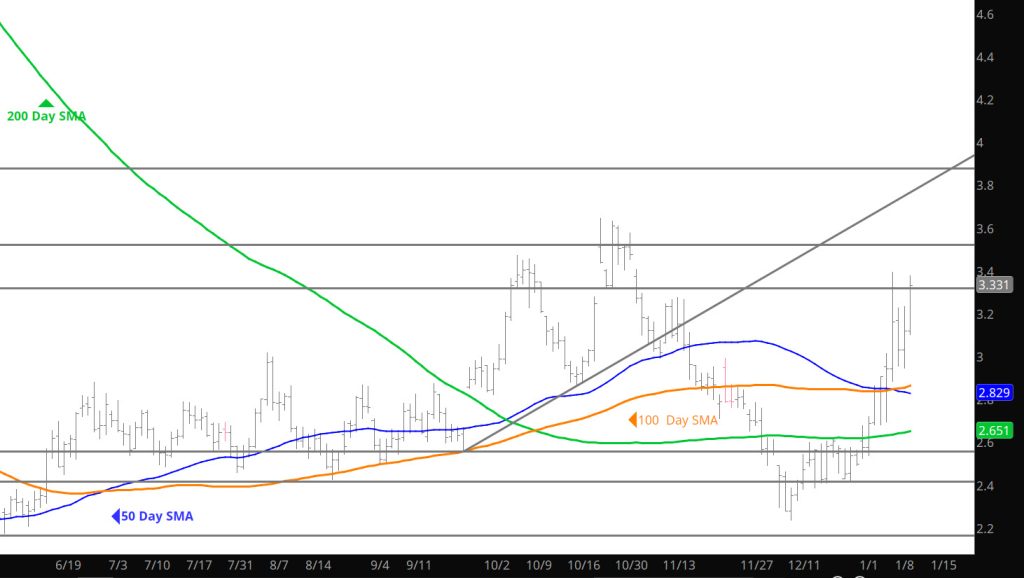

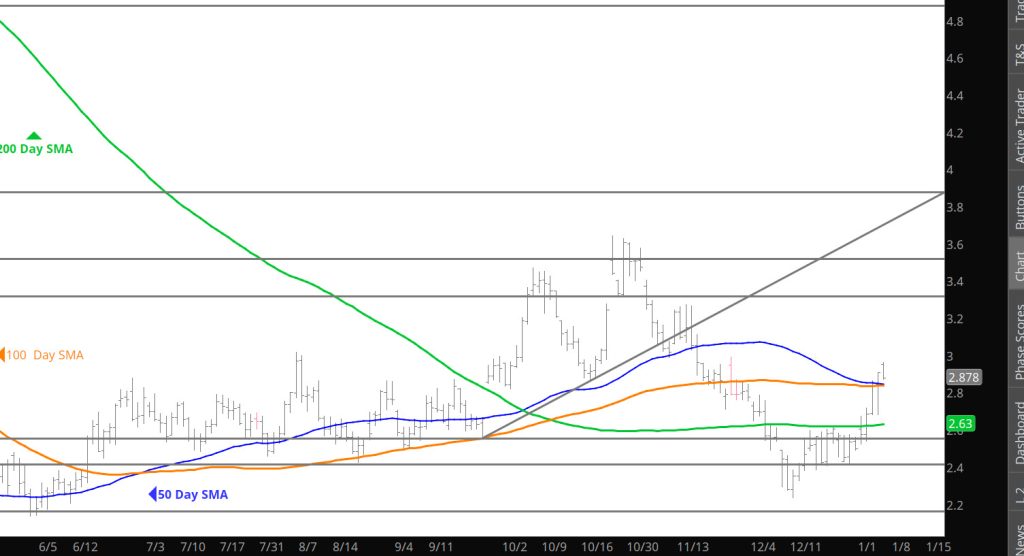

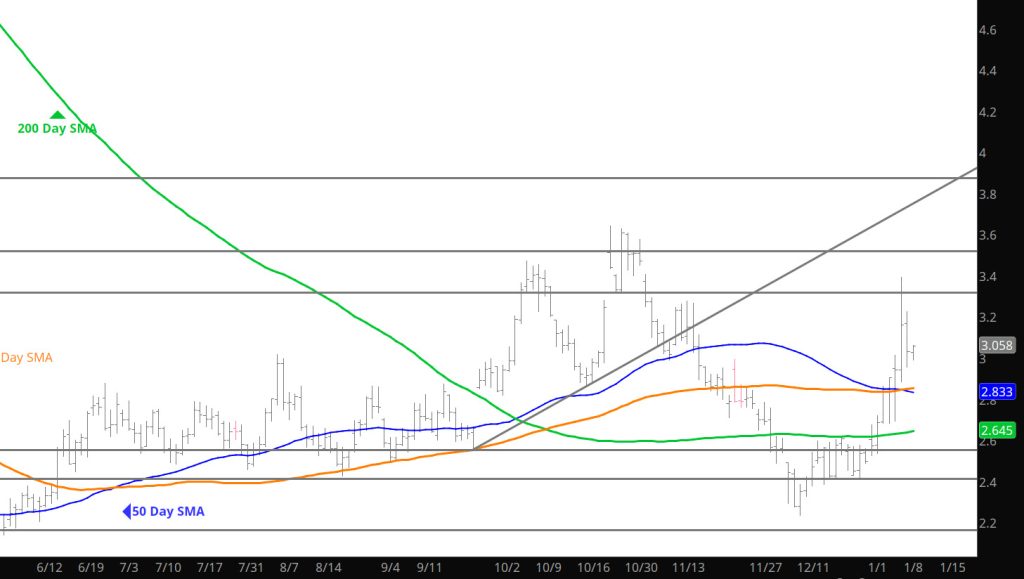

Suspected This

Daily Continuous

Want to apologize for any issues with yesterday’s Daily — (there was only one complaint) — but it reminds me to remind all of you that if you don’t have a Daily in your email — it maybe an email issue — so be sure to log in and check the website. Unless I am ill there should be a posting.

On to the market– once again a big short covering event ran out of steam there were no follow through buyers to build on the price. Not over yet as I noticed that total open interest had a small gain yesterday (according to the CME) while the February contract had significant declines in open interest. Perhaps the short covering was just rolling forward and selling a differed contract but covering the Feb exposure. Time will tell as the week wraps up.

Major Support:, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.62, $2.47, $2.38-$2.26, $2.17

Major Resistance $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

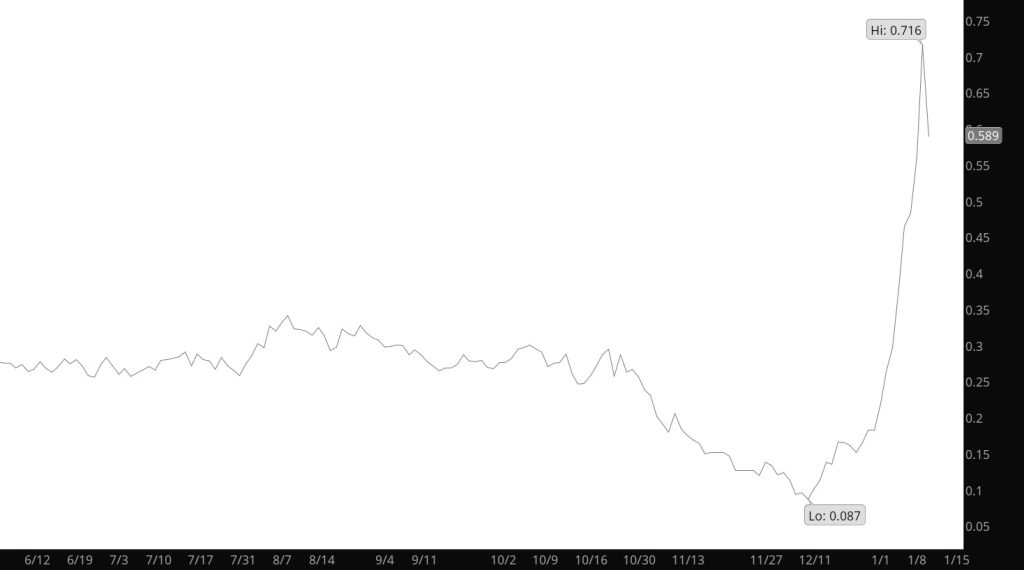

THAT Is A Short-Covering Rally

Solid Short Cover Based Rebound

Break Above Resistance Continues

Slight Break Out Above Resistance

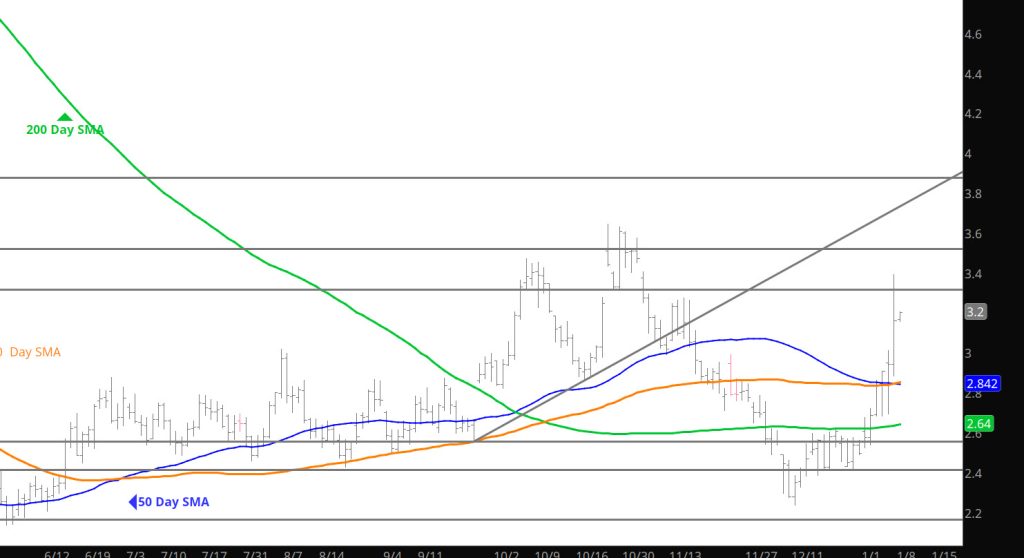

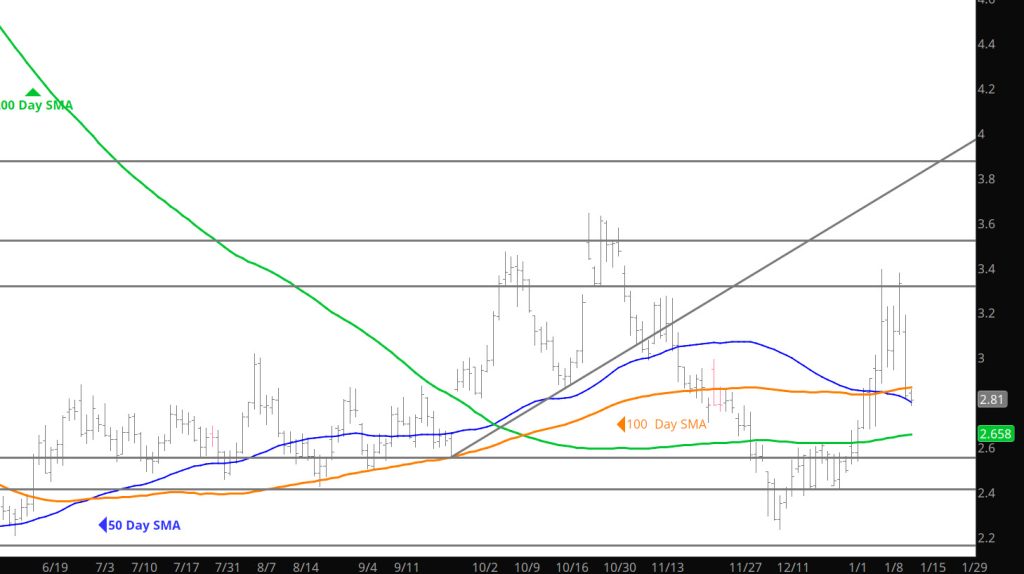

New Year, Same Old Range

Daily Continuous

Prices started with a bump early then just fell back into the old range– this market needs an issue to catch the traders eye — one way or the other.

Major Support:, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.47, $2.38-$2.26, $2.17

Major Resistance$2.62, $2.786-$2.865, $3.00, $3.16, $3.48, $3.536, 3.59, $3.65