Category: Daily Call

Contrary to Expectations

Bearish Storage Has Little Effect

Seven in a Row

Declines Just Continue

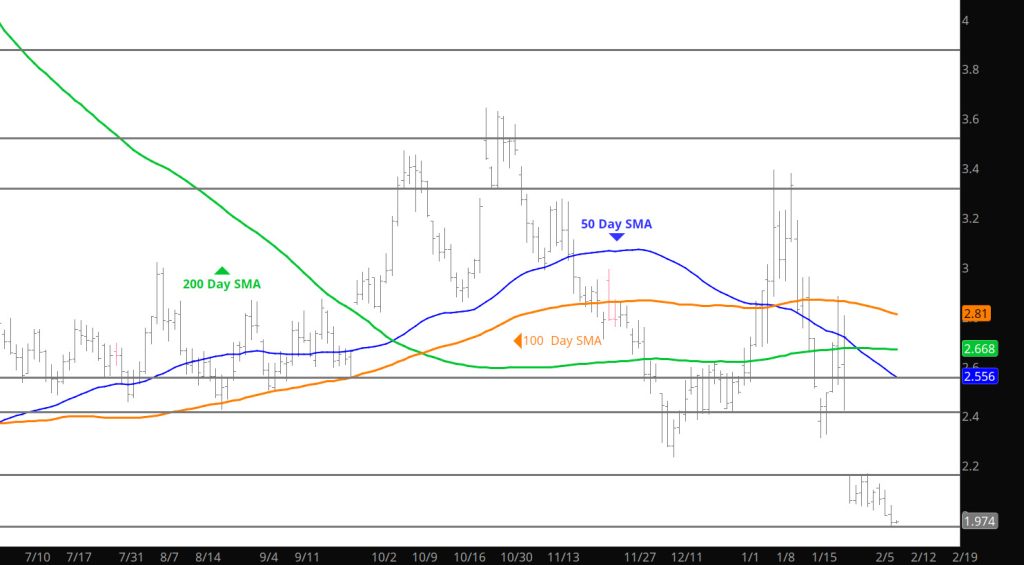

Daily Continuous

Not much to say that hasn’t been discussed of late. If you are playing this decline — continue to play it on short expectations and gain. If your playing with length ask “why” — never been good at the knife catching business– look for some divergences in the momentum indicators before entering.

Major Support:, $1.795-$1.766

Minor Support :

Major Resistance $2.00, $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

Heading South — Be Careful

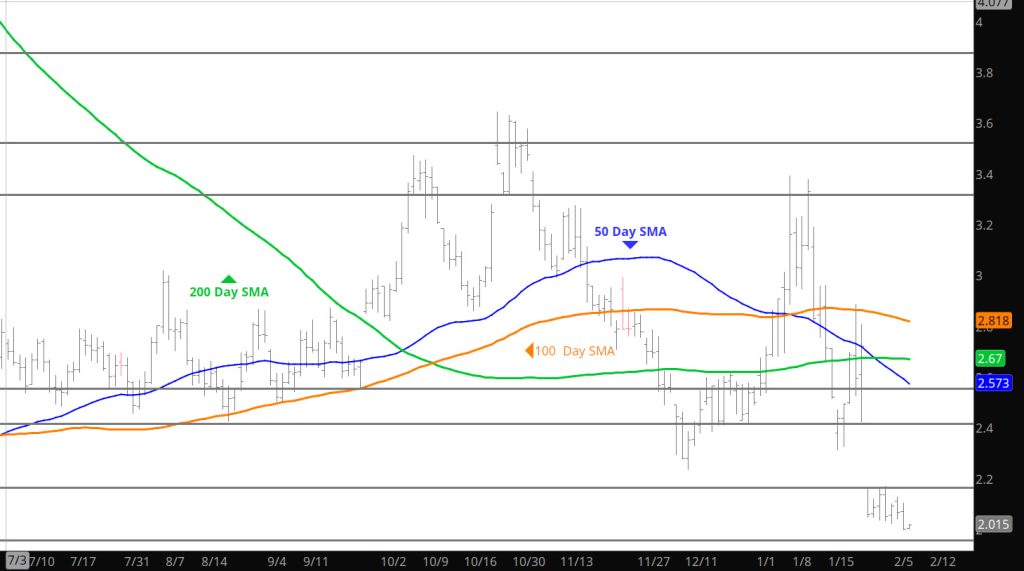

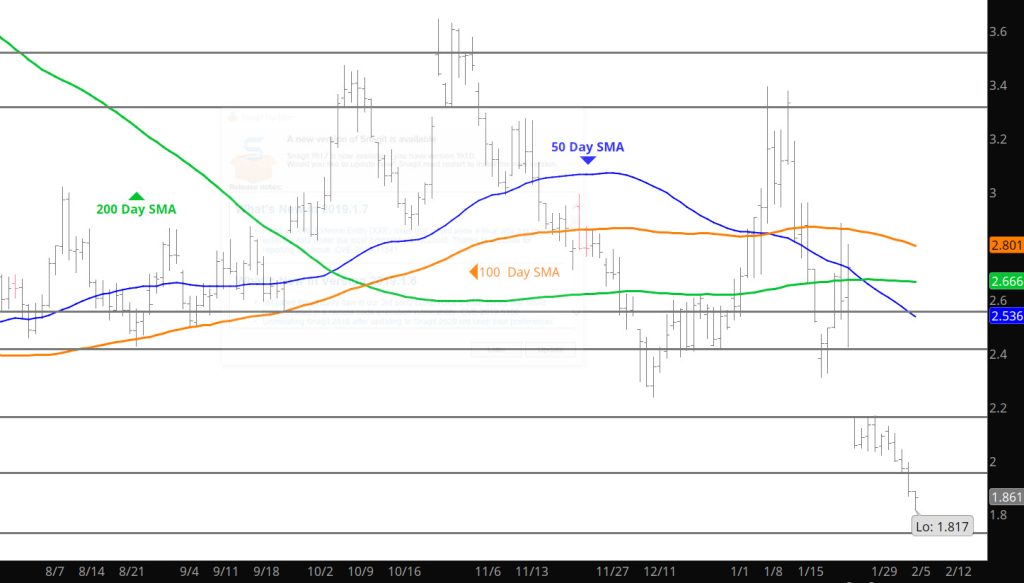

Daily Continuous

None of the technical indicators show the market is over sold except the Bollinger study that maintains the market is over 2 deviations beyond the 20 week SMA. This provides the short sellers to add to positions and as mentioned in the Weekly section, could send price another $.25 lower. Waiting until I see some divergence in the momentum indicators for starting any length.

Major Support:, $1.795-$1.766

Minor Support :

Major Resistance $2.00, $3.00, $3.16, $3.48, $3.536, 3.59, $3.65