Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Another Storage Release

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

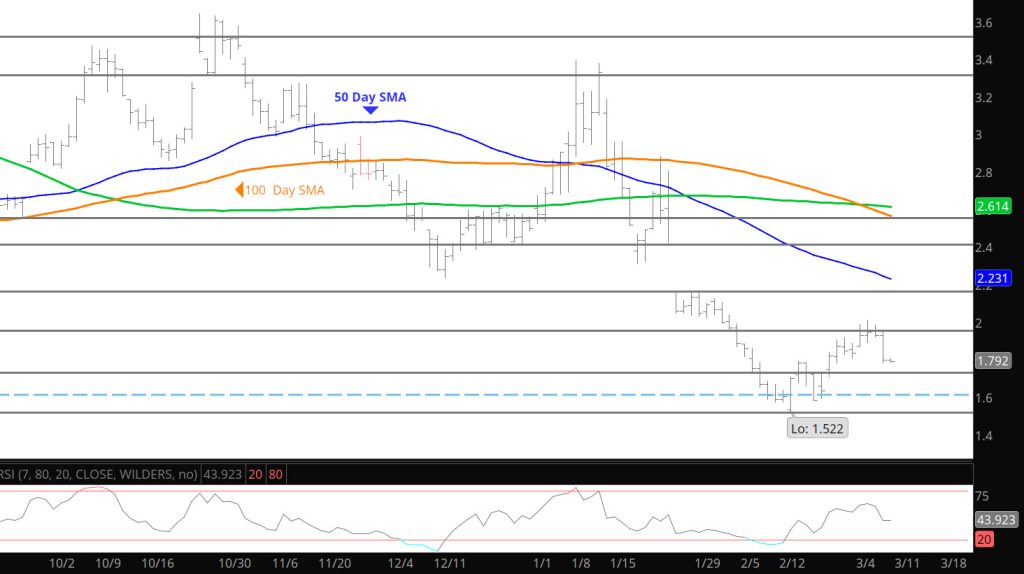

Short Term Base May Be Forming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

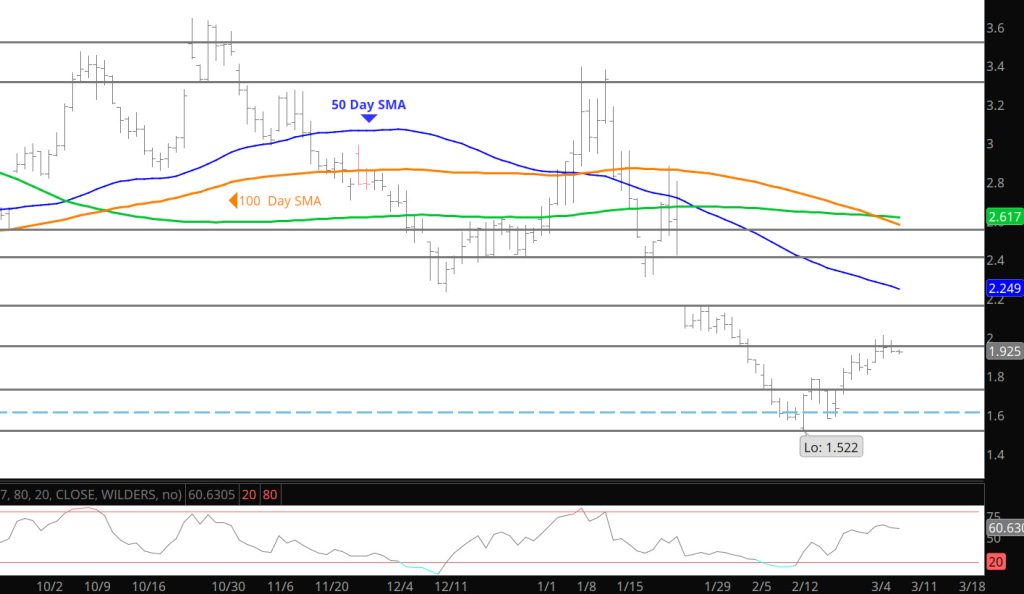

You Have to Love Range Trading or Premium Selling

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Key Support Never Tested

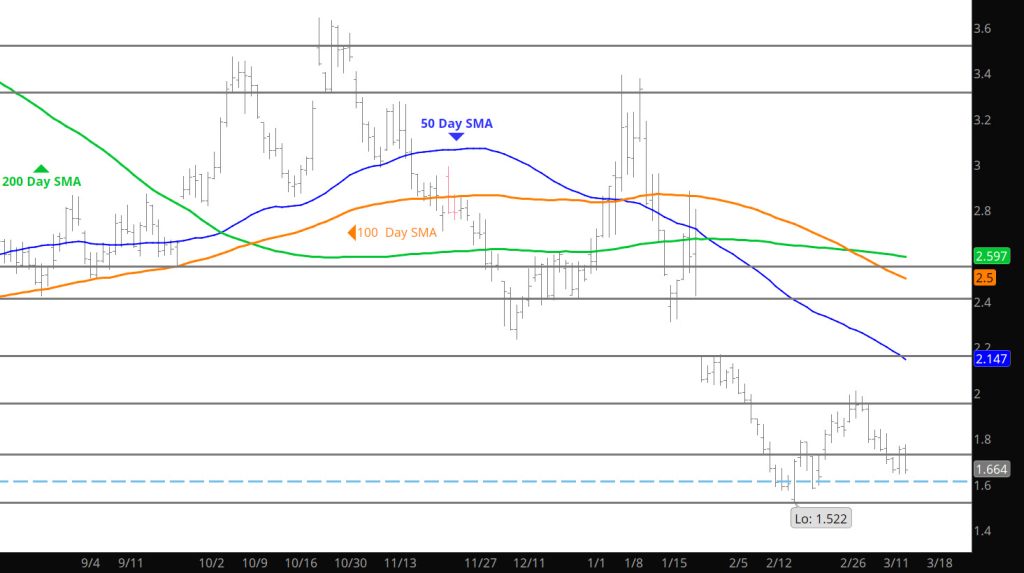

Daily Continuous

Prices never tested the key levels of support before finding buyers and gaining a dime. Perhaps we have developed another range trade and will be testing the resistance either tomorrow or next week. The market has not left the range trade of the last 5 weeks between the $1.50’s and $2.00 but prehaps the market is consolidating in a narrower range.

Major Support:, $1.595, $1.52-$1.519, $1.432, $1.312

Minor Support :

Major Resistance: $1.863, $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,

Coming Close to Key Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Going to Get Set For Storage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Wish It Could Be More Dramatic

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slight Break Down on the Report

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Going To Need an Alarm — Wake Me Up

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.