Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

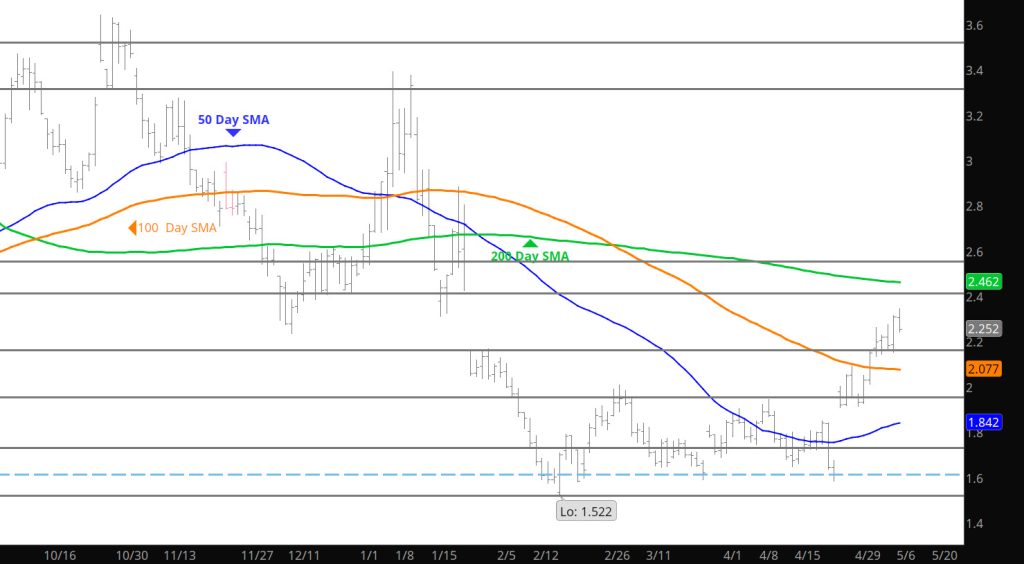

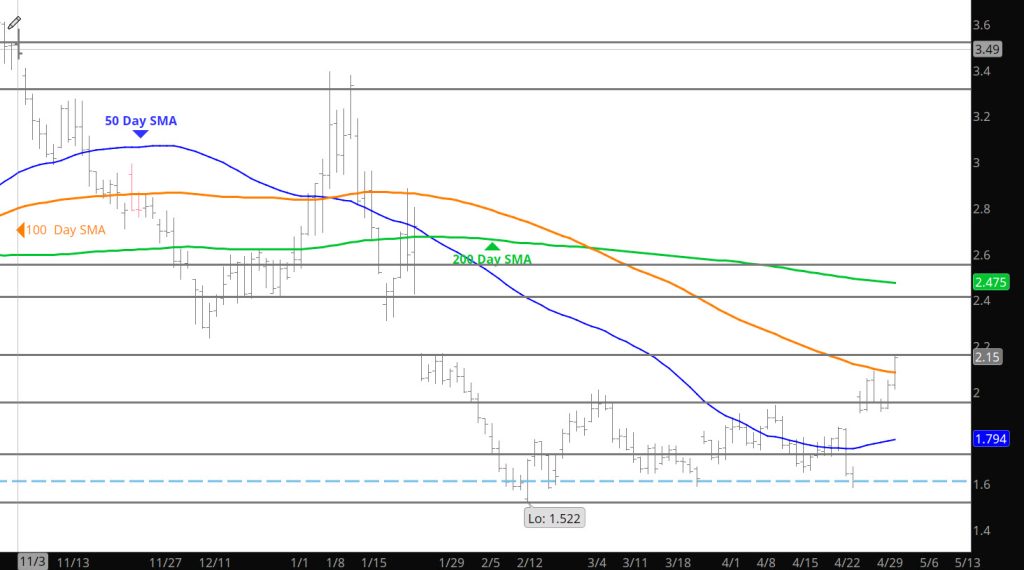

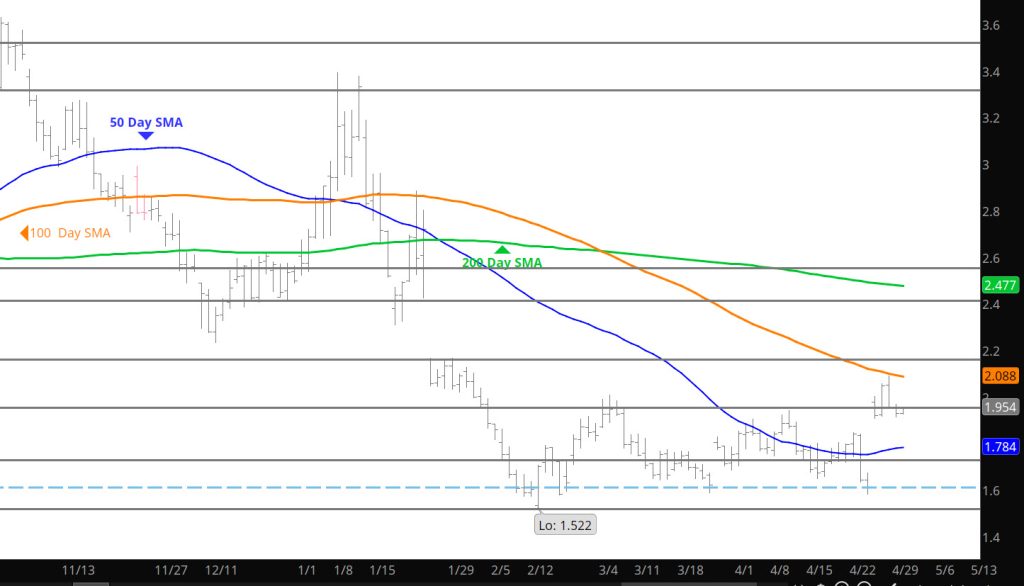

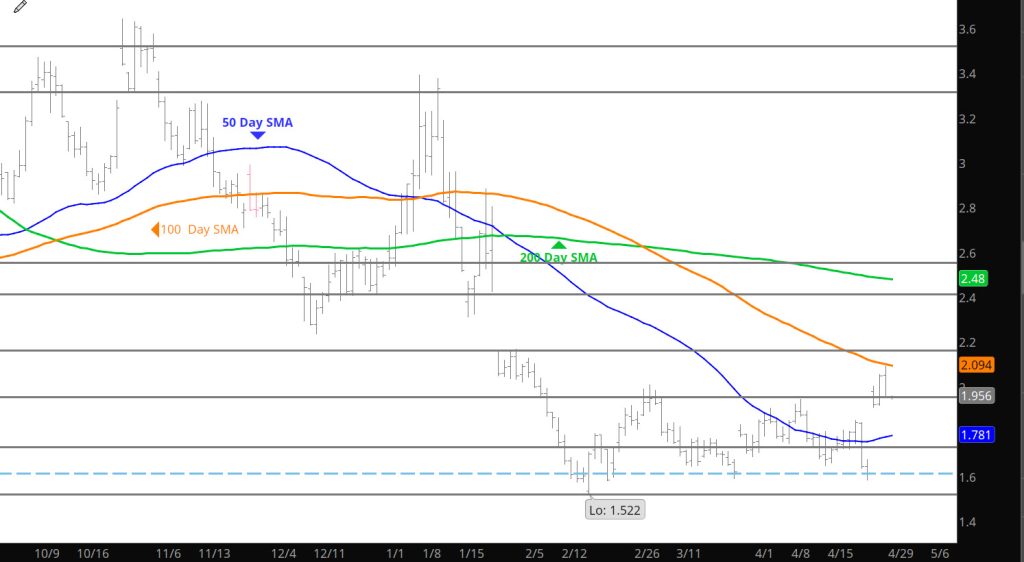

Additional Bites Into Gap

Daily Continuous

The rally continued after the storage release with prices testing near term support only to rally and bite into the gap from January. Playing with length seems to be profitable – but care and respect should be given to the gap closing– should it occur. The bias continues to confirm the change but time will tell and the weekly close should provide my more information.

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.12, $2.00, $1.967- $1.94

Major Resistance: $2.168-$2.411 (gap), $2.26

Important Storage Release

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

May Be Building a Near Term Base

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Little More of the Gap Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Technically — A Bias Conversion

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Remain Within June Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Didn’t Like the Altitude

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rare Close Over $2

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Where We Going

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.