Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bounce Ends

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Solid Bounce

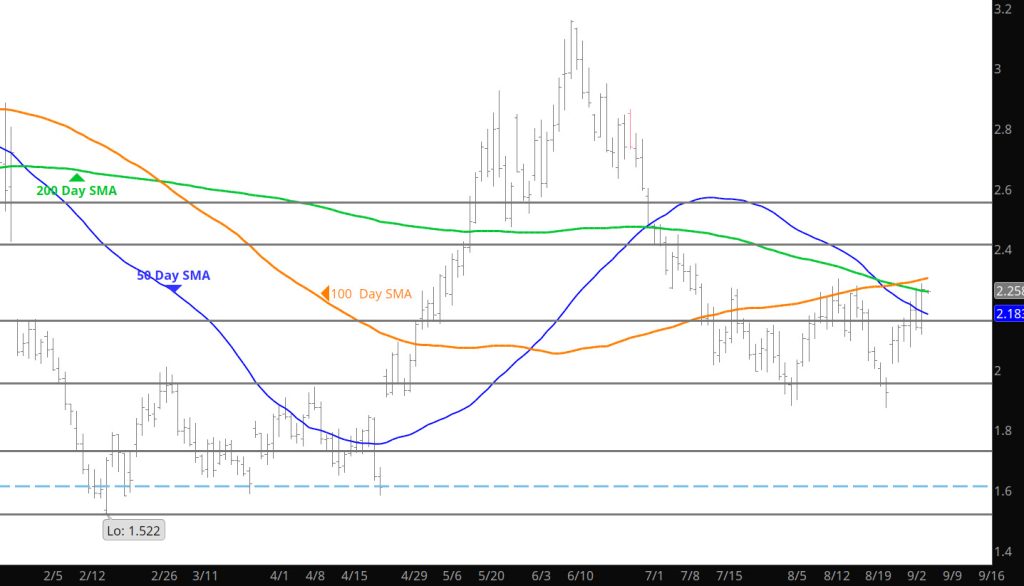

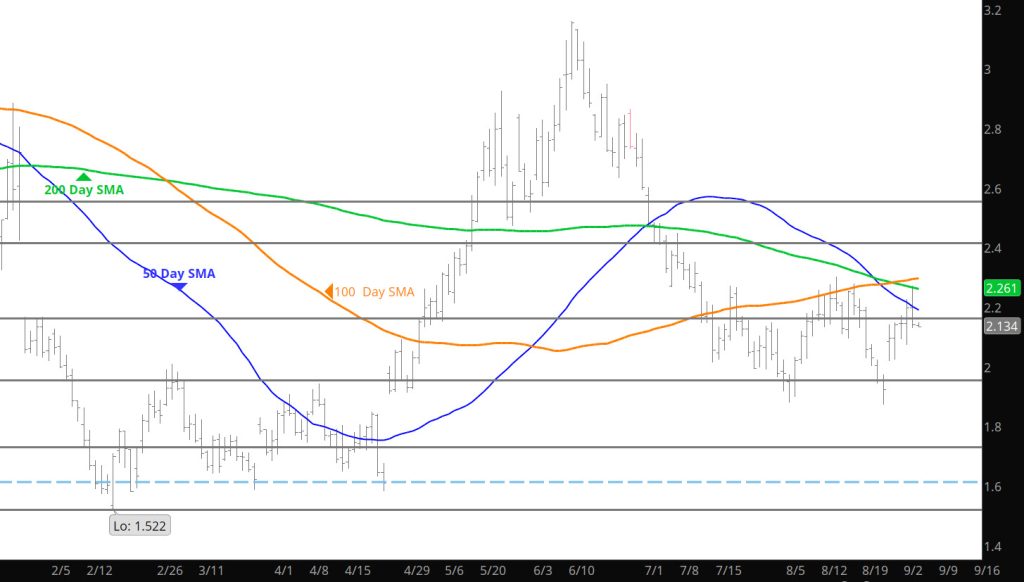

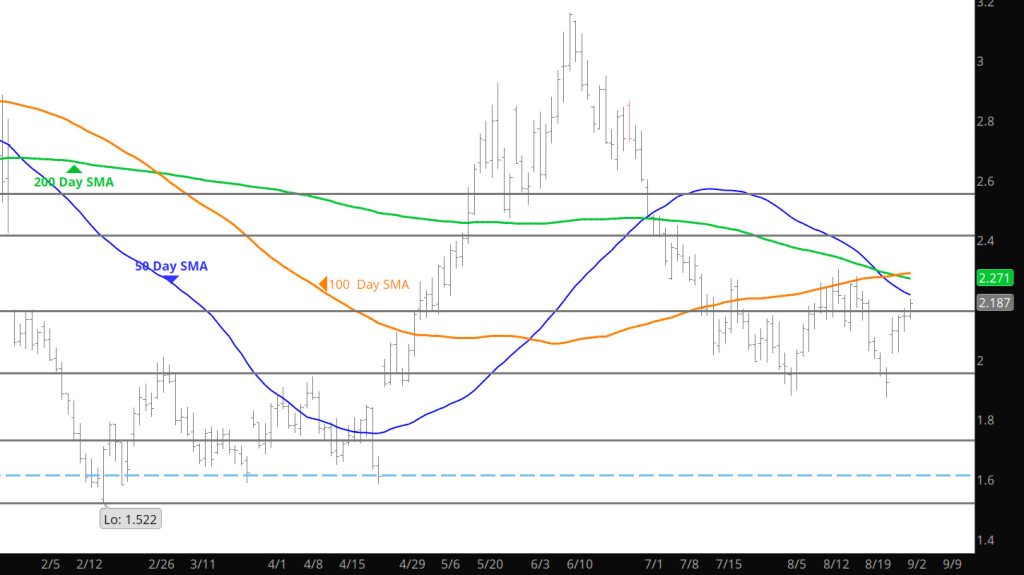

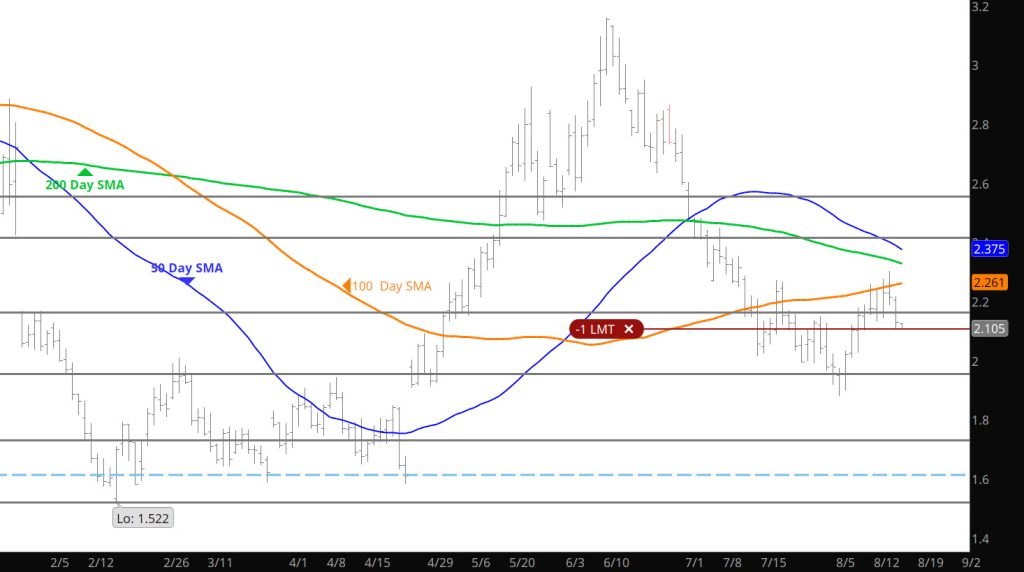

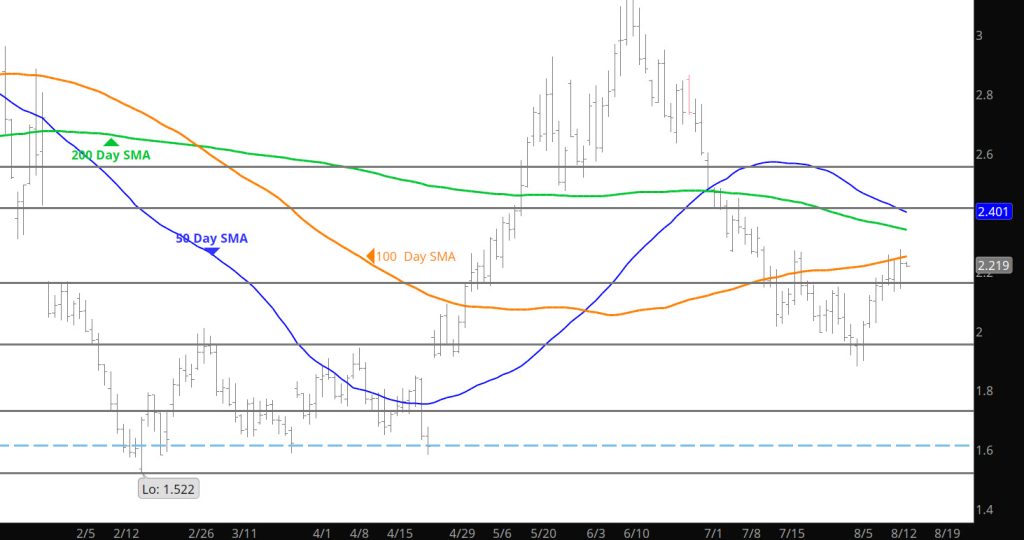

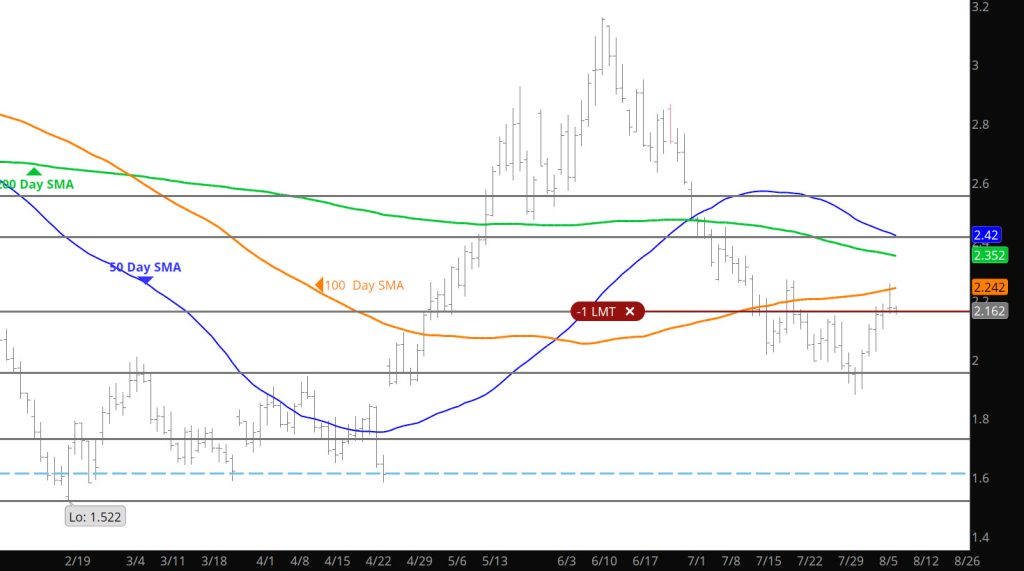

Daily Continuous

Prices rices bounced from a test of support — but are now heading into serious initial resistance areas so be patient for the trade. The past couple of weeks have started strong only to wither during the week. Let the market define its upcoming directional bias before reacting in a strong way.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance:$2.18, $2.25-$2.310, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

Leave For a Week –Nothing Has Changed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Weakness Begets More Weakness Going Into Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Retreating From Resistance Failure

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Run Ends at Several Resistance Levels

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strength Continues and Closes Above Initial Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Yesterday All Over Again

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Brief Consolidation of Recent Gains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.