Category: Daily Call

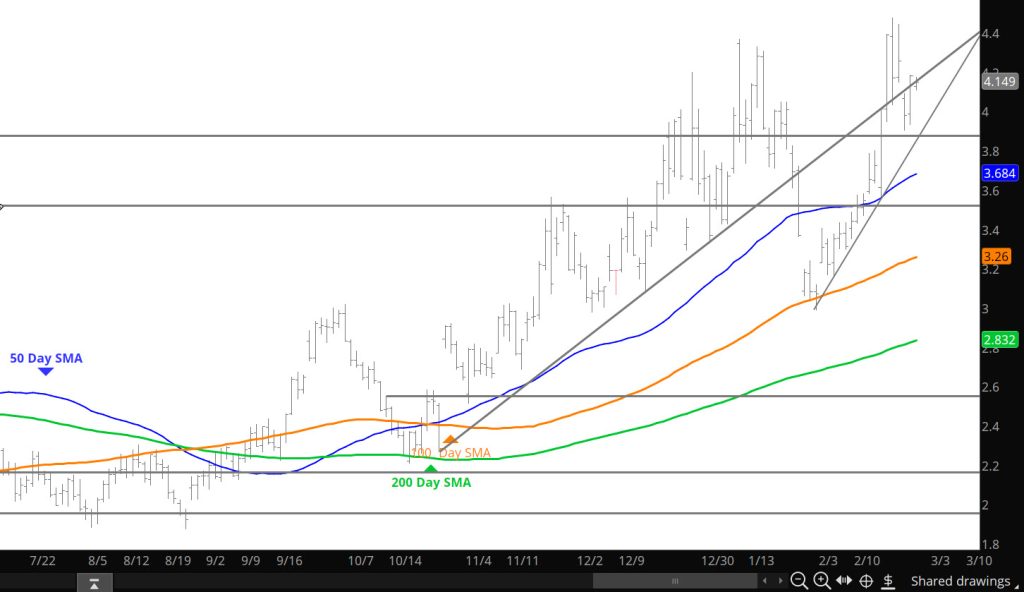

Expectations of the “Rhyme”

First Indications Rhyming with 2014

Daily Continuous

Not expecting the Jan high to be surpassed by the Feb high was using history to our benefit. Go into the recent history in the Weekly section — last week’s events have only happened a handful of times and the results are similar (especially in the last 12 years). Sure to the concepts of the Weekly writing — prices opened significantly lower on Sunday night. Won’t be claiming technical victory (got burned in the phases of the 2014 collapse) but will be watching the price movements closely this week.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $4.16-$4.00, $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $4.378-$4.394, $4.461,

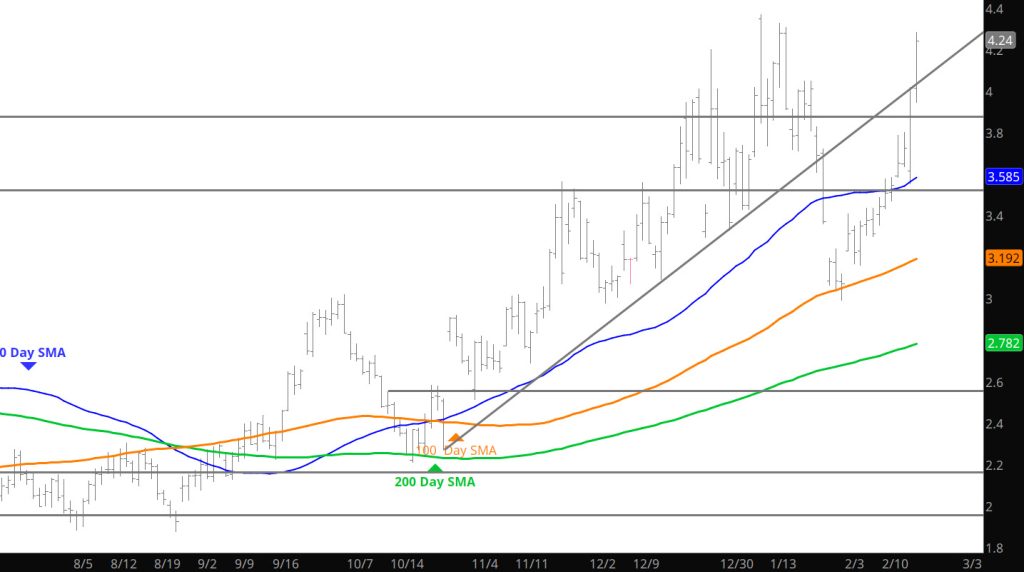

Buying Dries Up

Daily Continuous

The run ran out of steam and retraced after the storage release which I thought was bullish miss. That is why I don’t follow trade on fundamental data. The declines did not break below $4 and now that seems to be support. There are four more trade days in the March contract, and the decline I was expecting (to major support at $3.16) seems unlikely. Should the market remains supported over the next days there may be a new “range” or para-dime in natural gas during 2025. This recent strength should be respected and I will follow up with additional analysis over the weekend.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $4.00, $4.201, $4.378-$4.394, $4.461,

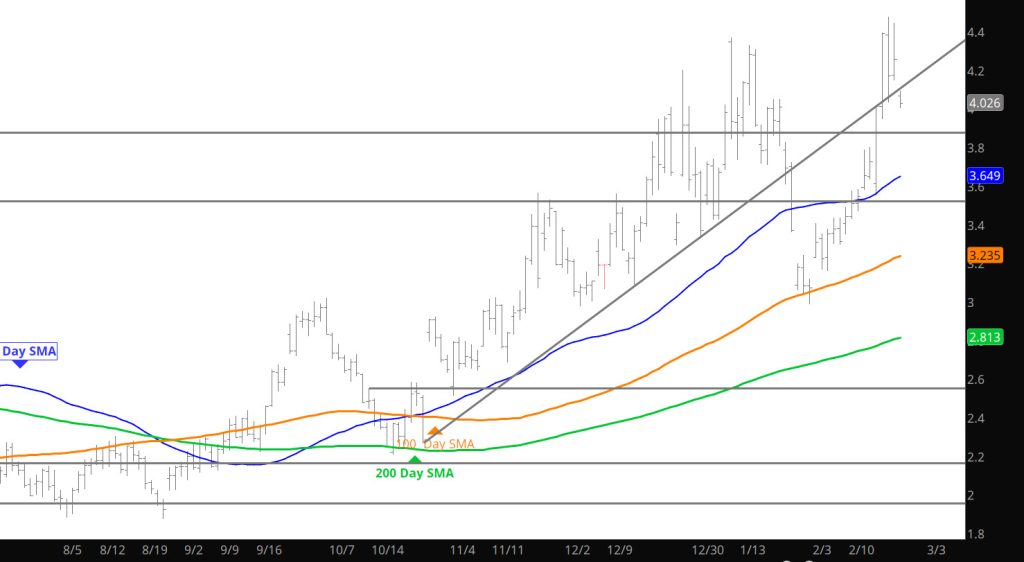

Challenge at Resistance Succeeds For Now

Solid Run At Highs

Light Volume Sends Prices Down

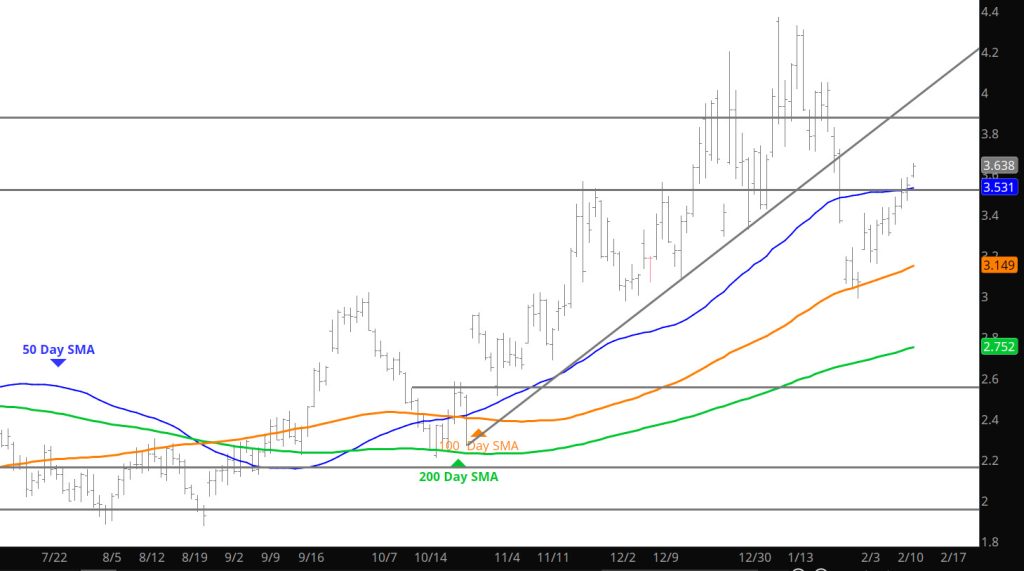

Daily Continuous

With the light trade on the holiday, prices retreated back down to conventional support from the 50day SMA. Went into expectations in the Weekly Section but from the Daily perspective — it’s the range controlling the trade.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

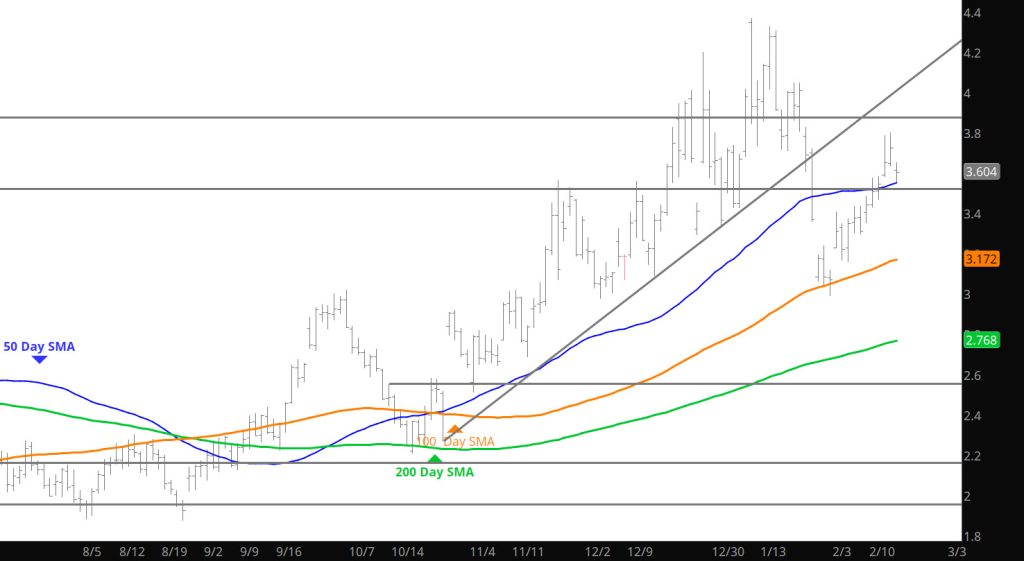

Trying to Trade a Higher High

Daily Continuous

The move continued (especially in the late day trade) trying to entice the rally to take out the $3.84 area (not a higher high- monthly) but will lead to potential trade to set a higher monthly high– today is storage which may bring the volume to set a new high.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,

Momentum Working Against Gains

Price Gains Hold

Daily Continuous

The gains posted on Sunday night held but didn’t grow during the trade day. Prices are butting up against near term resistance — but his may also be a consolidation period to send prices higher (cold weather continues the momentum) or for the market correct to test support at $3.00 and set up the Q1 low. The answer will be in the coming seek or so as the ending inventories will provide insight as to the trader’s perspective.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.16, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.34, $3.39, $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461,