Category: Daily Call

Starting To Like a Potential Weekly Reversal

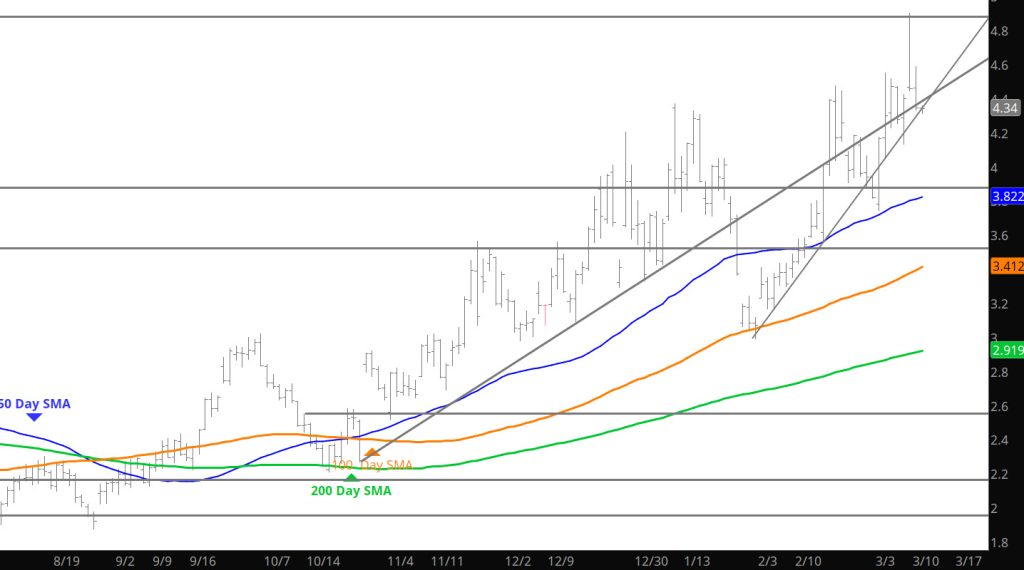

Daily Continuous

Spoke earlier in the week about the market continuing to go up until it runs out of buyers– suggesting that a daily/weekly reversal would start to suggest a lack of buyers. Recently each decline has found buyers but the trade yesterday and Tuesday clearly did not find folks buying the dips. Today is storage and will likely give further indications of the potential further actions.

Major Support: $3.16-$2.97, $2.727, $2.648,

Minor Support : $4.00, $3.827-$3.801 $3.742

Major Resistance: $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

Nothing To Add

Somewhat of a Reversal

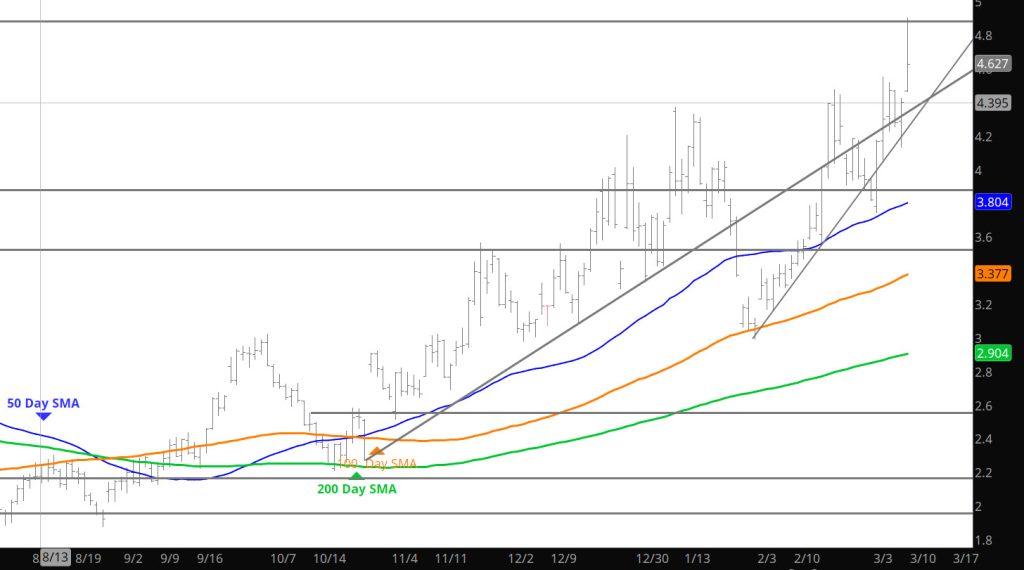

Daily Continuous

The trade yesterday provided a daily reversal (waiting to see the volume data) from an extraordinary Sunday night late rally. The action created an interesting Candlestick pattern the may become relevant if confirmed in later trade this week. Until those and other elements of yesterday’s extraordinary price action come clearer as the week moves along.

Major Support: $3.16-$2.97, $2.727, $2.648,

Minor Support : $4.369, $4.212, $4.00, $3.827-$3.801 $3.742

Major Resistance: $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

9

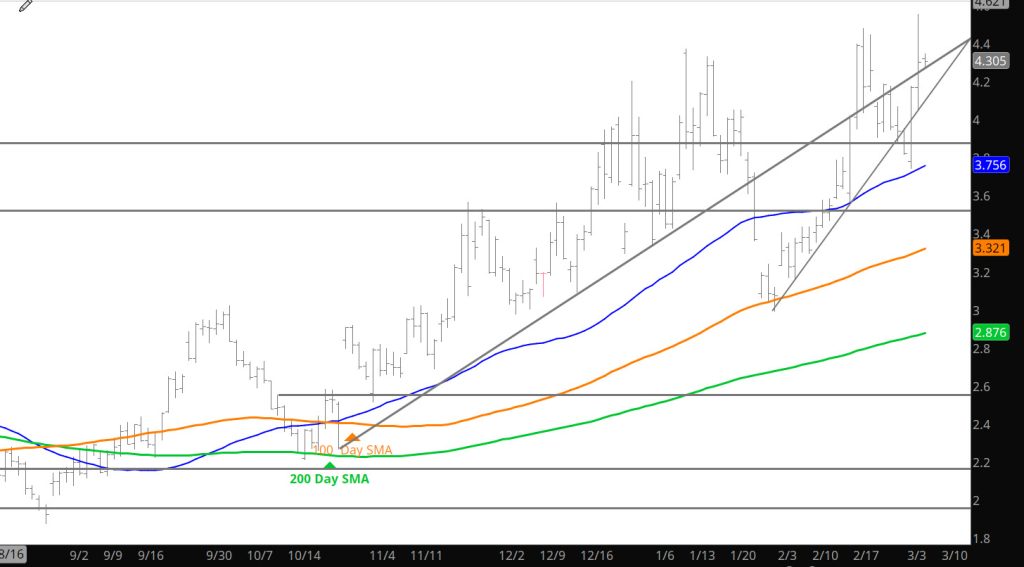

Market Defines Its Bias

Market Committed to +$4.00 For Now

Daily Continuous

Not stating that the market will not decline back under the $4.00 level, but last week, I mentioned that the break above and the several attempts showing strength at and above that level was a key to the bias of the gas market. I am still not willing to commit that the $2.99 printed was the Q1 low but it looking more and more that the market is not interested in visiting those declines. This week’s gains have been on supported by higher volume (through Tuesday) and gains in open interest that suggests that there is more room to move higher. Today, we get storage and it may give us inclinations of gains continuing or a brief correction lower after three solid days of gains.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $4.00, $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $4.378-$4.394, $4.461,

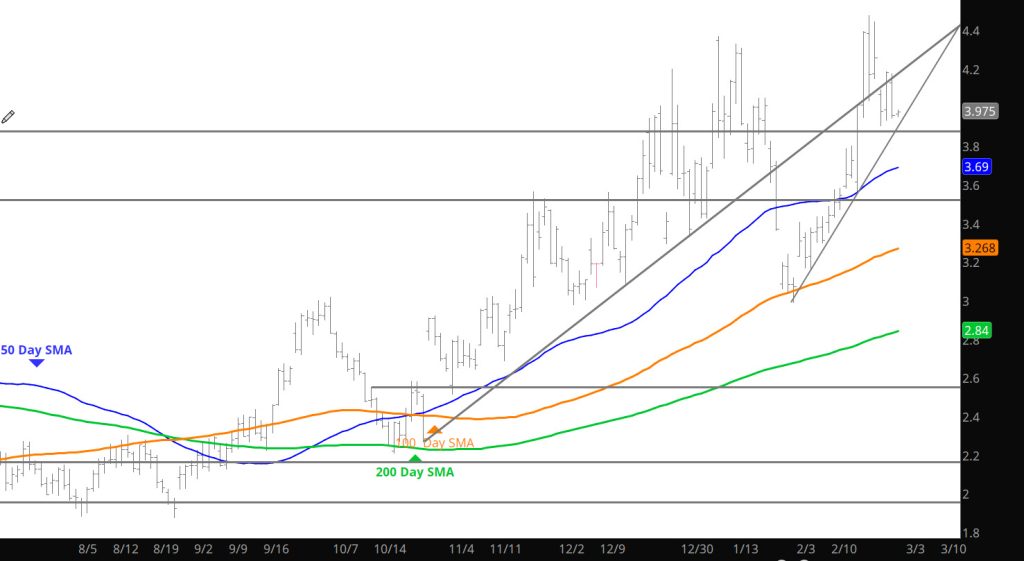

Failure At Resistance

Rhyming With History — Weakness in March

Brief Pause

Expiration Just Below $4.00

Daily Continuous

The now prompt April contract will likely be me with some softness, continuing the recent trade. The potential exception would be the storage report, should there be a surprise. Short of a surprise, I am expecting a consolidation — low volatility market for the next few days.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $4.00, $3.34, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $4.201, $4.378-$4.394, $4.461,