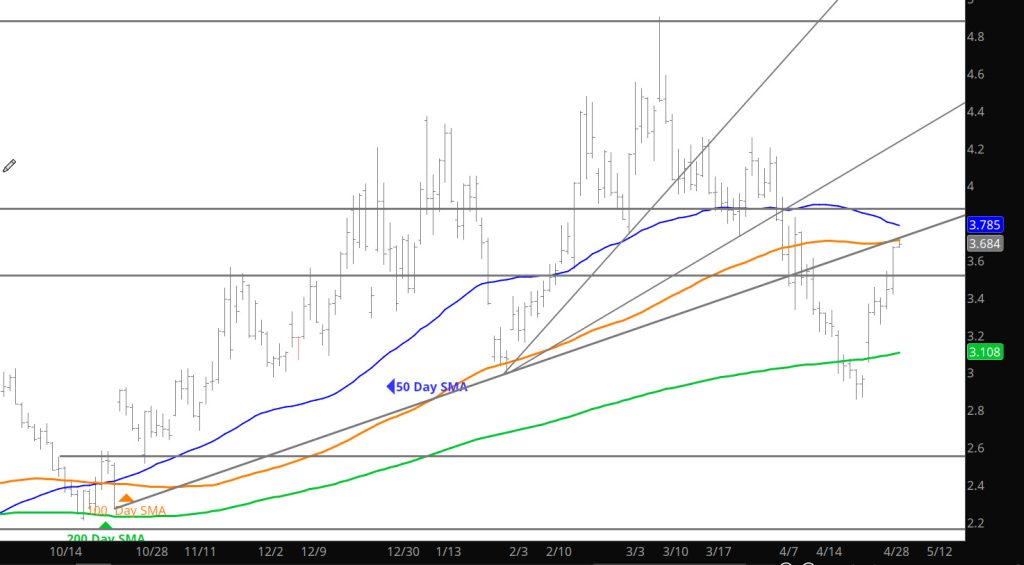

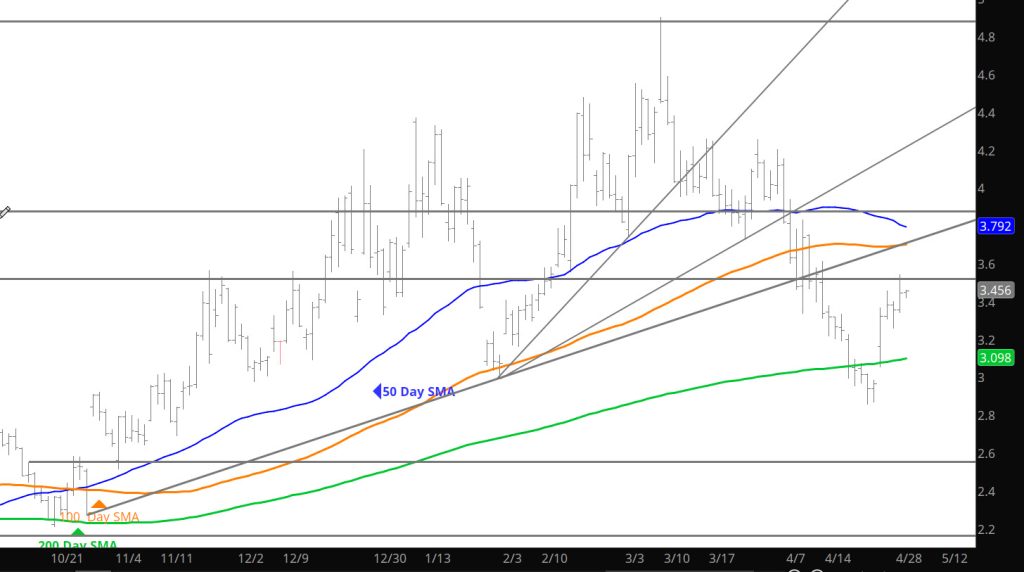

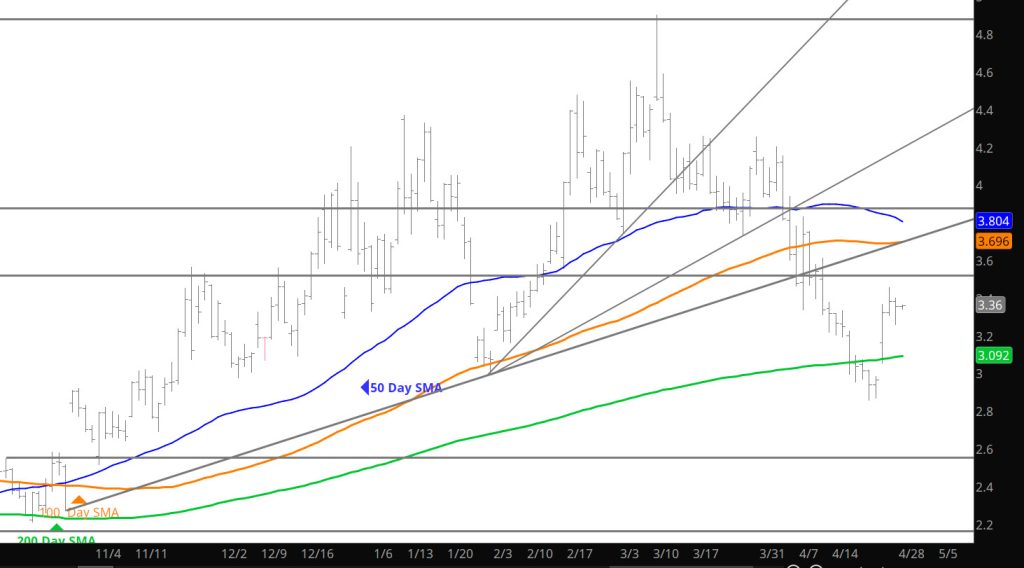

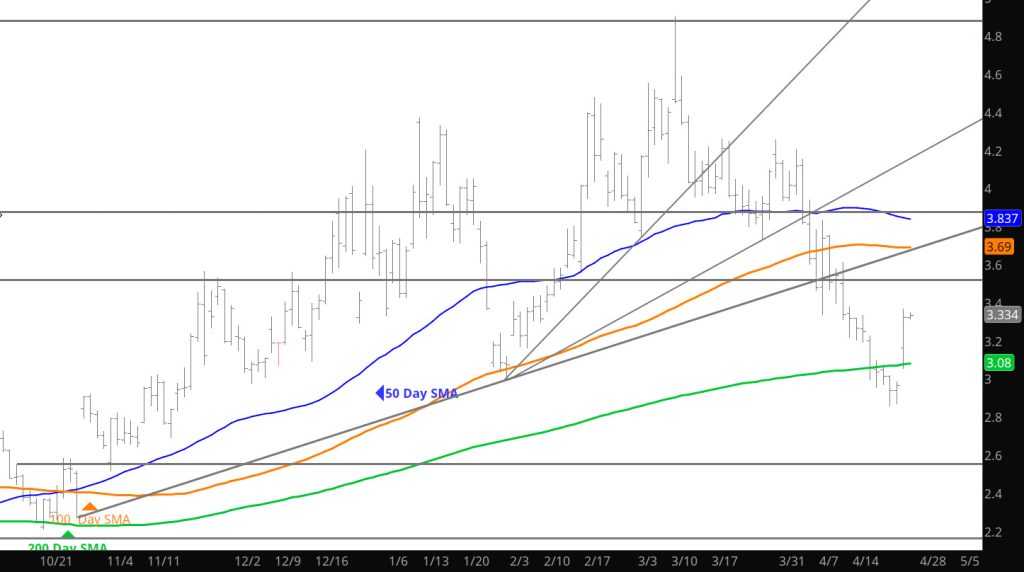

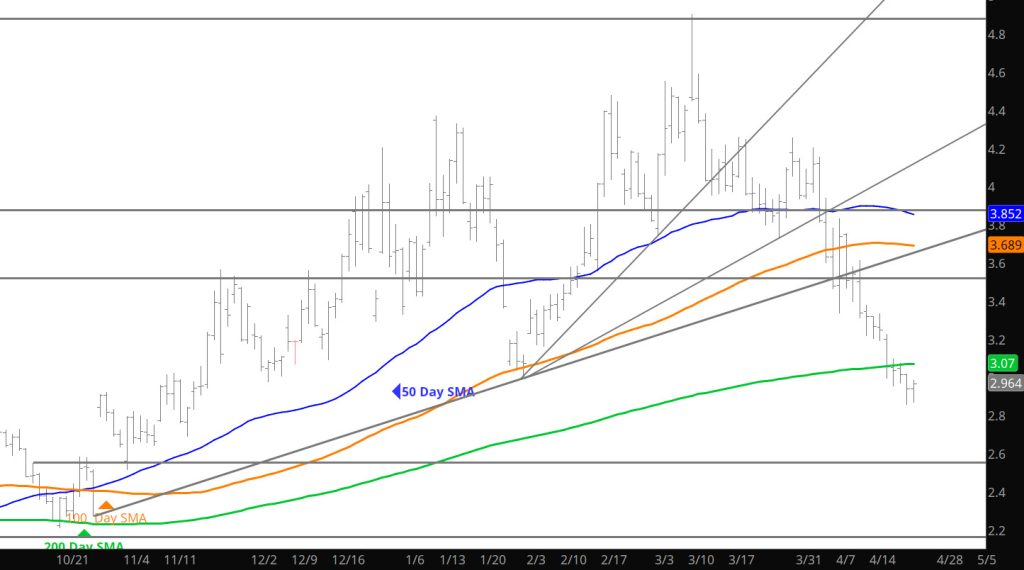

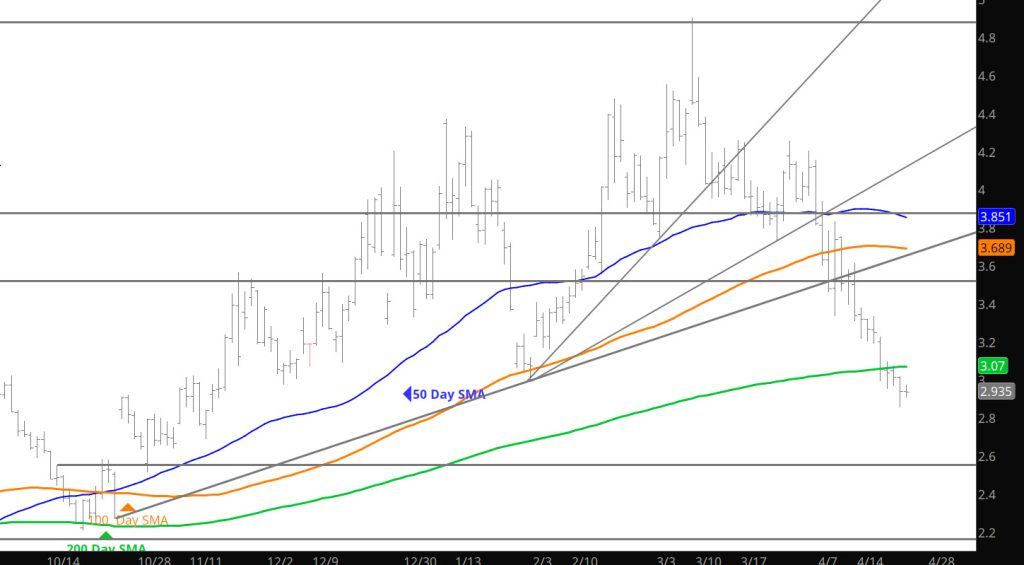

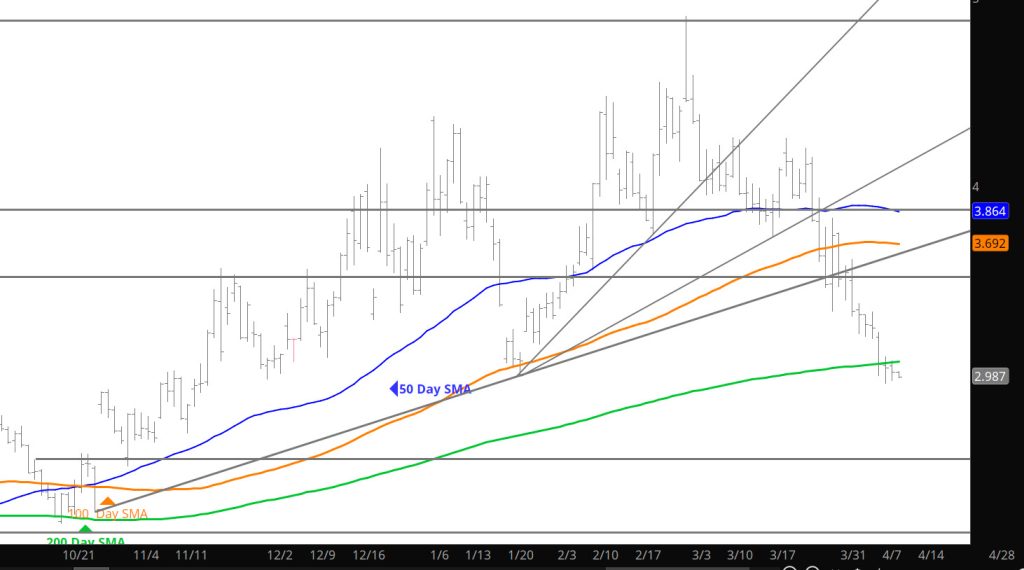

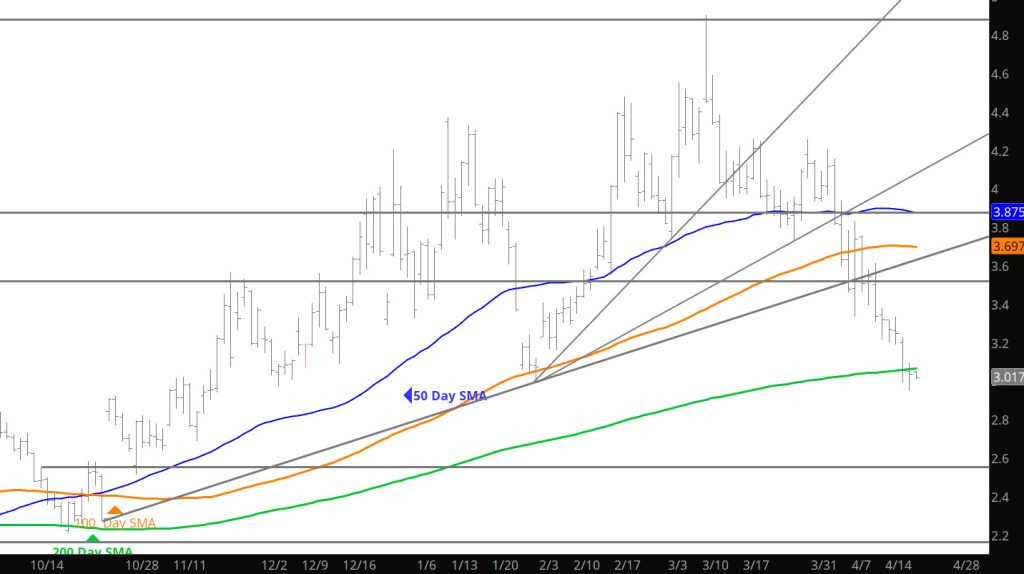

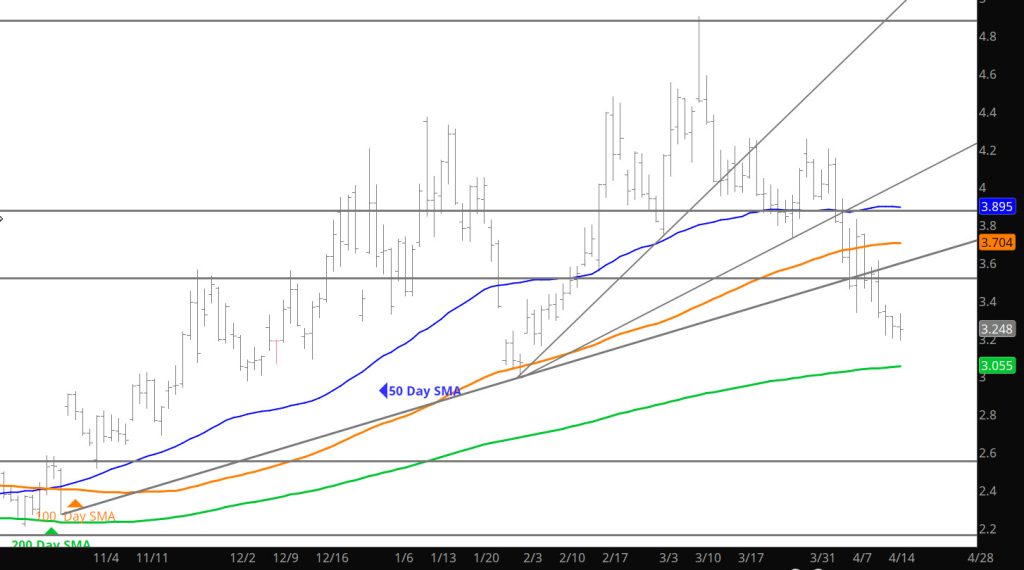

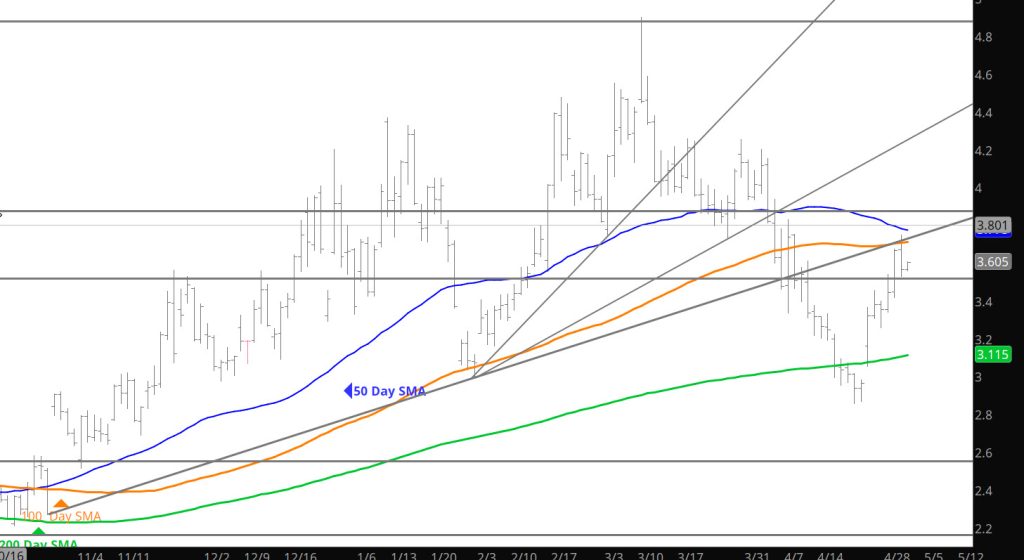

Daily Continuation

Not a lot to add to the heading as the market is testing and establishing a range for near term price action– would play the further sides of support or resistance to avoid being chopped by the potential action.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03