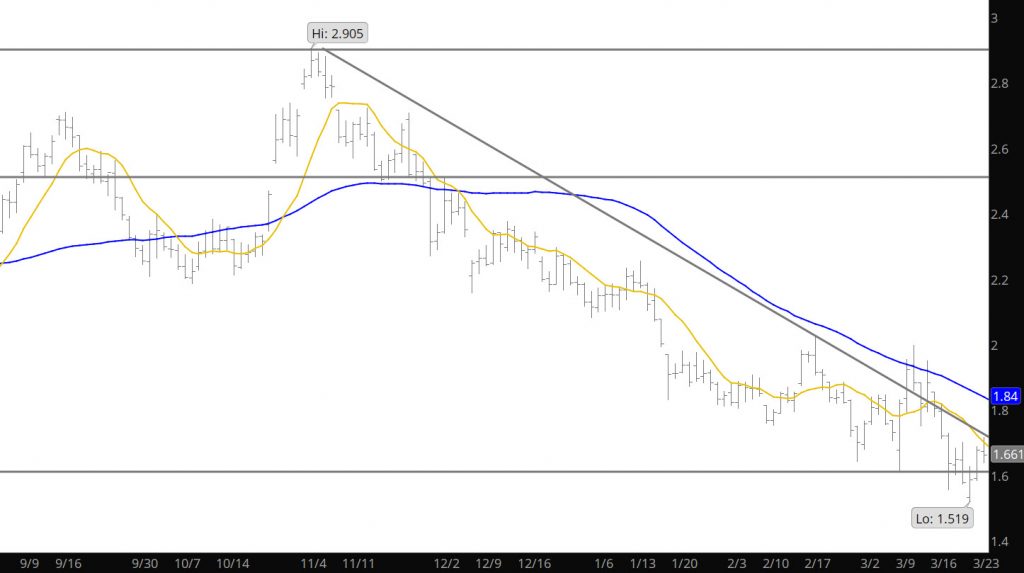

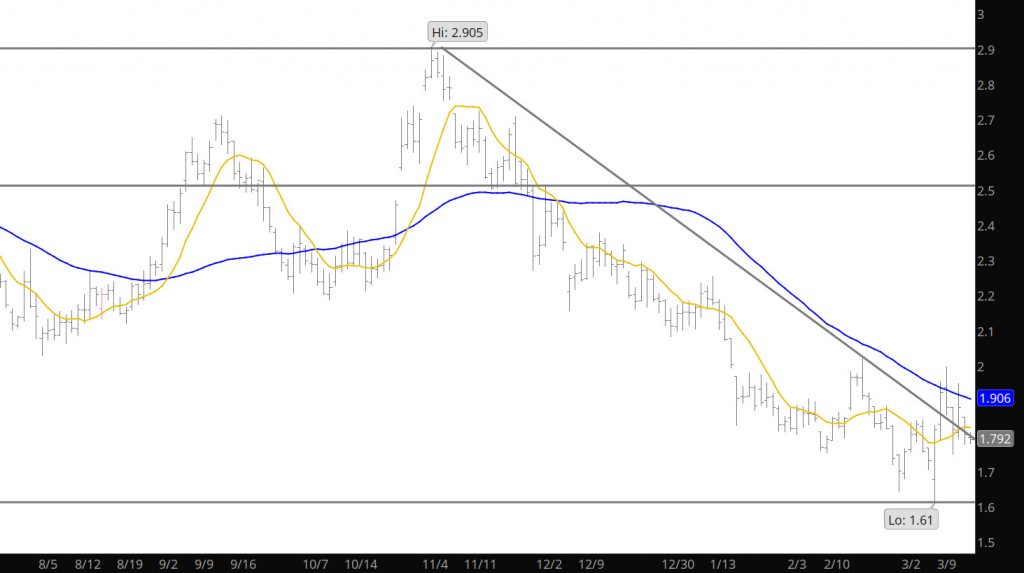

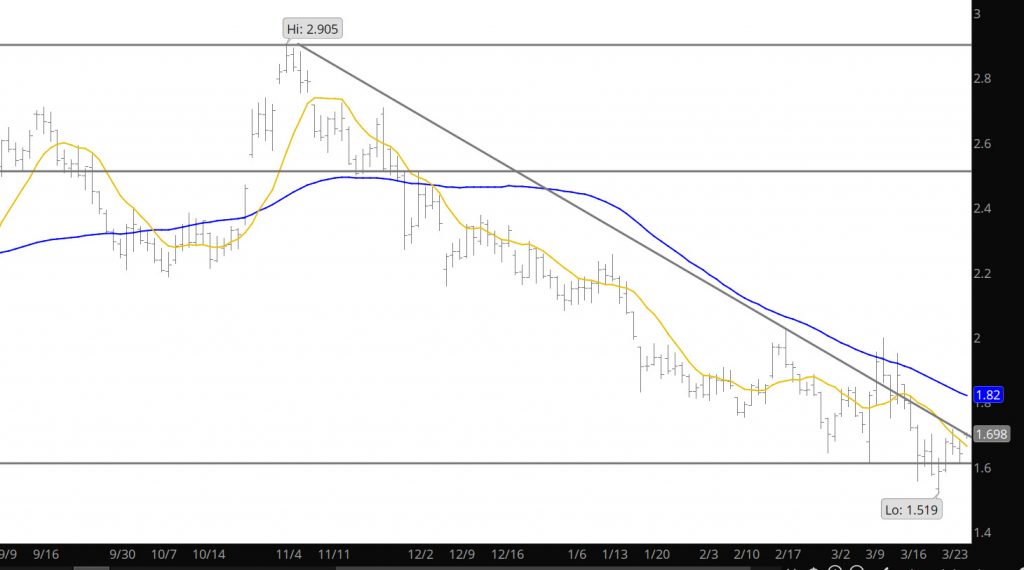

Not much to say with the upcoming expiration as price action is low on volatility. Obvious to work on May contract and depending on how April expires — play that momentum direction — whether to the low or high end of the range.

Major Support: $1.611, $1.555–$1.519

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,