Category: Daily Call

Strong Finish To a “Building” Trade

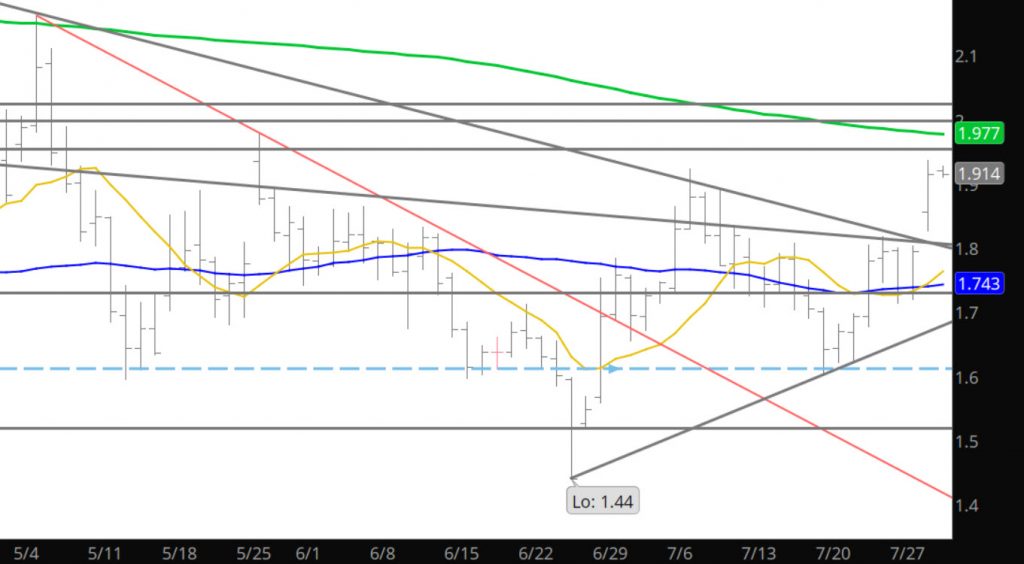

As discussed in the Long Term area of the web site, prices are behaving a little differently recently. I would guess there are fundamental reasons for this, though that confuses me as the market is still long storage etc., but there has been a shift in the trade habits lately. Caution though, as it remains in a range environment and should be traded accordingly. It is now approaching serious resistance and this behavior will indicate potential future expectations.

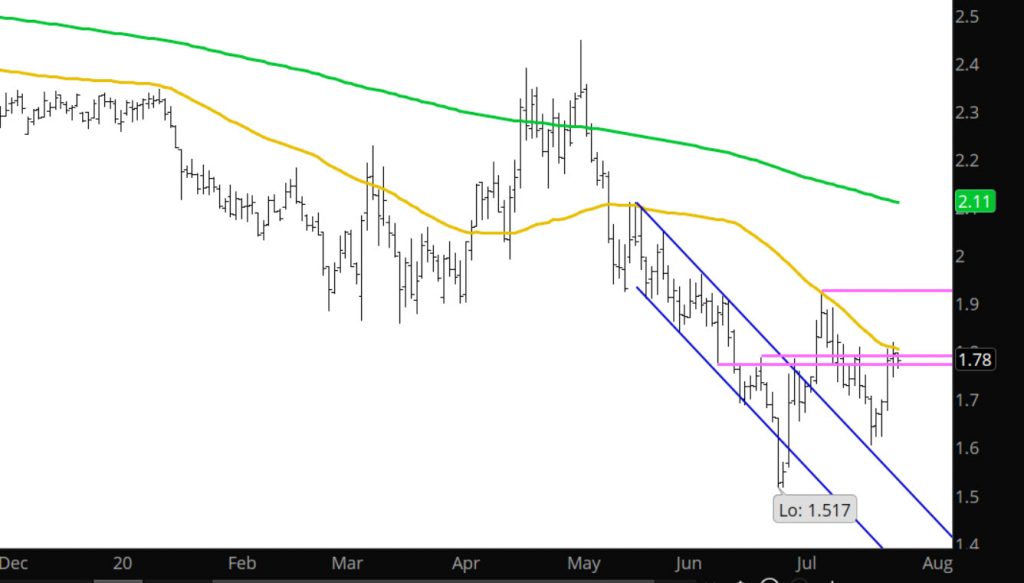

Major Support: $1.527, $1.484-$1.44, $1.336

Minor Support: 1.893- $1.854, $1.719

Major Resistance: $1.924-$1.956, $1.974-$1.976, $1.989

Minor Resistance:

Weekly Similarities Continue

Monday Trend Continues

Short Covering Rally Forces a Dime Gain

Handful Up Handful Down

After the Excitement Declines End

Confusion Is Upon Me

Range and No Directional Bias

Went into my psyche on the long term, so no need to waste time here. Something is browing and I have not clue directional y the pain will be felt but I can say tow things- 1) Q3 and calendar August have a history of weakness; 2) with the changes in the CFTC data the most pain is evenly split between those speculating long and or short. Now we sit at the lower end of the recent range.

Major Support: $1.484-$1.44, $1.336

Minor Support: $1.527, $1.66, $1.722

Major Resistance: $ $1.864-$1.896

Minor Resistance: