Category: Daily Call

Price Action Consolidates on Storage

Extension Down in Early and Light Trade

Brief Collapse Was Expected

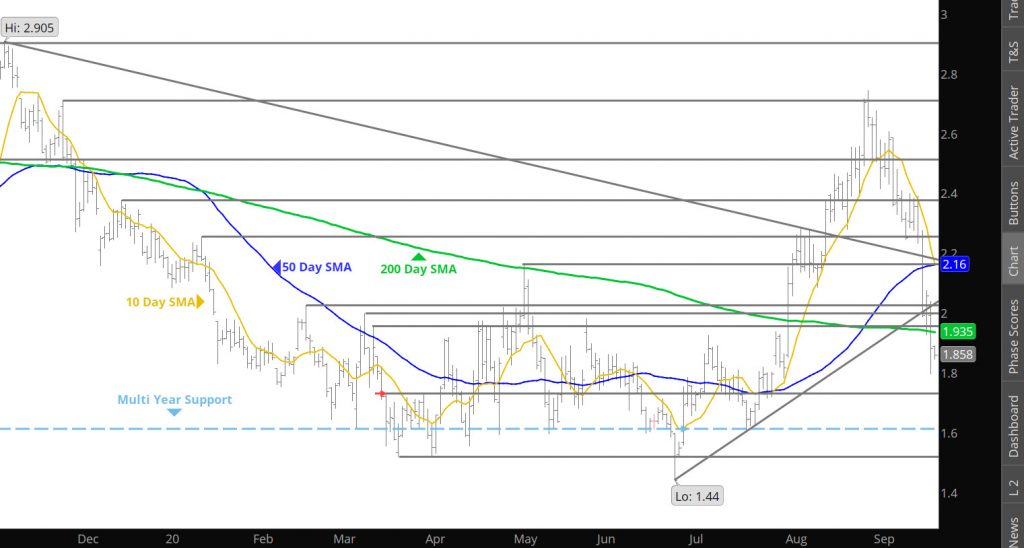

Spoke yesterday of the high side resistance to further gains and confirmation of that occurred yesterday. Expect further probes lower, but there will be a bounce (like we saw last week- just not as volatile). It seems now that traders are looking at fundamental data input (go buy some subscriptions) for the upcoming winter. This trader will wait patiently for some technical indication of the depths of the declines vs when to buy some winter.

Major Support: $2.544, $2.518-$2.496

Minor Support: $2.388-$2.415

Major Resistance: $ 2.905, $2.928

Until the End

Say Goodbye to Wild October

This Will Be An Interesting Contract Expiration, Monday

Whiplash

Nov Comes Down More Then Oct

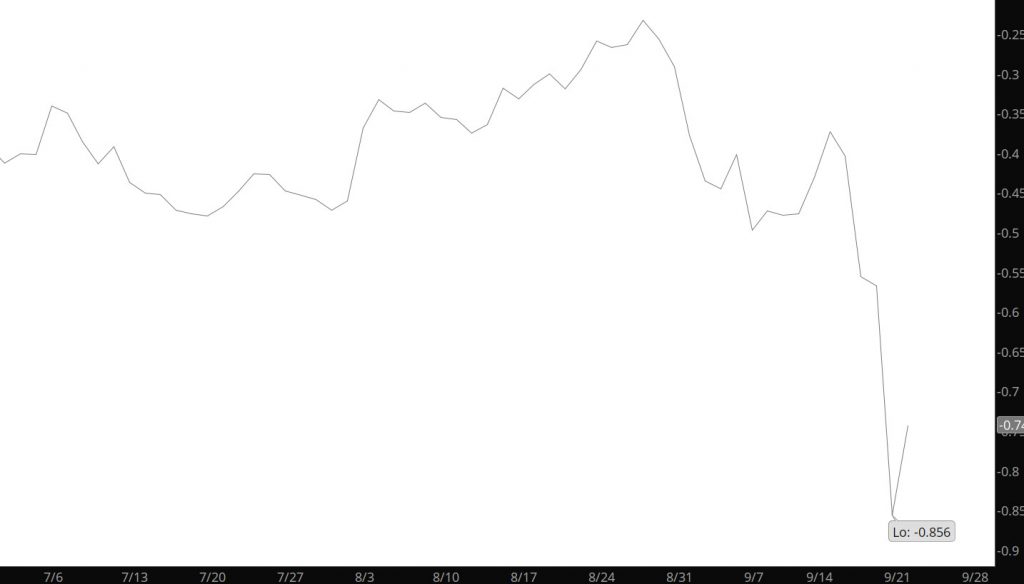

For the first time in a while the differed contracts lost significantly to the prompt and brought some reality to the recent price action. Perhaps this is the first step in the correction bringing prompt closer to the second month, yesterday brought the Nov contract back after trading to an $.85 premium. Unfortunately, if you look at the Dec / Nov spread– it too is at an extreme wide margin. Mentioned yesterday, the prompt Oct contract is a “no touch” depending on your risk profile— perhaps the Nov contract brings opportunity (short term) from the bear side.

Major Support: $1.864-$1.852, $1.768-$1.70

Minor Support:

Major Resistance: $ 2.162-$2.18, $2.275

Minor Resistance:$1.964-$2.008