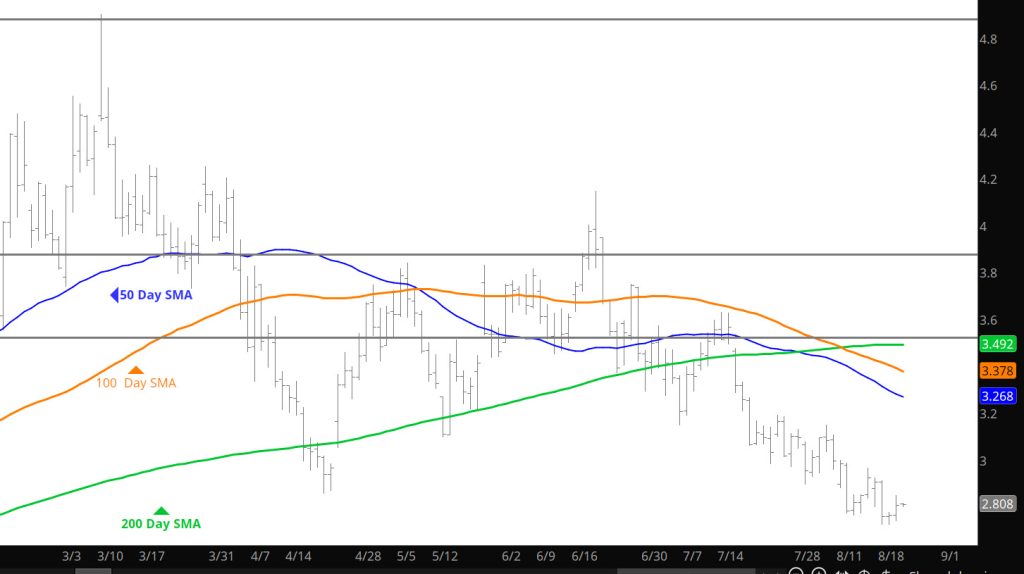

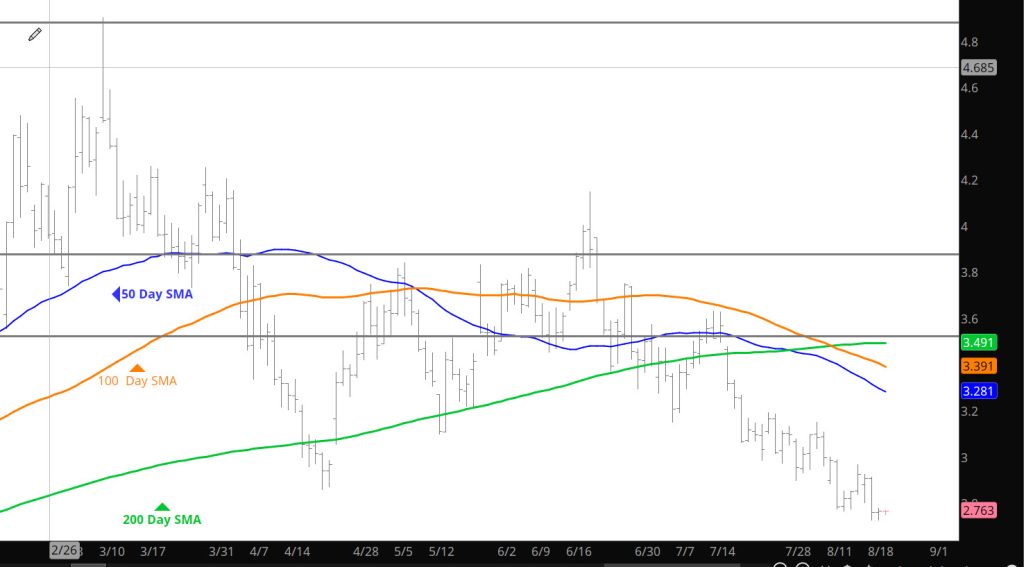

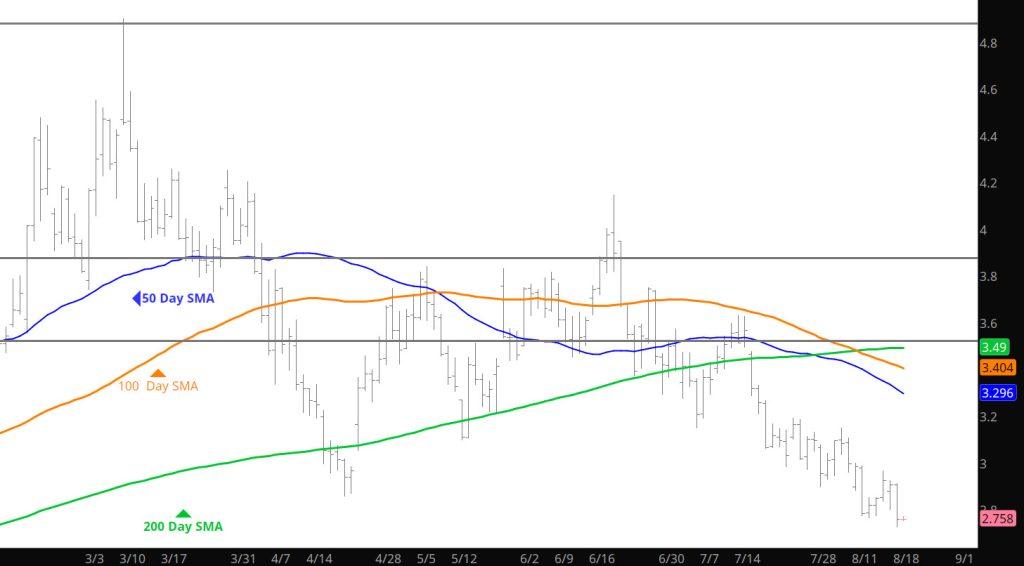

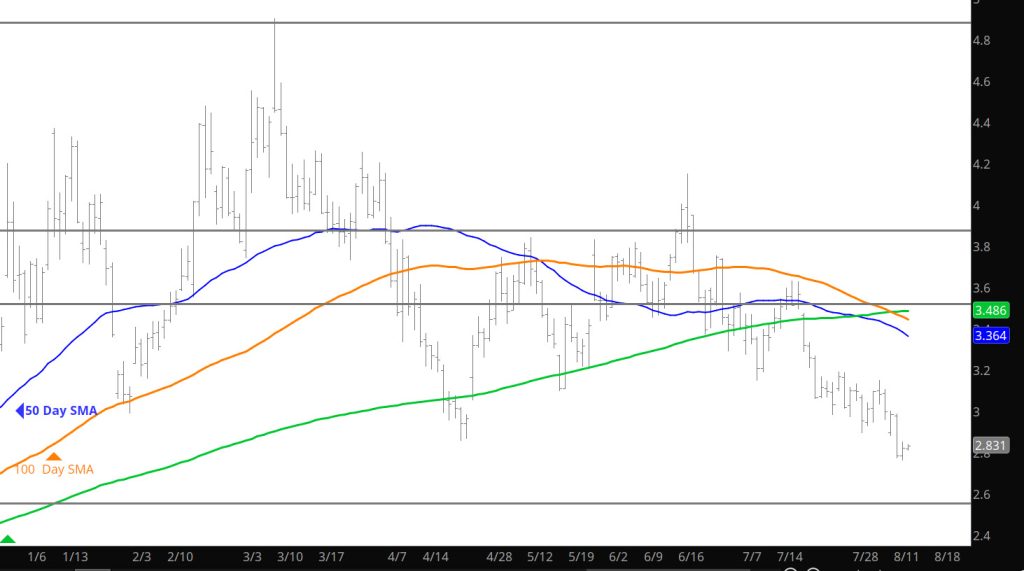

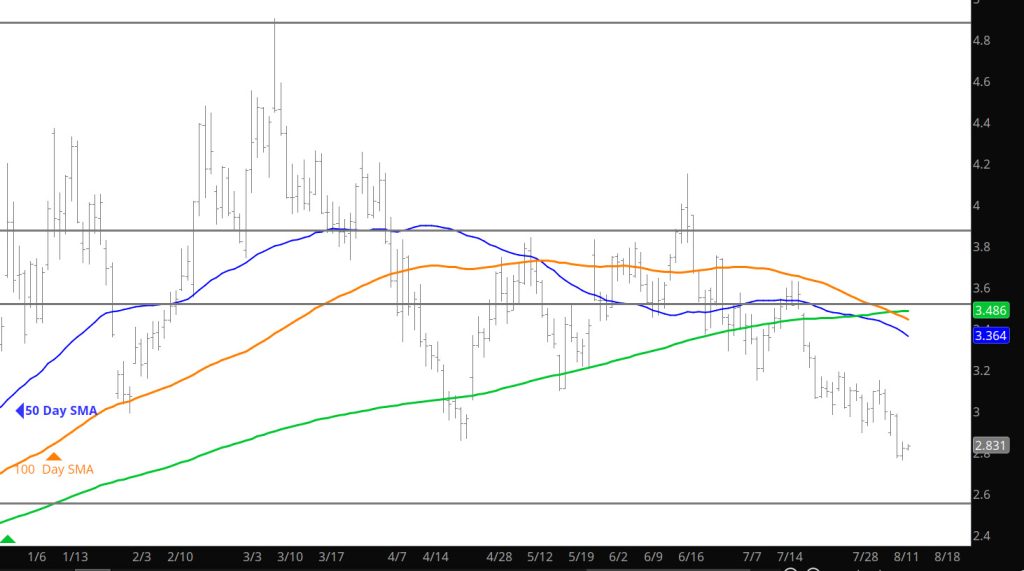

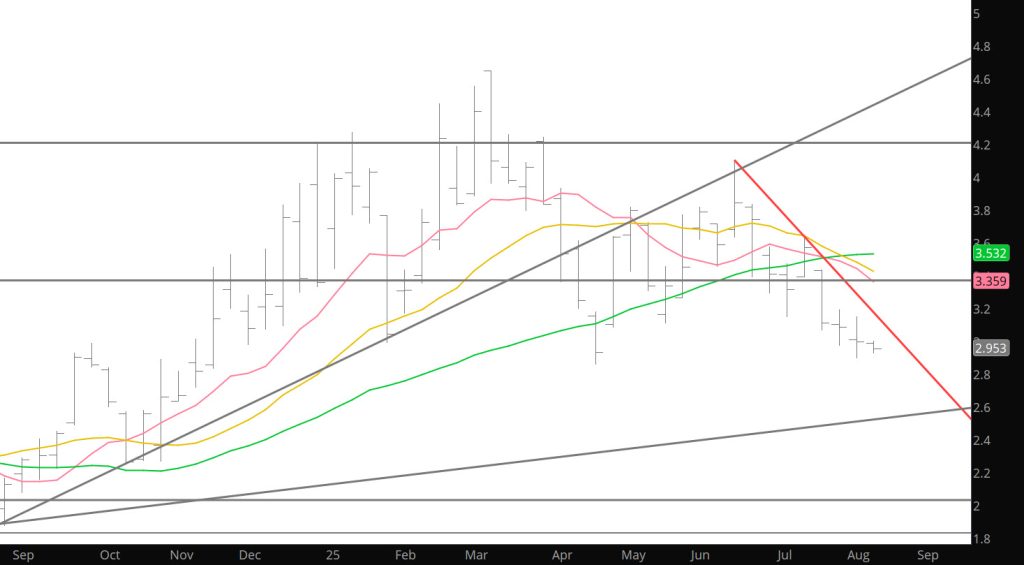

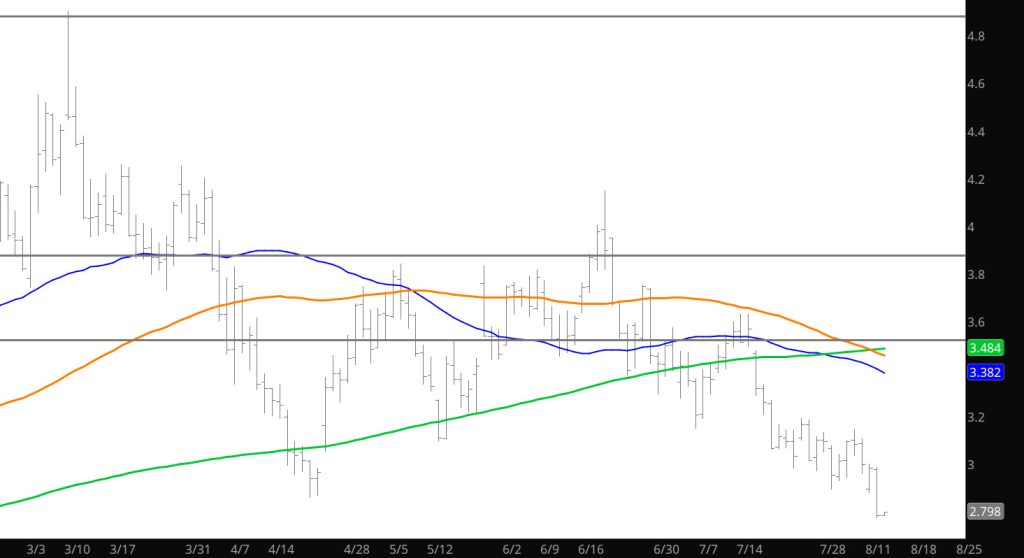

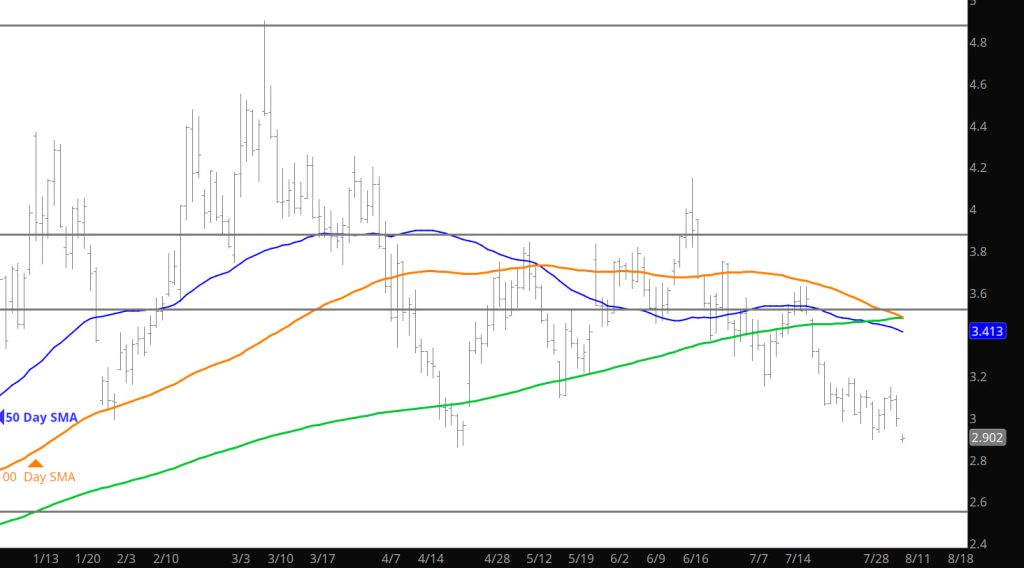

Daily Continuous

Expiration of the September contract is upon us with options going out today. Yesterday tried to extend the lows only to find some support, likely from some folks covering earlier placed shorts. Would leave the market alone for now unless you are looking for some lows in the winter months as the trade is starting to catch the recent trend.

Major Support: $2.727, $2.648

Minor Support :

Major Resistance:$2.843, $2.97-$2.99-$3.00, $3.061,$3.192, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461,