Yesterday turned out to be a good day to suffer a stomach issue as the market just churned lower and now this morning seems to be looking to set the low end of the range. My apologies for not emailing the Daily and the tardy post, but I am still not in my game plan.

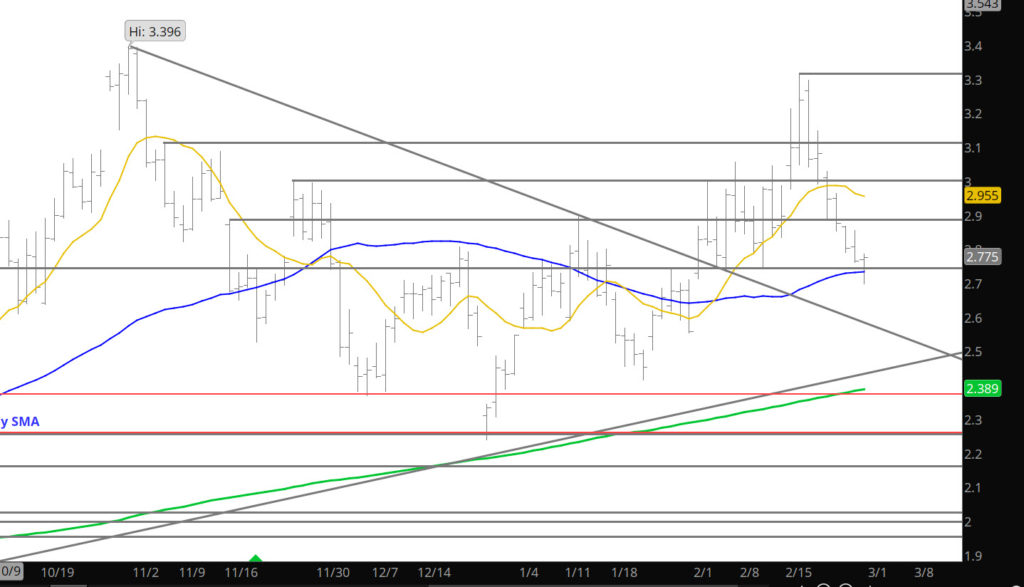

Support:$2.764, $2.74, $2.65, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.71, $2.60-$2.554,$2.483, $2.162

Major Resistance: $2.94, $2.98-$3.05, $3.082, $3.316-$$3.396, $3.486

Minor Resistance:$2.85