Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slowly Moving Nowhere — Hello Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Stronger Close to the Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slight Correction as Expected

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Melts Up to the Highs

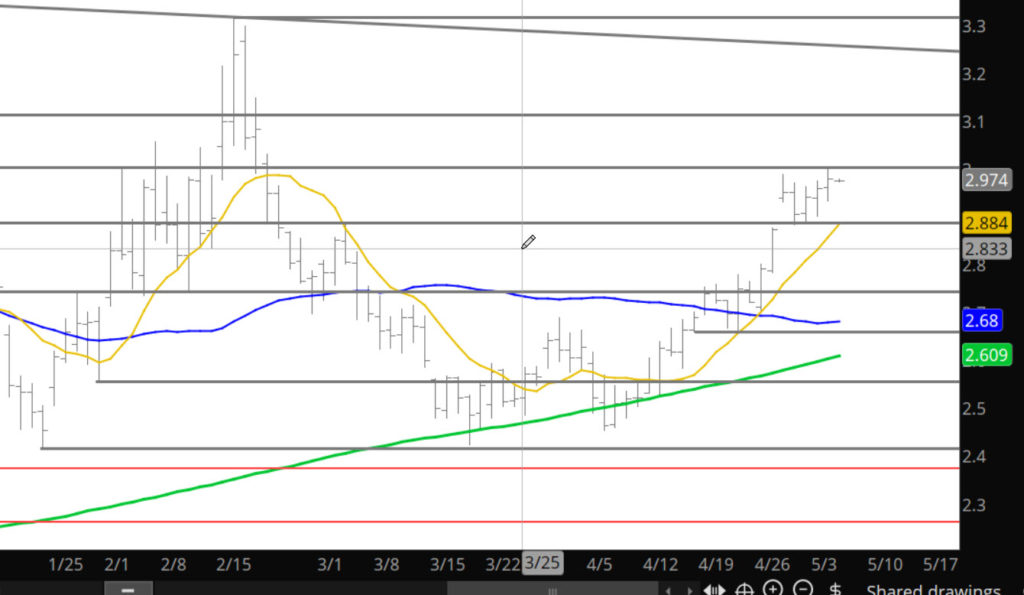

Didn’t surprise me that the contract expired near the highs yesterday (which turned out to be the third highest daily close for the May contract in over a year) as this market is continue to show strong bias. Been hearing little from my fundamental trading folks, indicating that they too are befuddled by the action. Now is the key time for the June contract — would prefer a brief pull back and re-define the support areas before accosting the $3.00 zone — but my preferences are truly irrelevant. From a technical perspective — a brief period of consolidation is warranted.

Support: $2.89, $2.71-$2.70, $2.658, $2.52, $2.422-$2.414

Minor Support: $2.897, $2.694, $2.483, $2.162

Major Resistance: $2.98-$3.05, $3.12

Minor Resistance:

Didn’t See This Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Commodity Tear Flows Over to Gas

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Week of Questions

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Little Volatility

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Breakout Holds — Consolidation on A Dime Move?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.