Category: Daily Call

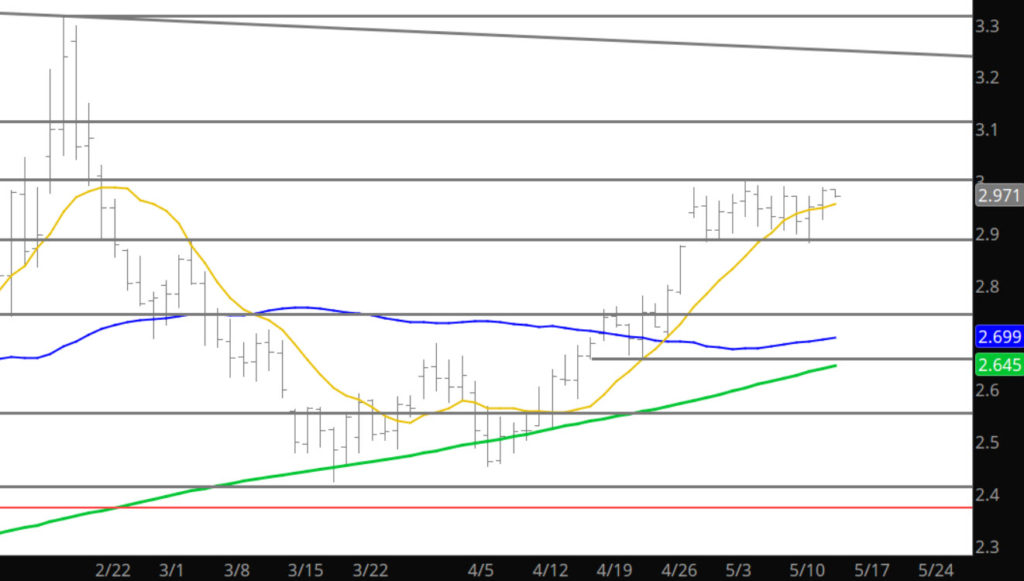

No Fake Out — Prices Hold Above $3.00

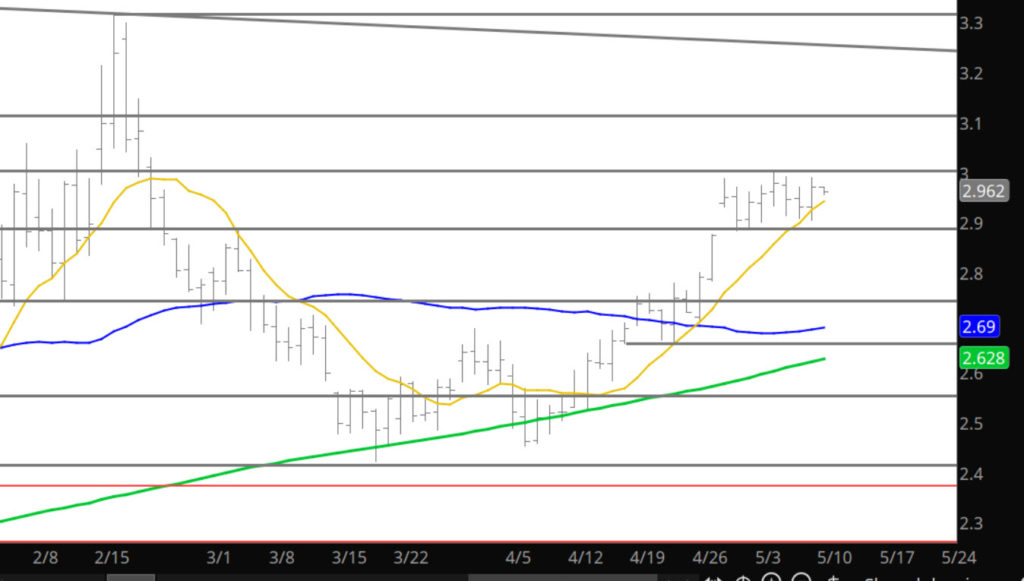

Sunday Night Fake Break or Real

Was going to discuss, yet another failure at key resistance, but the open on Sunday night caught me be surprise. As discussed last week, and this week in the Weekly section, was expecting June contract to meander in the range created during the month, with the break above pushed back until the July contract takes over as prompt– It will be interesting to see if the break above holds during the day. Would be cautious here until the day defines itself.

So Much For Those Ideas

OK Something Maybe Forming

Well, perhaps the market is starting to gather the fortitude to attack the $3.00 top end of the range as most of the other commodities have during the last month (some on numerous occasions). If gas does not garner the momentum to break above $3.00 it is miss a great chance to do so. From my trading perspective, I am not going to be selling at the resistance on the first opportunity and rather observe how the market behaves. We all know what will happen if the rally falls short again.

Support: $2.78, $2.71-$2.70, $2.658, $2.52, $2.422-$2.414

Minor Support:$2.876, $2.694, $2.483, $2.162

Major Resistance: $2.98-$3.05, $3.12

Minor Resistance: