Author: Willis Bennett

Hard to Sell Energy Now

Redefine or Just Test Support Levels

Sunday Trade Shows Strength

Action Continues Lower as Volume Declines

Extension Lower

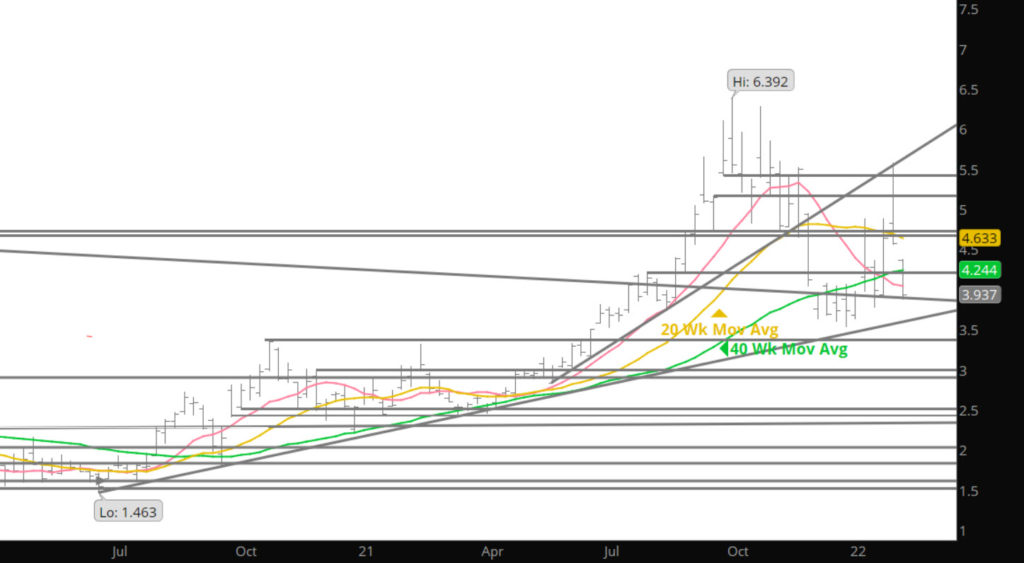

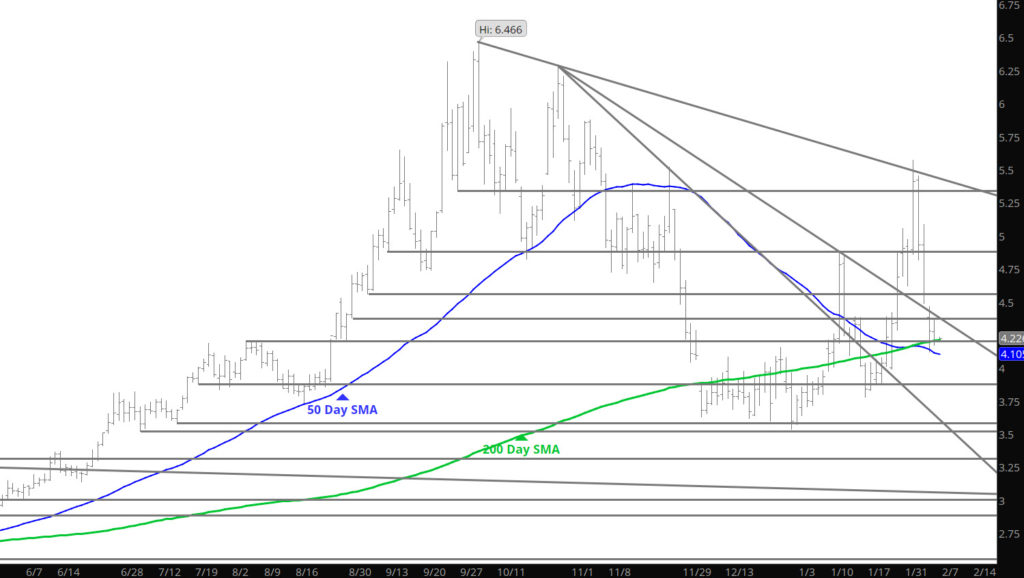

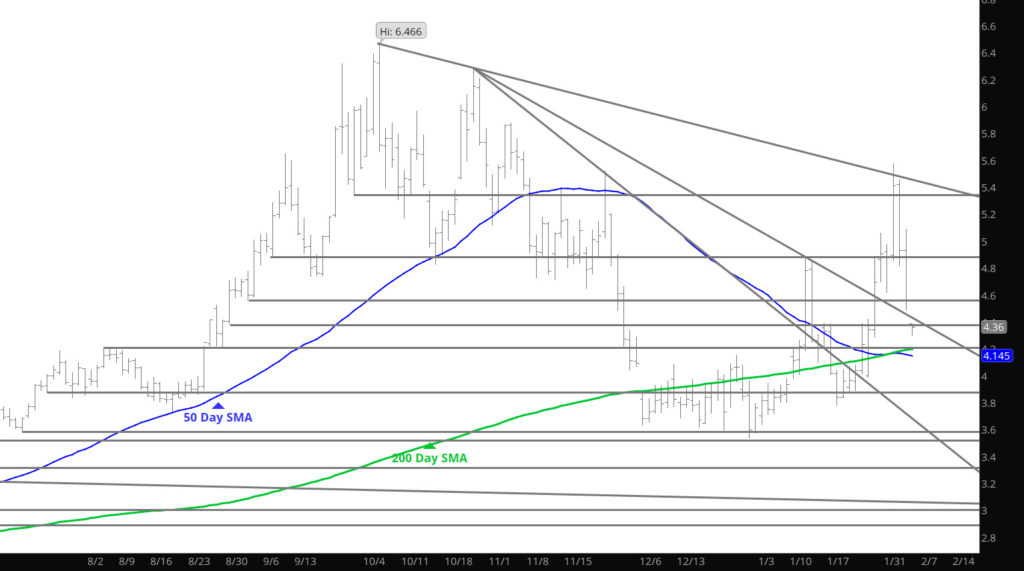

Action declined during the trade yesterday, taking the price down to intermediate support from the 40 wk SMA of March gas ( hard to believe) or just the fact prices went to $4.00. Still think that the market is seeking for near term support levels and perhaps the storage report will provide an indication of a floor. Let the market provide the indications of potential momentum directions — even on the range trade.

Major Support:$4.057-$3.972, $3.734, $3.63, $3.584-$3.522

Minor Support:

Major Resistance: $4.46-$4.48,

Bounce As Predicted

Perhaps a Small Bounce and Consolidation

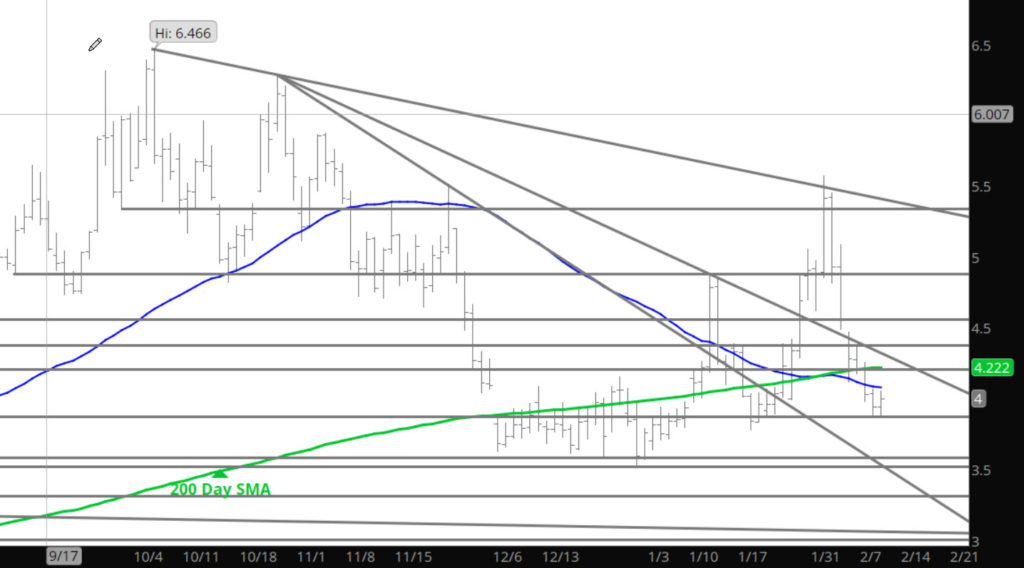

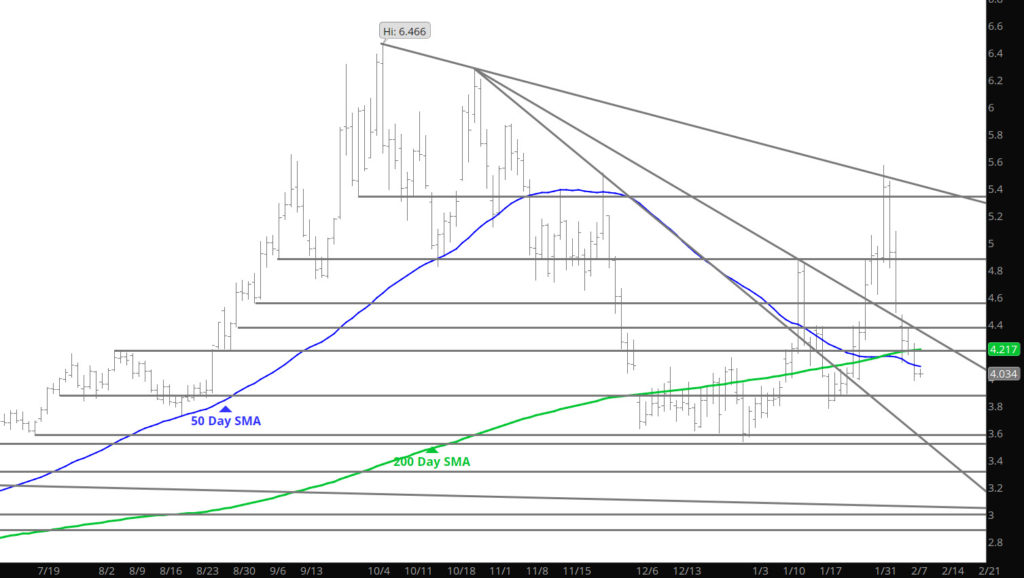

Prices action continue to behave well for additional declines but not sure today will be down that much — look for a small decline or perhaps a little bounce. The gap from yesterday should be thought of as the near term high end of the range.

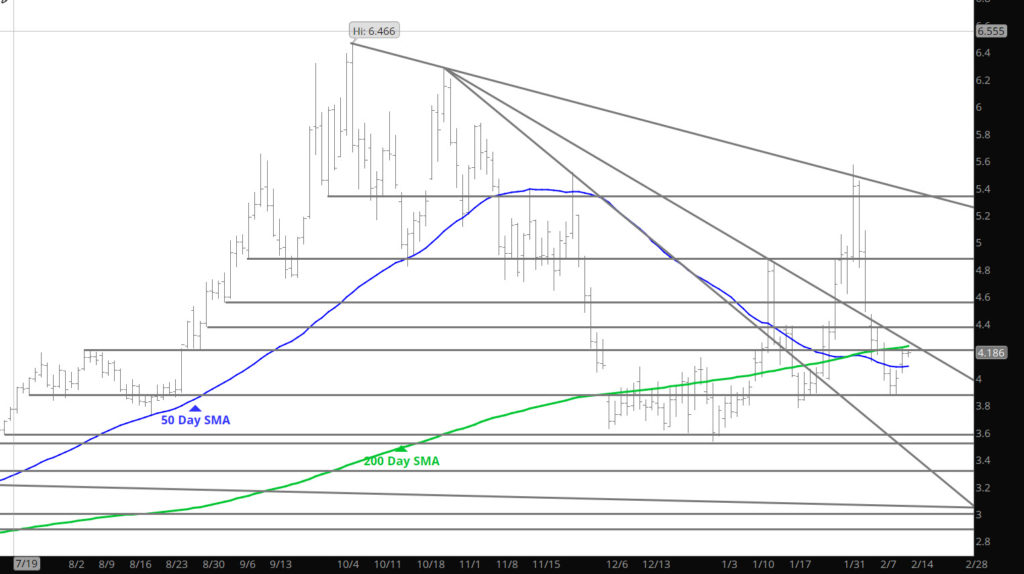

Major Support: $4.20-$4.186, $4.057-$3.972, $3.734, $3.63, $3.584-$3.522

Minor Support:

Major Resistance: $4.46-$4.48, $4.82, $5.5