Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

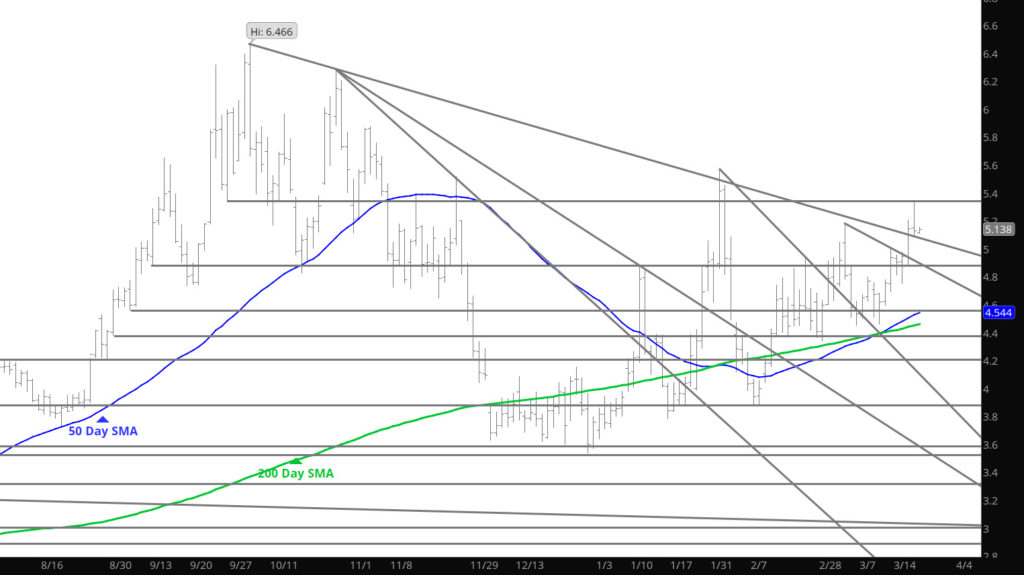

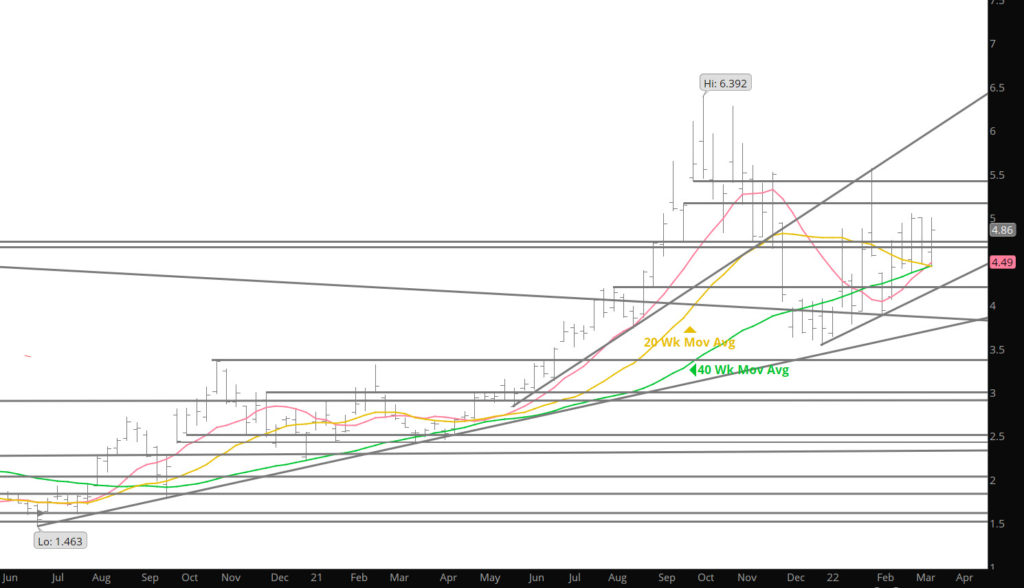

A Close Above $5.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Early Declines Find Buying

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

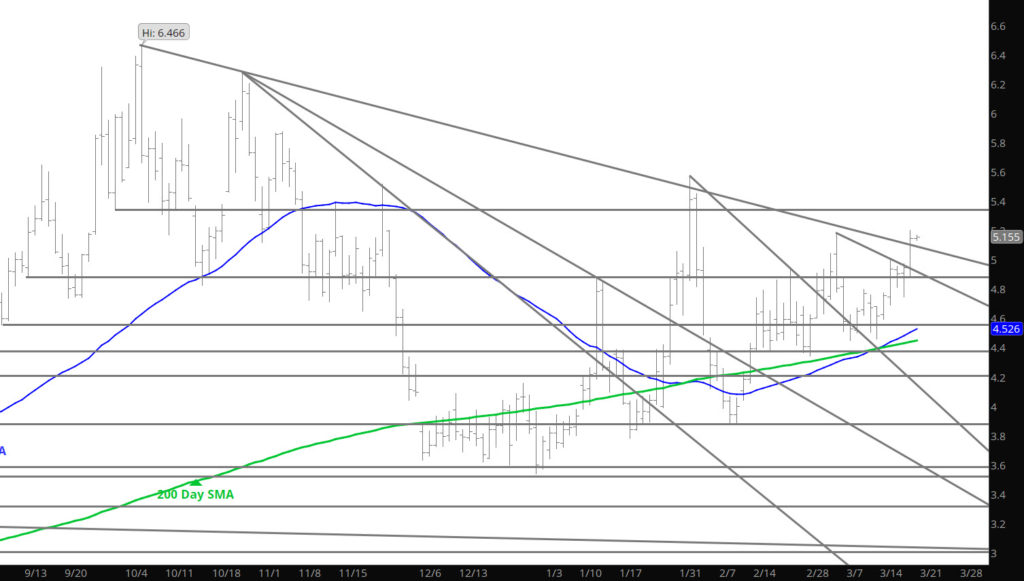

Rejection At $5.00 — So Far

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Inside Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Is It a Higher Weekly High

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bounce to High End of Mini-Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

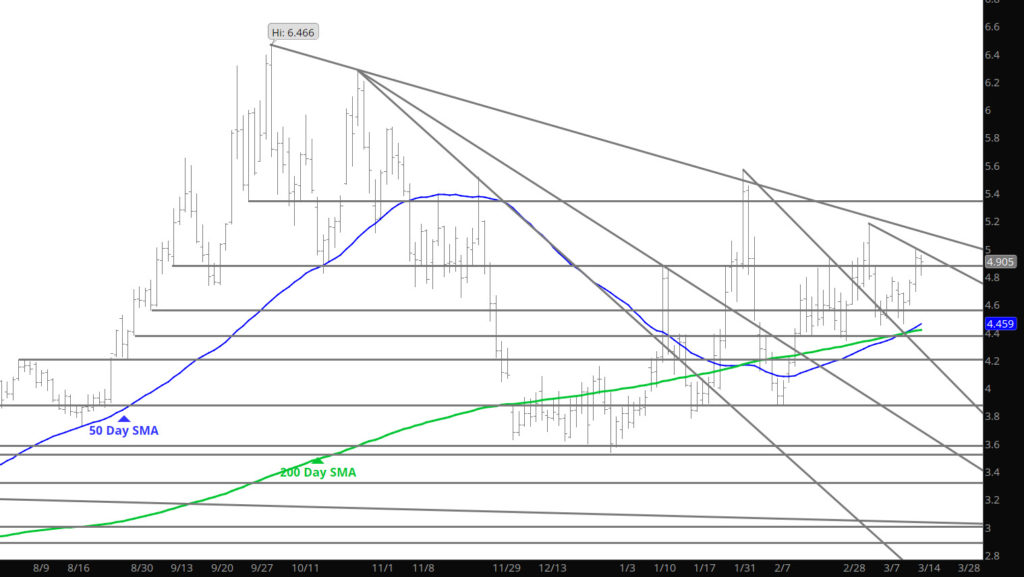

Near Term Support Tested

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Work Recent Mini-Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

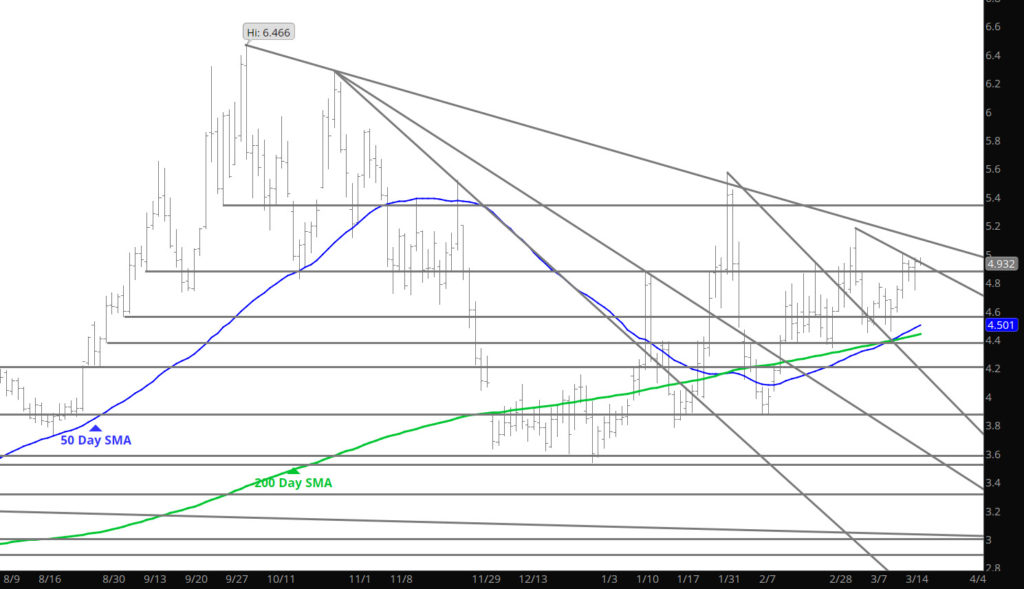

Price Action Showing Base Building

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.