Author: Willis Bennett

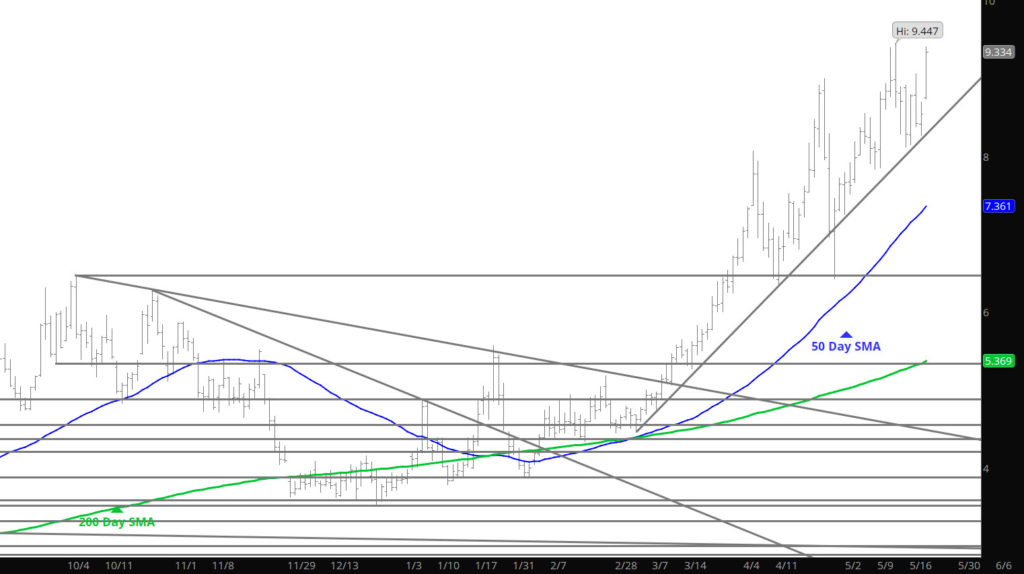

I Stand Corrected–Unlikely That Q2 High Is In

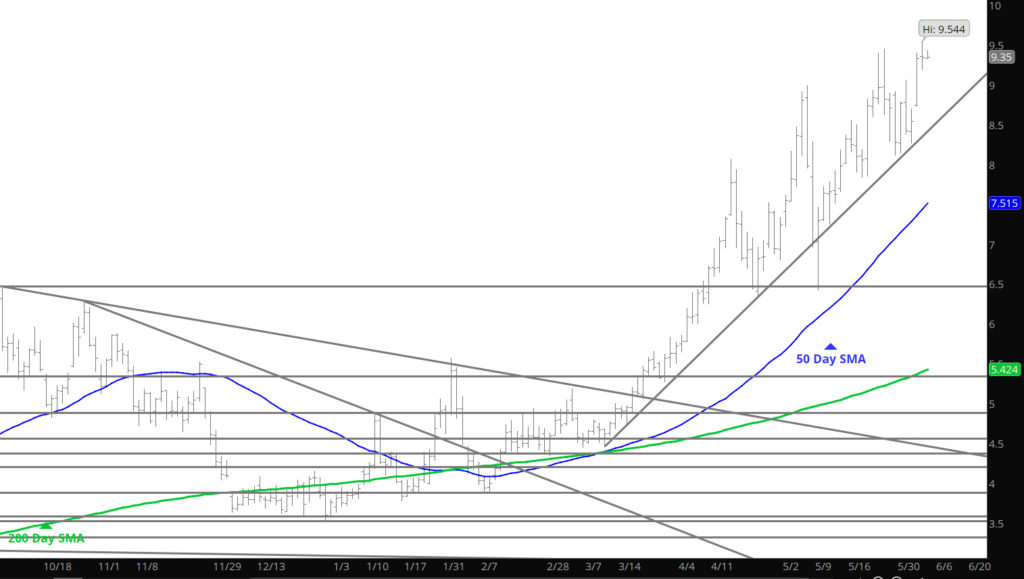

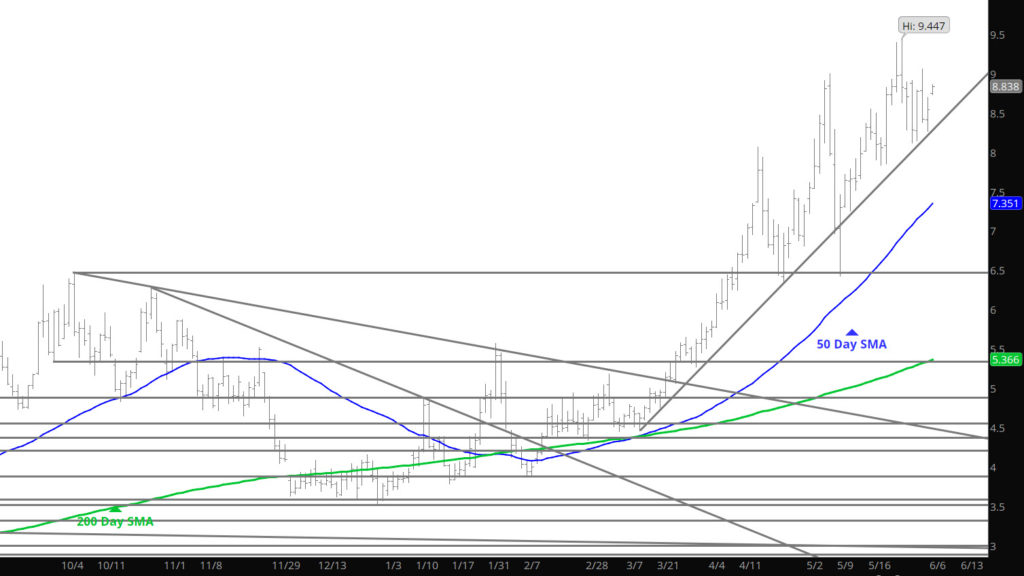

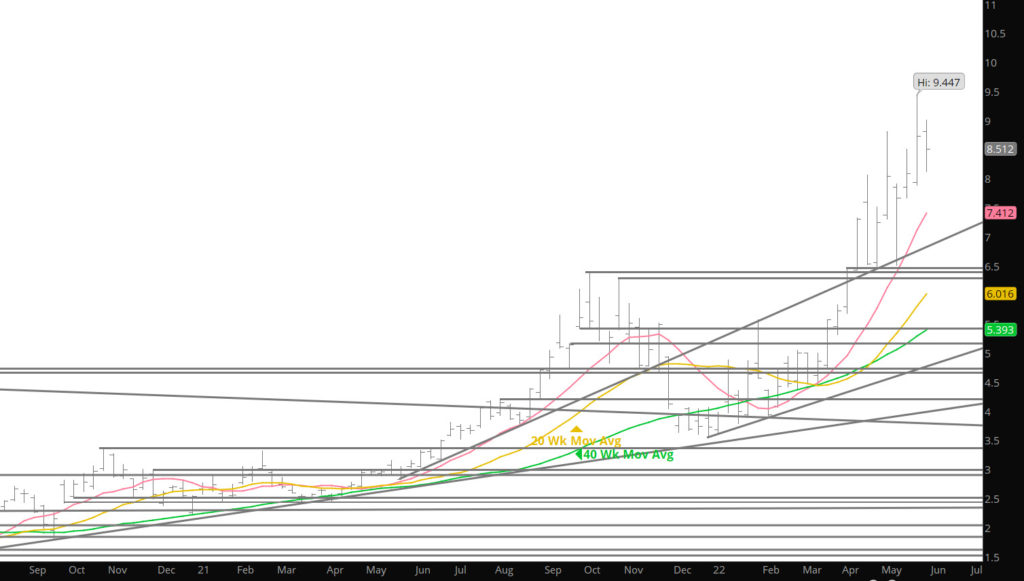

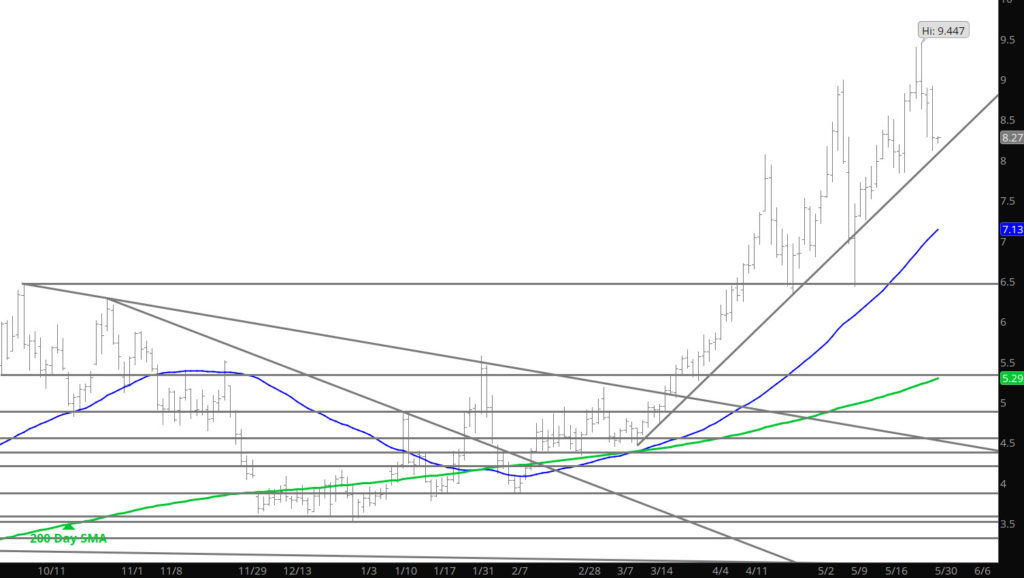

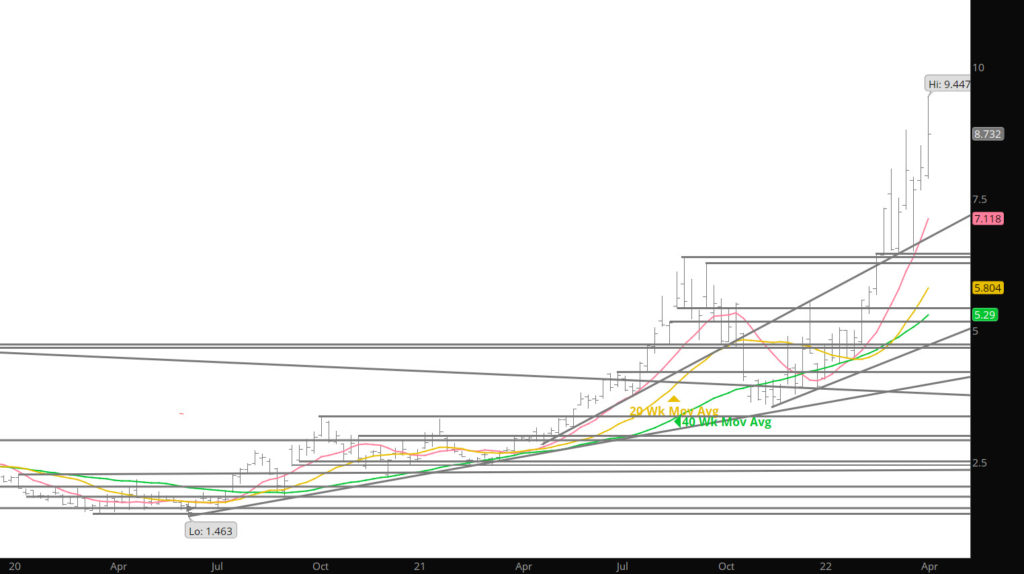

Mentioned yesterday that the it was unknown if the Q2 high was established and that upcoming trade would help define. If prices can’t set a higher high than the May high after yesterday’s gap opening and $.70 rally it is going to miss a great chance to break out above. Not many resistance zones above that level until you hit $10 and above. Declines will need to close the gap from yesterday at $8.73.

Major Support:$$8.73, 8.283-$8.24, $8.12

Minor Support: $8.065, $7.69,$7.36,

Major Resistance: $9.447, $9.60

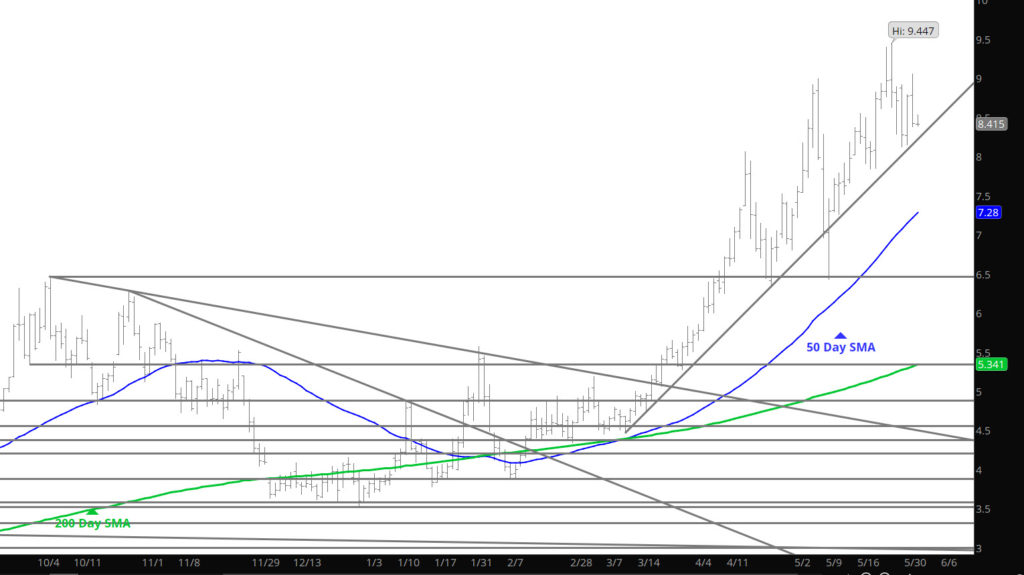

Here We Go Again

Holiday Weakness Plays Out

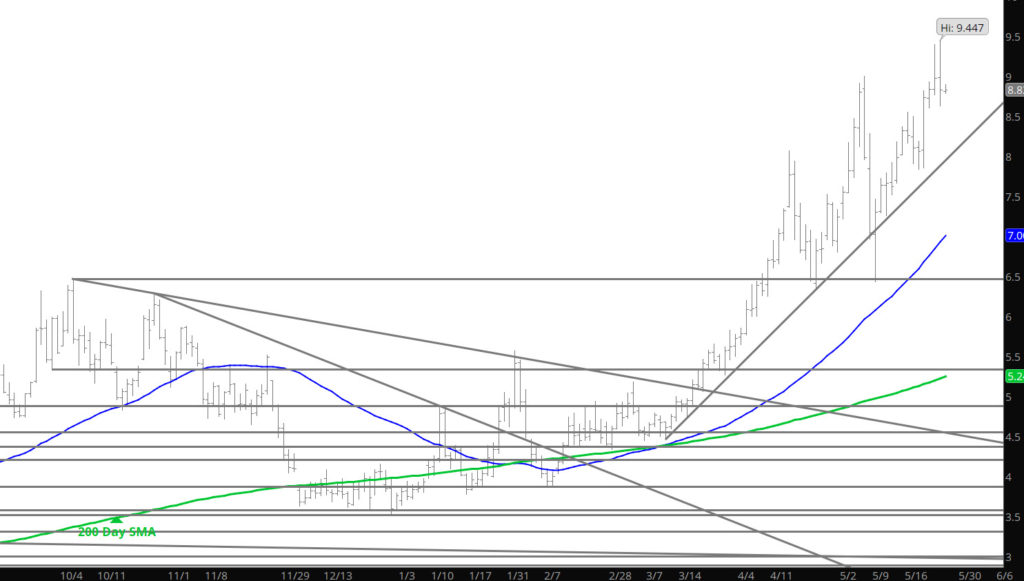

Great Test of $9.00 Only To Run Out of Gas

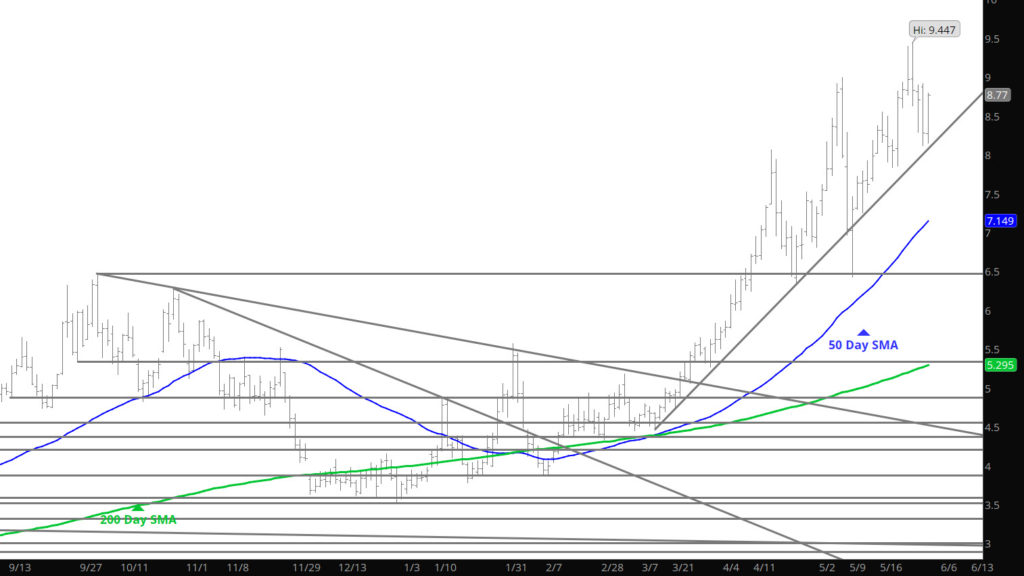

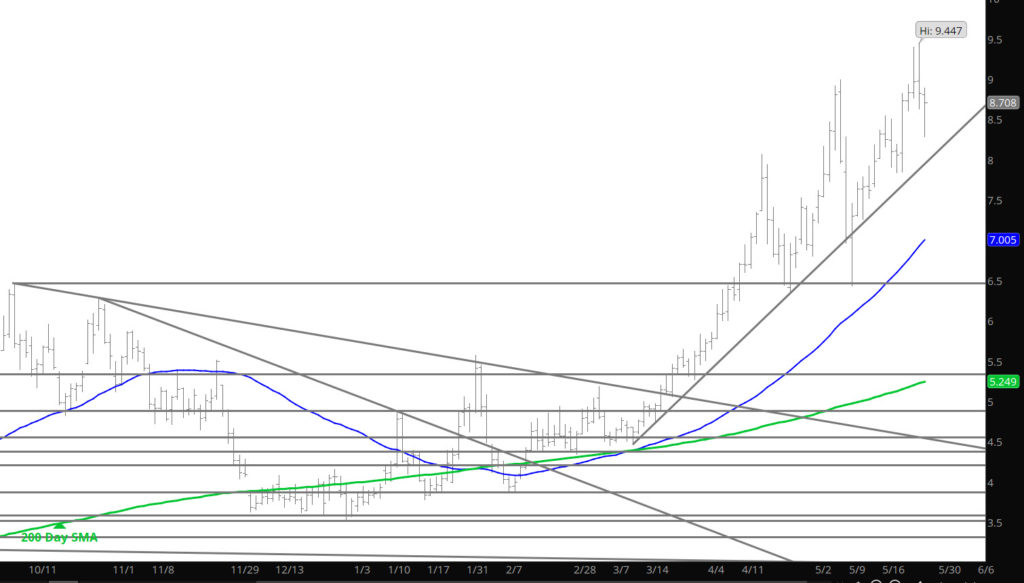

The rally ran low before the storage release just below $9.00 and the collapsed after the public release. Found some brief support sending prices back up above $8.70 only to decline through the close. This week will provide some direction as discussed in the Weekly section and perhaps a serious test of support around the earlier low at $8.11 will get tested.

Major Support:$8.283-$8.24, $8.12

Minor Support: $8.065, $7.69,$7.36,

Major Resistance:$8.916, $8.996, $9.60