Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Nov Contract Ready to Retire

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Dec Premium Reduced

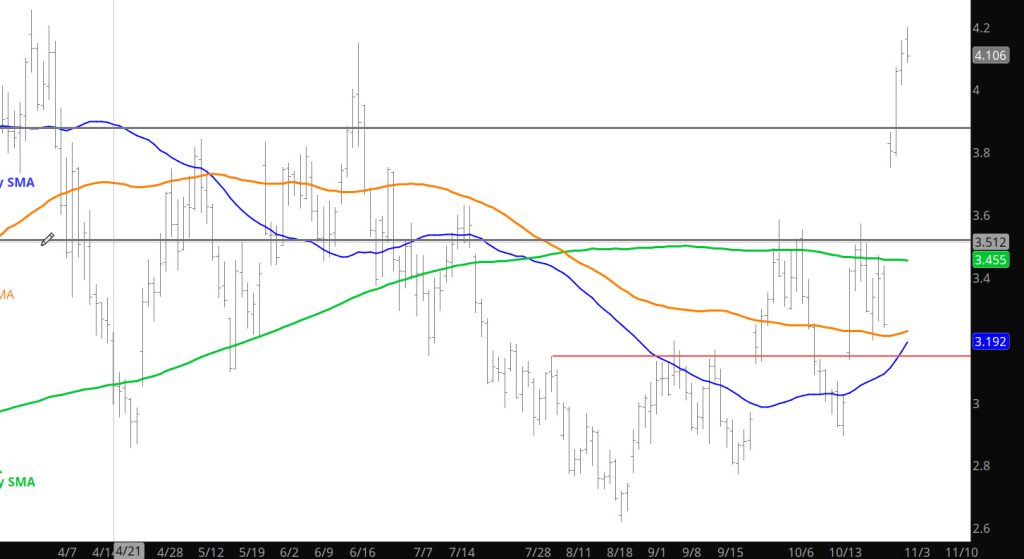

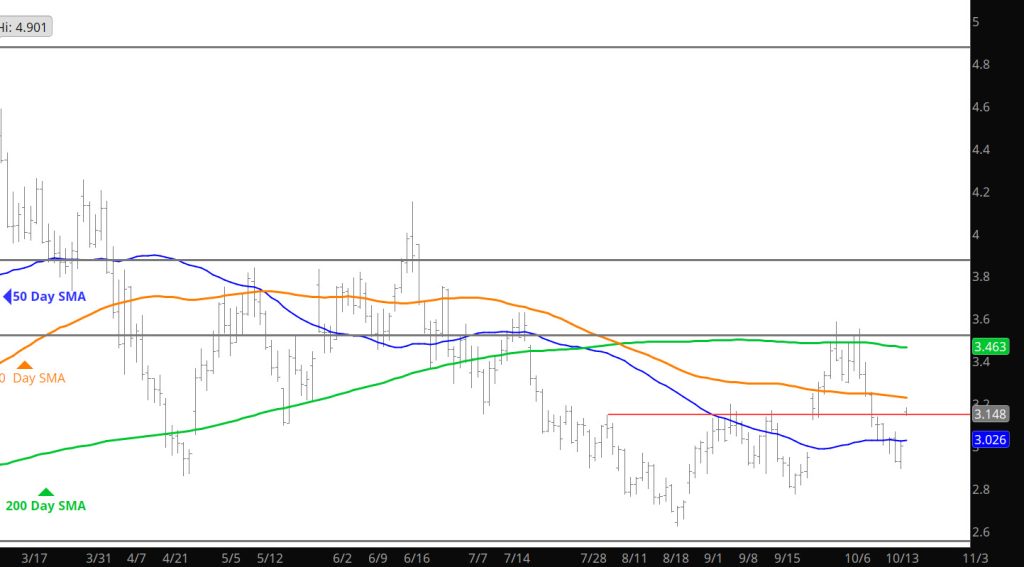

Daily Continuous

Discussed the premium being afforded in the Weekly and the market chose to narrow that yesterday as the prompt rallied and Dec basically went nowhere (down during the morning). For this reason my suggestion is to watch the Dec price action and should it establish a “flooring” behavior build some positions accordingly. If you are negative in bias then play the spread to Jan accordingly.

Major Support: $3.06, $3.00-$2.97, $2.843, $2.727, $2.648

Minor Support : $3.16

Major Resistance: $3.39, $3.62, $3.80-$3.85, $4.168, $4.461,

Should Be Interesting Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Slight Bias Moderation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Interesting Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gains Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Continue to Rock in Late Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Forecasts ?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Clueless on Direction

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.