Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Technical Damage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Exciting Week With Ramifications

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Another “Quiet” Day

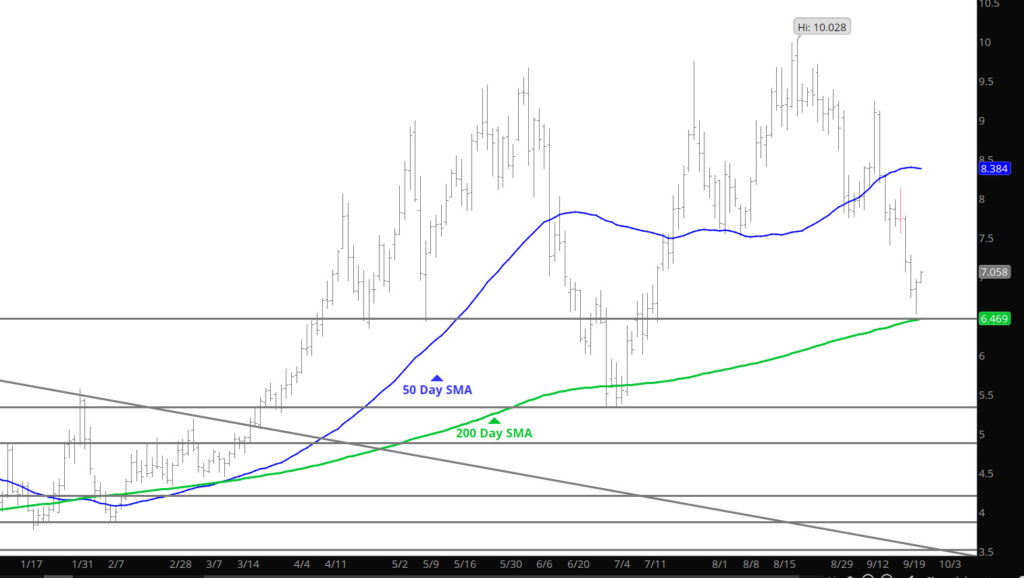

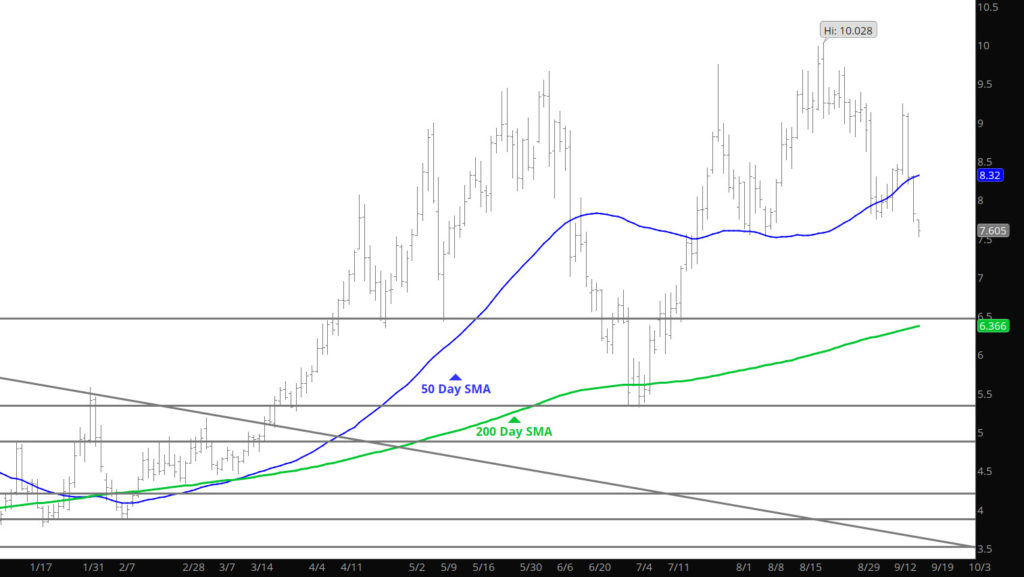

Price action took another day trading in a quiet range considering the last few months. Starting high end and giving up the gains during the day only to find footing toward the end. This consolidation will set up the next move and there are no clues whether it was either up or down. The recent range between $8.25 and $7.50 is the market for now so trade accordingly.

Major Support: $7.55, $7.14, $7.078, $6.88, $6.754,$6.38, $6.02, $5.623,

Minor Support $7.35, $7.41, $6.42, $5.548, $5.40-$5.45

Major Resistance:$8.26, $8.32, $8.45, $9.021, $9.05-$9.12,$9.35, $9.40, 9.664–$9.67, $9.98

A Day of Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Early Weakness Finds Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Baby

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Price Collapse

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Give and Take

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

So Much For Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.