Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Issues Await

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No Bias Change Indication

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Push Higher

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation In a Narrow Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

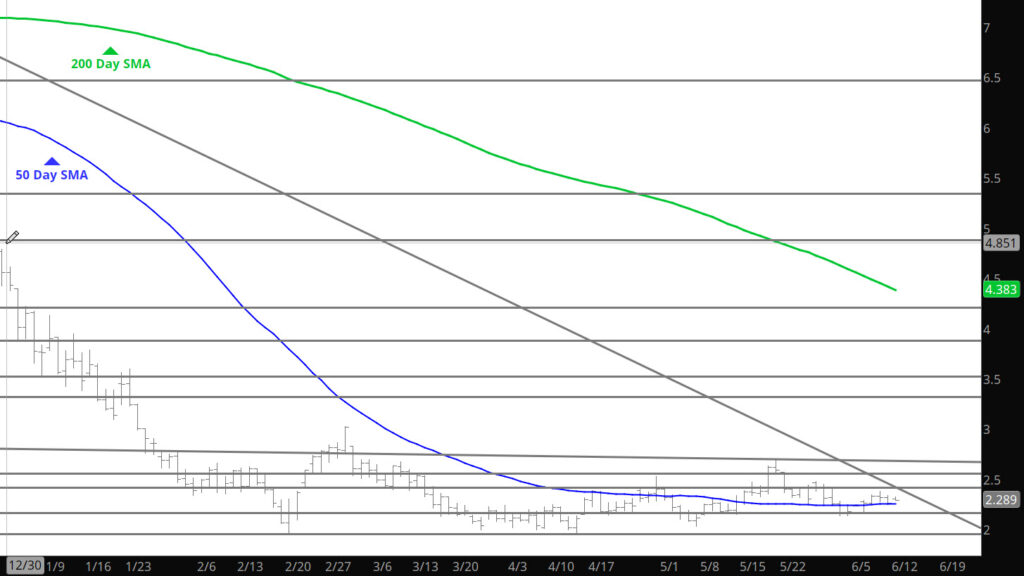

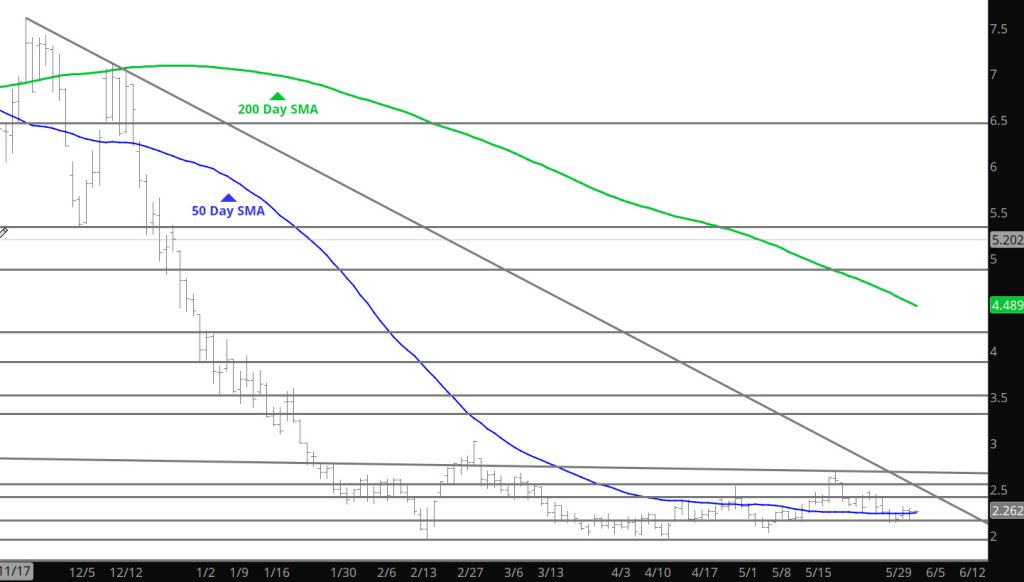

Per Weekly– Prices Run to Test Resistance

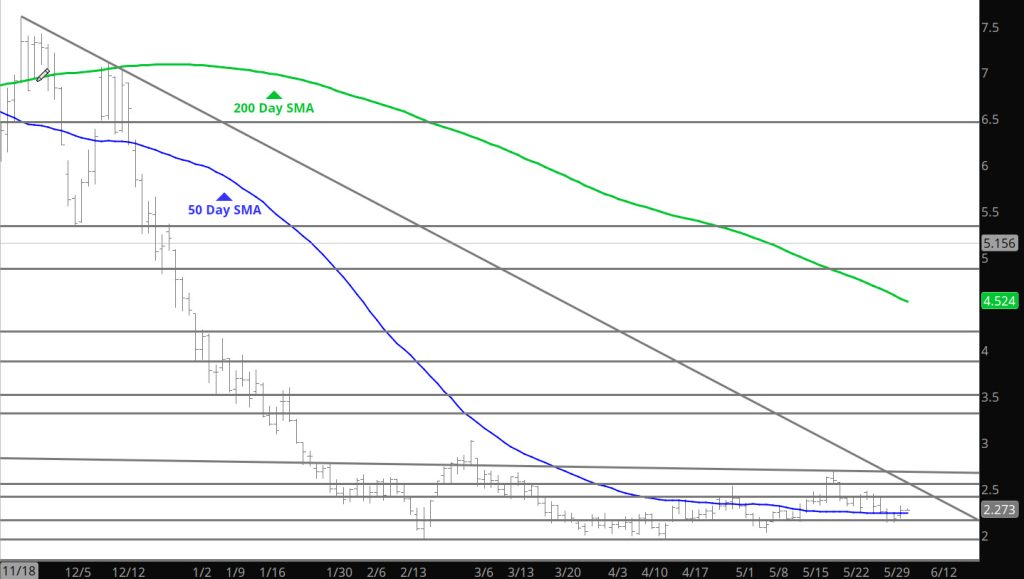

Mentioned in the Weekly section yesterday to expect a test of initial resistance at the $2.27 area and that happened quickly as the run climbed over $2.30. From there, prices came back to close the day just under the initial area. Would expect additional test as prices are heading into the historically bullish period for prices in July.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support: $

Major Resistance $2.543-$2.604, $2.836, $3.00, $3.536, 3.595

Declines Ran Out of Steam (For Now?)

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

New Month — Same Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Early May Lows Look Targeted

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Testing For Lower Monthly Low

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.