Author: Willis Bennett

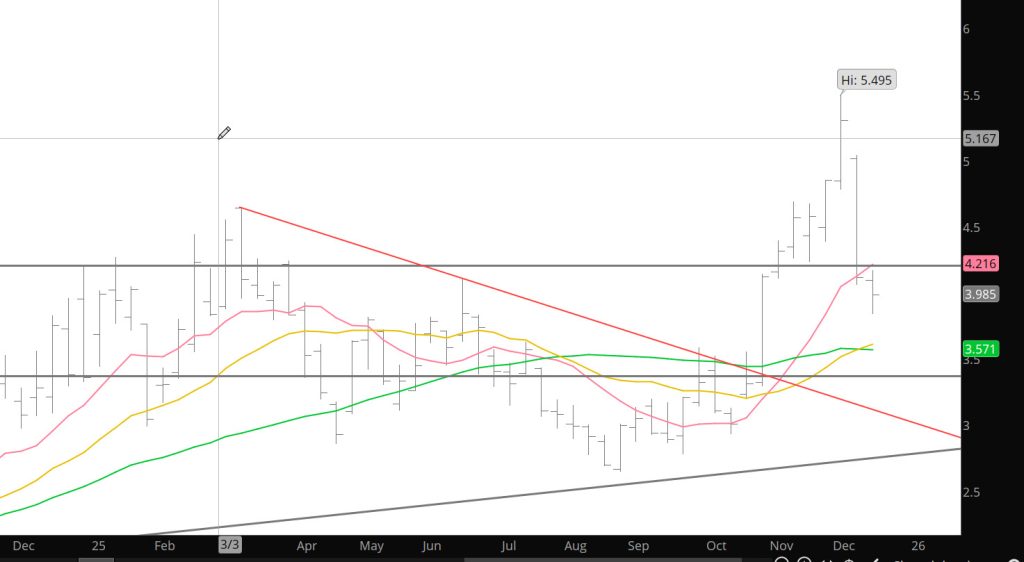

Negative Bias Returns to Gas

Daily Continuous

Go into the many aspects of why the market flipped to a negative bias in the Weekly section — but all you need to see is that prices are down $.15 and challenging support zones in the early Sunday trade. Not sure how this will track (1: an immediate decline during Jan or 2: or a series of lower highs and lower lows) but the market is clearly setting up for the Q1 lows to be established. My guess is the latter with the low occurring next month.

Major Support: $3.57-$3.546, $3.334,$3.16-$3.148

Minor Support/Resistance : $3.489,$3.467

Major Resistance: $3.787-$3.831, $4.063, $4.086

Two Weeks in One

Wild Price Movements

Not A Lot to Add

Price Presses Downward

This Next Week -Likely Volatile

Rally Runs Into Storage

Eventually Prices Will Rally

Daily Continuous

Not sure when we are going to run out of sellers but I can assure you after all the selling going on I will be interested in the open interest study late in the week to asses the new “short” positions. Until then, don’t try to catch the falling knife.

Major Support: $3.82, $3.75 $3.654,

Minor Support/Resistance : $3.75,$3.65

Major Resistance: $4.00, $4.095, $4.16

Lows Expanded

Daily Continuous

Mentioned in the Weekly area yesterday that the market might rally off of the $4 support area– was surprised that the support zone would be tested this early in the week. Is what it is — now the question remains does the price rally slightly from this support zone.

Major Support: $4.083,$4.055,

Minor Support/Resistance : $4.46-$4.42, $3.75,$3.65

Major Resistance: $4.901, $5.01, $5.325, $5.37