Author: Willis Bennett

Brief Consolidation of Recent Gains

Running Into Support

First Technical Indication Of a Slight Bias Change

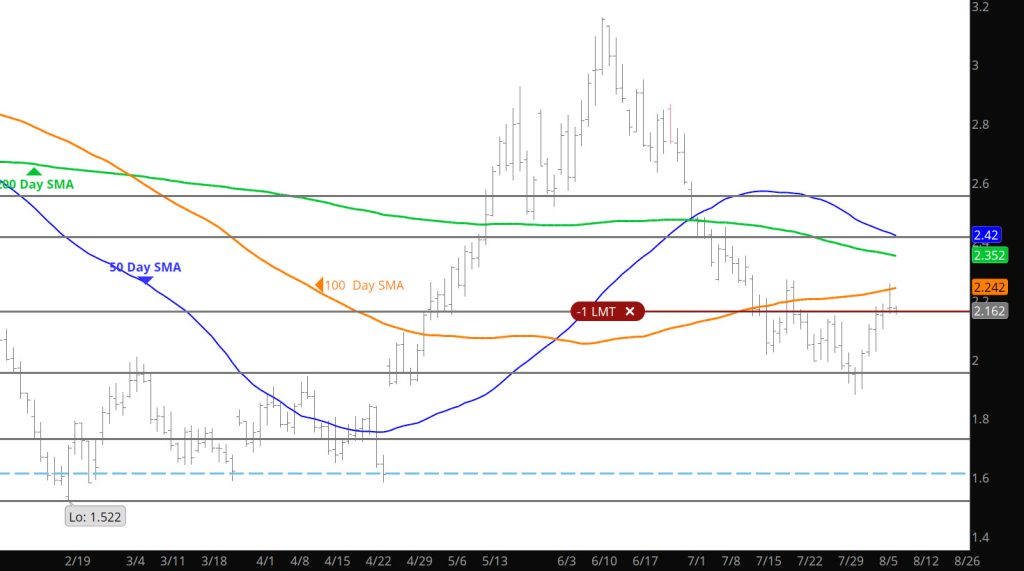

Solid Move Up to Initial Resistance

Daily Continuous

Finally got a little move up to initial resistance — it will be interesting to watch. Still bearish technical input and now all this should be characterized as a counter trend rally to test resistance.

Major Support:, $1.848, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.00, $1.967- $1.94

Major Resistance:$2.18, $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

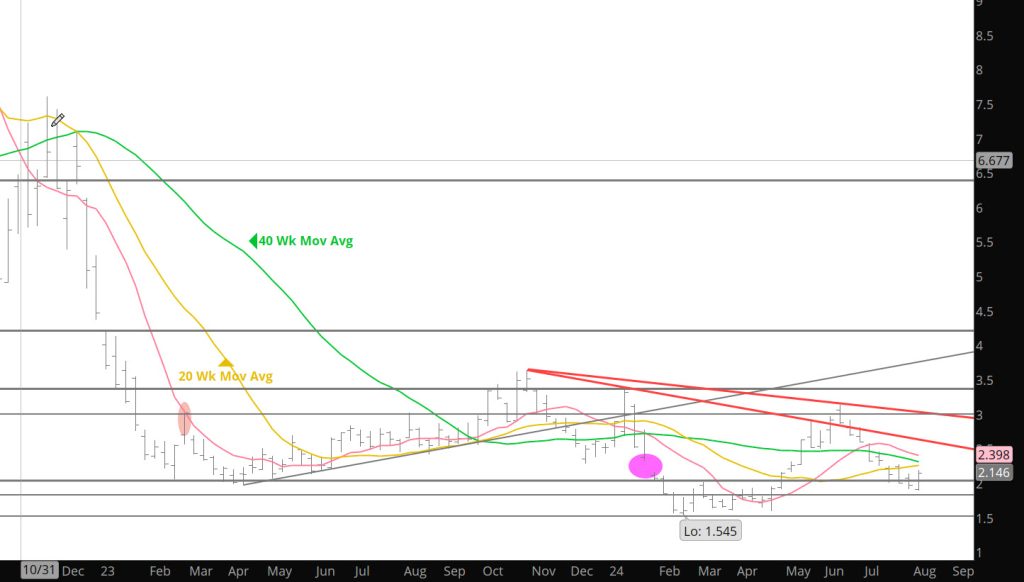

Weakness Prevails

Weekly Continuous

August gas fell into expiration as was expected. This makes it the seventh straight month (all of the expiration’s in calendar ’24) the prompt was amply offered into expiration and the fourth of those seven to trade the low of its tenure as prompt coincident with expiration.

New prompt September closed higher for two days after August was off the board, managing to close above some declining trend line resistance, but without volume confirming the recovery with a reversal following with increased volume (and a significant increase in open interest strongly suggesting heightened interest in shorting the new prompt). September traded new contract lows on Thursday and Friday, trading as low as low as $1.920 before ending the week $.084 lower (on a continuation basis prompt gas was .0$39 lower). August’s closing range before recovering raises the technical odds that September will get a shot to finish closing the gap. If September closes below $1.848 then the daily gap comes into focus ($1.628 – $1.85).

On May 1st total open interest was 1,587,270. By June 12th the total had fallen to 1,443,769 allowing for that nearly 150,000 contracts of short covering had been a significant contributor to the June 100%+ rally. Since 06/12 open interest has returned to and this week surpassed the early May high (currently 1,592,601). That total is less than 25,000 contracts below the twin peaks that preceded the February and March lows.

Give the downside momentum created by the multiple weeks decline from the June high, the expected weak expiration of August gas and September trading a new contract low, expect the prompt to be offered lower to close the late April gap. On a weekly continuation basis, the fraction of that gap remaining is between $1.848 and $1.856.

Longer term, these declines and the constant attack at rallies by the bears will lead to a short covering rally similar to what was experienced in early June. Perhaps, that will be the driver for the annual upcoming Q4 run.

Major Support:, $1.848, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.00, $1.967- $1.94

Major Resistance: $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

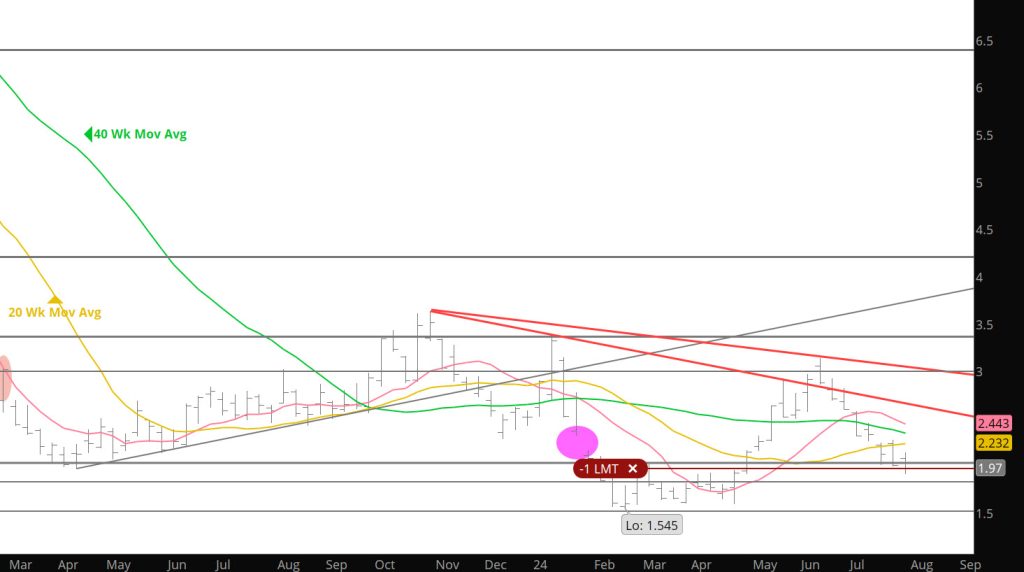

Selling Begets Selling

This Defines Consolidation

Daily Continuation

Up eight down five welcome to the consolidation world. This is the perfect environment for selling premium which I will continue to do.

Major Support:, $1.848, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.00, $1.967- $1.94

Major Resistance: $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16

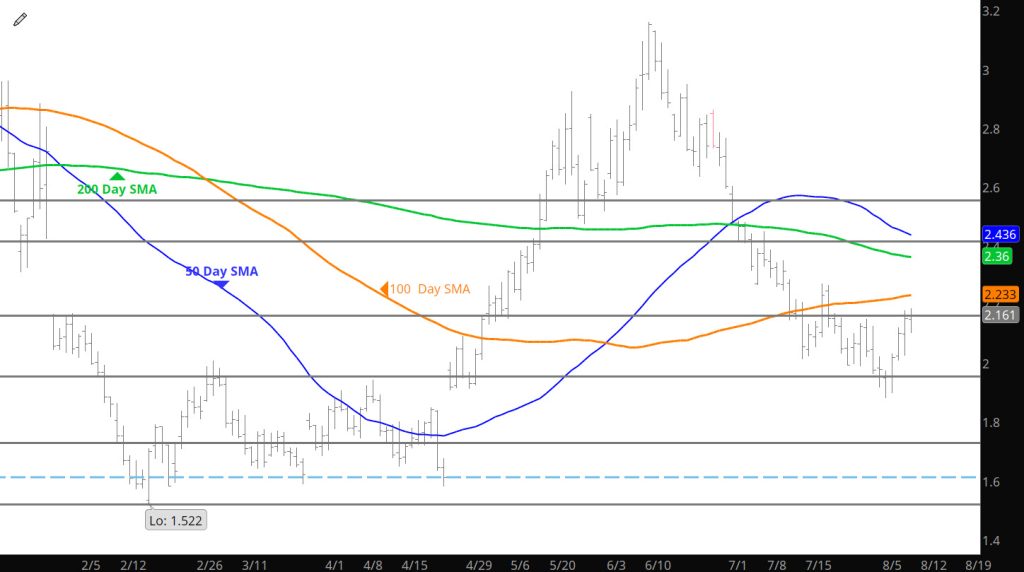

Slight But Solid Gains

Daily Continuation

The first day of the September contract as prompt showed some slight strength but time will tell for the contract. Still expecting the lows later in the month so perhaps this is just some consolidation until the next decline occurs.

Major Support:, $1.848, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.00, $1.967- $1.94

Major Resistance: $2.39, $2.44-$$2.502, $2.618, $3.00, $3.16