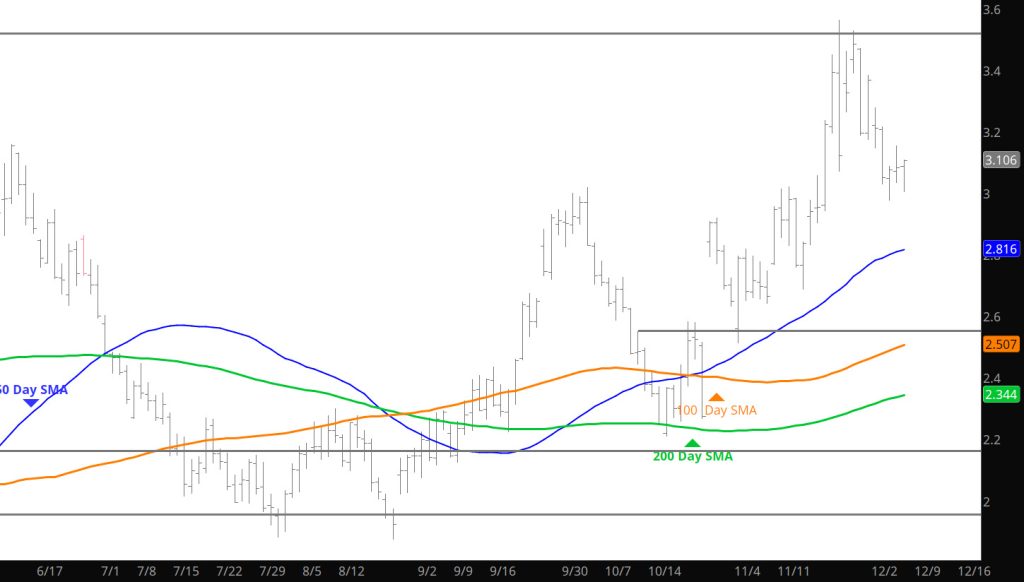

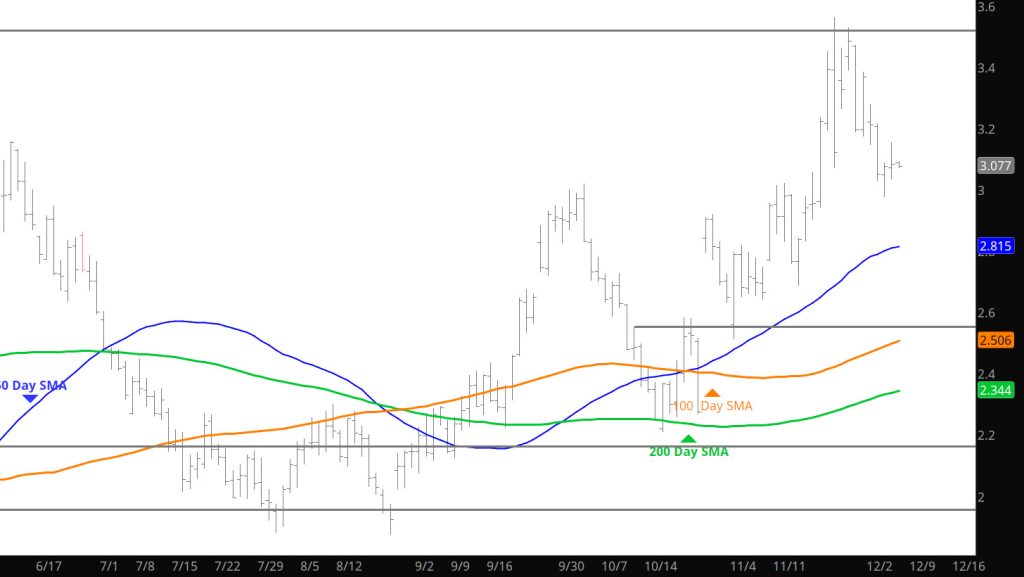

Daily Continuous

Go into the expectations in the Weekly section bu suffice to say, that prices are likely to continue in the recent range that was discussed last week but mentioned again in the Weekly. Prices are starting the Sunday trade lower — so expect a decline lower to the Support zone.

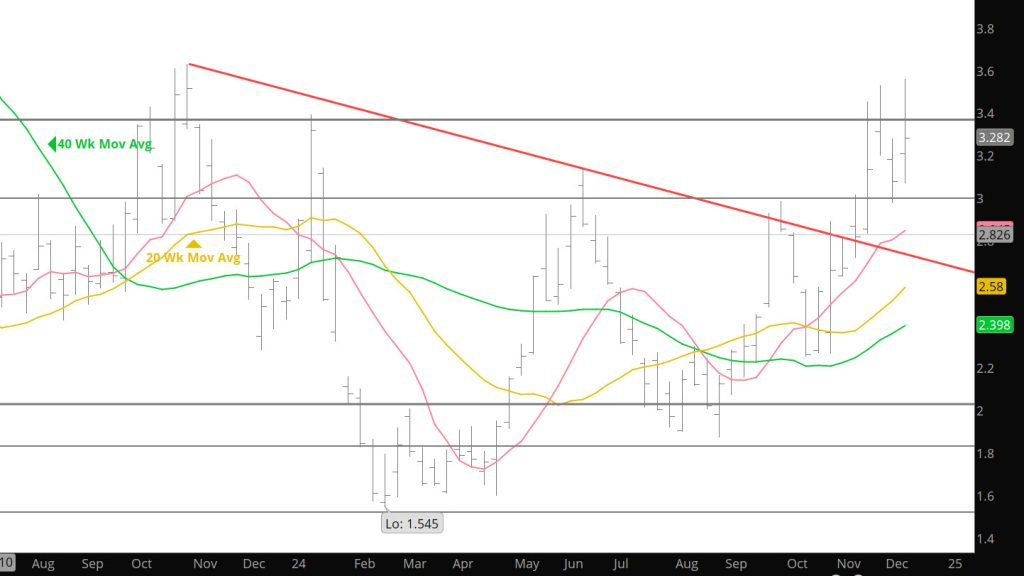

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.307 $3.392, $3.487, $3.527–$3.563