Author: Willis Bennett

Welcome 2025

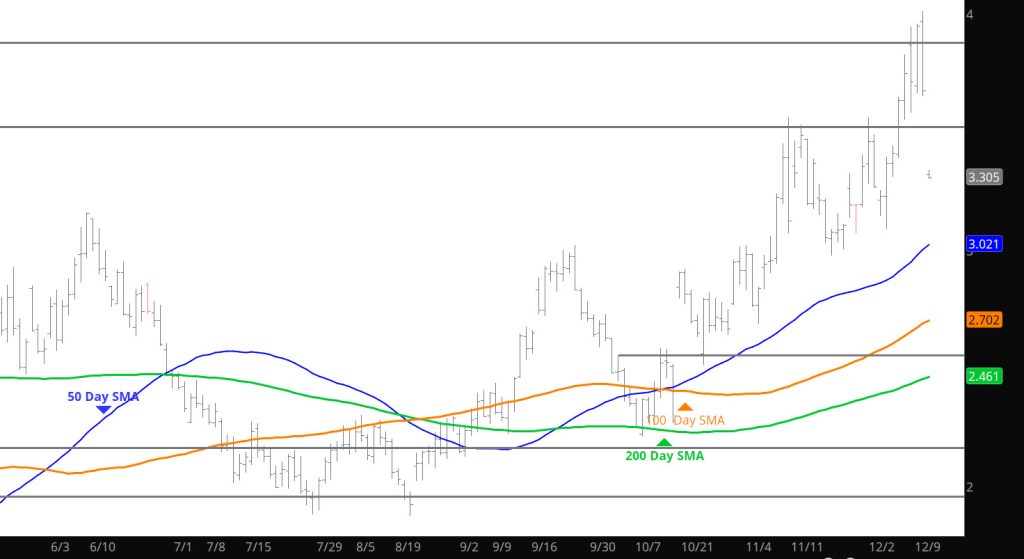

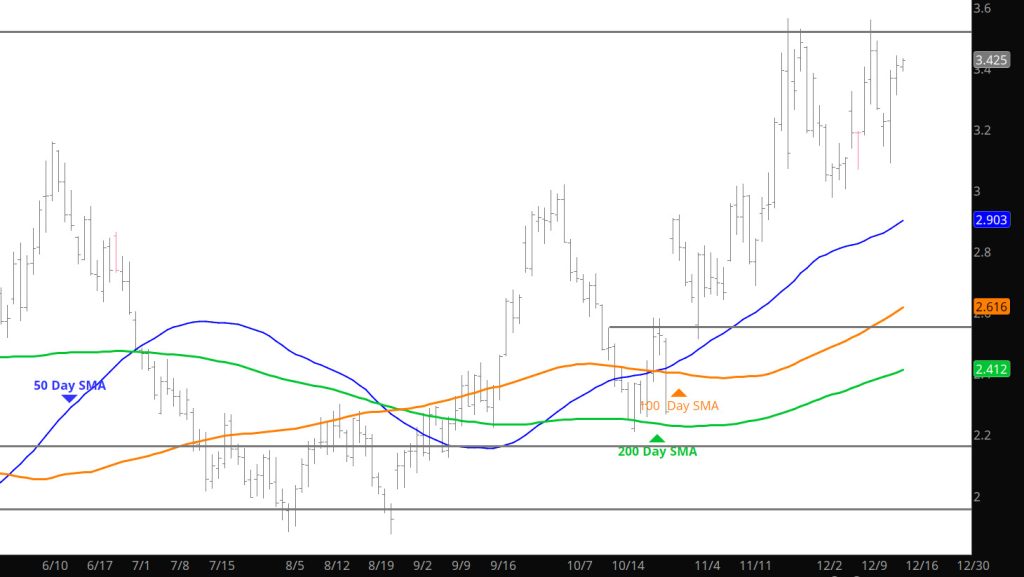

Weekly Continuous

I mentioned in the Daily last week that I was going to quote a wonderful historical analyst (Larry Marshall) who has been following the gas market as long as I have. Here are some of the highlights of his thoughts……

Sometime in the late ‘90s I noticed a tendency of consistent price change at the beginning of each calendar year…almost without exception. Because of the consistency of the tendency and disproportional importance relative to the other eleven calendar months I came to call it the January Phenomenon. Each year about this time I write a summary of those year ending/beginning events…the following is not a lot different than more than twenty – five or so (I lose count) that preceded it.

Almost since the beginning of recorded time (which in natural gas trading for convenience begins in December ’91 – January ’92), late December/early January highs or lows have consistently been more significant going forward into each New Year than the endings/beginnings of other calendar months.

To summarize the 33 years ending since 1991 – 92:

Twenty three of the thirty – three have begun with a gap (although a couple of times the gap occurred during the last or next to last trading day of December).

At the end of ‘23/beginning of ’24 there were two gaps. The first, on 12/28 was an expiration gap…February was offered at a discount to January ($2.536 v $2.621). The second was on the first trading day of the year. Both were quickly closed.

Eight times (five of which began with a gap) the high of the year traded during January, most often during the first week.

Seven times (five of which began with a gap) the low of the year traded during January, most often during the first week.

In the other seventeen years (now 18), thirteen of which began with a gap, either the high of low for January (and in several cases neither) would not be violated for a period of months but once either was, it was consequential…setting the direction of gas prices for an extended period.

The January ’23 low traded on 01/31 at $2.037. That low was violated on 02/01. Prompt gas traded lower until late March, falling another 27%.

During the six years beginning in ’18 and ending in ’23, the January low was the low of the year twice (’21 and ’22). The January high was the high in ’19. In 2018 the January high was not exceeded until November, in ’20 during August. During ’23 the January high…$3.392 traded on 01/09 (the sixth trading day of the year) was not exceeded until November 21st. Prompt gas has closed above that high twice, the last time was 12/12 at $3.455…the highest daily close since 11/03/23.

All things considered, 2024 conformed pretty closely to the expectation flowing from the January Phenomenon. We are not sure what the 2025 January Phenomenon will provide but I do find it interesting that a gap has already traded on the 27th (last Monday) meeting the historical norm. That gap remains open and should be considered as support.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.631-$3.681, $3.829, $3.92, $4.00

New Year — Same Range

Feb Decides to Rally Back to Jan Range

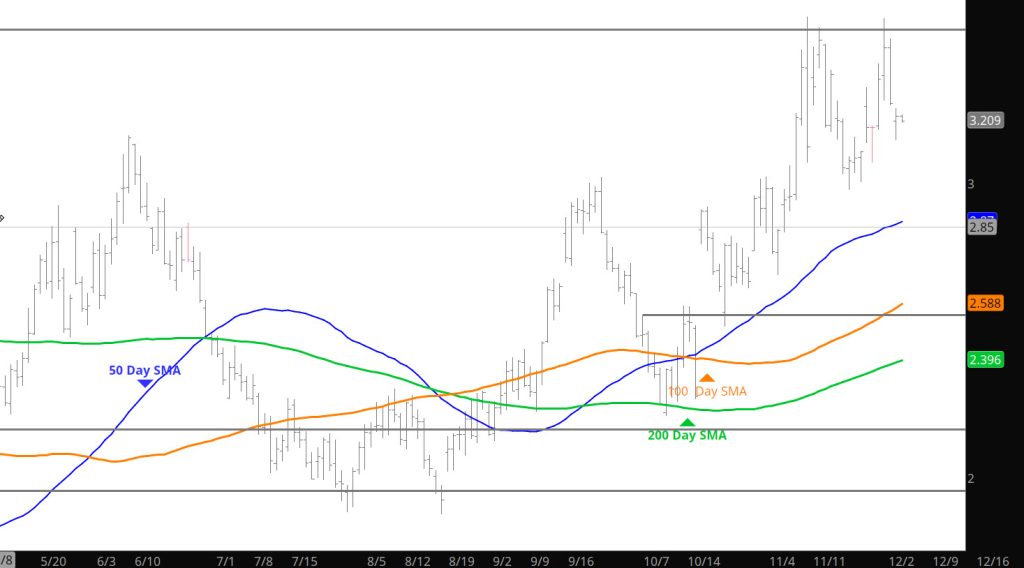

Daily Continuous

First off the Daily will be spotty this week with the New Year’s and my travel. The Weekly will be available on Dec 31st and it will have an interesting historical tendency for prices in early Jan, that posting may well be the last of next week. In the mean time, the action on Sunday night took the Feb back up to the range of Jan. Not sure if that will hold during the trade on Monday after more participants join the party. As suggested during the expiration- play the ranges until a defined bias is created on normal volume.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.631-$3.681, $3.829, $3.92, $4.00

Price Run Hits a Wall

Dec Rally Falls Short

Breakout Excitement

Similar Drift Upward to Last Week

Daily Continuous

Similar trade behavior to last week with the early week weakness followed by a small rally into the storage release. Last week the Thursday rally set the high for the week before melting back into the range on Friday. Have to wait and see how this report effects price action but from the trading standpoint you have to continue trading the range.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.307 $3.392, $3.487, $3.527–$3.563