Daily Continuous

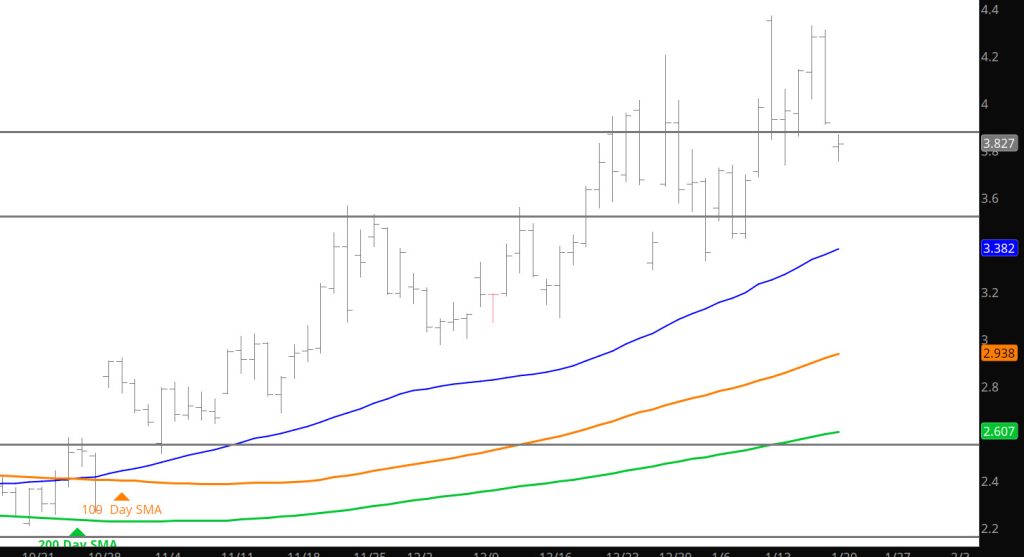

As we wrap up the Jan trade and put the Feb contract to bed, I am startled at the behavior with strong days of volatility, but over the month prices moved within a $1.00 Range (less than 30%). Must be aging faster than I thought–or the market is changing (both thoughts are accurate). Go into expectations in the Weekly section and will not attempt to give you a expiration range (especially because prices are down $.20 on Sunday night)– I can only recommend that you keep a eye on the March contract pictured in the Weekly section. That trend line may prove important.

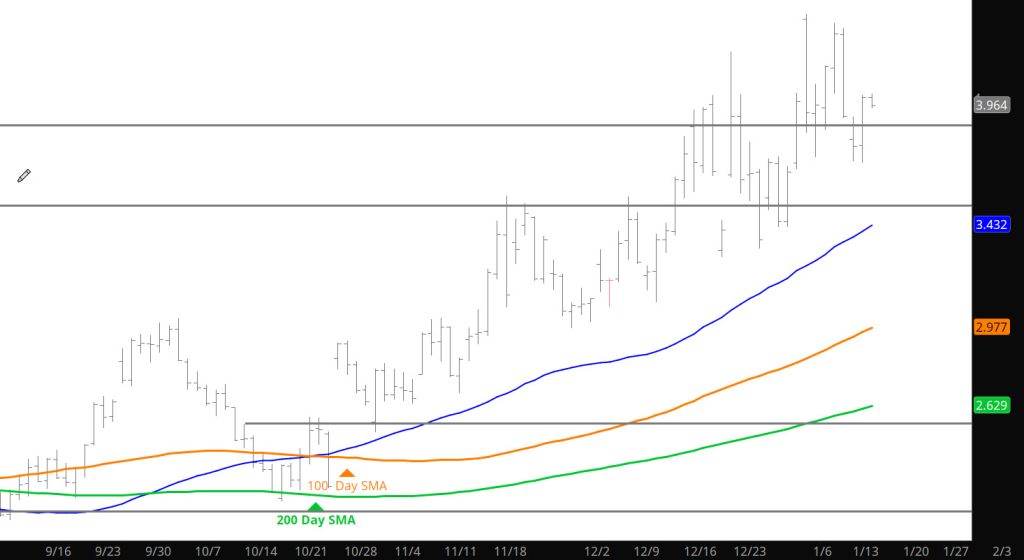

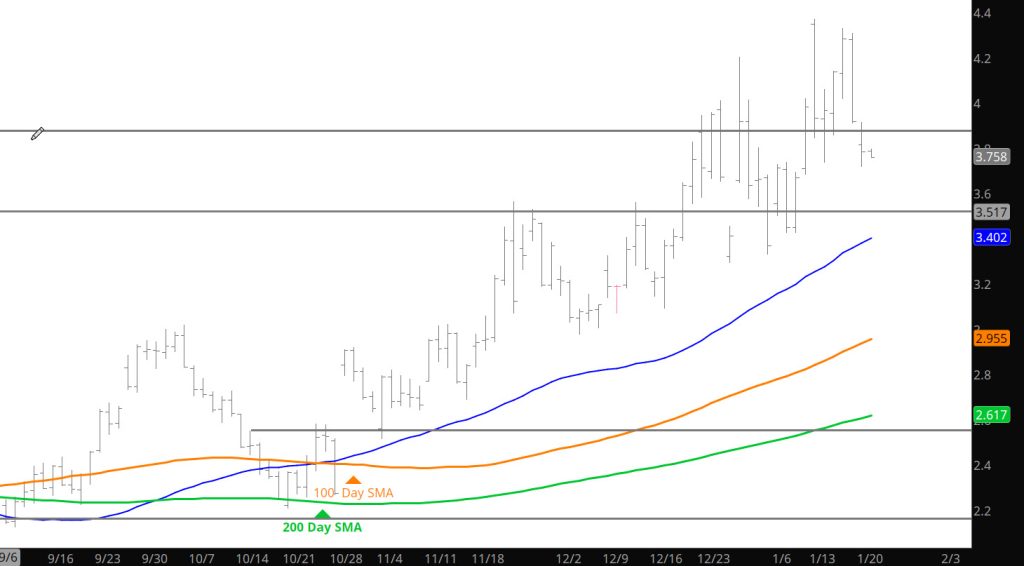

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461, $4.75