Author: Willis Bennett

Price Declines Challenge Trend Line Support

Temps and Storage Allow Weekly Close at $4.00

Strong Close to Week–Not Sure Enough

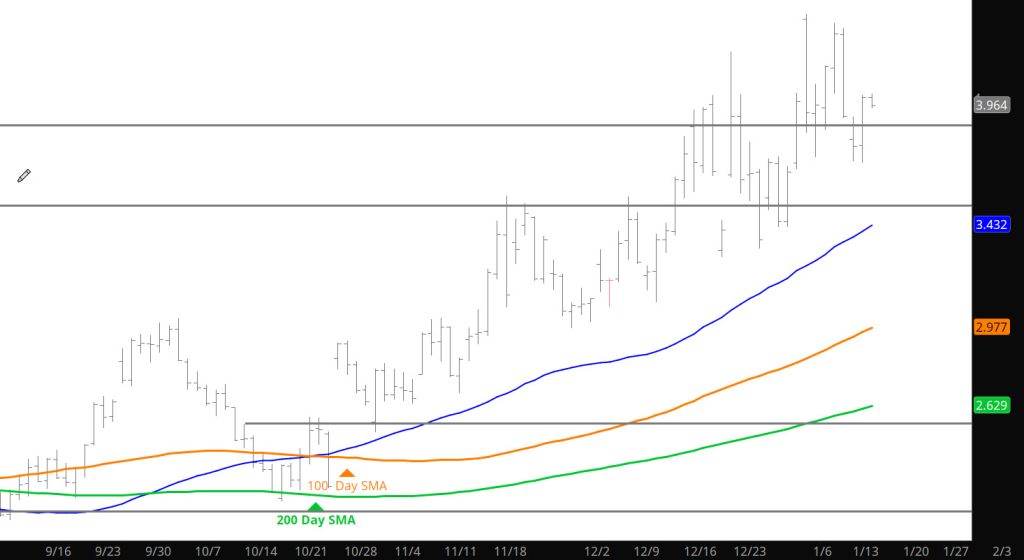

Daily Continuous

As we wrap up the Jan trade and put the Feb contract to bed, I am startled at the behavior with strong days of volatility, but over the month prices moved within a $1.00 Range (less than 30%). Must be aging faster than I thought–or the market is changing (both thoughts are accurate). Go into expectations in the Weekly section and will not attempt to give you a expiration range (especially because prices are down $.20 on Sunday night)– I can only recommend that you keep a eye on the March contract pictured in the Weekly section. That trend line may prove important.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461, $4.75

Strong Run Into Storage

Steady Declines

Holiday Quiet Trade

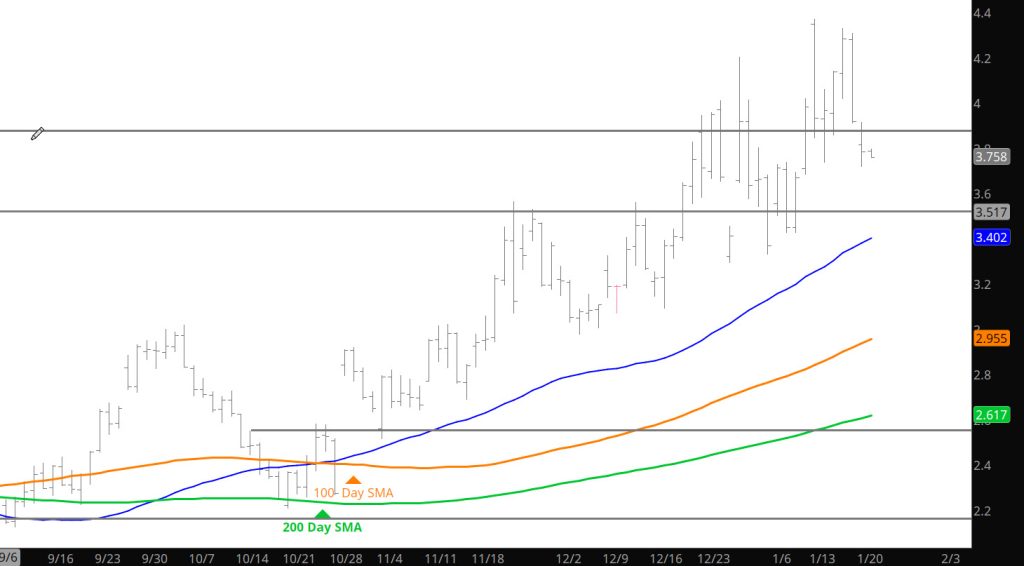

Daily Continuous

Just want to reiterate the comments from yesterday and price action had no change to the comments from yesterday’s comments.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461, $4.75

Friday’s Weakness Likely to Spill Over

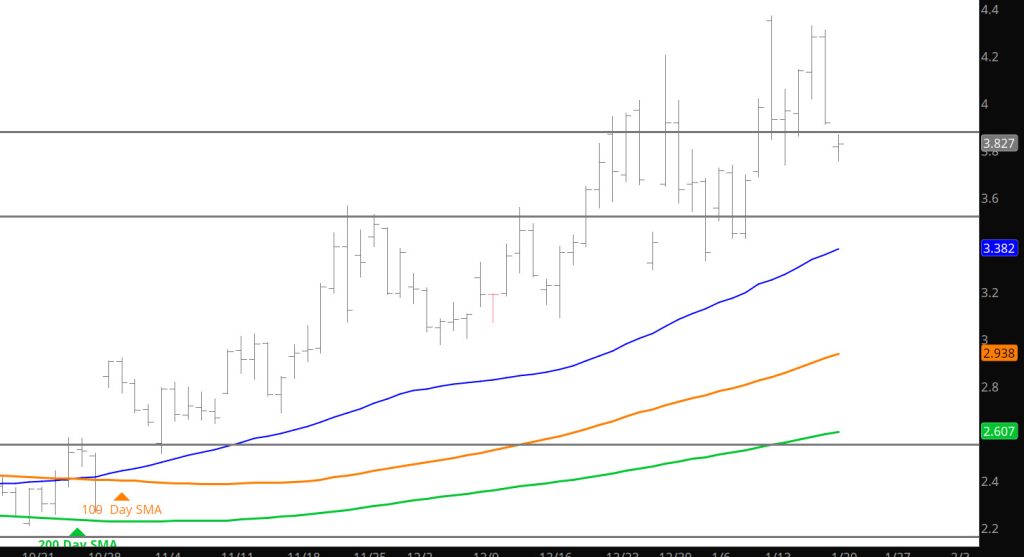

Daily Continuous

The $.40 collapse in prices on Friday indicates that the run up ran out of steam as prices attacked the $4.30 (and above) area was not surprising as technical indicators confirmed the lack of long term support for higher prices. Today is a light trading day with the Holiday — which presents itself as a potential opportunity to indicate near term bias.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461, $4.75

Another Failure at Resistance With Divergences

Another Close Over $4.00

Daily Continuous

Prices close over the key area of $4 again and is starting look like its comfortable at those levels.Perhaps some of the strength is tied to the price of crude or the idea that the storage release should be a fairly strong number (perhaps eliminating a large chunk of the surplus over the 5 year average). Regardless, of where the strength is sourced — it should be respected and traded.

Major Support:,$2.727-$2.784, $2.648, $2.39, $2.35, $2.112,

Minor Support : $3.39-$3.31, $3.167, $3.00-$2.95, $2.914, $1.856,$1.89-$1.856

Major Resistance: $3.829, $3.92, $4.00, $4.201, $4.378-$4.394, $4.461, $4.75