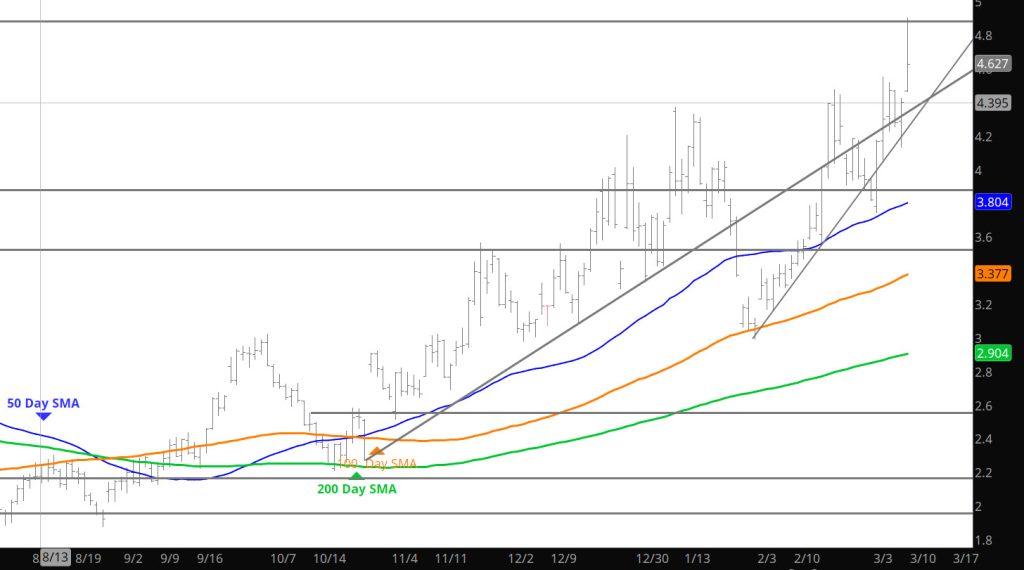

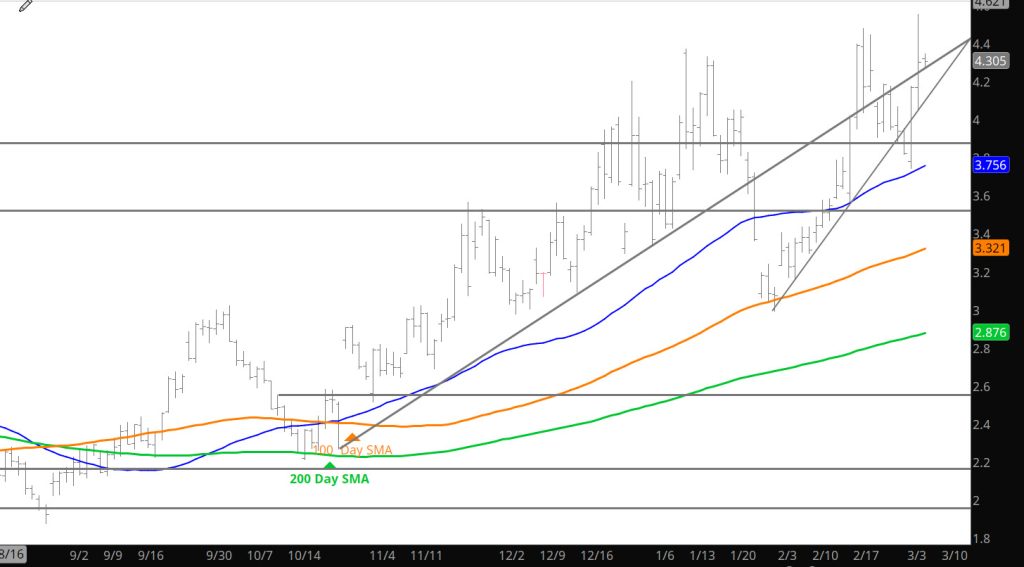

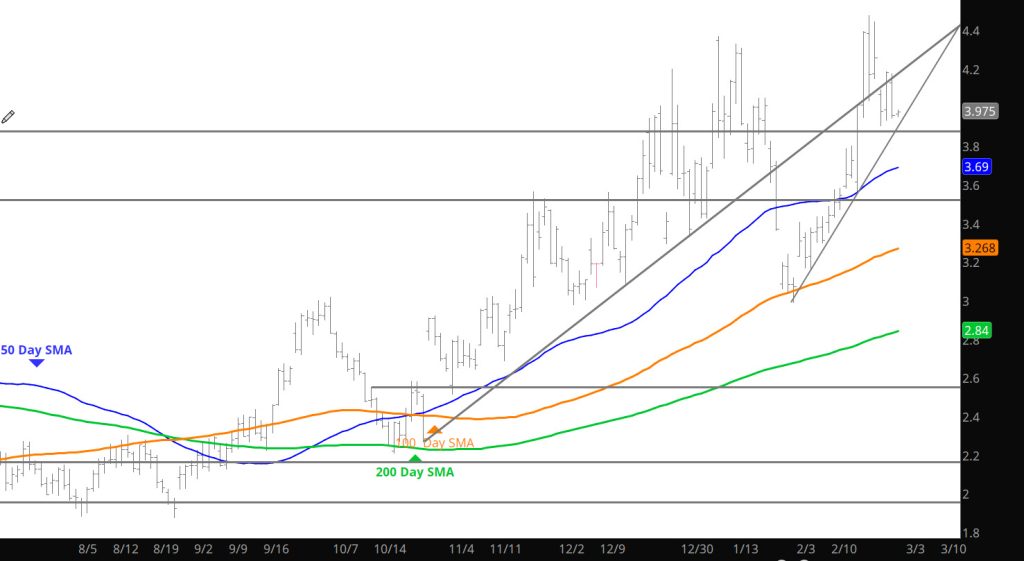

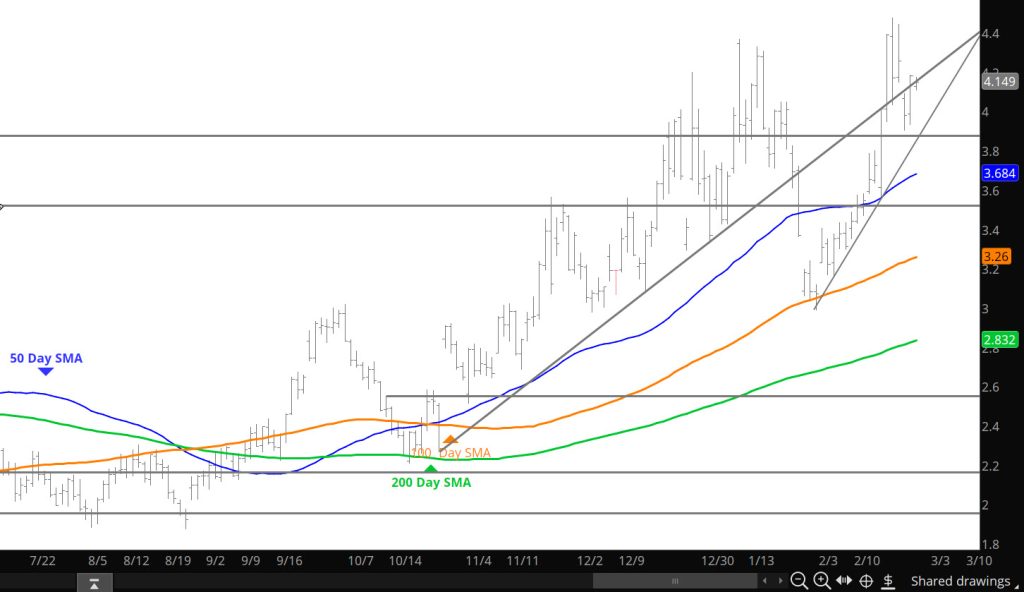

Daily Continuous

The trade yesterday provided a daily reversal (waiting to see the volume data) from an extraordinary Sunday night late rally. The action created an interesting Candlestick pattern the may become relevant if confirmed in later trade this week. Until those and other elements of yesterday’s extraordinary price action come clearer as the week moves along.

Major Support: $3.16-$2.97, $2.727, $2.648,

Minor Support : $4.369, $4.212, $4.00, $3.827-$3.801 $3.742

Major Resistance: $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

9