Author: Willis Bennett

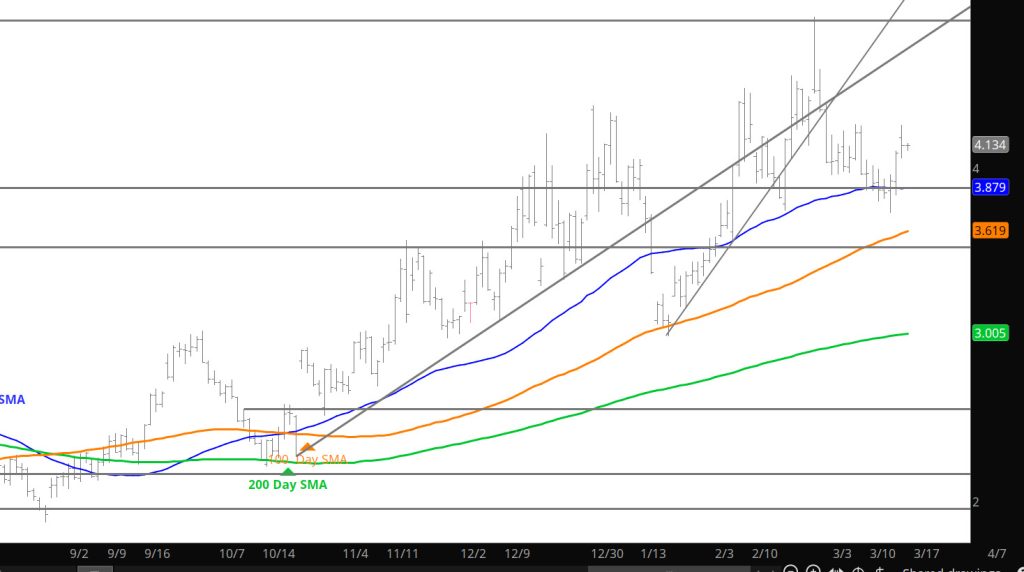

Will Energy Weakness Pressure Gas

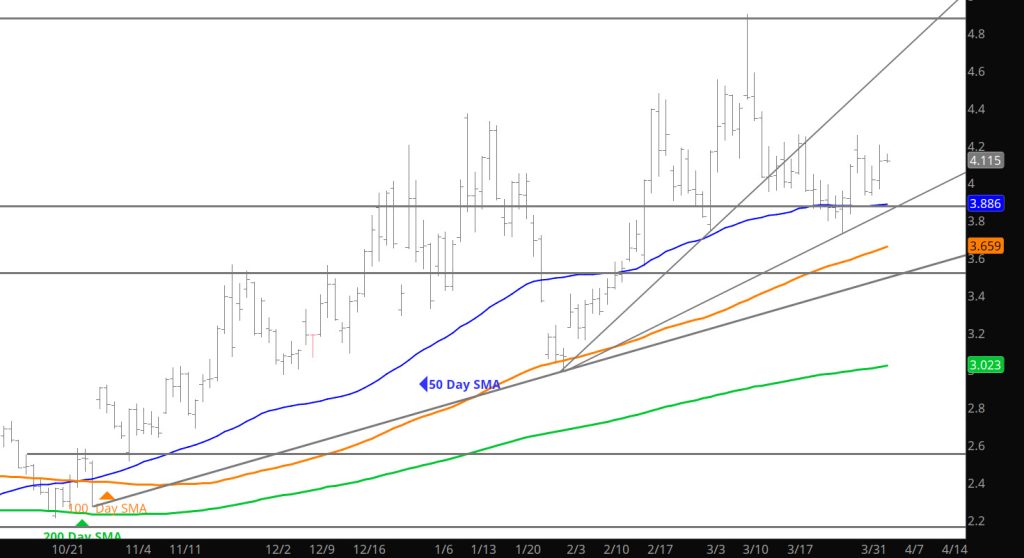

Quiet and Developing Range

Daily Continuous

No break out or down after the storage release and the price action reflected the non-action by maintaining the recent range — nothing new for tomorrow. Keep the range trading on.

Major Support: $3.60-$3.584, $3.16-$2.97, $2.727, $2.648,

Minor Support : $3.827-$3.801 $3.742

Major Resistance: $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

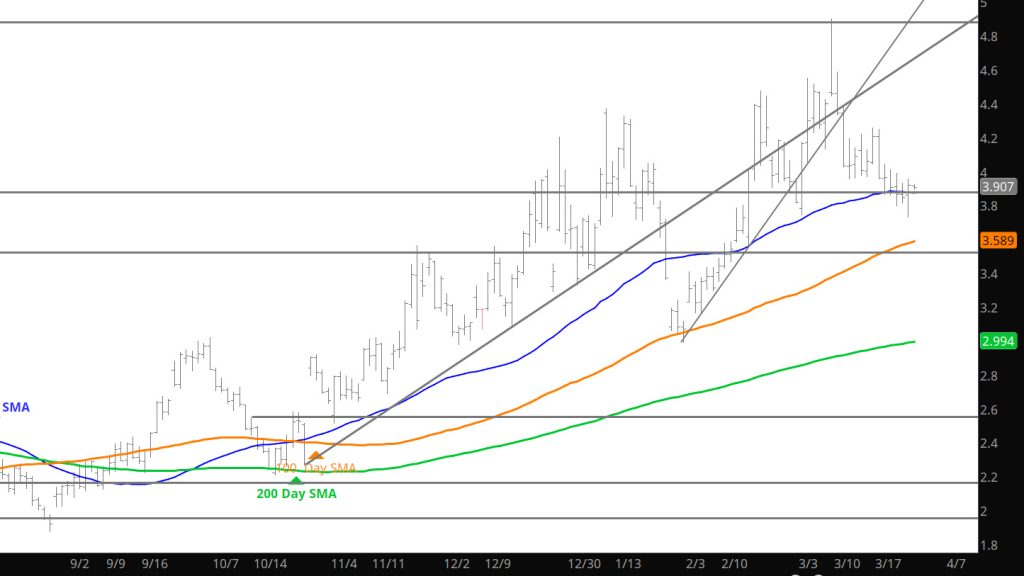

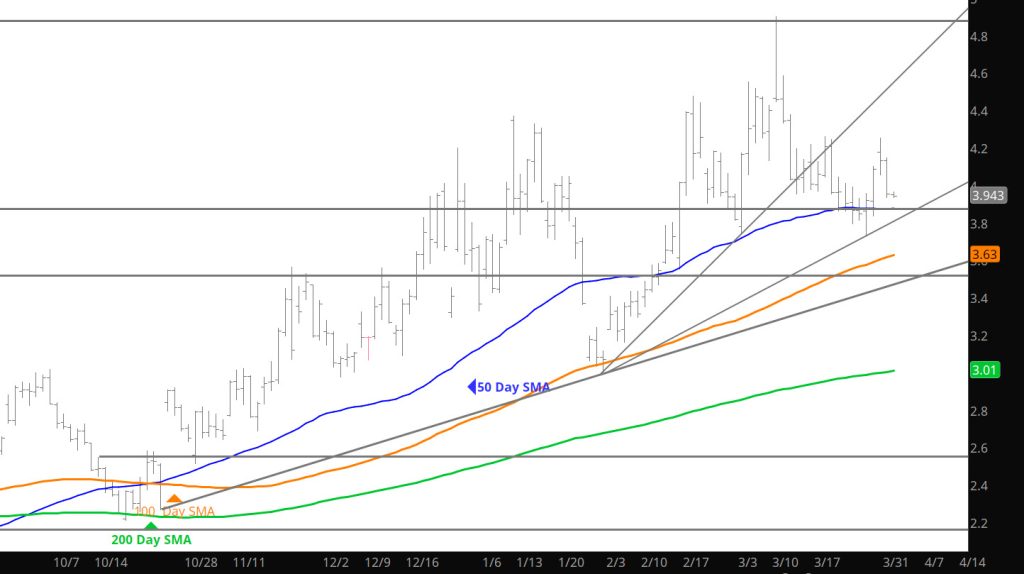

Trying to Define

Daily Continuous

Have been discussing the market trying to establish a base for the next bias direction, either up or down, and is the definition of a technical range trade that will likely hold for the near term.

Major Support: $3.60-$3.584, $3.16-$2.97, $2.727, $2.648,

Minor Support : $3.827-$3.801 $3.742

Major Resistance: $4.00, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

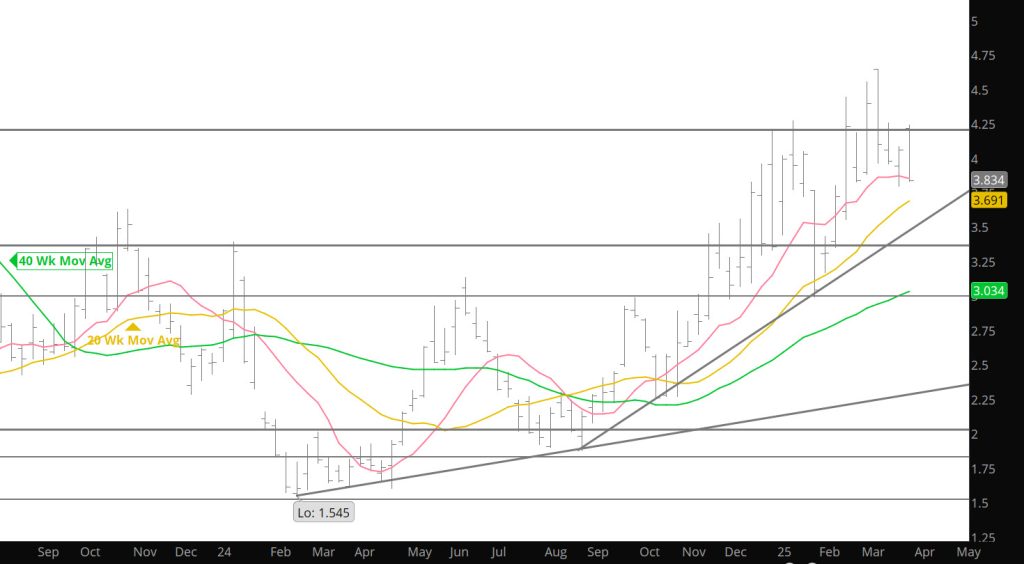

Range Remains

The Process Continues

Daily Continuous

Usually there are short – term trends between that support and resistance but when volatility is elevated those boundaries are defined by high volume highs and lows. For May gas there was a high volume low on 02/18 at $3.628, another on 03/03 at $3.810. It is pretty rare but in both cases high volume highs were traded on the following day at $4.326 and $4.588, respectively. In both cases the combined volumes of those two days is greater than any other two day period. The zone between the lows is definable support, between the highs is resistance. Volume is the energy that drives price higher…or lower. Volume on the day of the price spike to $4.901 was substantially lower than on the days that defined the zone of resistance (discussed in the Daily). The energy to drive prompt gas higher was simply not present, hence the breakout failed. Also note that volume was lacking on 03/27 when May tested the support and the breakdown failed. While, price and volume are doing the right things for prices to eventually move higher, a correcting substantial increase in volume is going to be required in order for that to occur. I stand that the market will need to consolidate and build for that sponsorship to develop and until, it is going to be range bound.

Major Support: $3.60-$3.584, $3.16-$2.97, $2.727, $2.648,

Minor Support : $3.827-$3.801 $3.742

Major Resistance: $4.00, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

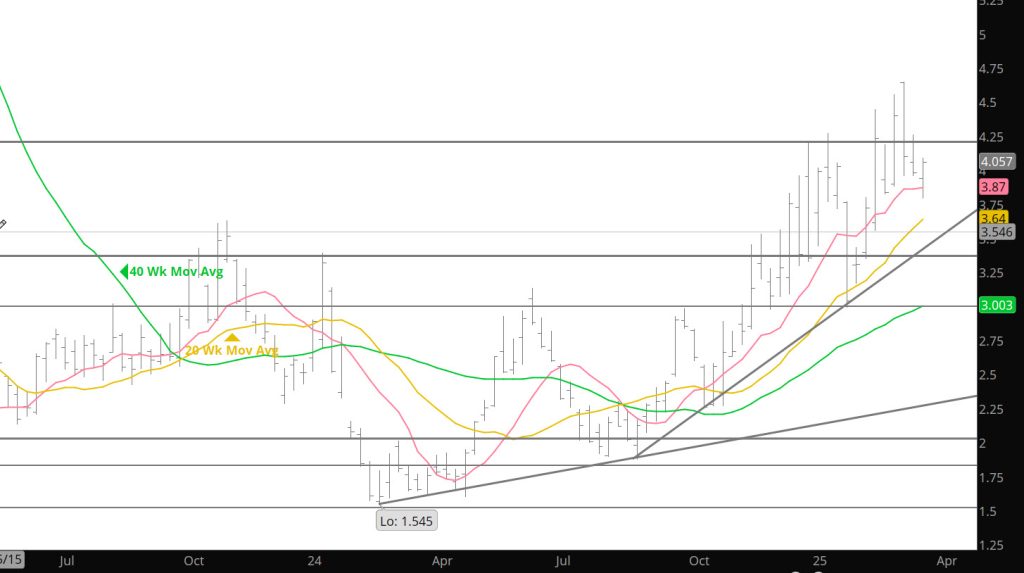

Supported Expiration

Nothing New as Expiration is Upon Us

Daily Continuous

Nothing has occurred that wasn’t discussed in the Weekly and Daily on Monday– so I chose to be quiet. Nothing really happened yesterday that was dramatic or earth shattering to a technical interpretation but I did want to send a quick flag for the expiration– It should hold the March lows of $3.742 and if it breaks that level we may see a brief test of the major support sub $3.60 with the April contract or the May contract as it takes over as prompt.

Major Support: $3.60-$3.584, $3.16-$2.97, $2.727, $2.648,

Minor Support : $3.827-$3.801 $3.742

Major Resistance: $4.00, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.031