Author: Willis Bennett

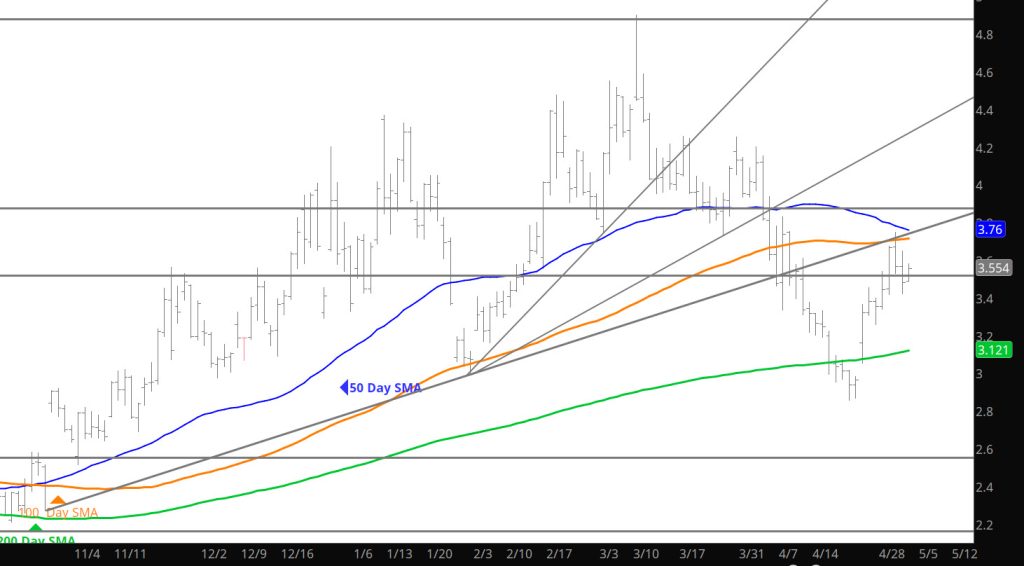

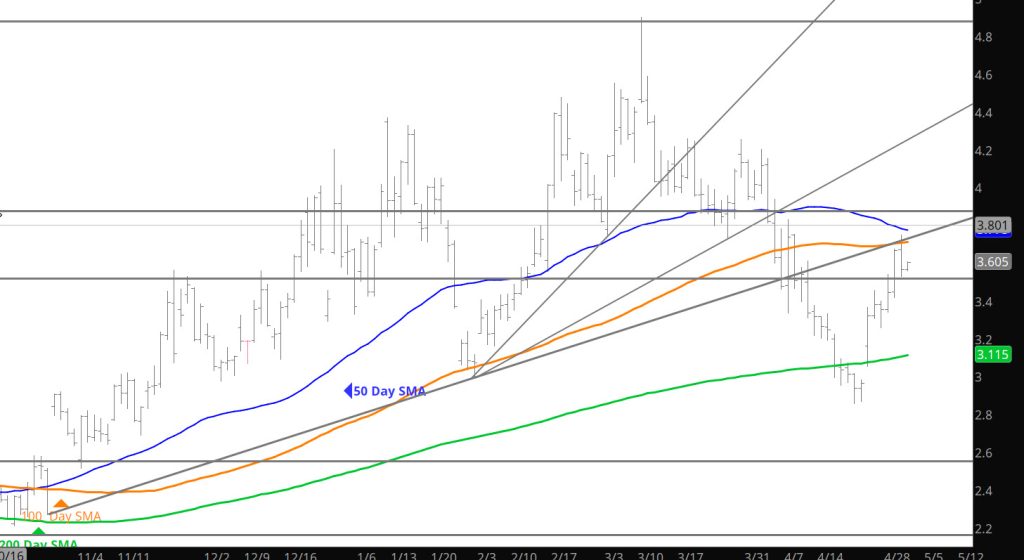

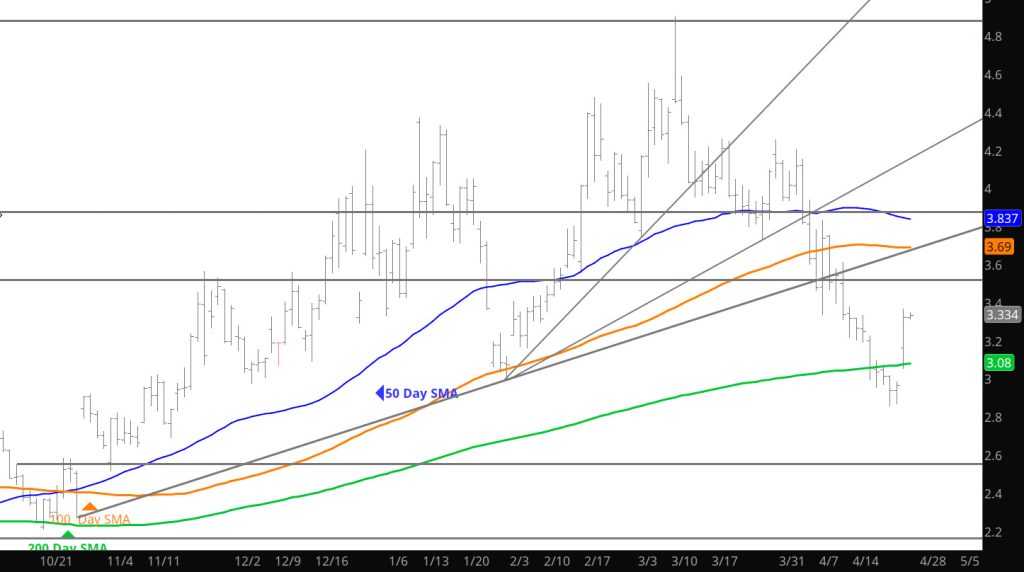

Range Testing Continues

Daily Continuation

Not a lot to add to the heading as the market is testing and establishing a range for near term price action– would play the further sides of support or resistance to avoid being chopped by the potential action.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

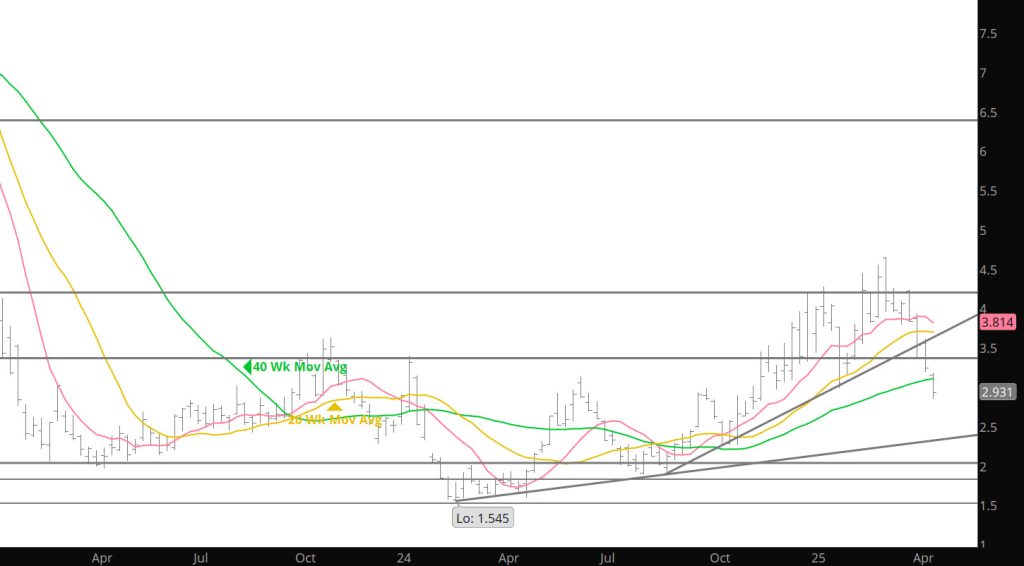

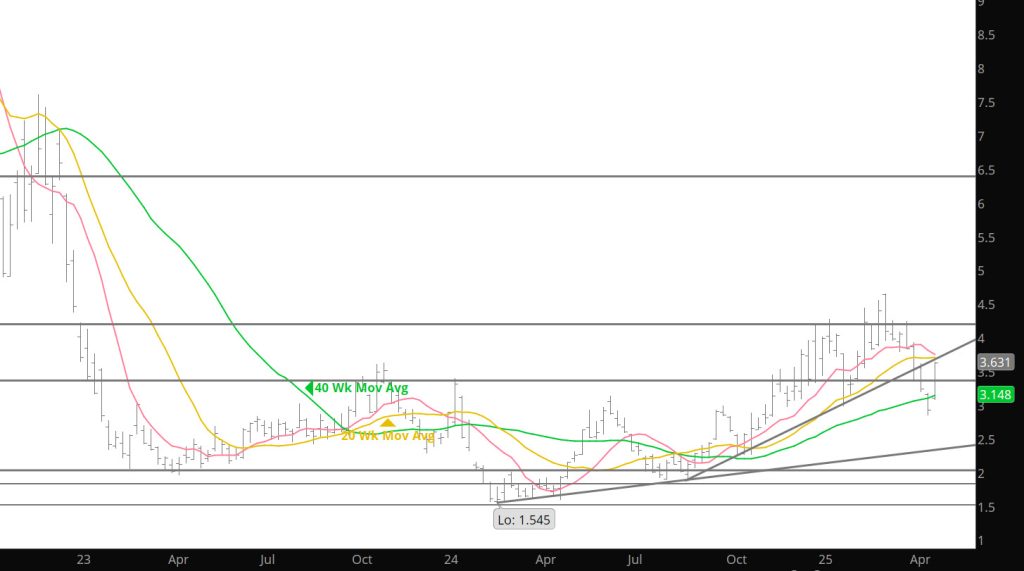

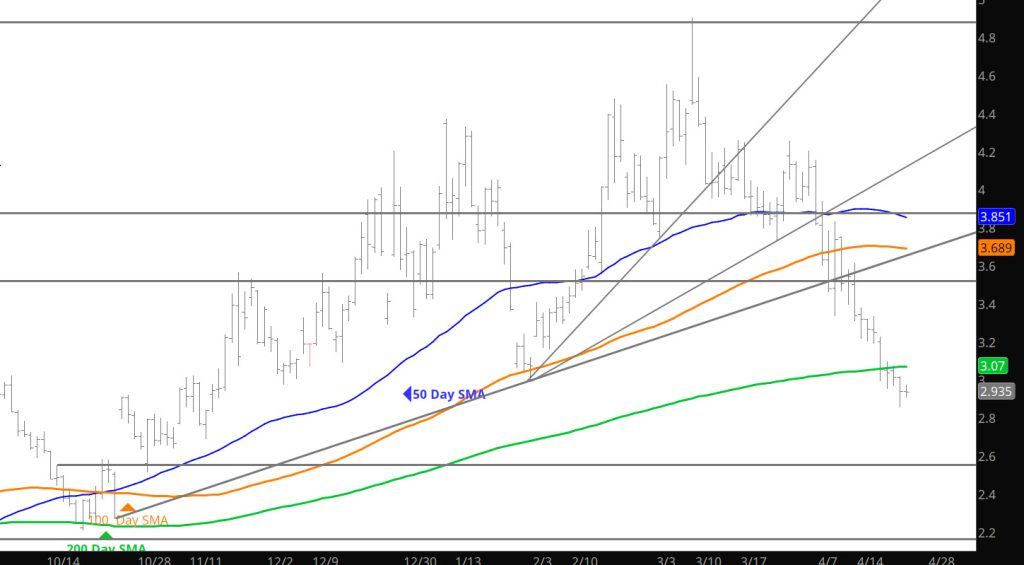

Does It Build or Consolidate

Weekly Continuation

Last week’s rally was not among the things was not my immediate expectation. My view was that new prompt May would forfeit its premium and prompt gas offered lower to test rising trend line support and that technical “damage” done by the precipitous decline during calendar April (from a high on 04/03 at $4.203 to a 4/24 low at $2.858) including a weekly close below the December and January lows ($2.977 – $2.990) would render a significant recovery problematic at best.

The caveat was that in addition to vulnerability flowing from the persistent liquidation of open interest, prompt gas was severely short – term oversold and was two standard deviations below the 20 – weeks SMA for the first time in more than a year. As it worked out those conditions trumped the downside momentum that had built with six of seven lower weekly closes since the March high (the only exception was week ending 03/28 when new prompt May gained $.041). The weekly gain was the second largest for a prompt contract in more than a year ($.518 v $.565 for week ending 03/07) as June traded through layers of defined resistance as handily as it had violated similar levels of support.

Volatility…which can be a hedgers best friend or worst nightmare, increased this week.

Given the elevated level of volatility and this week’s range traded of $.814 (including the gap) it would be reasonable to expect increased volume. That did not happen. Average daily volume fell more than 25,000 contracts and the lowest of the week accompanied Friday’s .151 gain and strong close. Open interest did increase for the first time in four weeks but only modestly…+/- 10,000 contracts. Those are not the characteristics of a sustainable rally.

The rapidity and magnitude of this week’s gain left little definable support, June’s April low ($3.007) and the calendar April low and the low of week ending 05/02 ($2.858 – $2.859), but there is a ton of identifiable resistance including the 20 – week SMA…which as of late prompt gas seems to swing to extremes around. The 20 – week is currently $3.732. A few weeks ago, the solution for dealing with a persistent elevated level of volatility (the weekly ATR is $.587 and has been $.50/dt/week or higher since the beginning of ‘25/. In early May ‘24 it was $.306),

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

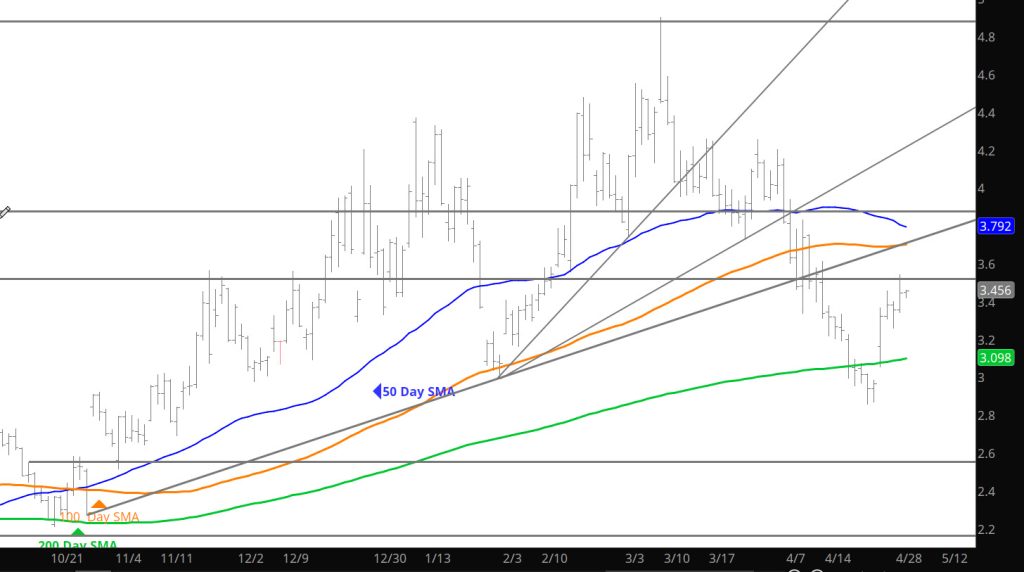

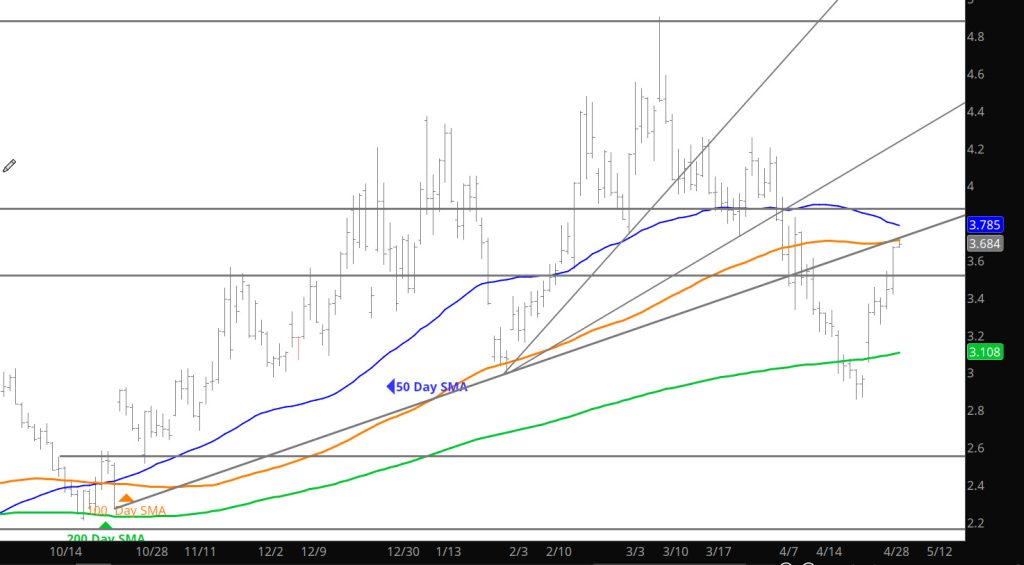

Market Needs to Define

Daily Continuous

Market is challenging initial resistance areas which will help define the June prompt range. The moving average levels will be key in the move and breaks above may provide the momentum to move prices higher.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

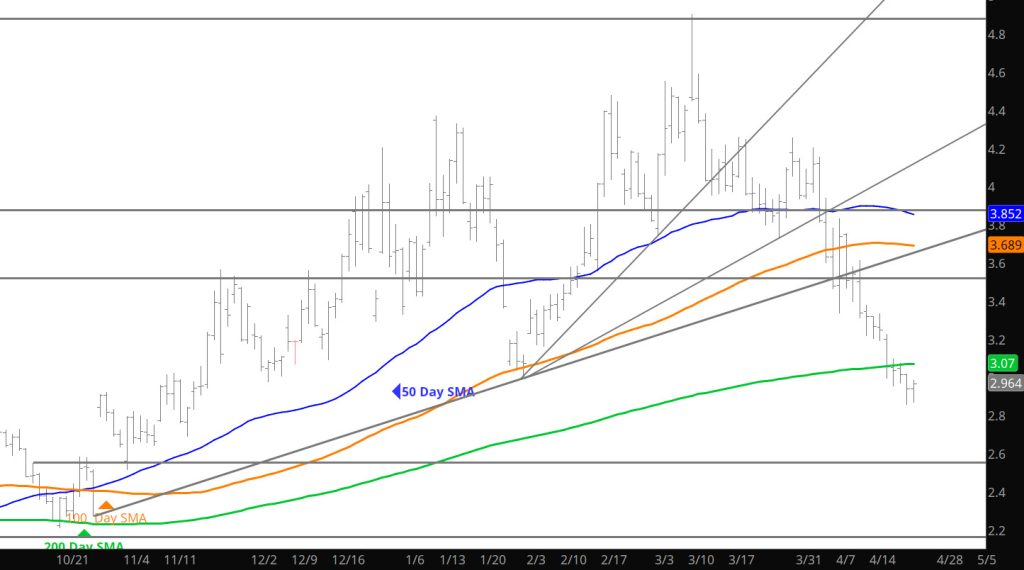

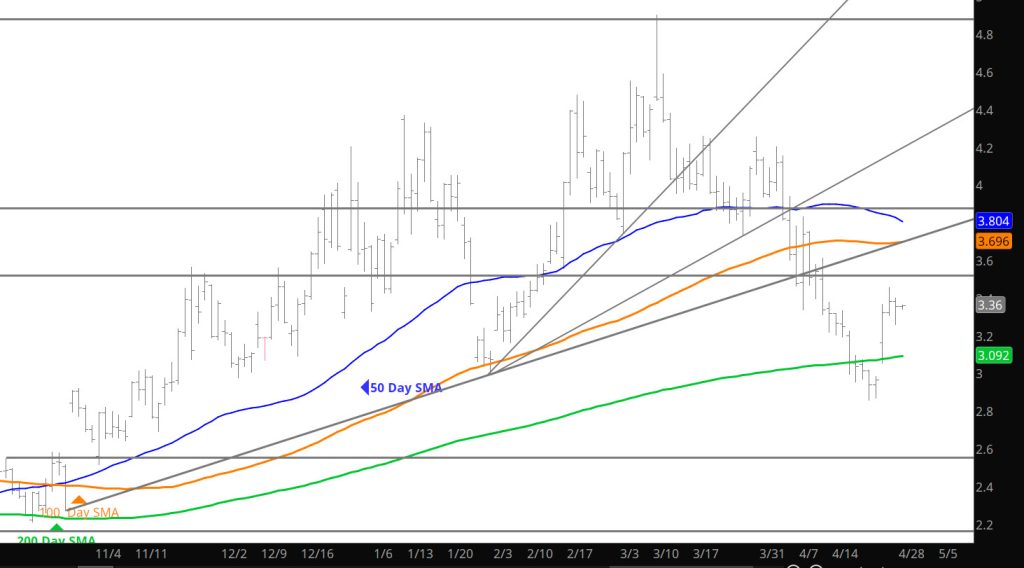

Storage Brings Upward Push to Initial Resistance

Expiration Seemed Drain Momentum

Daily Continuation

The expiration of the May contract seemed drain any further positive momentum from the expiration and left the market with a tight range trade. This consolidation may take the rest of the week, but I would expect a market test of the support zone from the May expiration.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

Didn’t Expect That

Daily Continuous

Did not see a $.20 rally in both the prompt and June contract on expiration. What does it mean? — still in the range that held through the end of April– so I would expect the range to remain intact. Then again I had no expectations of yesterday’s move. Was it short covering or new positions in — will evaluate that with the volume and open interest data today.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.16, $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03

Expiration Day

Seasonal Tendencies Remain Intact

Expiration Monday

Daily Continuous

The price decline took prices down to levels not seen since last December before finding some support. If you are a long time subscriber, you are well aware that I don’t participate in the expiration trade and very rarely work the upcoming prompt (in this case it is the June contract). I will be watching the spread between expiring May and upcoming June prompt over the next two days. Will update over the weekend and define thoughts in the Weekly section on Monday.

Major Support: $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.16, $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03