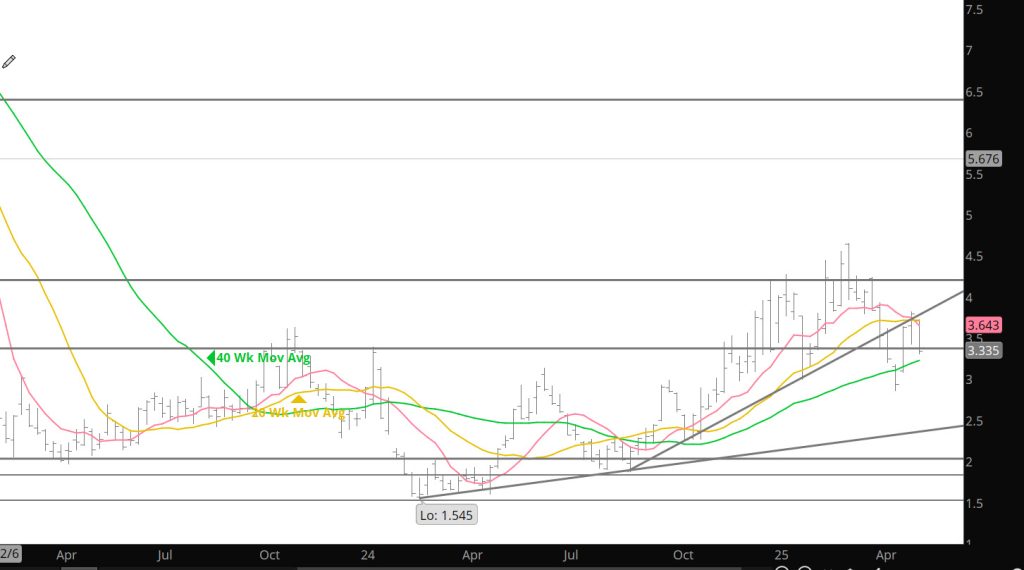

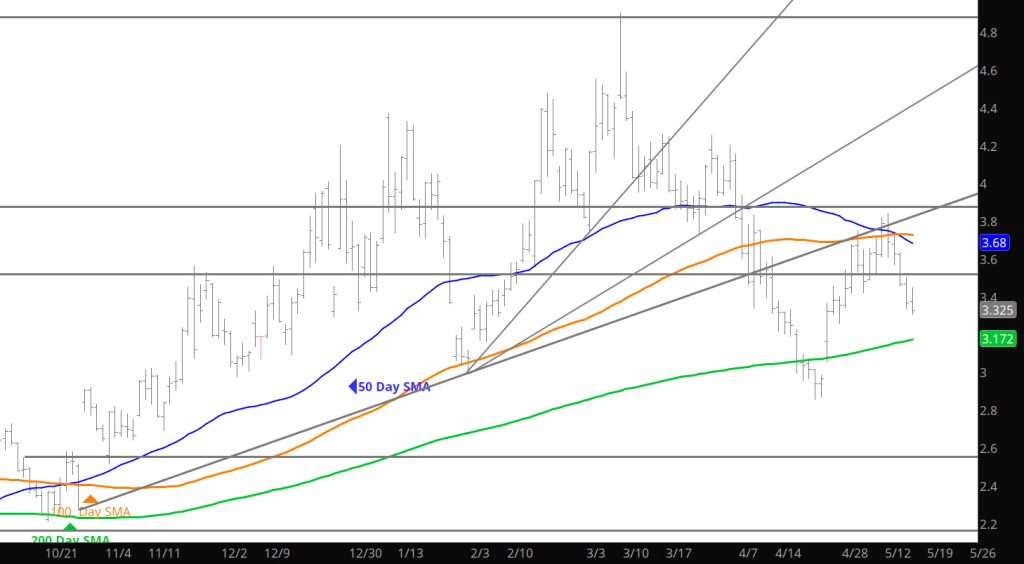

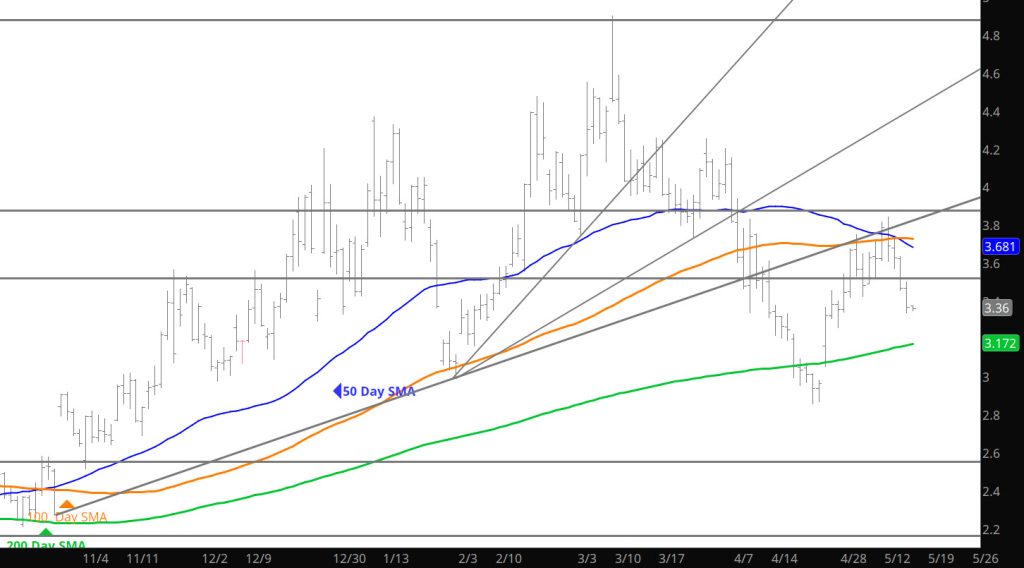

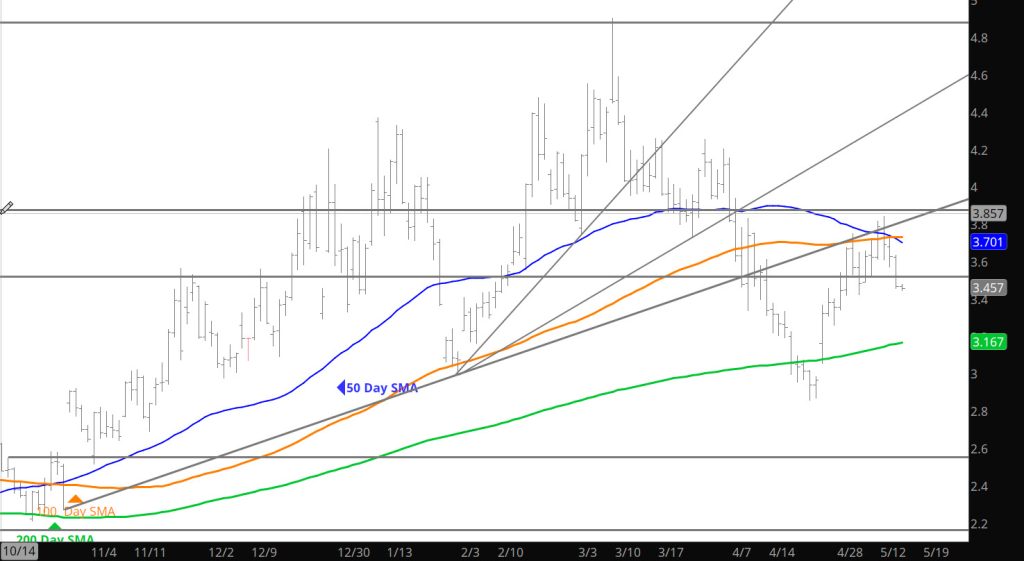

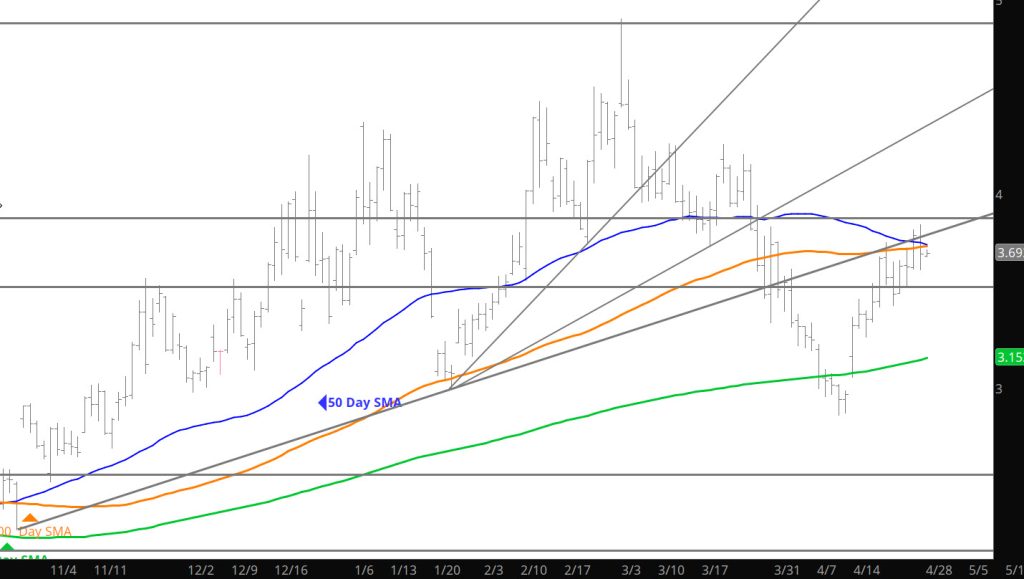

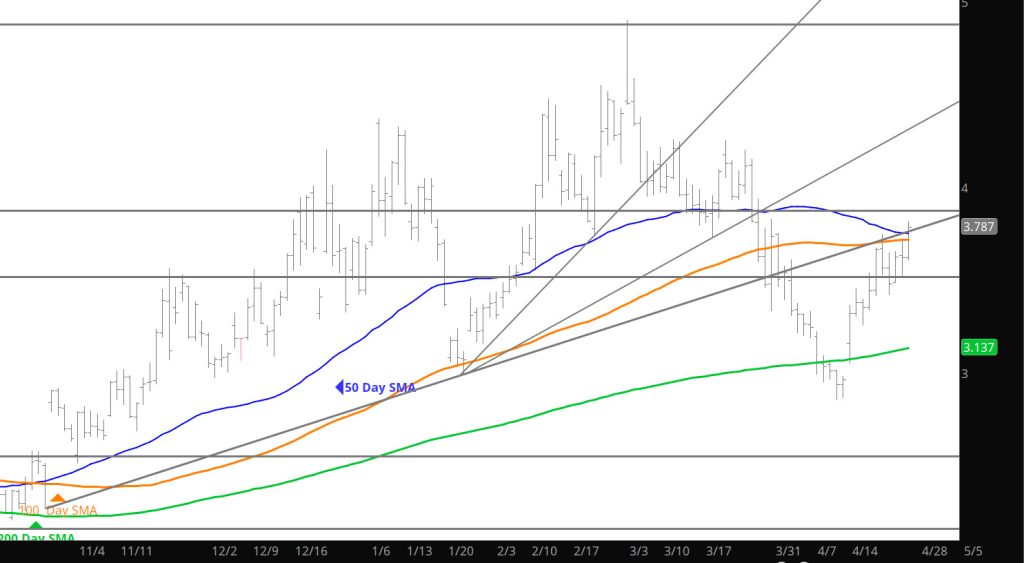

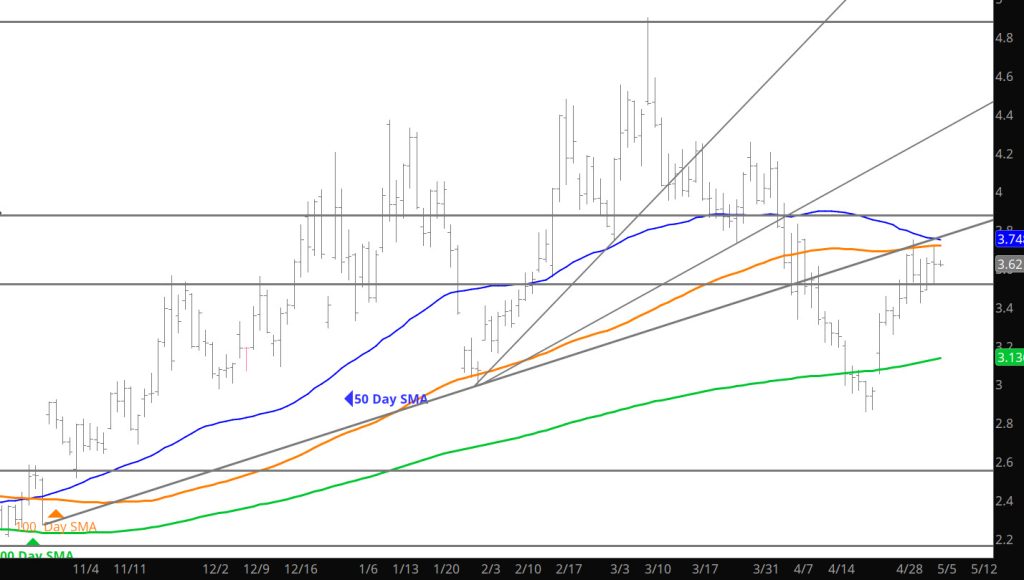

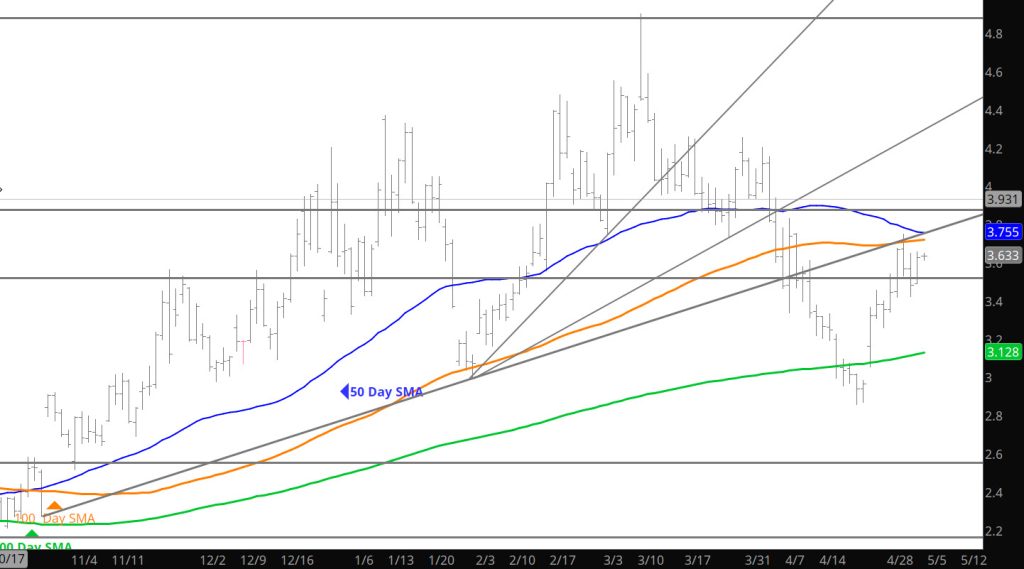

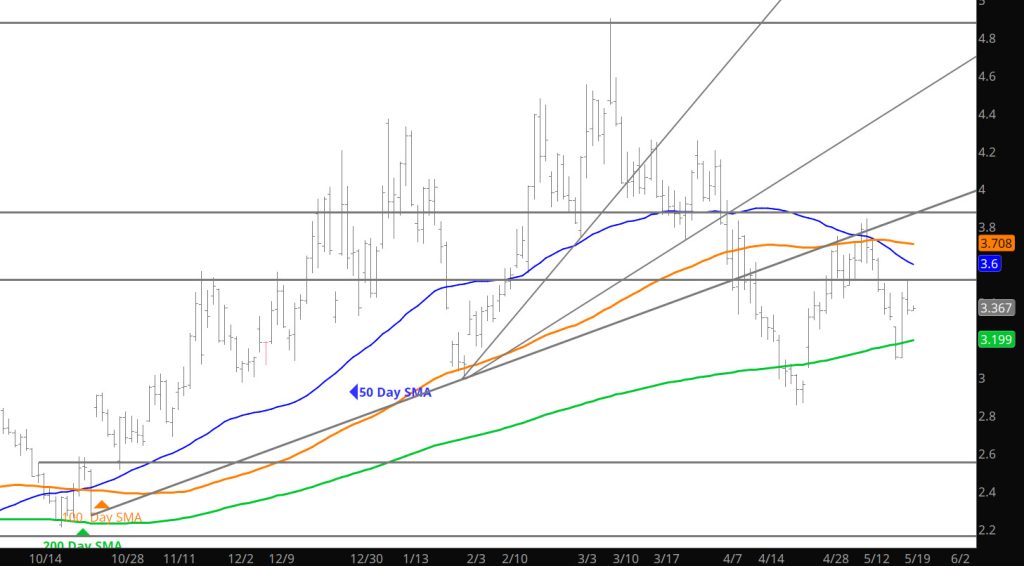

Daily Continuous

With the storage release I was wondering if the recent strength would be curtailed and that it was. The heading says it all – back into the range that June has created.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.26-$3.305, $3.46, $3.628, $3.86, $4.168, $4.461, $4.501,