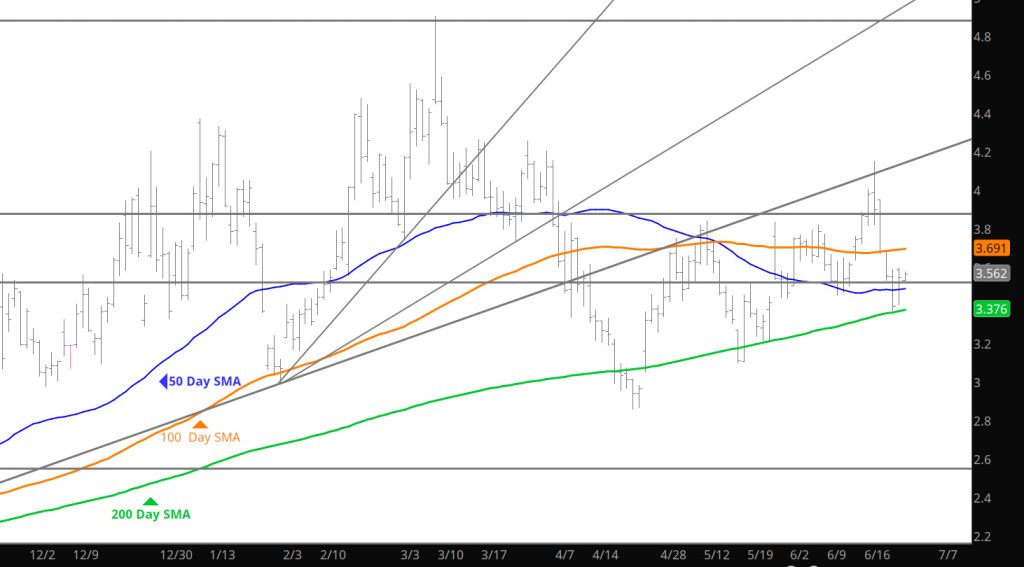

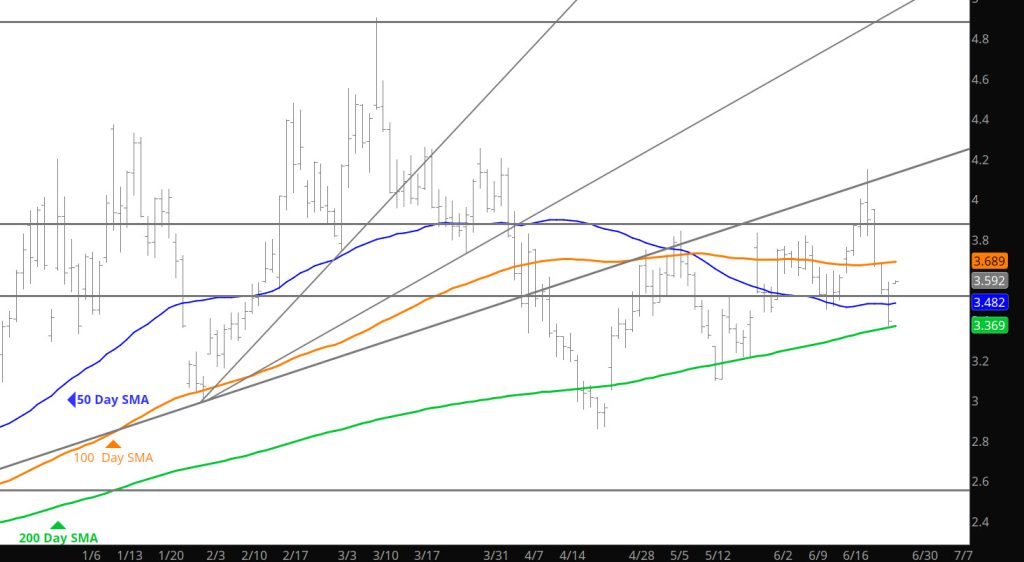

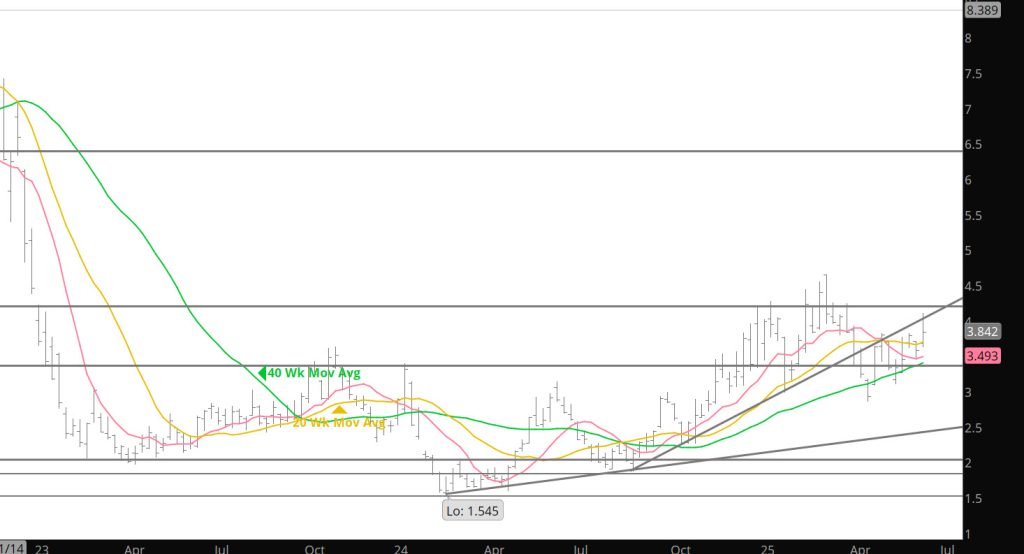

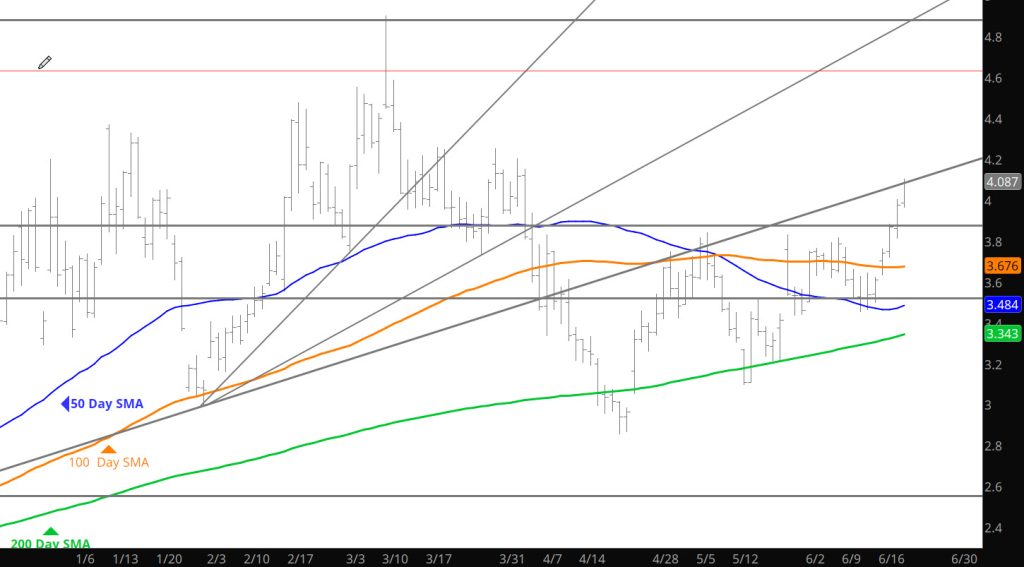

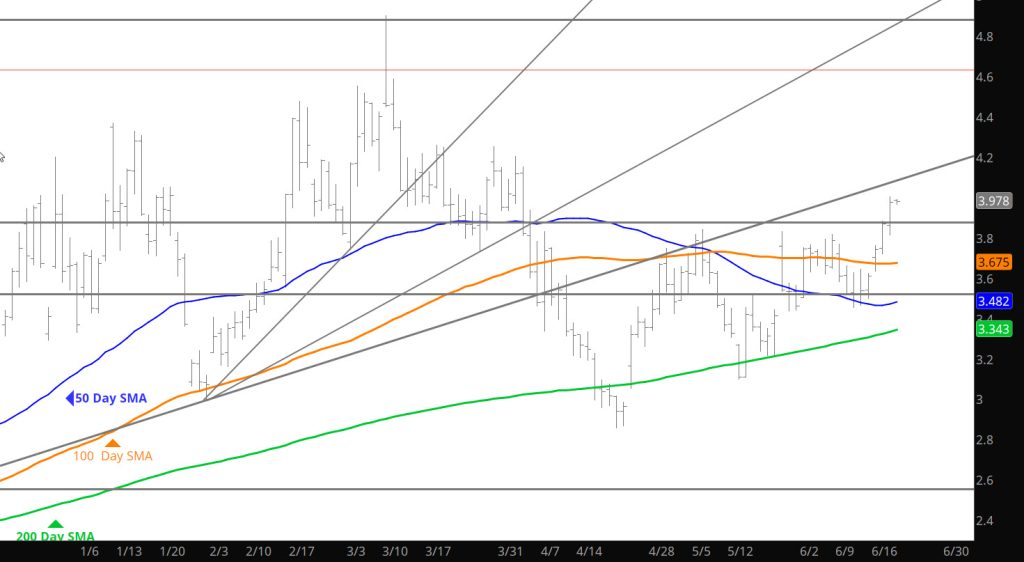

Daily Continuous

Declines took price to the high side of the support range ($3.25 topside), failed and then rallied slightly. Trade seems light going into the Holiday so look for anomalies that the thin trade may provide. Doubt the trade will provide any kind of major move but the slow declines may provide opportunities for selling some premium.

Major Support: $3.25-$3.16, $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501