Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

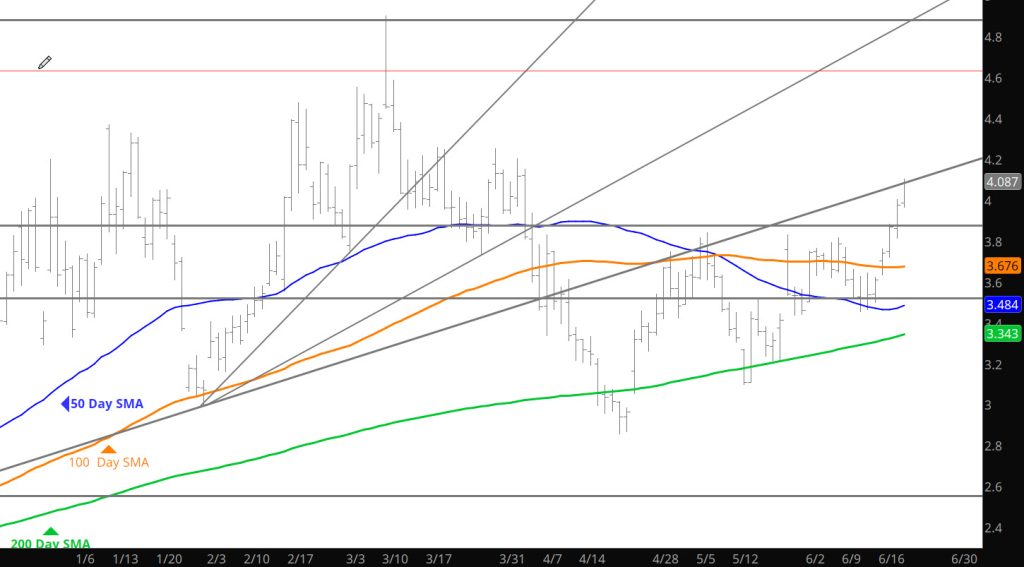

Possible Break Out Extends

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

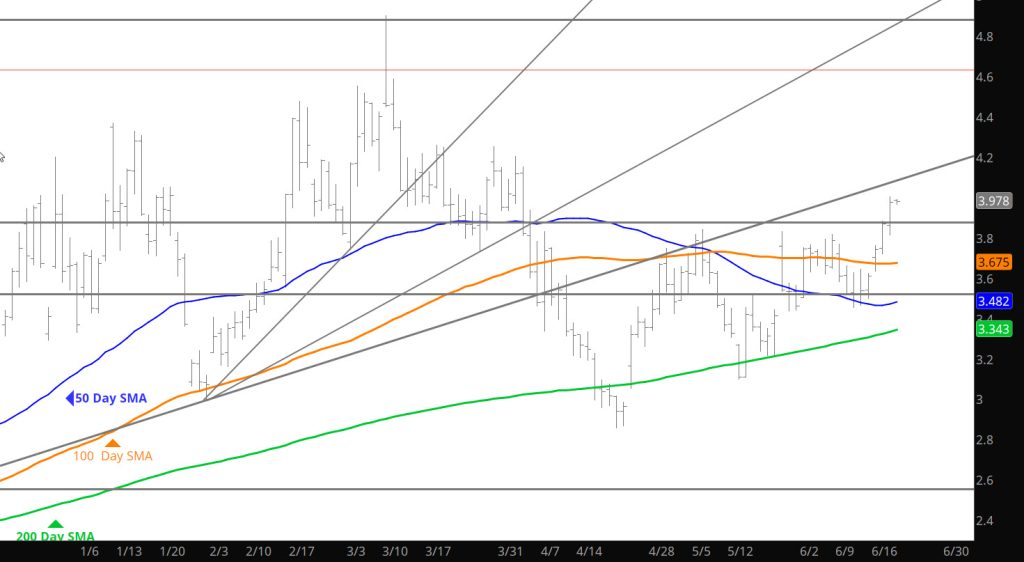

Is This a Breakout

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Boring

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Stalled

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bearish Storage–Prices Decline–Momentarily

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

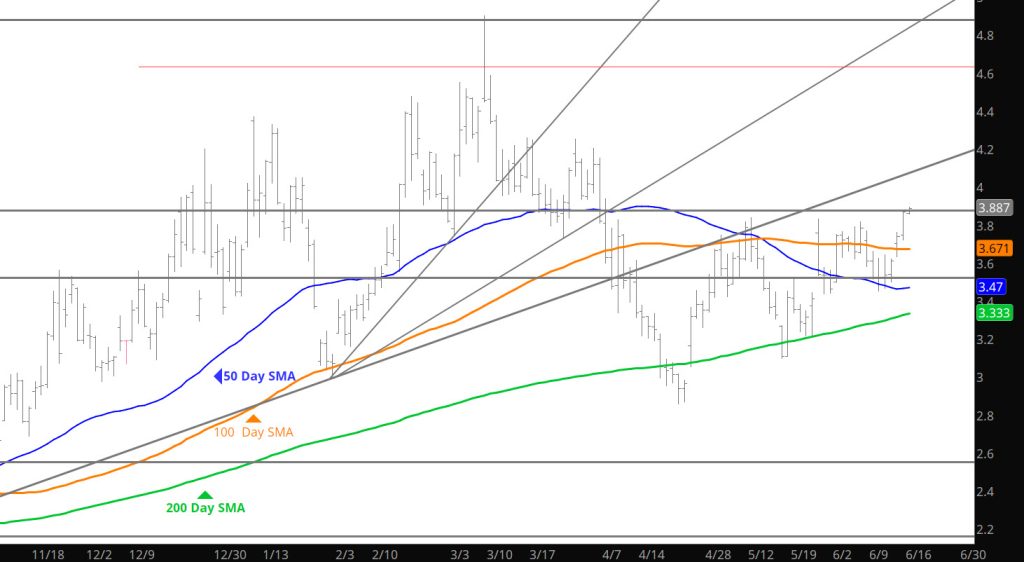

Nothing To Add

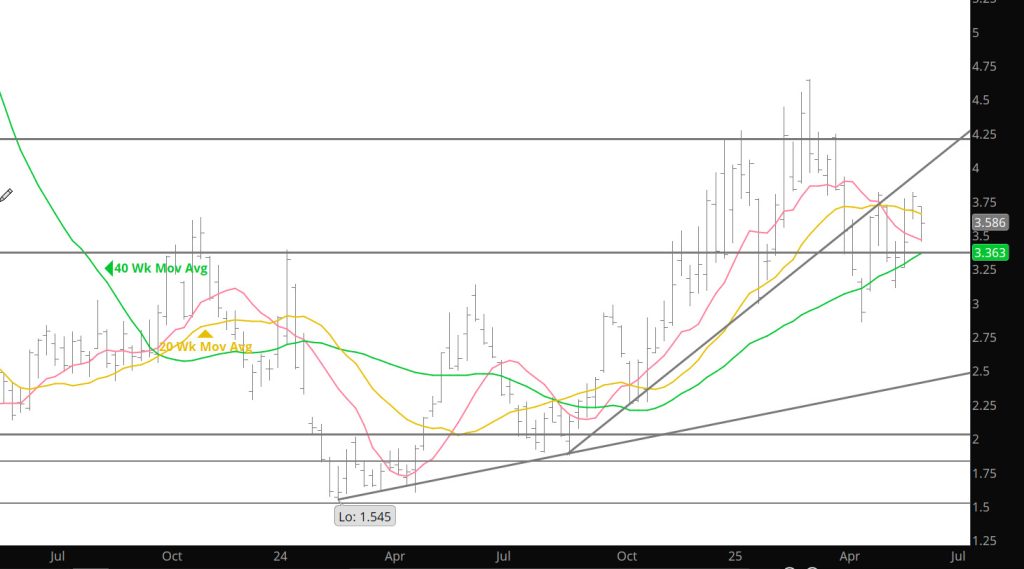

Daily Continuous

Can not add to the previous three Daily’s nor the Weekly on Monday.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.46, $3.30-$3.26

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501

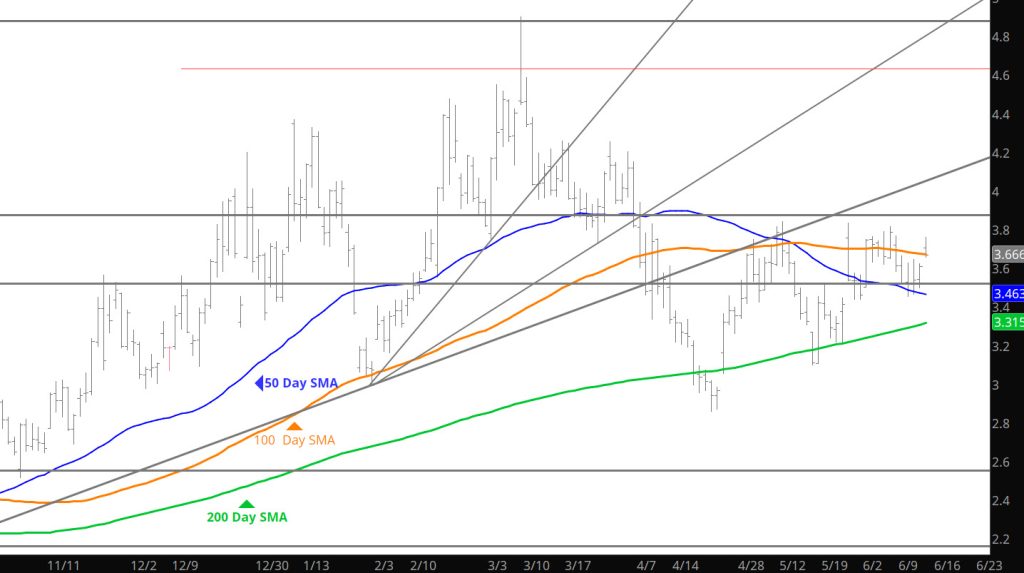

As Expected

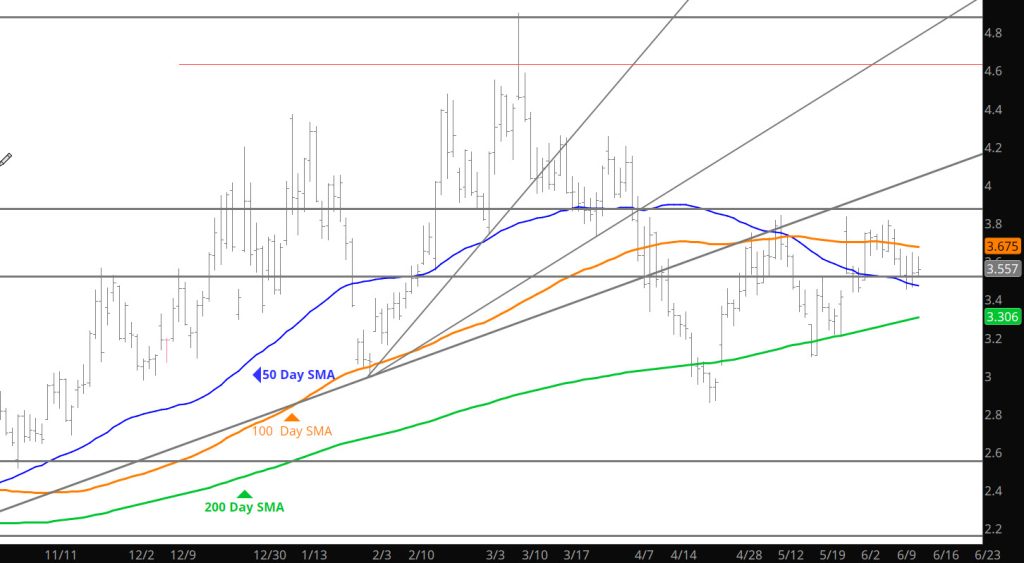

Daily Continuous

Not much to add from the last few week as the market seems to be comfortable with the range that the trade has developed. Prices going nowhere slowly– this market needs a fundamental jolt — either way.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.46, $3.30-$3.26

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501,

Rambling Through the Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Ranging Along — Now Near Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.