Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Light Sunday Trade Wants to Break $3.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

New Prompt Same Range–Maybe Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

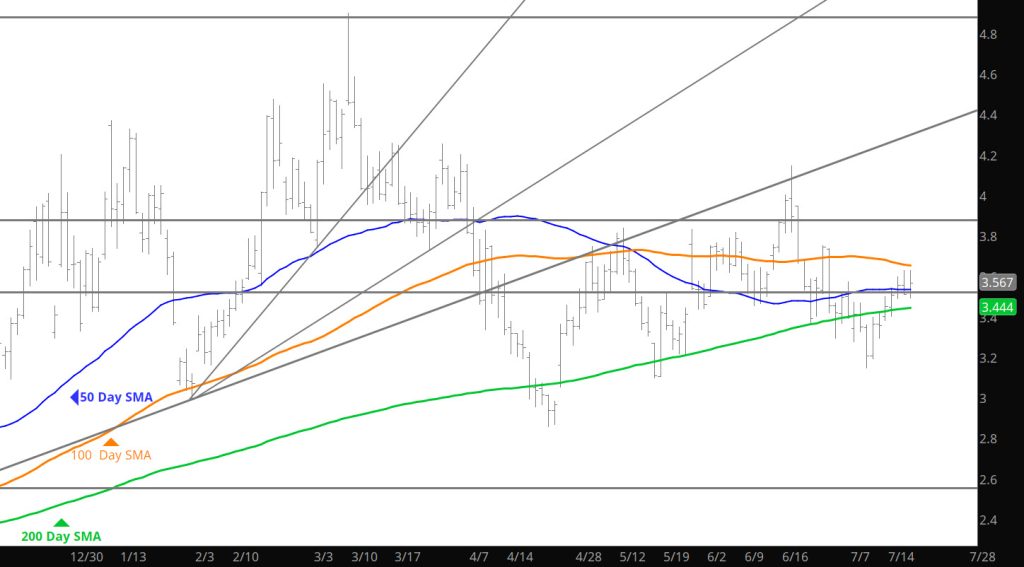

New Prompt — New Range?

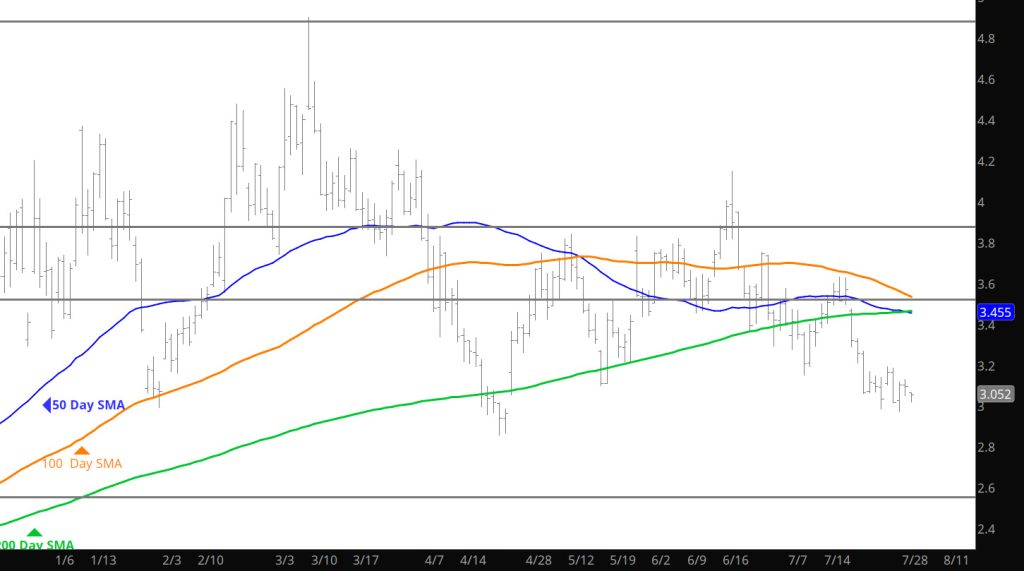

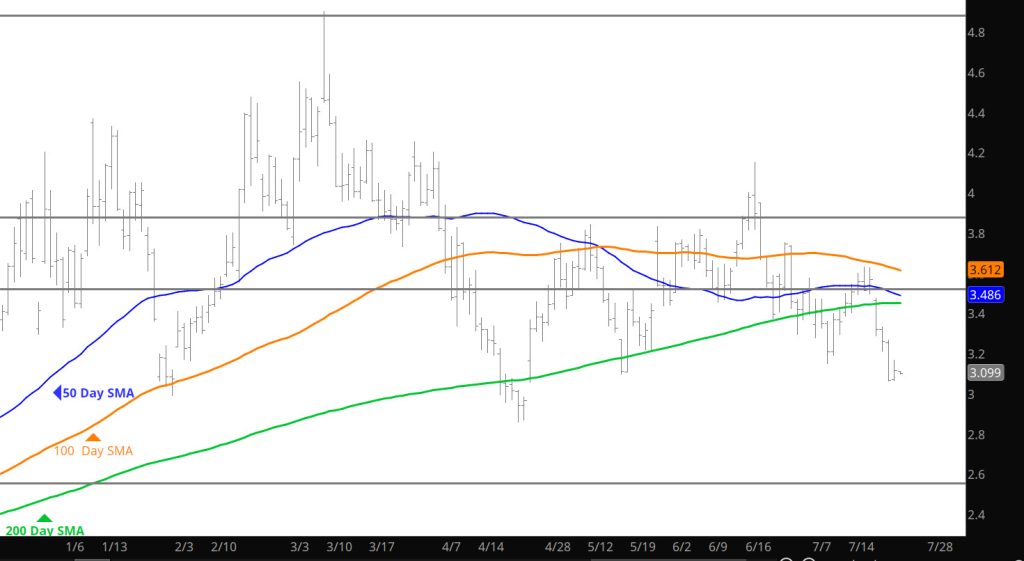

Daily Continuous

Expiration brought on a slight rally– we will have to wait for any follow through. We are at some lows maybe look to the winter months for long positions or prompt months for short postitions.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support : $3.30-$3.26

Major Resistance:$3.25-$3.31,$3.39, $3.62, $4.168, $4.461, $4.501

Weakness Into Expiration Is the Recent Trend

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Going To Keep Testing Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

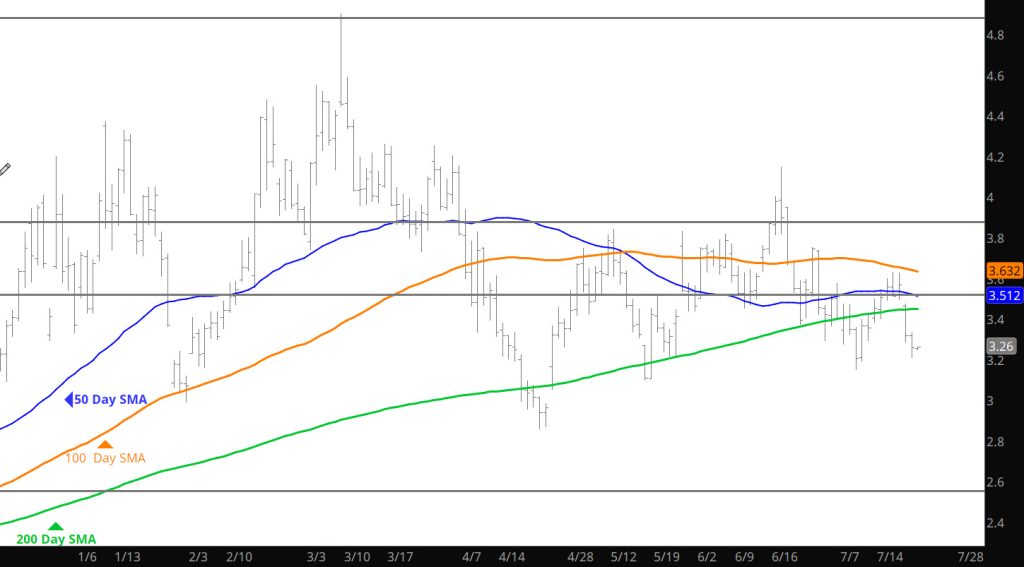

Rebound Off of Support Test

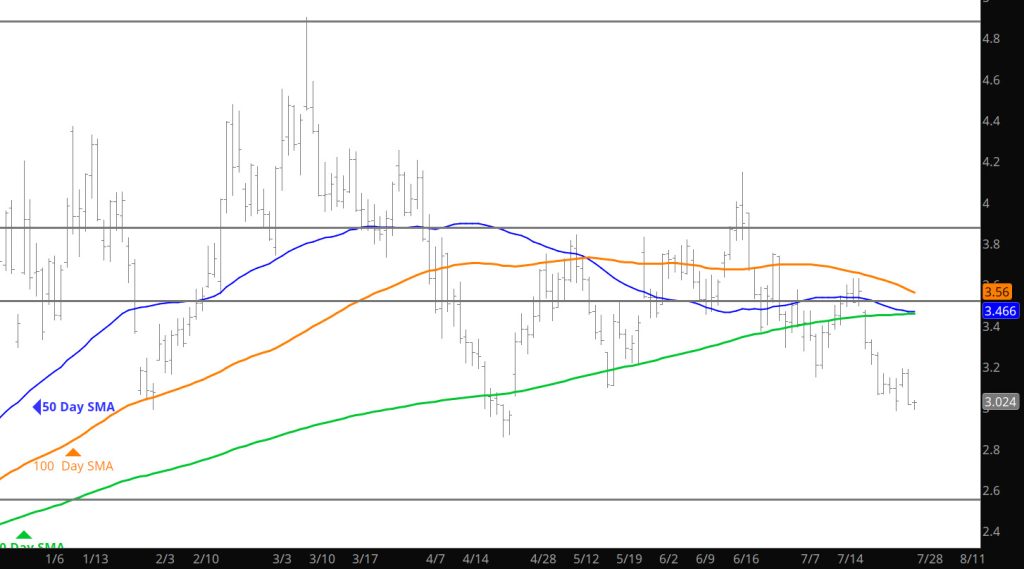

Daily Continuous

The declines neglected challenging the key support area and on the storage release rallied over $.10 but gave the gains up during the remaining trade. Still believe that any declines will be rejected at the support lows — that said would not load up on length.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support $3.30-$3.26

Major Resistance:$3.16-$3.25, $3.43, $4.168, $4.461, $4.501

Testing the August Contract Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Testing August Low’s

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Continue Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.