Author: Willis Bennett

Minor Bounce Off of Support Test

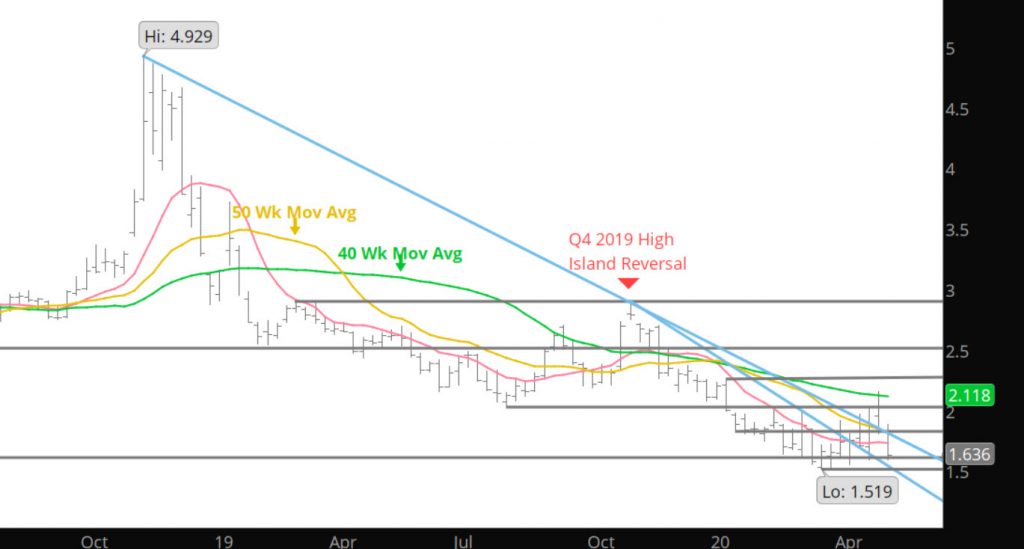

Trend Line Destruction Takes Prices to Test Major Support

Prices Find Support

Trend Line Violation Opens Door For Declines

Once the trend line in the Weekly (see Web) and the spot June, the trap door was open, and some liquidation occurred. We may be similar in trade to 2016 which had an uncommonly early May Q2 high, but with the volume being rather anemic for this type of activity do not believe the high is in so close to the establishment of the Q1 low (just six weeks earlier). The trade does look like it wants to go down and test the expiration range low from the May expiration at $1.59. Would expect the area between the March low of the June contract ($1.649) and the previous mentioned low, to find some buying interest.

Major Support: $1.649-$1.611-$1.59, $1.555-$1.519

Minor Support:

Major Resistance: $1.82-$1.849, $1.873, $1.90

Minor Resistance: $2.029

Great Opportunity – No Follow Through

Extension Downward –Testing Trend Line Support

Strong Reversal Off of 200 Day

Additional Declines – No Dip Buyers Yet

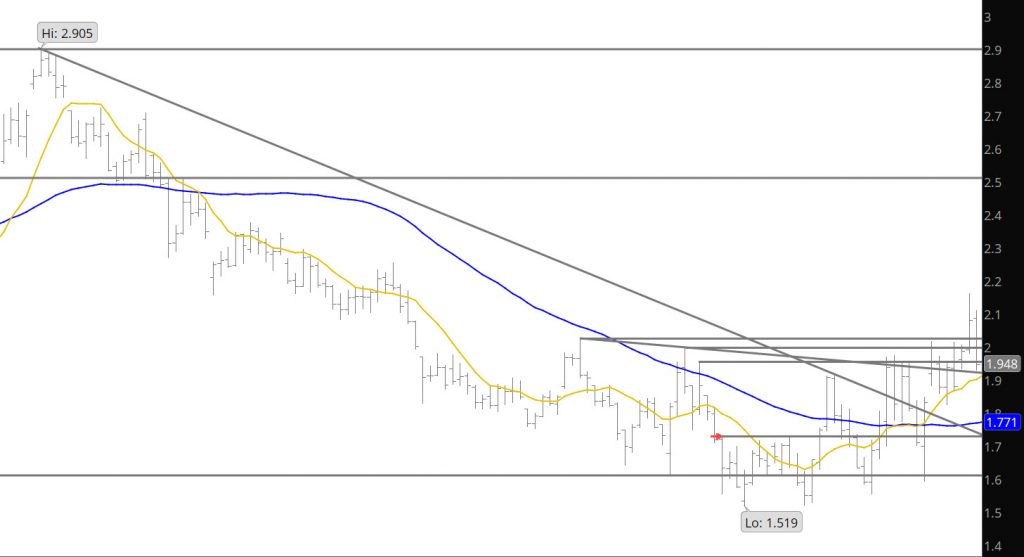

Not surprising to find additional declines post the storage report. The volume the last two day has been lighter on the declines than the short covering run early in the week, which should be expected. Perhaps the market is testing support and consolidating the gains made earlier in the week, but in reality the prompt is where it was post May expiration. Lots of volatility and no clear directional bias.

Major Support: $1.82, $1.611, $1.555-$1.519

Minor Support: $1.794, $1.78-$1.765

Major Resistance: $2.062,$2.08-$2.102–$2.108,$2.139-$2.16, $2.255

Minor Resistance: