Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Continued Extension

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rather Subdued Monday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Friday’s Trade Speaks Loudly

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Momentum Builds

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Storage Report Has Little Impact

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Initial Test of Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Churn

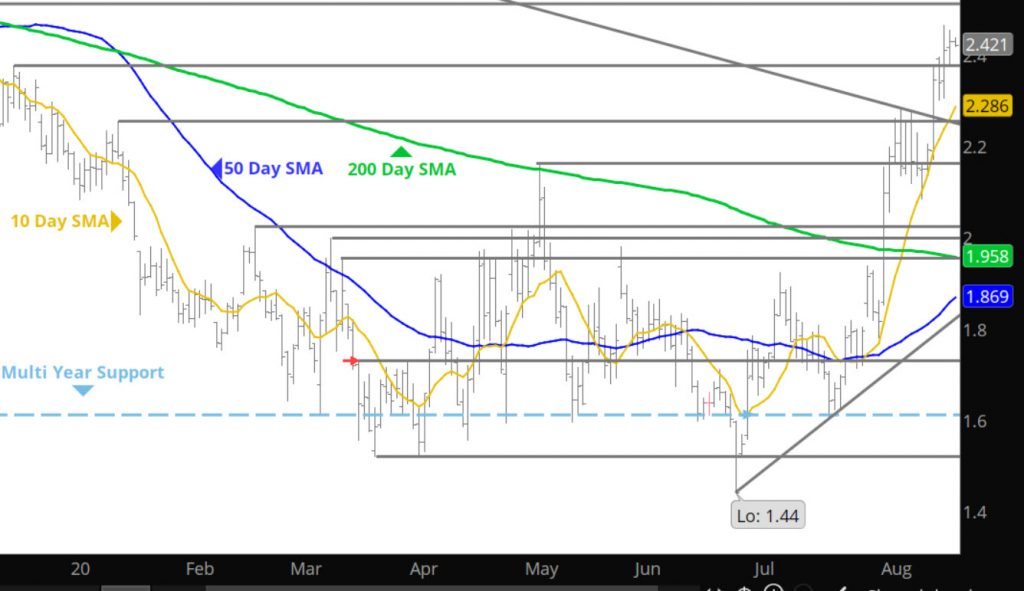

Apologies first off wrote the Daily only not to set up the software properly to publish. Prices just jockeyed yesterday as the trade was evaluating near term direction. Judging from the trade early today- it is testing additional support zones as discussed here. The market needs this testing and establishment of the new support and resistance zones – the high end near term was well defined last week at $2.28 — it looks like the low side will be determined this week.

Major Support: $2.055, $2.029-$1.937, $1.86, $1.527, $1.484-$1.44, $1.336

Minor Support: $2.102, $1.975, $1.719

Major Resistance: $2.255, $2.377-$2.397,$2.43

Minor Resistance:

The Bias Change Confirmed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Running Low on Food – Perhaps

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.