Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

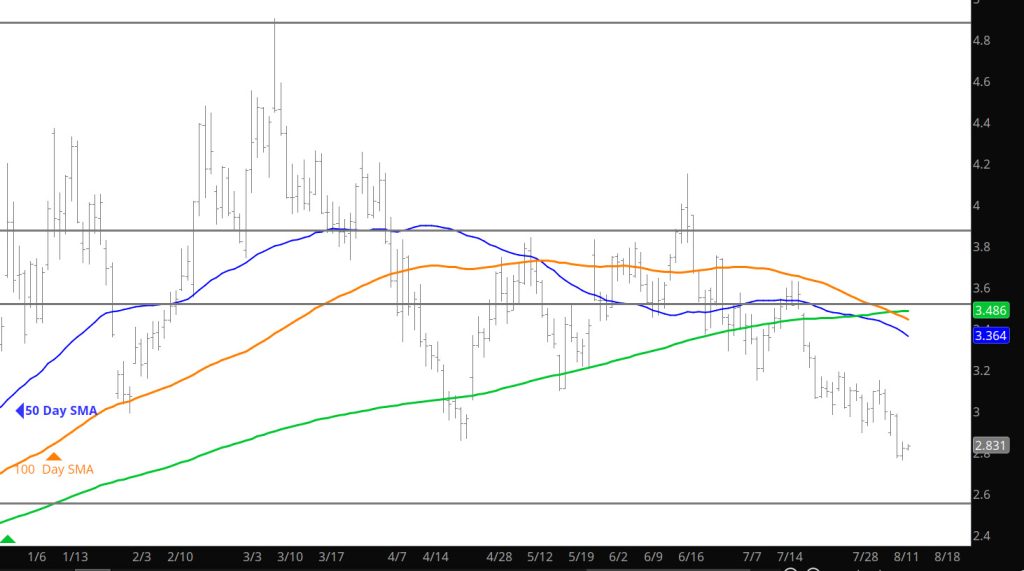

Market Not Expanding Declines from Death Cross

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What’s Coming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

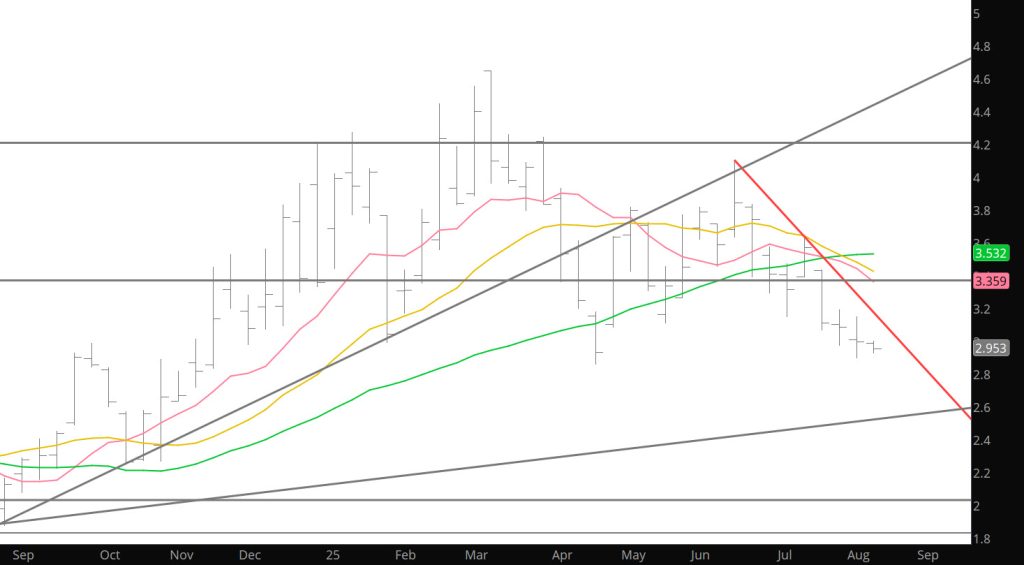

Market Against Medium Term Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

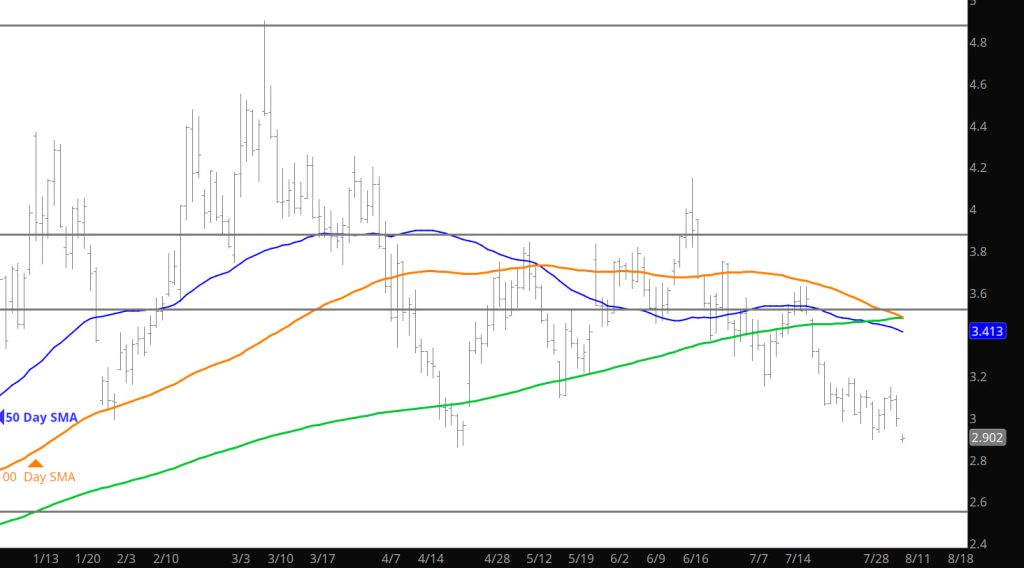

Likely To Be Important Week for Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

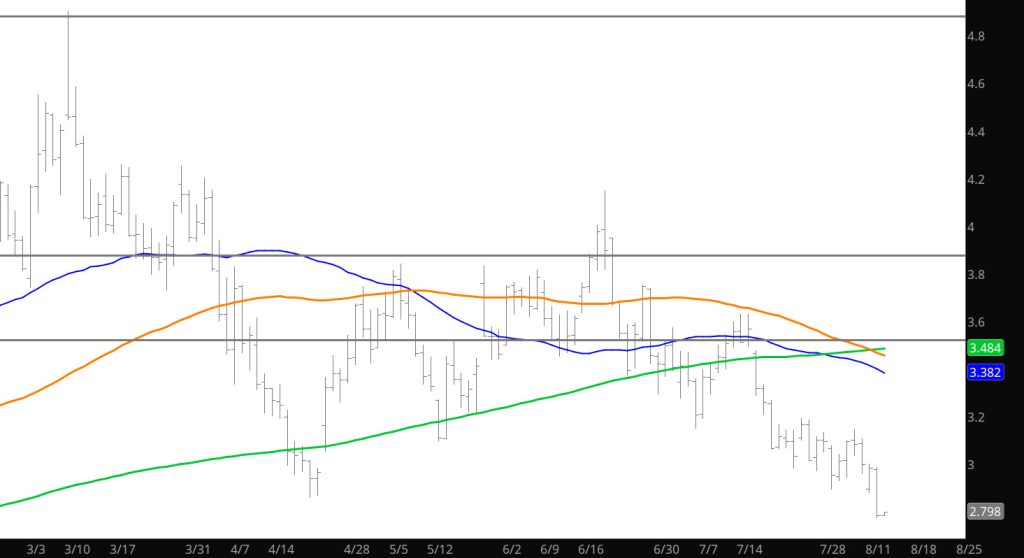

Rebound Off of Support

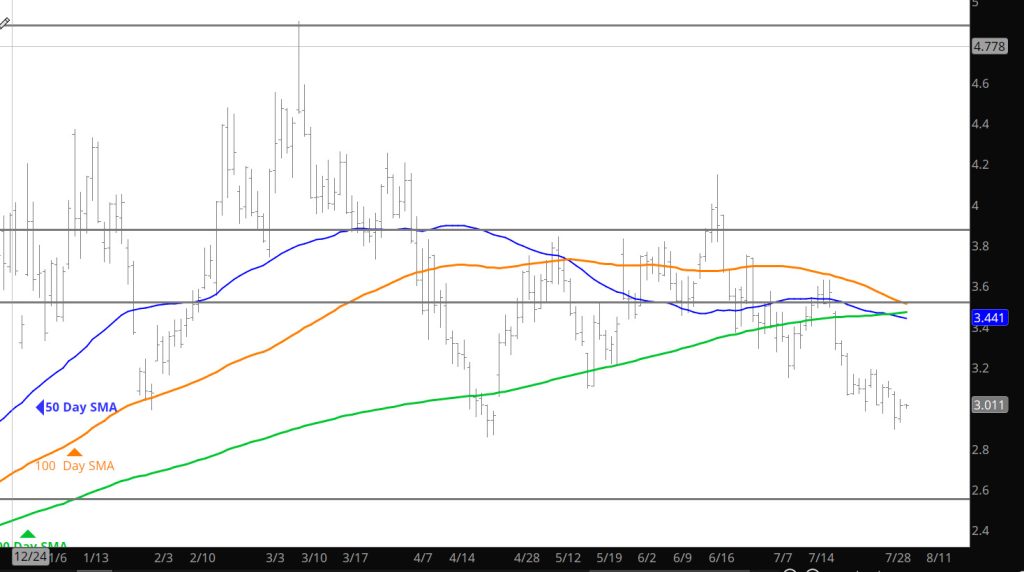

Daily Continuous

Spoke yesterday regarding the break down in prices and whether it was going to be built on with additional declines. Prices started lower, but then had a solid rebound. Next issue will be the storage release today and will the gains remain.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :

Major Resistance:$3.167, $3.25-$3.31,$3.39, $3.62, $4.168, $4.461, $4.501

Fake to the Down Side

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Market Needing Stimulus

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Light Sunday Trade Wants to Break $3.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

New Prompt Same Range–Maybe Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.