Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

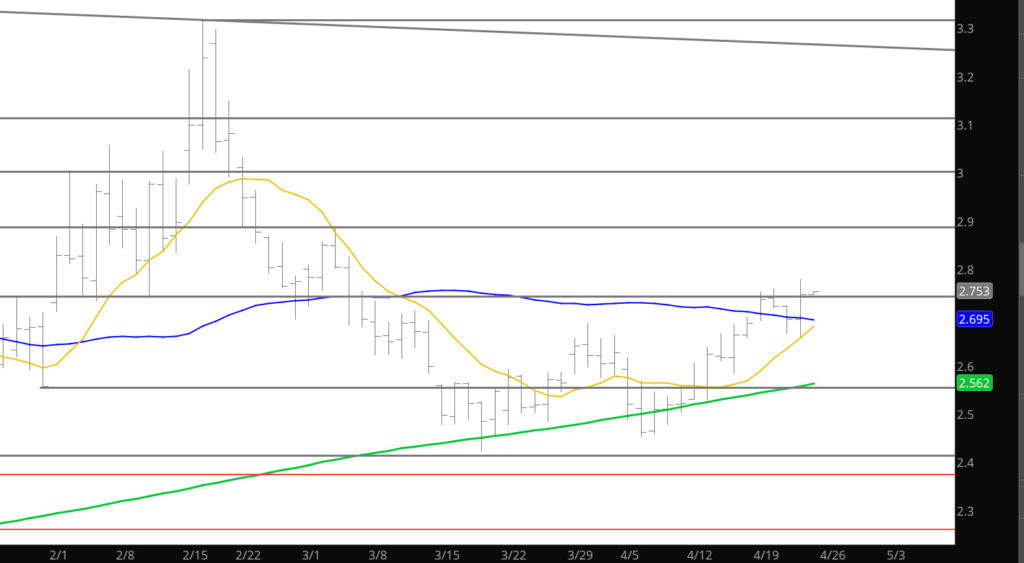

A Little Volatility

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

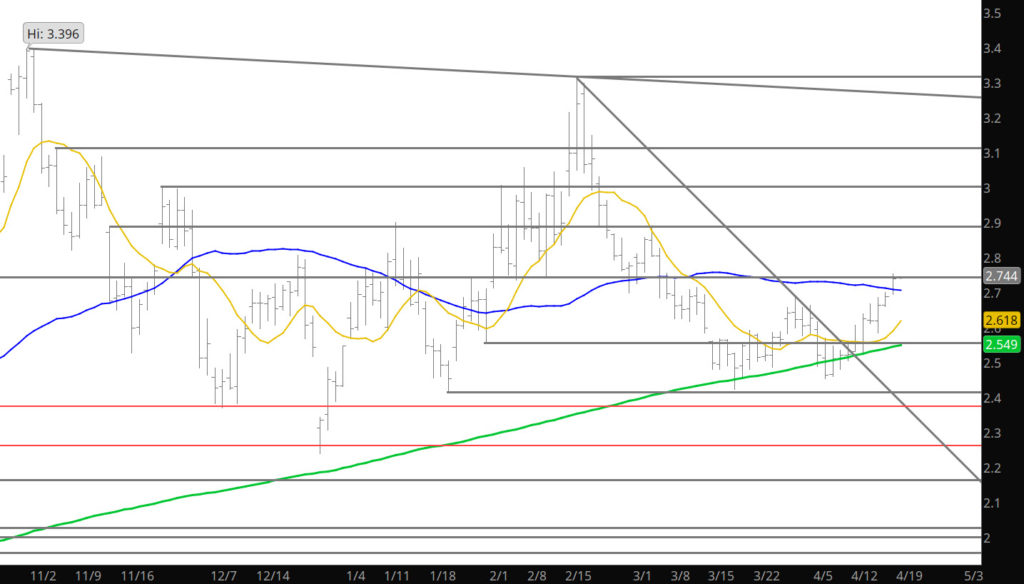

Breakout Holds — Consolidation on A Dime Move?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

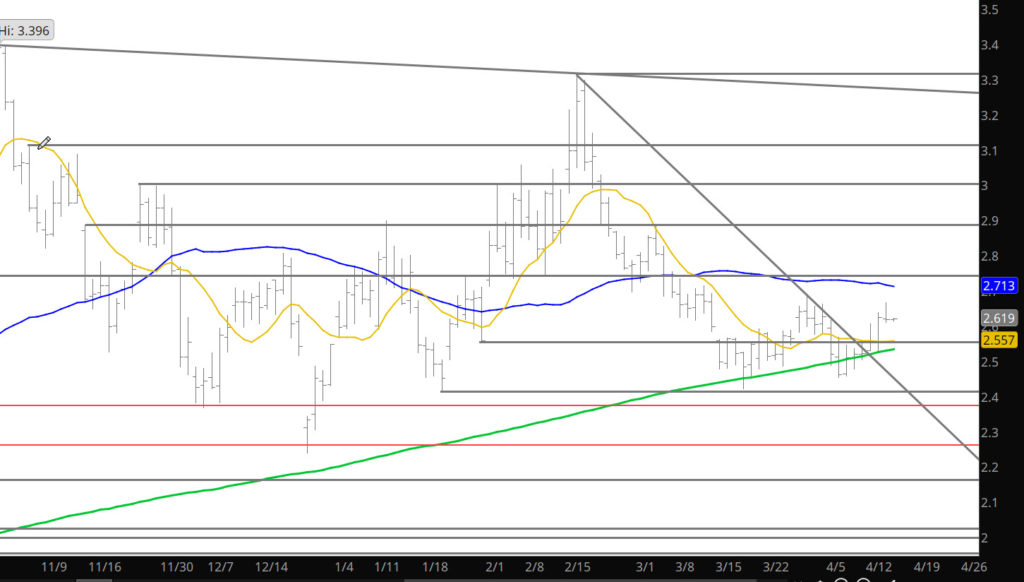

Breakout Yes — Volatility No

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

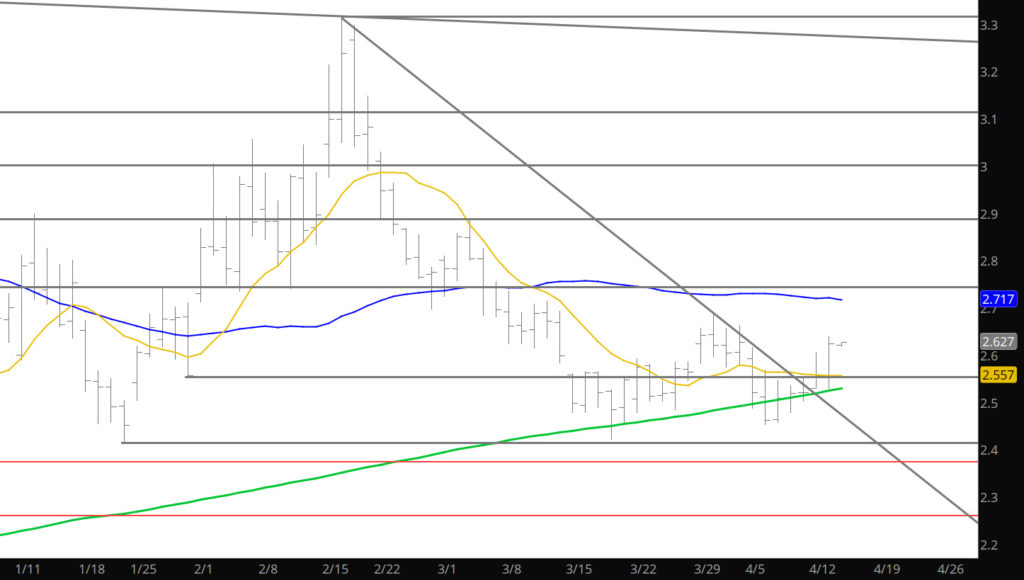

Time to Break Above?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Why Not Gas?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Almost

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Thrust Higher Only to End Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Is This a Break Out?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Nothing Yet

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.